5G Edge Cloud Network and Services Market - Growth Drivers and Challenges

Growth Drivers

- Acceleration of AI and IoT workloads at the edge: The large-scale deployment of sophisticated AI and billions of IoT devices is a principal growth driver, necessitating local, real-time data processing. Edge cloud provides the necessary compute and storage locality to enable real-time AI/ML inferencing and data aggregation without having to upload data all the way back to distant core clouds. This blending enables next-gen business applications across industrial automation, security, and enterprise venue services. Enterprise customers expect end-to-end offerings powered by automation and AI-driven orchestration to be deployed seamlessly. For instance, in June 2025, Tata Consultancy Services (TCS) and Microsoft announced an expanded collaboration focused on building new AI-led solutions using platforms like Microsoft Copilot Studio and Azure AI Foundry. The partnership addresses the need for pre-integrated, full stacks at the edge.

- Ultra-low-latency enterprise applications requirements: Commercial deployment of mission-critical applications such as AR/VR remote expertise, autonomous navigation, and dynamic logistics relies heavily on the achievement of single-digit millisecond latency. 5G and MEC are the only two technologies available that can reliably meet this tight objective, transforming industries such as manufacturing and healthcare. This critical capability powers competitive edge for first-movers in high-performance digital business. In September 2025, Verizon announced it would be the first wireless carrier to offer the new AI-powered Meta Ray-Ban Display glasses. This follows the existing strategic partnership between the two companies, which has previously explored leveraging Verizon's 5G Mobile Edge Compute infrastructure for applications like XR cloud rendering and low-latency streaming

- Strategic telco-hyperscaler collaboration models: The expansion of the market is increasingly driven by strategic, collaborative solutions between mobile network operators and top public cloud providers (hyperscalers). These partnerships combine the telcos' access to spectrum and networks with the hyperscalers' cloud infrastructure and developer ecosystems. The shared model accelerates the rollout of private 5G networks and distributed cloud regions to enter markets more rapidly and grow more aggressively. The market is accelerating growth in shared cloud roll-outs, and there is mutual risk and reward. For instance, Canalys had indicated in August 2025 that telco-hyperscaler collaborations are propelling edge cloud partnerships for 5G private networks and low-latency services at a rapid rate, in partnership with the leading global operators.

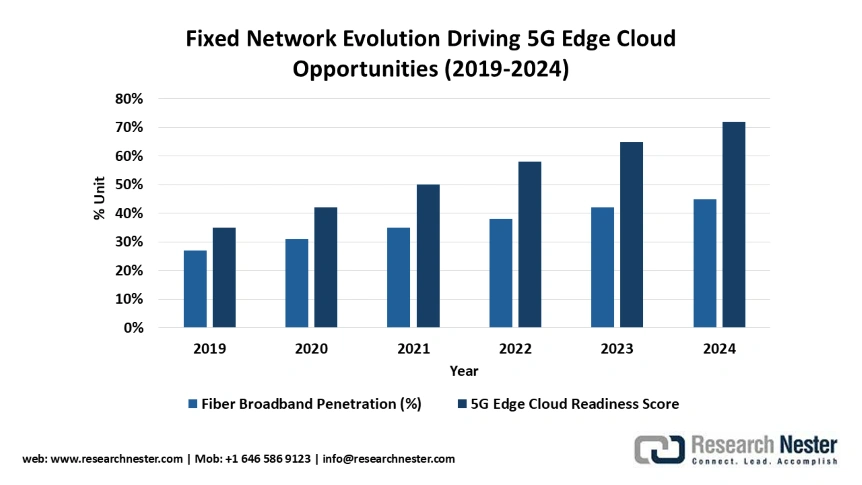

Fixed Network Evolution Driving 5G Edge Cloud Opportunities (2019-2024)

The steady growth of fiber broadband in countries, increasing from 27% to 45% of fixed subscriptions between 2019 to 2024, provides critical infrastructure for 5G edge cloud network deployment by ensuring reliable backhaul connectivity. This expanding fiber footprint enables hybrid architectures where 5G wireless access combines with fiber backhaul to deliver low-latency edge computing services to urban and suburban areas.

Source: OECD

5G Edge Cloud Infrastructure Readiness & Market Opportunities

|

Infrastructure Component |

Market Status |

Edge Cloud Service Enablement |

Growth Driver |

|

Fiber Backbone Networks |

44.6% OECD penetration; 4 countries >80% fiber adoption |

Enables ultra-low latency edge computing and network slicing |

Critical for data-intensive applications (AR/VR, autonomous systems) |

|

5G Mobile Infrastructure |

33% of mobile subscriptions; 48% YoY growth |

Supports mobile edge computing and distributed cloud services |

Drives demand for edge-native applications and network APIs |

|

Fixed Wireless Access (FWA) |

5.8% OECD fixed broadband; 17% annual growth |

Extends edge coverage to underserved/rural markets |

Cost-effective solution for last-mile edge connectivity |

Source: OECD

Challenges

- Compliance with regulations and data sovereignty: The decentralized nature of the 5G edge cloud ensures that it is challenging to adhere to the regulations, particularly where data sovereignty, privacy, and national security concerns regarding infrastructure management are involved. This fractured regulatory environment poses a significant technical and regulatory hurdle to the development of truly global, but compliant, edge solutions. Governments worldwide are increasingly insisting that significant public sector information and services be hosted within local or acceptable geographic boundaries. For instance, in July 2024, Germany made agreements with domestic telcos requiring the removal of all Huawei/ZTE equipment from 5G core networks by 2026 to secure the 5G edge ecosystem and ensure technology sovereignty for public services security. These steps require immediate vendor supply chain and network architecture adjustments.

- Standardization and interoperability of multi-vendor edge platforms: One of the technical challenges of primary importance is the lack of shared standards for hosting and managing services on the enormous quantity of vendor-specific 5G network stacks and clouds. Lack of interoperability prevents mass enterprise adoption and constrains edge application scalability generalized over to a wider number of instances, increasing integration costs. This is recognized at the government level, with the European Commission's ICT Standardizations Rolling Plan in August 2025 indicating harmonized reference frameworks to have in place interoperable cloud-edge networks for the public services and European critical infrastructure. Vendors are anticipated to make open architecture their priority to solve this challenge.

5G Edge Cloud Network and Services Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

18.5% |

|

Base Year Market Size (2025) |

USD 7.5 billion |

|

Forecast Year Market Size (2035) |

USD 40.9 billion |

|

Regional Scope |

|