Search and Rescue Robots Market Outlook:

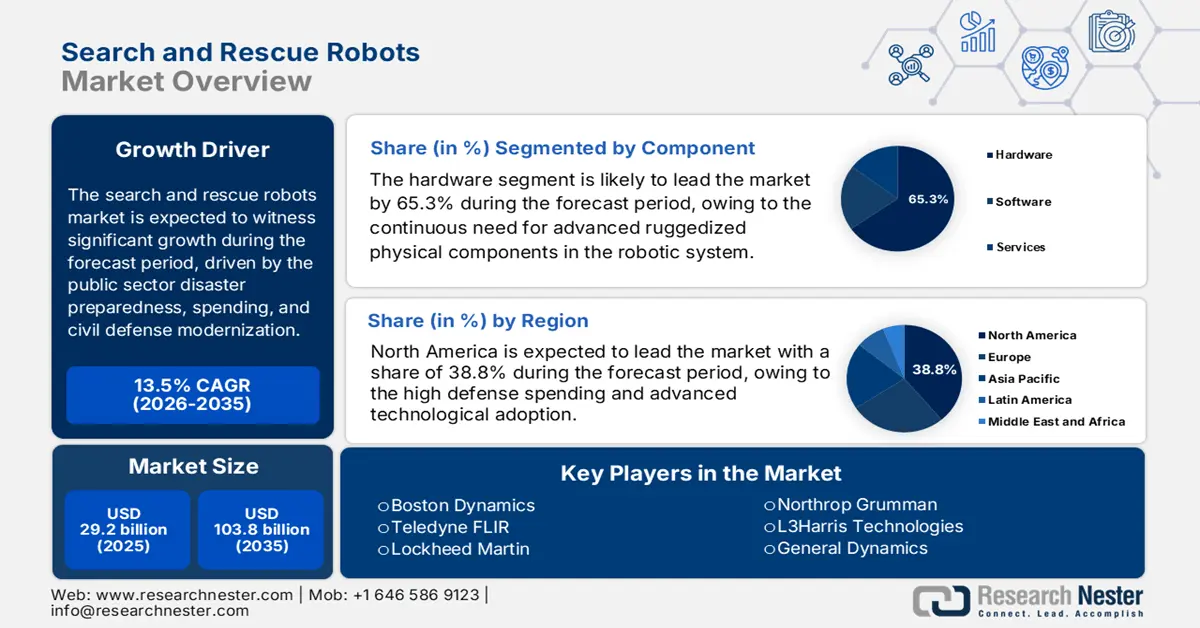

Search and Rescue Robots Market size was valued at USD 29.2 billion in 2025 and is projected to reach USD 103.8 billion by the end of 2035, rising at a CAGR of 13.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of search and rescue robots is estimated at USD 33.2 billion.

The global demand for the search and rescue robots market is closely tied to the public sector disaster preparedness, spending, civil defense modernization, and urban resilience programs. Government continue to increase allocations for disaster response due to the rising frequency and cost of natural hazards. The report from the U.S. National Centers for Environmental Information in January 2025 has indicated that 27 weather and climate disasters were confirmed, with the losses exceeding USD 1 billion, creating a sustained pressure on federal and state agencies to improve the response speed and responder safety via automation support systems. Further, the Federal Emergency Management Agency received a significant amount in 2024 discretionary budget authority, with a growing share directed toward urban search and rescue emergency logistics and responder capability upgrades, where robotic platforms are increasingly piloted for hazardous environment assessment and victim location tasks.

Besides, the search and rescue robots market expansion is also supported by the defense and homeland security programs that prioritize unmanned systems for operations in collapsed structures, contaminated zones, and conflict-affected urban environments. The U.S. Department of War in March 2023 funded autonomous systems under the Research, Development, Test & Evaluation budget, which exceeded USD 145 billion in 2024, with robotics and autonomous platforms cited as core capability areas. Further, the public safety agencies are integrating robotics into standardized response frameworks. The National Institute of Standards and Technology has expanded its Disaster Response Robot Evaluation Exercises, enabling agencies to validate robotic performance against real-world rescue scenarios, stimulating institutional acceptance and procurement readiness.

