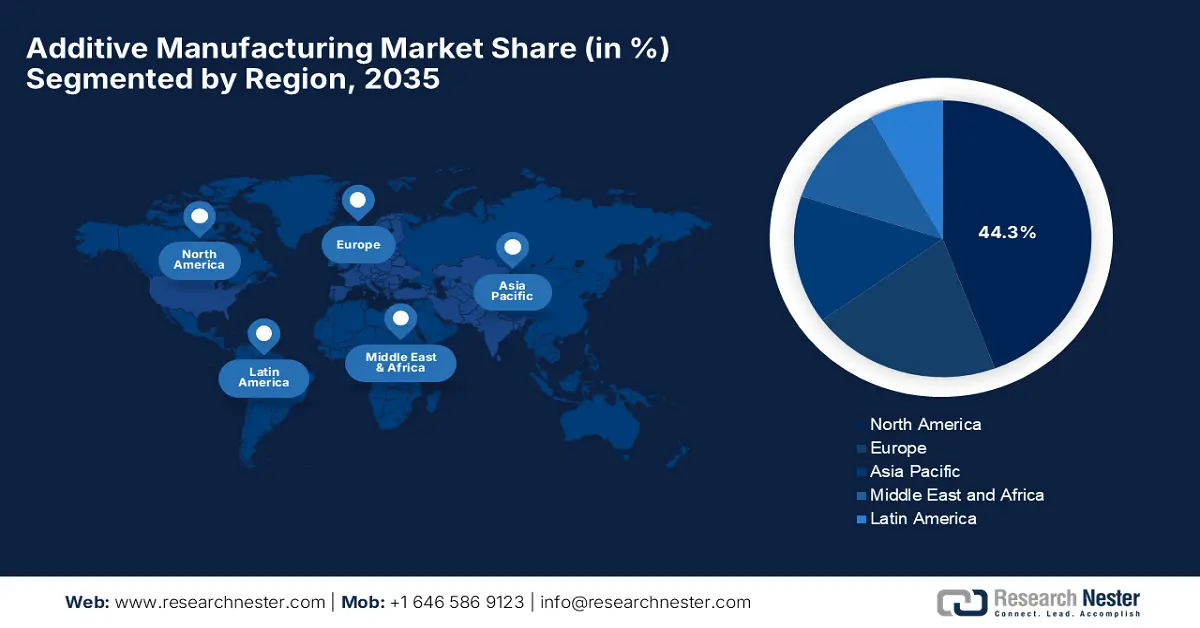

Additive Manufacturing Market - Regional Analysis

North America Market Insights

North America market is predicted to hold the highest share of 44.3% throughout the discussed tenure. The region’s leadership in this field is attributable to the strong R&D capabilities, well-established aerospace and automotive industries, and robust federal funding. In June 2025, the U.S. National Science Foundation announced that it made an investment of USD 25.5 million to advance research and workforce development in future manufacturing through its NSF Future Manufacturing Program. Besides, the funding supports multidisciplinary projects in areas such as biomanufacturing, cyber and eco-manufacturing, and additive manufacturing, including innovations such as AI-based recyclofacturing and multi-material 3D printing. Furthermore, by fostering new manufacturing capabilities and preparing a skilled workforce, the program aims to strengthen U.S. leadership in manufacturing and emerging technologies.

The U.S. has gained a dominating position in the regional additive manufacturing market, backed by an increased adoption across aerospace, healthcare, and industrial sectors, with extensive support from policies that are promoting Industry 4.0 manufacturing. In November 2025, Future Foundries, developed by Oak Ridge National Laboratory, reported that it integrates wire-arc additive manufacturing, machining, heat treatment, and inspection into a single, flexible platform, which efficiently reduces production cycles and lead times. In addition, its modular, adaptive design allows manufacturers to customize workflows, leverage existing equipment, and scale operations more efficiently, which benefits both small and large enterprises. Furthermore, by unifying processes, the company is readily enhancing automation and enabling continuous optimization, hence making it suitable for overall market growth.

Canada is continuously growing in the North America additive manufacturing market, readily propelled by material research and manufacturing solutions that are suitable for clean energy, aerospace, and medical applications. Its growth is also backed by supportive innovation funding and a growing base of AM-focused enterprises. For instance, in November 2024, Renishaw announced a partnership with Canada Makes to promote additive manufacturing across the nation, combining Renishaw’s AM expertise with Canada Makes, which is an extensive network of organizations and knowledge-sharing initiatives. In this context, the collaboration aims to advance innovation, scale production, and expand AM applications in sectors such as healthcare, aerospace, and automotive. Furthermore, it supports the transition from prototyping to mass manufacturing while driving standards and accessibility in the country’s market.

