3D Virtual Fence Market Outlook:

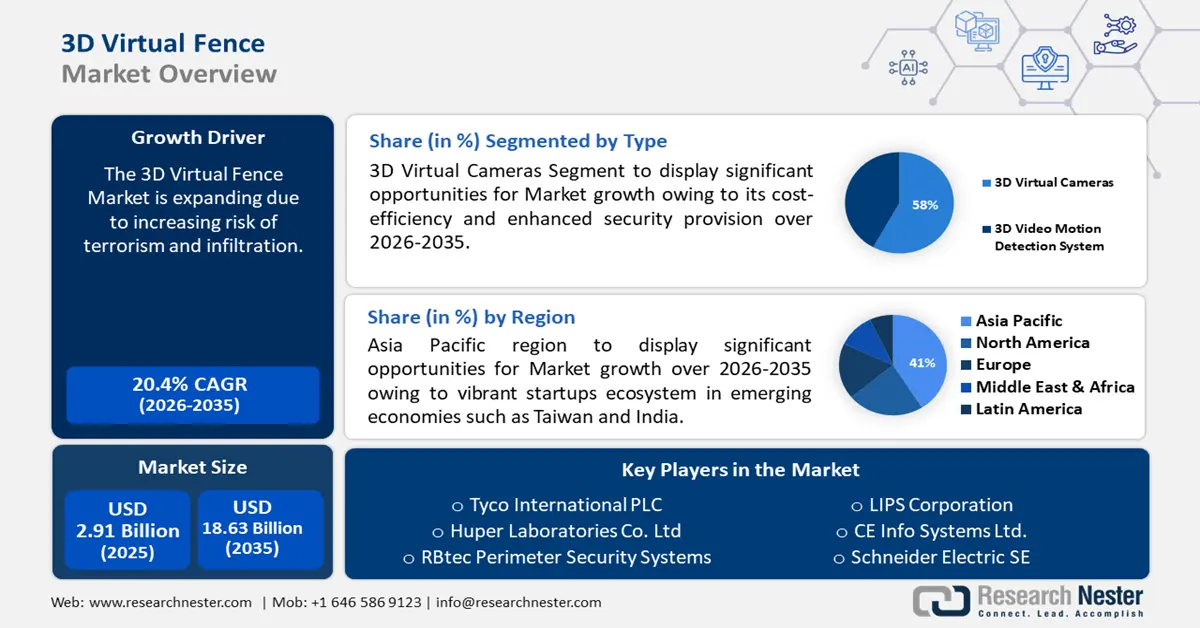

3D Virtual Fence Market size was over USD 2.91 billion in 2025 and is projected to reach USD 18.63 billion by 2035, witnessing around 20.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 3D virtual fence is evaluated at USD 3.44 billion.

The increasing risk of terrorism and infiltration serves as the primary boosting parameter for the market. This surge is fundamentally due to the increasing need for advanced security measures, as underlined by the United States designating specific individuals and groups as global terrorists. The leap in terrorism’s lethality, from 1.3 to 1.7 deaths per attack from 2021 to 2022, marks the first increase in the fatality rate in half a decade, sharpening the focus on sophisticated defense mechanisms.

In addition to these, factors that are believed to fuel the market growth of 3D virtual fence include its capability to monitor secure areas using advanced sensors and video analytics. This digital boundary, alerting security upon perimeter breaches, is a significant driving factor in modern surveillance and security systems.

Key 3D Virtual Fence Market Insights Summary:

Regional Highlights:

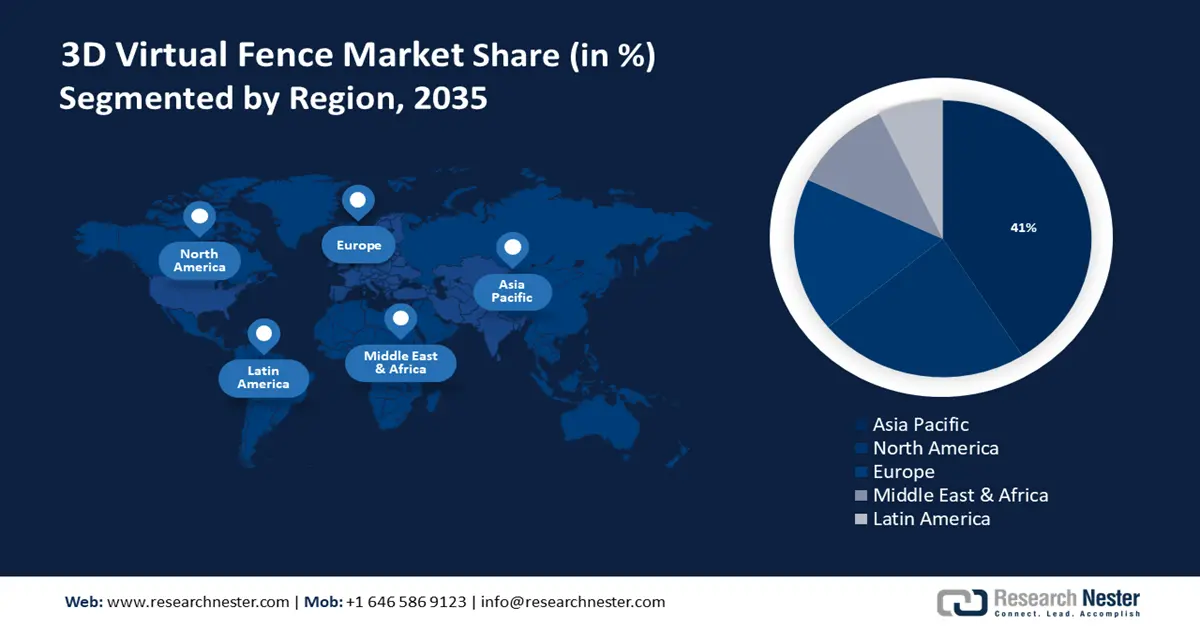

- The Asia Pacific 3D virtual fence market attains a 41% share by 2035, driven by the vibrant startups ecosystem and increased investments in security measures.

- The North America market will account for 23% share by 2035, attributed to escalating concerns over terrorist threats and surge in innovation with funding.

Segment Insights:

- The 3d virtual cameras segment in the 3d virtual fence market is projected to hold a 58% share by 2035, driven by its cost-efficiency and enhanced security provisions across key sectors.

- The agriculture segment in the 3d virtual fence market is projected to hold a 54% share by 2035, driven by the use of 3D virtual fencing for livestock management and controlled grazing.

Key Growth Trends:

- Enhanced Border Security Measures with Advanced Surveillance

- Advancements in Security Technologies for Escalating Terrorist Threats

Major Challenges:

- High Implementation Costs

Key Players: Avigilon Corporation, Controp Precision Technologies, Ltd., Tyco International PLC, Huper Laboratories Co. Ltd, RBtec Perimeter Security Systems, Agersens Pty Ltd, LIPS Corporation, CE Info Systems Ltd., Schneider Electric SE, DXC Technology Company.

Global 3D Virtual Fence Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.91 billion

- 2026 Market Size: USD 3.44 billion

- Projected Market Size: USD 18.63 billion by 2035

- Growth Forecasts: 20.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, South Korea, Thailand, Mexico

Last updated on : 16 September, 2025

3D Virtual Fence Market Growth Drivers and Challenges:

Growth Drivers

- Enhanced Border Security Measures with Advanced Surveillance - India’s “Smart Fence” project launched along the Indo-Pak border in 2018, represents a significant advancement in perimeter security technology. This initiative features an array of high-tech components, including ground surveillance radar capable of scanning 180 degrees and detecting vehicles up to 5 km away. Along with motion sensors, radars, and day-night vision cameras, this comprehensive surveillance system is designed to detect and deter illegal cross-border activities effectively. By integrating these sophisticated surveillance and detection systems, the project aims to fortify the border, reduce human surveillance errors, and enhance the overall security infrastructure against potential terrorist threats.

- Advancements in Security Technologies for Escalating Terrorist Threats - The increasing sophistication and lethality of terrorist attacks, highlighted a 22% rise in terrorism-related deaths to 8,352, the highest since 2017, underscores the necessity for advanced security technologies. Despite a 22% decrease in the number of incidents to 3,350 and a reduction in affected countries t0 50, the deadliness of attacks has intensified. This scenario necessitates the deployment of smart and virtual fencing technologies, which incorporate real-time data analysis, facial recognition, and artificial intelligence. These systems are crucial for predicting and preventing attacks, offering immediate detection and response capabilities, and enabling a proactive and dynamic security strategy to counter the evolving and increasingly deadly nature of global terrorism.

