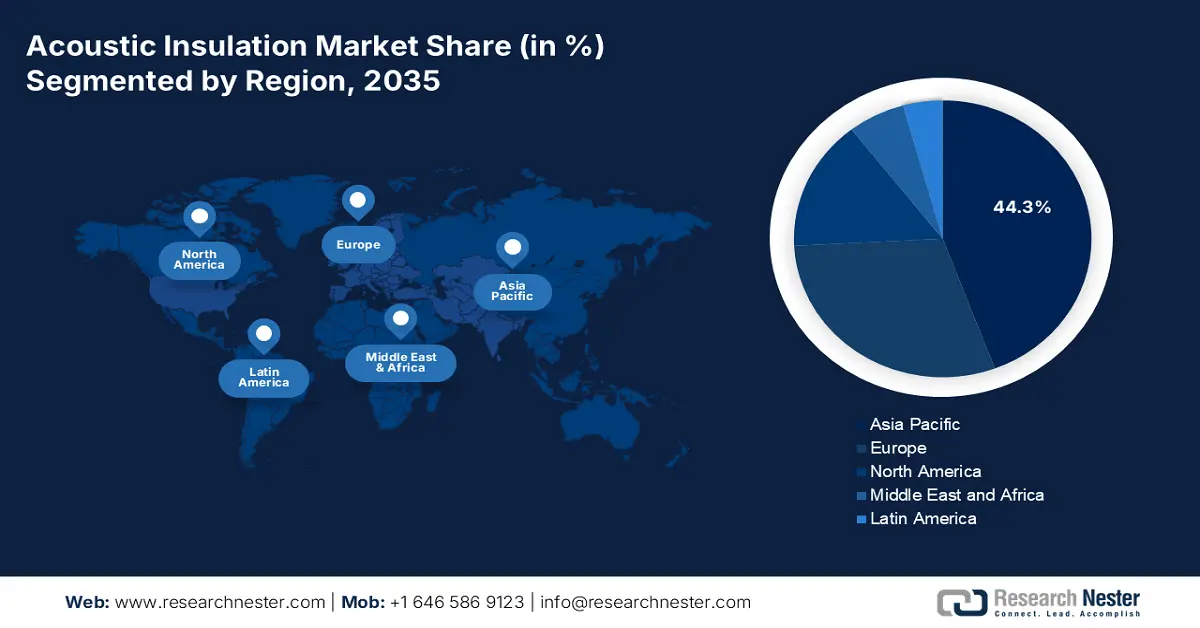

Acoustic Insulation Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to lead the acoustic insulation market with a share of 44.3% by 2035. The market for acoustic insulation is expected to expand over the next several years due to the expanding transportation sector and infrastructure. The market for acoustic insulation materials is expanding due to several causes, including the stringent building acoustic isolation regulations, the need to control noise in industrial equipment and transportation, and others. An optimistic outlook for market expansion has been provided by the construction industry. A typical lightweight office partition provides about 45 dB Dw sound insulation, reducing 65 dB of speech to roughly 20 dB. If the source noise rises to 75 dB, the adjacent room experiences about 30 dB, making conversation audible. The industry has grown as a result of advanced building methods and stringent requirements for these structures, one of which is acoustic comfort.

The China acoustic insulation market is expanding as Chinese consumers become more conscious of the negative health impacts of noise pollution, including stress, sleep disorders, and decreased productivity, driving up demand for soundproof living and working spaces. China’s three-year civil airport noise action plan aims to build a pollution control standard system by 2025. Airports handling nearly 5 million passengers must enable real-time noise monitoring, while by 2027, areas around airports with more than 10 million passengers should see improved environmental quality. As more individuals place a higher priority on soundproofing to create calm and healthy interior environments, this trend is propelling the usage of acoustic insulation materials in the residential, commercial, and healthcare sectors. In February 2025, China built 2,132 quiet communities, installed 4,005 noise-monitoring stations in 338 cities, and placed 177,000 industrial enterprises under a noise-emissions permit system. In 2024, 11 provinces designated over 860 square kilometers as noise-sensitive building zones.

