5-HT3 Receptor Antagonists Market Outlook:

5-HT3 Receptor Antagonists Market size was valued at USD 2.8 billion in 2025 and is projected to reach USD 4.4 billion by the end of 2035, rising at a CAGR of 5.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of 5-HT3 receptor antagonists is estimated at USD 3 billion.

The increasing global burden of chemotherapy-induced and postoperative nausea and vomiting, as well as irritable bowel syndrome, cancer, and other gastrointestinal disorders, is the key factor propelling the upliftment of the market. Testifying to this, Heliyon in February 2024 revealed that a study involving 724 patients found that both postoperative nausea and vomiting and severe pain are most prevalent within the first 6 hours after general anesthesia, gradually declining over 24 hours, highlighting the presence of a reliable consumer base in this field.

In addition, in terms of healthcare economics, the pricing and reimbursement aspects are the most influential factors in this landscape, particularly in well-established healthcare systems. In this context, the study by AGA journals in May 2025 highlighted that in 2021, gastrointestinal diseases in the U.S. resulted in USD 111.8 billion in healthcare expenditures, highlighting a major economic burden. These conditions led to 14.5 million emergency department visits and 2.9 million hospital admissions.

Key 5-HT3 Receptor Antagonists Market Insights Summary:

Regional Insights:

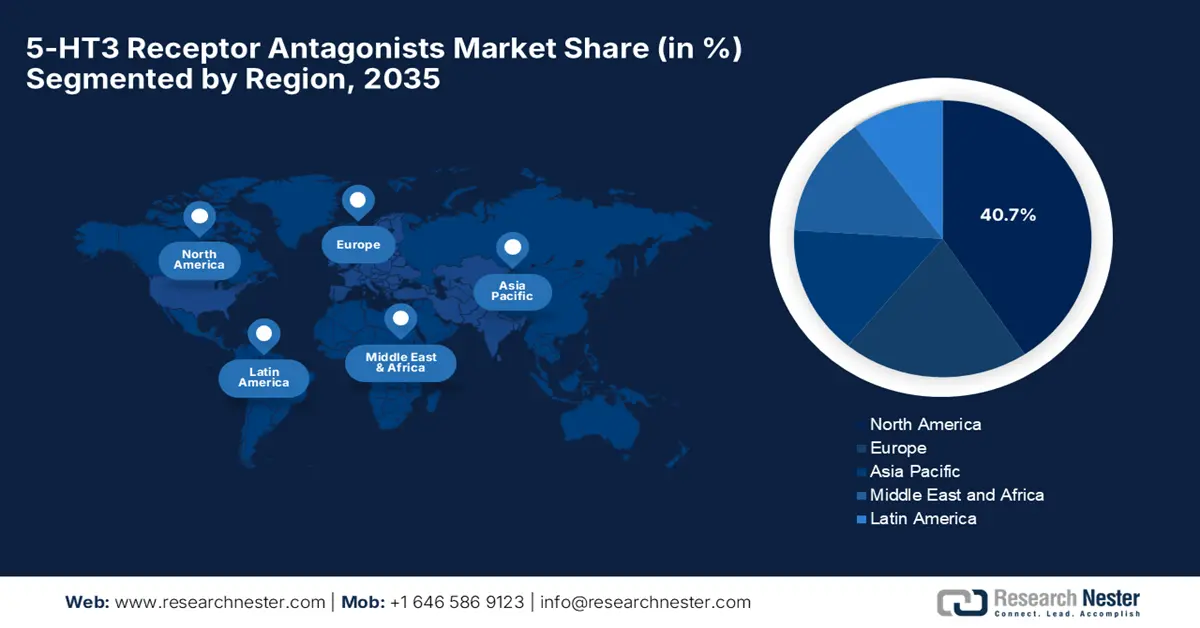

- North America is expected to hold a 40.7% share in the 5-HT3 Receptor Antagonists Market by 2035, driven by increased federal budget allocation and rising cancer treatment admissions.

- Asia Pacific market is projected to grow at the fastest pace by 2035, owing to expanding oncology infrastructure and rising cancer prevalence.

Segment Insights:

- Hospital Pharmacies segment is projected to account for 70.7% share in the 5-HT3 Receptor Antagonists Market during the discussed timeframe, propelled by the administration of intravenous chemotherapy and immediate post-operative care.

- Chemotherapy-Induced Nausea and Vomiting segment is expected to hold a 65.4% share by 2035, owing to the increasing burden of cancer.