- Adoption of Digital Geo-Fencing in Urban Security - Sweden’s introduction of terrorist-proof digital geo-fencing is a testament to the evolving landscape of urban security in response to radical terrorism and organized crime. This technology employs advanced sensors capable of identifying and locating specific sounds like gunshots, explosions, and breaking glass, transmitting this information to police monitoring stations instantly. Such a system allows for a swift response to potential threats, illustrating a proactive approach to urban security. It represents a move towards more intelligent, real-time surveillance and response systems that can significantly mitigate the impact of terrorist activities.

Challenges

- High Implementation Costs - The introduction of a 3D virtual fence is primarily obstructed by the high financial outlay required for hardware and software procurement, installation, and ongoing system maintenance. This economic strain is felt acutely by small enterprises, where budget constraints are typically more pronounced.

- The industry currently experiences a deficit in technical expertise regarding the 3D virtual fence market. This shortage means many organizations lack the necessary know-how to successfully implement and operate these systems.

3D Virtual Fence Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.4% |

|

Base Year Market Size (2025) |

USD 2.91 billion |

|

Forecast Year Market Size (2035) |

USD 18.63 billion |

|

Regional Scope |

|

3D Virtual Fence Market Segmentation:

Type Segment Analysis

The 3D virtual cameras segment is estimated to gain the largest market share of about 58% in the year 2035. This segment is recognized for its cost-efficiency and enhanced security provision and is anticipated to be the leading contributor to the 3d virtual fence market expansion. The increasing demand for advanced surveillance and the prevention of unauthorized entry are key factors in boosting revenue, particularly in applications across homeland security, military, and other public safety organizations.

End User Industry Segment Analysis

The agriculture segment is estimated to gain a significant share of about 54% in the year 2035. The segment growth can be attributed to the 3D virtual fencing’s diverse application in the agricultural sector, including livestock management and controlled grazing. As an animal-friendly solution that eliminates the need for physical barriers, its integration with other security systems enhances its appeal. Effective in both environmental management and species-specific strategies, such as in Alaska for reindeer reintroduction, continuous research promises to bolster its future potential.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Type |

|

|

End User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

3D Virtual Fence Market Regional Analysis:

APAC Market Insights

The 3D virtual fence market in Asia Pacific is anticipated to hold the largest with a share of about 41% by the end of 2035. The market growth in the region is also expected on account of multiple growth factor, one being the vibrant startups ecosystem in emerging economies such as Taiwan and India. These nations are enhancing their market positions, backed by the deployment of innovative security measures like advanced fencing systems. Parallel to economic developments, the Asia Pacific region has faced a 30% uptick in terrorism-related incidents concentrated in the Philippines, Myanmar, and Thailand, with around 4,000 events in five years. This surge is linked to the infiltration of transnational terrorist organization. Consequently, nations within the region are ramping up investments in security protocols, focusing significantly on border and national defenses to safeguard and promote stability, which in turn fosters sectoral expansion.

North American Market Insights

The North America 3D virtual fence market is estimated to be the second largest, registering a share of about 23% by the end of 2035. The market’s expansion can be attributed majorly to the escalating concerns over terrorist threats. Such anxieties have escalated the frequency of perimeter security breaches at both governmental and private entities, thereby propelling sector demand. Additionally, the region is witnessing a surge in innovation within the 3D virtual fencing market, propelled by substantial grants and funding streams, which further solidifies its sectoral expansion. A notable development reinforcing this trend occurred in April 2023, when the Bezos Earth Fund endowed the College of Agriculture and Life Sciences (CALS) with a USD 9.9 million grant. This funding is designated for pioneering a cost-effective virtual livestock fencing system. Such investments underscore the broader sectoral expansion efforts throughout the region.

3D Virtual Fence Market Players:

- Avigilon Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Controp Precision Technologies, Ltd.

- Tyco International PLC

- Huper Laboratories Co. Ltd

- RBtec Perimeter Security Systems

- Agersens Pty Ltd

- LIPS Corporation

- CE Info Systems Ltd.

- Schneider Electric SE

- DXC Technology Company

Recent Developments

- The LIPSafeGuard 3D virtual fence represented a cutting-edge advancement in enhancing safety within robotic manufacturing environments. This innovative technology created a three-dimensional boundary that serves as a protective barrier between humans and robots. By integrating advanced sensors and real-time monitoring systems, it ensured a secure workspace by preventing unauthorized access or potential collisions.

- Agersens is collaborating with Ohio State Univesity to conduct trial of the eShephard technology in the American beef and dairy sectors. This partnership aimed to evaluate the effectiveness of eShephard, a virtual herding system, in managing cattle across the US beef and dairy products.

- Report ID: 5947

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

3D Virtual Fence Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.