In India, the need for efficient acoustic insulation solutions has increased due to the fast urbanization of the nation, especially in major cities. Due to the construction growth, there is a greater requirement for noise reduction in both residential and commercial settings. The region's industry is expanding more quickly now that more reasonably priced and effective materials are available, which has made it simpler for manufacturers and builders to incorporate acoustic solutions. Budgetary allotments for infrastructure in India have increased rapidly, reaching ₹10 lakh crore in 2023-2024. The need for acoustic insulation solutions has been fueled by India's expanding infrastructure development and growing awareness of the value of acoustics in building projects, especially in places such as Mumbai and New Delhi.

Europe Market Insights

Europe is expected to lead the acoustic insulation industry with a share of 29.9% by 2035. Strict building code requirements for energy efficiency and noise pollution are the main drivers of the rising demand for soundproofing solutions. The use of acoustic insulation in residential and commercial structures has been pioneered by nations such as France, Germany, and the U.K. This demand has been driven by a rise in development projects aimed at improving the quality of life, as well as a growing focus on creating quieter urban areas. One of the main goals of the EU's zero pollution action plan is to lessen the adverse effects of exposure to environmental noise. By 2030, the plan seeks to cut the number of individuals who are regularly bothered by noise from transportation by 30%.

Germany's growing need for acoustic insulation solutions has been fueled by significant construction projects, including the expansion of public transportation networks and the remodeling of commercial buildings. The region's supremacy has also been aided by the growth of green building programs and the use of sustainable construction techniques. Its significant building industry and dedication to sustainability have led to a dramatic increase in the use of acoustic insulation solutions. Knauf Insulation glasswool, made with advanced German fiberisation and ECOSE Technology from recycled glass, offers non-combustibility per AS 1530.1. In steel stud systems with 13mm plasterboard, it's 11kg/m³ acoustic batts deliver superior STC ratings compared to polyester insulation. Furthermore, the technological developments in the area of insulating material manufacturing have aided in the market's overall expansion.

In the U.K., consumers in the market were looking for better interior surroundings, particularly in commercial settings. Due to this demand, businesses, educational institutions, theaters, and entertainment venues are prioritizing the best possible acoustics for both customer satisfaction and efficiency. Furthermore, the market has benefited from increased spending on cars and leisure activities brought on by rising disposable income. In May 2024, the PERFORMANCE Technology Group company Mayplas introduced a thermal and acoustic insulation product for suspended ceiling systems in May 2024 that is derived from industrial hemp farmed in the United Kingdom. The hemp pad, named 'Thermapad', is part of the company's new GroundID line of insulating products that incorporate natural fibers. A natural fiber hemp slab is sliced and enclosed by Mayplas to create Thermapad, which comes in various sizes to match metal tray ceiling systems from various manufacturers.

North America Market Insights

North America is expected to lead the acoustic insulation industry with a share of 15.3% by 2035. Owing to strict building regulations to improve energy efficiency and manage noise in commercial as well as residential applications. Increased urbanization, growth in the construction infrastructure, and heightened awareness of the benefits of indoor acoustic comfort encourage the use of acoustic insulation. Demand stretches across the construction, automotive, and industrial market segments, and increased innovations in environmentally-friendly materials, along with an active government commitment to developing green buildings, will all continue to stimulate growth across this region. North America is expected to remain a recognized global leader in providing acoustic insulation solutions.

Dramatic growth in the U.S. acoustic insulation market is driven primarily by an increased focus on federal and state energy-efficiency regulations in combination with sustainable construction practices. The combination of high urban density and a healthy renovation activity has increased demand for residential and commercial buildings. Approximately 40-60% of fiberglass products are made from recycled glass. In the production of mineral wool, 75% post-industrial recycled material is typically used. Vehicle manufacturers are increasingly incorporating high-performance acoustic materials to meet comfort and emission standards. Wool’s unique chemistry allows it to absorb up to 30% of its weight in moisture without feeling damp, helping regulate and maintain balanced humidity levels inside a car’s interior.

The expansion of the acoustic insulation market in Canada is driven by various factors, which include building codes, adverse climatic conditions, and government drives for energy-efficient, noise-reducing constructions. Urban activity continues to drive demand for multi-family units with improved soundproofing in cities like Toronto and Vancouver. Growth of new developments in automotive and industrial applications, along with ambitious sustainability goals and incentives to procure sustainable materials, is driving rapid innovations in the market. Likewise, Canada's ongoing commitment to low-carbon and high-performance buildings will allow more and more advanced acoustic insulation to be adopted in residential, commercial, and industrial projects.