Key Search and Rescue Robots Market Insights Summary:

Regional Highlights:

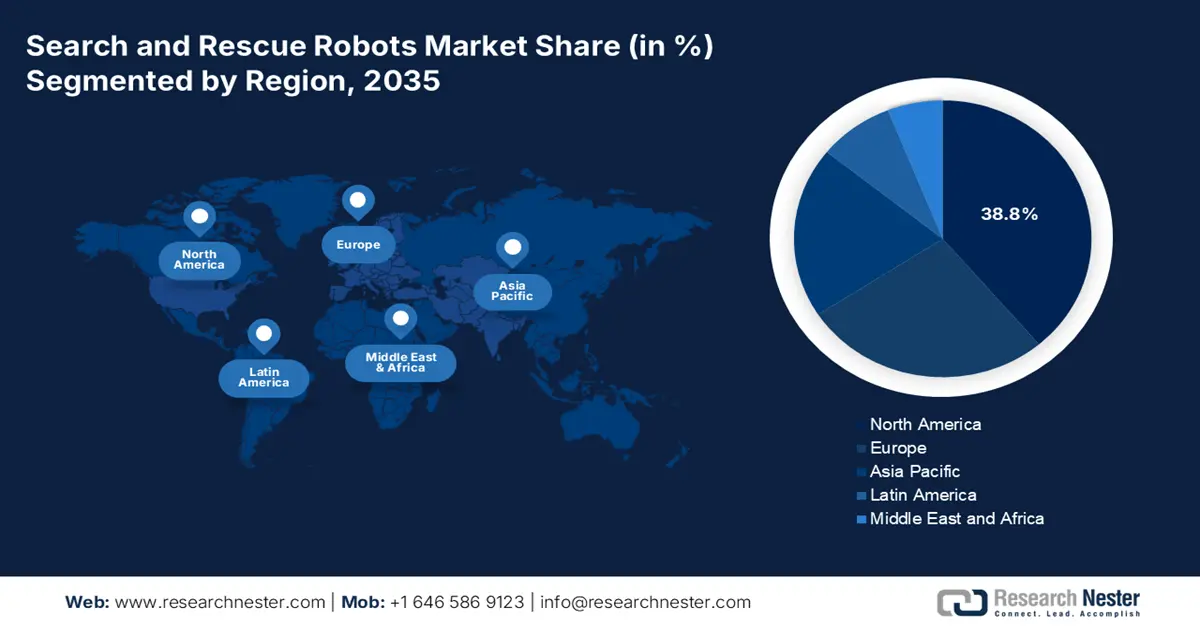

- North America in the search and rescue robots market is expected to secure a leading 38.8% share by 2035, reflecting strong institutional adoption and long-term demand momentum, supported by sustained defense spending and federally backed integration of robotics into emergency response frameworks.

- Asia Pacific is projected to emerge as the fastest-growing region at a CAGR of 10.8% during 2026–2035, positioning itself as a high-growth hub catalyzed by the formal incorporation of robotic systems into national disaster management programs.

Segment Insights:

- Hardware sub-segment in the search and rescue robots market is forecast to account for a dominant 65.3% revenue share by 2035, underscoring its central role in system valuation, reinforced by increased federal procurement activity and expanding R&D funding for core robotic components.

- Small robots sub-segment is expected to lead the size category by 2035, benefiting from broader deployment across tactical and emergency scenarios, enabled by government-led initiatives accelerating adoption of compact and agile robotic platforms.

Key Growth Trends:

- Escalating government spending on disaster preparedness and response

- Rising humanitarian response funding for the rapid assessment technologies

Major Challenges:

- Prohibitively high R&D and unit costs

- Stringent and slow regulatory approvals

Key Players: Teledyne FLIR, Lockheed Martin, Northrop Grumman, L3Harris Technologies, General Dynamics, AeroVironment, QinetiQ, Elbit Systems.

Global Search and Rescue Robots Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.2 billion

- 2026 Market Size: USD 33.2 billion

- Projected Market Size: USD 103.8 billion by 2035

- Growth Forecasts: 13.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Australia, France, Canada

Last updated on : 5 January, 2026

Search and Rescue Robots Market - Growth Drivers and Challenges

Growth Drivers

- Escalating government spending on disaster preparedness and response: Rising disaster frequency and the economic losses are directly driving the government investment in advanced response capabilities, which include SAR robotics. The U.S. Department of Homeland Security has allocated its total budget authority of USD 29.4 billion in 2023, reflecting higher allocations for logistics and responder safety programs. Similarly, the European Commission’s Civil Protection Mechanism expanded the funding under the rescEU program to boost the member state disaster response assets, including the unmanned systems. These funding increases create procurement opportunities for SAR robots designed for collapsed structures, flood zones, and hazardous environments. Actionably, vendors aligning products with FEMA USAR capability gaps or EU civil protection tenders gain faster adoption.

- Rising humanitarian response funding for the rapid assessment technologies: Humanitarian agencies increasingly rely on technology-enabled rapid assessment to improve the response efficiency. The report from the USAID in June 2024 indicates that nearly 200 million people require humanitarian assistance by 2050 due to the disasters straining human responder capacity. The government backed donors channel funds towards technologies that improve the safety and situational awareness, including the SAR robotics. These platforms reduce the exposure of responders in unstable or contaminated environments. Further, the SAR robot vendors partnering with the humanitarian organizations can access donors funded deployment that later influence government procurement. This driver boosts the demand in disaster-prone developing regions where international aid supplements national budgets.