Key Growth Trends:

- Increasing use of chemotherapy & radiation

- Improvements in healthcare infrastructure

Major Challenges:

- Patent expiry

- Side effects and limited long-term use

Key Players: Helsinn Group, Fresenius Kabi, Sandoz (Novartis), Teva Pharmaceutical, Cipla Ltd., Sun Pharmaceutical, Dr. Reddy's Laboratories, Pfizer Inc., GlaxoSmithKline (GSK), Hikma Pharmaceuticals, Aurobindo Pharma, Mylan N.V. (Viatris), Eisai Co., Ltd., Roche Holding AG, Samsung Bioepis, Aspen Pharmacare, Jiangsu Hengrui Medicine, MSD (Merck & Co.), Mayne Pharma, Duopharma Biotech Berhad and other.

Global 5-HT3 Receptor Antagonists Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.8 billion

- 2026 Market Size: USD 3 billion

- Projected Market Size: USD 4.4 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: U.S., Germany, Japan, UK, France

- Emerging Countries: China, India, South Korea, Malaysia, Canada

Last updated on : 26 September, 2025

5-HT3 Receptor Antagonists Market - Growth Drivers and Challenges

Growth Drivers

- Increasing use of chemotherapy & radiation: The rising instances of cancer, followed by chemotherapy and radiation, are the major factors driving business in the market. Testifying to this, NIH in March 2025 revealed that about 80% of chemotherapy patients experience these distressing side effects, which increases the demand for effective antiemetics like 5-HT3 receptor antagonists. Also, their routine incorporation in oncology care protocols further underscores their critical role in supportive cancer treatment worldwide.

- Improvements in healthcare infrastructure: This, along with enhanced healthcare access, is fostering a profitable business environment for the 5-HT3 receptor antagonists industry. In February 2025, Tata Capital–backed MOC Cancer Care secured a substantial USD 18 million in funding from Elevation Capital to expand its community-based oncology services across India. The organization has 24 existing centers delivering over 65,000 chemotherapy sessions annually, making it suitable for standard market growth.

- Innovations in drug formulations: The newer long-acting agents and more convenient dosage forms, such as transdermal patches and injectables, are allowing broader usage in this field. In January 2022, Cumberland Pharmaceuticals reported that it had acquired U.S. rights to SANCUSO, which is an FDA-approved transdermal patch for chemotherapy-induced nausea and vomiting, from Japan-based Kyowa Kirin, which highlights ongoing innovation and competition within the industry.

Cancer Epidemiology: New Cases and Deaths in 2020

|

Statistic |

Value |

|

Global cancer deaths |

Nearly 10 million (about 1 in 6 deaths) |

|

Breast cancer |

2.26 million cases |

|

Lung cancer |

2.21 million cases |

|

Colon & rectum cancer |

1.93 million cases |

|

Prostate cancer |

1.41 million cases |

|

Skin cancer (non-melanoma) |

1.20 million cases |

|

Stomach cancer |

1.09 million cases |

Source: WHO

Revenue Opportunities in the Market (2022-2025)

|

Year |

Company |

Product |

Market / Region |

Description (Revenue Opportunity) |

|

2025 |

Knight Therapeutics & Helsinn |

ONICIT (palonosetron) |

Mexico, Brazil, LATAM |

Exclusive license & distribution for IV formulation; expands Latin America oncology portfolio. |

|

2024 |

Avenacy |

Palonosetron Hydrochloride Injection |

U.S. |

Launched a generic equivalent to Aloxi; targets the US market with differentiated packaging. |

|

2022 |

Pharmascience Canada |

PRpms-ONDANSETRON ODT |

Canada |

Launched generic ODT tablets for pediatric, adult, and geriatric indications at a lower cost. |

Source: Company Official Press Releases

Challenges

- Patent expiry: This is one of the major challenges in the market, owing to the loss of patent for several key drugs, such as ondansetron and granisetron. On the other hand, the expiration of patents leads to generic manufacturers dominating in this field, which leads to significantly reduced prices and profit margins for brand-name producers. Therefore, this intensifies competition, especially in developed economies such as the U.S. and Europe.

- Side effects and limited long-term use: This is yet another factor negatively influencing progression in the market. The potential risks include QT interval prolongation, constipation, and serotonin syndrome, especially when combined with other serotonergic agents. Therefore, this aspect adds limitations to their use, particularly in patients with cardiovascular comorbidities or those on multiple medications. Additionally, 5-HT3 antagonists are mostly prescribed for short-term management, which restricts the market’s growth potential.