APAC Market Insights

Asia Pacific is likely to register the fastest growth in the global additive manufacturing market owing to the rapid industrialization, smart manufacturing initiatives, and strong government support. Prominent countries such as Japan, China, and India are leveraging AM for consumer electronics, automotive, and medical parts, whereas regional digitalization is making AM more accessible. In June 2025, Shimadzu Corporation stated that it was selected by Japan’s NEDO for a five-year R&D program to develop an integrated metal additive manufacturing system, in collaboration with universities and industry partners. It also reported that the project aims to enable high-value, complex parts with improved functionality and shorter delivery times using Shimadzu’s BLUE IMPACT 6 kW blue laser DED technology. Furthermore, the program also focuses on establishing quality assurance standards and optimal production workflows to advance the country’s manufacturing capabilities.

China is recognized as the central player in the additive manufacturing market, which is expanding rapidly due to strategic investments in smart cities, rising domestic production, and high-value manufacturing. Domestic firms are constantly putting efforts into scaling up in both polymer and metal printing, capitalizing on a large manufacturing base and increasing demand for innovative, on-demand production. Simultaneously, manufacturers in the country are also making investments in research and development to enhance material capabilities, printing speed, and precision. The country’s market also benefits from collaboration between universities, research institutes, and private entities, which is fostering innovation, thereby accelerating the commercialization of additive technologies. Furthermore, the country is focused on establishing standardized processes, ensuring both quality and reliability for industrial-scale applications.

The government initiatives, such as Make in India and digital manufacturing goals, are helping to increase adoption, especially in sectors like aerospace, automotive, and defense, positioning India as the key growth engine in the additive manufacturing market. The country also hosts a startup ecosystem that is active in developing numerous AM solutions for both prototyping and low-volume production. In April 2025, EOS and Godrej Enterprises Group announced that they had formed a strategic partnership to advance additive manufacturing in India’s aviation and space sectors, focusing on large-scale, multi-laser AM technology for production. The collaboration aims to simplify complex assemblies and build a robust AM supply chain to serve both domestic as well as global OEMs. In addition, this initiative supports the country’s space ambitions and aligns with the government’s Make in India program, as stated by EOS.

Europe Market Insights

Europe is growing exponentially in the market, supported by the presence of a large industrial base, sustainability goals, and cross-border R&D programs. Prominent countries in this region are utilizing AM to reduce waste, improve lightweight designs, and digitize production, especially in terms of aerospace and automotive sectors. In November 2025, Renishaw announced that its RenAM 500 series and TEMPUS technology were fully integrated into Dassault Systèmes’ 3DEXPERIENCE virtual machine, which allows users to set up, program, and analyze additive manufacturing processes virtually. It also stated that this TEMPUS technology optimizes laser operation during recoater movement, cutting build times by around 50% while maintaining part quality. Hence, this, coupled with France’s potential, which has a growing additive manufacturing sector with strong industrial, research, and innovation capabilities, is prompting a profitable business environment for the players in this region.

France: Additive Manufacturing Sector - Key Metrics & Insights

|

Metric |

Value |

Details |

|

Global Market Share |

3% |

France ranks 4th in AM after Germany, Italy, and the UK |

|

Projected Market Size (2030) |

~USD 700 million |

Assuming a 17% growth rate |

|

Number of AM Companies |

~200 |

Includes private sector firms in AM |

|

R&D Centers |

60 |

Includes universities, labs, and research institutes |

|

Clusters & Innovation Centers |

40 |

Part of initiatives like Additive Factory Hub |

|

Tool Parts Produced via AM |

65% |

Molds, inserts, and pliers are produced additively |

|

Distribution Entities |

~100 |

Includes wholesalers, resellers, direct sales, and hybrid approaches |

Source: ITA

Germany is maintaining its strong leadership in the regional additive manufacturing market, highly attributed to its engineering capabilities, industrial precision, and high-value manufacturing culture. The country’s market also benefits since it is heavily integrated with its broader Industry 4.0 framework, wherein companies support in-house AM production for complex and high-performance parts. In November 2025, Brose introduced a high-performance metal 3D printer, which was developed with Farsoon Technologies, enabling larger, complex components and higher-volume additive series production in the country. The printer uses fully recycled metal powder from the firm’s press shops, thereby promoting sustainability and circular economy practices. Furthermore, by integrating additive processes from prototyping to series production, Brose enhances flexibility, productivity, attracting more players to operate in this field.

The U.K. has also acquired a leading position in the regional additive manufacturing market, primarily fueled by the aerospace, medical use cases, and is bolstered by solid digital infrastructure and R&D investment. National strategies and innovation hubs are also helping firms in the country to scale additive adoption. In August 2025, Honeywell announced that it had led a UK government-funded consortium under the ATI Program to advance additive manufacturing for aerospace, with a prime focus on Environmental Control and Cabin Pressure Systems. The report also highlights that the STRATA project leverages AI, simulation, and additive manufacturing to optimize component design and consolidate complex assemblies into single parts, enhancing efficiency and sustainability. Furthermore, partners including 3T Additive Manufacturing, BeyondMath, Qdot Technology, and Oxford Thermofluids Institute will collaborate to strengthen the country’s aerospace supply chain.