- Institutionalization of robotic evaluation and standards by governments: Government-led testing and validation programs are reducing the procurement risk and stimulating the SAR robot adoption. The U.S. National Institute of Standards and Technology operates formal disaster response robot evaluation exercises, allowing public agencies to benchmark robotic performance in simulated disaster environments. These programs directly influence the purchasing decisions of the FEMA task forces, fire departments, and defense units. Standardized evaluation frameworks increase the buyer confidence and shorten the approval cycles, making the SAR robots more viable as operational assets rather than experimental tools. From an actionable standpoint, suppliers that align product development with the NIST test criteria improve the eligibility for government procurement. This driver signals a shift from ad hoc trials to structured adoption pipelines supported by the public sector institutions.

Challenges

- Prohibitively high R&D and unit costs: Developing a SAR robot requires an immense investment in the ruggedization of advanced sensors and the autonomous AI, leading to the high unit costs that limit the customer pools. For example, the Boston Dynamics Spot robots have an advanced sensor package costing significantly more than the base unit, making large-scale procurement difficult for municipal departments. Further, it is noted that reducing the cost of the capable small UGVs for the military remains a persistent challenge in the secure and rescue robots market, highlighting the industry-wide pricing pressure despite technological advancements.

- Stringent and slow regulatory approvals: Robots, mainly the UAVs, face complex airspace and safety regulations that delay the deployment. Top manufacturers in the secure and rescue robots market navigate this by using advanced technology design for the compliant infrastructure inspection, a stepping stone to SAR. However, the process is slow; many public safety drone flights were authorized, but each required specific waivers and approvals, creating a significant administrative barrier to rapid, scalable search and rescue robots market entry for new players.

Search and Rescue Robots Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.5% |

|

Base Year Market Size (2025) |

USD 29.2 billion |

|

Forecast Year Market Size (2035) |

USD 103.8 billion |

|

Regional Scope |

|

Search and Rescue Robots Market Segmentation:

Component Segment Analysis

Within the search and rescue robots market, the hardware sub-segment is expected to hold the largest revenue share and is projected to hold a share of 65.3% by 2035. This dominance is driven by the continuous need for advanced ruggedized physical components that constitute the core of any robotic system. Critical hardware includes advanced sensors, durable actuators, and manipulators, reliable communication modules, and long lasting directly dictate the overall system pricing. A key statistical driver is increased federal procurement and R&D funding. For instance, the White House 2025 report indicates that USD 86 million is allocated for air and maritime support, underscoring the substantial and sustained investment in the physical platforms and their enabling hardware technologies that form the market’s revenue backbone.

Size Segment Analysis

The small robots sub segment is leading the size segment in the search and rescue robots market. This is primarily due to their superior operational flexibility, ease of deployment, and lower unit cost, which enables wider adoption across military, first responder, and industrial sectors. The small robots, including most hand-launched UAVs and portable UGVs, can access confined spaces critical for victim location in collapsed structures and are logistically simpler to transport to disaster sites. Their proliferation is supported by government initiatives focused on tactical squad-level robotics. This trend is evidenced by the procurement data. The report from the Defense Innovation Unit has highlighted a specific initiative that sought to rapidly field the small unmanned ground systems to military units, demonstrating the scale of demand for compact agile platforms in operational environments.

Type Segment Analysis

In the type segment, the unmanned aerial vehicles are the top revenue leader in the search and rescue robots market. This supremacy is fueled by their unparalleled speed, aerial perspective for wide area assessment, and rapid technological maturation in autonomy and payload integration. UAVs are indispensable for initial disaster scouting, mapping, and delivering vital communications relays. The government's adoption solidifies this lead with agencies systematically integrating drones into the standard operating procedures. The concrete statistical evidence comes from the Federal Aviation Administration, which reported a massive increase in the sanctioned drone operations for public safety. In August 2022, the FAA report indicated that it had allocated USD 2.7 million in drone research to support disaster preparedness, validating the vital role of UAVs in modern search and rescue and public safety operations.