5-HT3 Receptor Antagonists Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 2.8 billion |

|

Forecast Year Market Size (2035) |

USD 4.4 billion |

|

Regional Scope |

|

5-HT3 Receptor Antagonists Market Segmentation:

Distribution Channel Segment Analysis

Based on the distribution channel, the hospital pharmacies segment is projected to garner the largest revenue share of 70.7% in the 5-HT3 receptor antagonists market during the discussed timeframe. The administration of intravenous chemotherapy and the immediate post-operative care require a clinical setting, which is a major factor driving growth in this segment. Besides, the management of CINV occurs mostly in hospitals, wherein the pharmacies remain as the primary procurement point for expensive IV formulations such as palonosetron, driving their revenue dominance in this field.

Application Segment Analysis

In terms of application, the chemotherapy-induced nausea and vomiting segment is expected to gain a lucrative share of 65.4% in the 5-HT3 receptor antagonists market by the end of 2035. The growth in the segment is effectively attributable to the increasing burden of cancer, which leads to a higher volume of chemotherapy cycles. According to the WHO report published in February 2024, 20 million new cancer cases were recorded across all nations in 2022, wherein lung, breast, and colorectal cancers led the burden, fueling demand for treatments such as 5-HT3 receptor antagonists.

Drug Type Segment Analysis

Based on drug type, the palonosetron segment is predicted to attain a significant share of 45.3% in the 5-HT3 receptor antagonists market during the discussed tenure. In January 2025, Helsinn Group and ESTEVE renewed their Distribution and License Agreement in Germany for AKYNZEO (netupitant-palonosetron) and ALOXI (palonosetron), which are two key therapies for managing chemotherapy-induced nausea and vomiting. Also, the long-term partnership ensures continued access to these FDA-approved, guideline-recommended 5-HT3 receptor antagonists for adult cancer patients.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Distribution Channel |

|

|

Application |

|

|

Drug Type |

|

|

Route of Administration |

|

|

Therapeutic Area |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

5-HT3 Receptor Antagonists Market - Regional Analysis

North America Market Insights

North America in the 5-HT3 receptor antagonists market is expected to capture the largest revenue share of 40.7% by the end of 2035. The growth in the region is effectively attributed to a surge in federal budget allocation and an increase in cancer treatment admissions. Testifying to the same, NCI states that as of May 2025, there are approximately 18.6 million cancer survivors in the U.S., making up about 5.4% of the population. Also, this number is projected to rise significantly, reaching 26 million by the end of 2040; therefore, this growing survivor population highlights the expanding need for long-term care.

In the U.S., the market is driven by increasing Medicare spending and various state-level initiatives, especially in Texas and California. For instance, as of October 2024, CMS reports Medicare processed over USD 1.1 billion fee-for-service claims and made payments totaling more than USD 424 billion, making it the largest healthcare payer in the U.S. These payments cover a wide range of services and settings, including inpatient care, outpatient departments, and physician offices, denoting a positive market outlook.

The 5-HT3 receptor antagonists market in Canada is driven by the increasing demand for chemotherapy, wherein Health Canada has also streamlined the regulatory approvals for the combination therapies, enabling faster access to the product across major provinces. In October 2024, Health Canada reported that it has committed USD 12.29 million over five years, along with USD 220,000 annually ongoing, to support the prevention and treatment of cancers linked to firefighting, providing an encouraging opportunity for pioneers in the country.

Financial Burden of Cancer Care in the U.S.

|

Year |

National Cancer Care Costs |

Notes |

|

2015 |

USD 190.2 billion |

Baseline estimate including medical services and oral prescription drugs costs |

|

2020 |

USD 208.9 billion |

10% increase from 2015 due to aging and growth of the U.S. population (in 2020 dollars) |

|

2030 |

USD 245+ billion (projection) |

Projected to exceed USD 245 billion by 2030, a 34% increase from 2015, mainly driven by population aging. |

Source: NIH

APAC Market Insights

The 5-HT3 receptor antagonists market in the Asia Pacific is poised to register the fastest growth by the end of the forecast duration, driven by expanding oncology infrastructure and a surge in the prevalence of cancer. There has been an increased spending on getting high-efficiency antiemetics for treating CINV in the Asia Pacific. On the other hand, countries such as China, India, Japan, and South Korea are investing heavily in healthcare infrastructure, leading to increased demand for effective antiemetic treatments, thereby fostering a favorable business environment.

