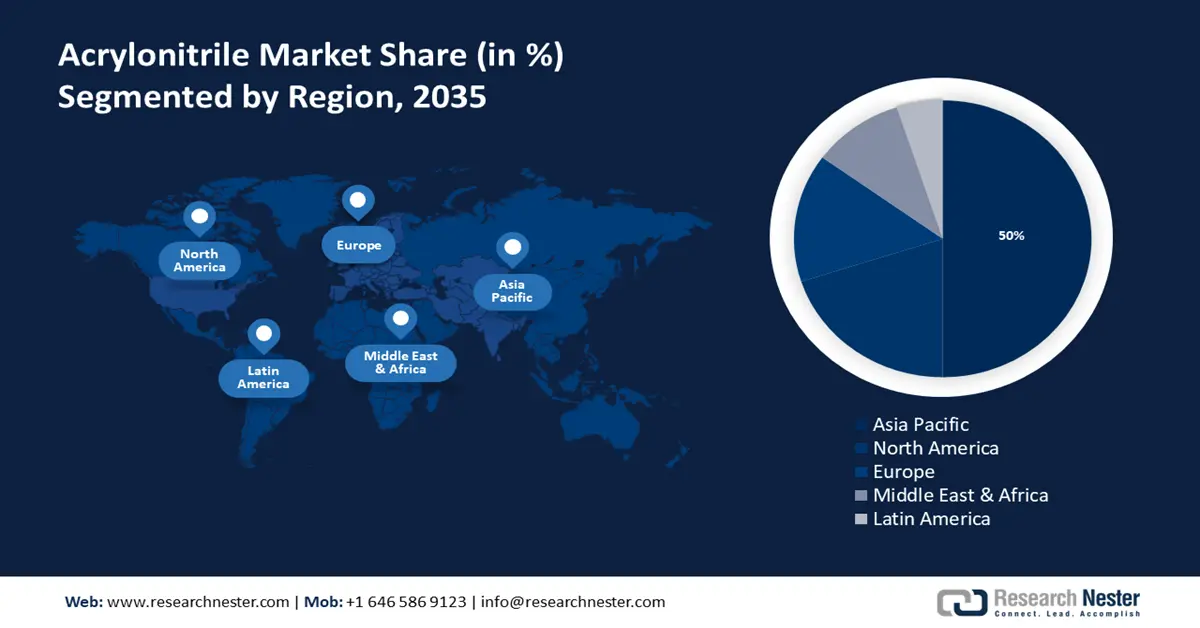

Acrylonitrile Market Regional Analysis:

APAC Market Insights

Asia Pacific acrylonitrile market is set to account for revenue share of more than 50% by the end of 2035. The textile and home furnishings sectors' growing demand are anticipated to have a beneficial impact on the market segment. It was predicted by World Bank that between 2024 and 2028, consumer expenditure in Asia on apparel and footwear will rise steadily by a total of USD 27.8 billion (+35.8%). It is predicted that fashion-related spending would reach 105.4 billion dollars in 2028, marking a new peak following eight years of growth.

China is prioritizing the development of new residential and commercial structures, and this trend is anticipated to continue. The regional market is also driven by elements like the growing need for energy-efficient building materials and developments in civil construction. Government statistics indicates that 77% of China's 2020 new urban construction projects were classified as green buildings.

Two examples of acrylonitrile-based polymers used in consumer goods packaging in the Japanese region are acrylonitrile butadiene styrene (ABS) and styrene acrylonitrile (SAN). These polymers are robust and resistant to impacts. By 2024, value added from Japan's consumer products sector is expected to reach USD 359.30 billion.

The transition towards sustainable and bio-based chemical products is anticipated to be a significant driver of growth for acrylonitrile enterprises in the Korean peninsula. Renowned Korean chemicals manufacturer LG Chem revealed plans to introduce new plant-based raw material-based acrylonitrile butadiene styrene (ABS) products.

North America Market Insights

The North America region will also encounter huge growth for the acrylonitrile market in this region. The strong presence of important corporations like Ascend Performance Material in the U.S. Over the projection period, market growth is anticipated to be aided by the aforementioned companies' primary focus on new product advancements in the industries of construction and automobiles. Approximately 10 million units are produced annually by American manufacturers. Two notable outliers were the 5.7 million cars produced in 2009 and the 8.8 million cars produced in 2020 as a result of the global COVID-19 pandemic.

In the United States, there is a growing need for environmentally friendly materials, which may support the future sales of bio-based acrylonitrile. A renewable acrylonitrile pilot production facility was being built in Charleston, West Virginia, in April 2022. Trillium Renewable Chemicals was constructing the facility, which was anticipated to cut gas emissions for acrylonitrile produced from petroleum feedstock by 70% when compared to conventional manufacturing methods.