The market in China is reinforcing its dominance over the regional landscape, driven by increased healthcare access, rising cancer rates, and a higher number of chemotherapy and surgical procedures. For instance, in May 2025, Jiangsu Hengrui Pharmaceuticals' subsidiary reported that it had received approval from the National Medical Products Administration for its Class 1 innovative drug called Fosrolapitant and Palonosetron Hydrochloride for Injection (HR20013), which is a combination of a 5-HT3 antagonist (palonosetron) with an NK-1 antagonist for preventing nausea and vomiting caused by highly emetogenic chemotherapy in adults.

In India, the market growth is driven by the launch of public health programs such as Ayushman Bharat, which involves surgery, oncology, and chemotherapy, which is generally used as a frontline treatment. In August 2025, MoHFW reported that under the Rashtriya Arogya Nidhi (RAN) scheme, financial assistance of up to ₹15 lakh is provided to poor cancer patients through the HMCPF for treatment at Regional Cancer Centres, Tertiary Care Cancer Centres, State Cancer Institutes, and government hospitals.

Financial Assistance under Rashtriya Arogya Nidhi (RAN) for Cancer Patients

|

Description |

Amount (₹) |

Amount (USD approx.) |

|

Maximum one-time financial assistance per patient |

15,00,000 (₹15 lakh) |

18,070 |

|

Total amount disbursed in 2024-25 |

27,06,00,000 (₹27.06 crore) |

3,258,000 |

|

Amount disbursed in 2025-26 (till 16 July 2025) |

9,14,00,000 (₹9.14 crore) |

1,101,200 |

Source: MoHFW

Europe Market Insights

The 5-HT3 receptor antagonists market in Europe is anticipated to garner significant traction on the back of robust regional expansion for the treatment of CINV and constant efforts from both domestic and international players. In April 2025, Helsinn Group announced the submission of a new formulation of AKYNZEO to the European Medicines Agency (EMA), which is used to prevent acute and delayed nausea and vomiting caused by highly and moderately emetogenic cancer chemotherapy, including cisplatin-based treatments.

In Germany, the market is gaining immense exposure owing to the robust investment in oncology and leading digital health infrastructure. The country also benefits from a robust pharmaceutical sector, wherein the increasing awareness of supportive care therapies in oncology supports steady growth in this market. Furthermore, the government initiatives to improve cancer care and an aging population contribute to the increasing use of 5-HT3 receptor antagonists across hospitals and outpatient settings.

The market in the UK is also witnessing significant growth owing to increased demand to handle chemotherapy-induced nausea and vomiting. In June 2025, the NHS highlighted that 5-HT₃ receptor antagonists such as ondansetron and granisetron are a cornerstone of anti-emetic therapy, specifically recommended for the prophylaxis of acute chemotherapy-induced nausea and vomiting. Besides, they are considered equally efficacious and are to be administered orally, typically only on the days of chemotherapy administration.

Key 5-HT3 Receptor Antagonists Market Players:

- Helsinn Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fresenius Kabi

- Sandoz (Novartis)

- Teva Pharmaceutical

- Cipla Ltd.

- Sun Pharmaceutical

- Dr. Reddy's Laboratories

- Pfizer Inc.

- GlaxoSmithKline (GSK)

- Hikma Pharmaceuticals

- Aurobindo Pharma

- Mylan N.V. (Viatris)

- Eisai Co., Ltd.

- Roche Holding AG

- Samsung Bioepis

- Aspen Pharmacare

- Jiangsu Hengrui Medicine

- MSD (Merck & Co.)

- Mayne Pharma

- Duopharma Biotech Berhad

The competitive landscape of the market is rapidly evolving as established key players, healthcare giants, and new entrants are investing in including novel medicines. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. Besides, the leading pioneers are adopting numerous strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to secure their market position.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In September 2025, Hoth Therapeutics announced positive preclinical results for its precision antisense candidate HT-KIT, which demonstrated rapid tumor cell death, strong suppression of the KIT oncogene, and a clean safety profile in models of gastrointestinal stromal tumors and systemic mastocytosis.

- In May 2025, Knight Therapeutics announced that it relaunched ONICIT in Brazil and Mexico, which is a second-generation 5-HT3 receptor antagonist, approved for the prevention of chemotherapy-induced nausea and vomiting and postoperative nausea and vomiting in adults, and in Brazil, for pediatric patients as well.

- Report ID: 3301

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

5-HT3 Receptor Antagonists Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.