Our in-depth analysis of the search and rescue robots market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Environment |

|

|

Size |

|

|

Locomotion |

|

|

Application |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Search and Rescue Robots Market - Regional Analysis

North America Market Insights

North America is expected to maintain a dominant position in the search and rescue robots market and is poised to hold a share of 38.8% by 2035. The market is driven by the high defense spending, advanced technological adoption, and proactive federal initiatives integrating robotics into first responder protocols. The key drivers include the U.S. Department of Defense’s sustained procurement of unmanned ground systems and the formalization of drone programs by agencies such as FEMA and the U.S. Forest Service for disaster response. The primary trend is the push for interoperability and multi-domain operations supported by the DHS S&T standards. The supply-side trends focus on developing rugged autonomous platforms for CBRNE and wildfire applications, with investment fueled by grants such as FEMA’s AFG program.

The U.S. search and rescue robots market is defined by a demand shift from the standalone platforms to integrated interoperable systems for multi-domain operations. A primary trend is the institutional adoption of drones by public safety agencies, driven by proven operational utility. The NLM October 2022 study indicates that a snake-like tracked disaster relief robot and an OmniTread4 robot were developed by U.S. scientists. Further, the OmniTread4 is designed to carry out rescue missions and can survey the unknown terrain, such as caves. Moreover, the NIST continues to develop critical performance standards for such robots that guide procurement and ensure reliability in field operations. This push for standardization is directly supported by the federal funding channels, such as FEMA, enabling the local agencies to acquire and integrate these advanced robotic systems into their standard response protocols.

The Canada search and rescue robots market is strongly supported by the direct federal procurement and pre commercial testing programs aimed at operational deployment. A key demand driver is innovation, science, and economic development. Canada’s innovation solutions Canada program explicitly solicits autonomous systems and robotics for search and rescue, emergency response, remote operations, and arctic environments. The report from the Government of Canada in November 2024 depicts that under the autonomous systems and robotics call for prototypes, the government offers contract-based funding of up to CAD 550,000 for civilian applications and CAD 1.15 million for military components, signaling the measurable public sector spending commitment. The program highlights the operations-ready air, land, and marine robots capable of functioning in GPS-denied, cold-weather, and low-connectivity environments, aligning directly with Canada’s SAR needs.

APAC Market Insights

The Asia Pacific is the fastest-growing search and rescue robots market and is projected to grow at a CAGR of 10.8% during the forecast period 2026 to 2035. The search and rescue robots market growth is fueled by the region’s acute vulnerability to natural disasters and complex geopolitical tensions. A primary demand driver is the formal integration of robotic systems into the national disaster management frameworks. For example, Japan’s New Energy and Industrial Technology Development Organization has historically funded the development of robots for response to earthquakes and tsunamis, creating a pipeline for specialized technology. The trend is toward the indigenously developed systems suited for local terrain alongside strategic partnerships with Western firms for technology transfer, positioning APAC as a critical innovation and procurement hub.

Japan’s search and rescue robots market is shaped by the sustained government focus on disaster resilience and the operational integration of advanced technologies across the emergency response systems. The recurrent earthquake, typhoons, and floods have driven national and local authorities to adopt the AI-enabled situational awareness platforms that work alongside robotic and autonomous SAR assets. The Government of Japan's March 2025 report has shown that the AI-based disaster intelligence services, such as the Spectee Pro, are now widely used by the local governments and disaster response organizations supporting real-time decision-making during the rescue operations. Since its launch, the platform has secured with 100% retention, demonstrating the institutional reliance on technology-enabled SAR ecosystems. Its deployment during the2024 Noto Peninsula Earthquake underscores how Japan’s SAR strategy increasingly combines AI analytics with the field-deployed robots to improve victim localization, responder safety, and response speed.

Government Adoption Signals for Japan SAR Technology Ecosystem

|

Indicator |

Evidence (Government Source) |

Year |

Relevance to SAR Robots Market |

|

Government-backed disaster tech adoption |

Spectee Pro adopted by numerous Japanese local governments |

2020–2025 |

Demonstrates institutional demand for SAR-supporting technologies |

|

Number of public-sector & enterprise contracts |

1,100+ active contracts, near 100% retention |

2025 |

Indicates scale, reliability, and procurement maturity |

|

National disaster deployment |

Used during the 2024 Noto Peninsula Earthquake |

2024 |

Confirms real-world SAR operational use |

Source: The Government of Japan March 2025

The search and rescue robots market in China is being shaped by the strong municipal and national government investment in embodied intelligence, emergency response, modernization, and urban disaster preparedness. A clear demand signal comes from the Shanghain Municipal People’s Government’s December 2025 announcement, which is actively promoting the rescue robots via government-backed platforms such as the Global Developer Pioneers Summit 2025 and the International Embodied Intelligence Competition. These initiatives simulate the real emergency rescue scenarios where the robots perform rubble navigation, heavy load transport, and remote reconnaissance, core SAR functions. Shanghai has established a 100 billion yuan industry fund to support the embodied intelligence and robotics development, creating a sustained pipeline from the R&D to deployment. Government-supported facilities like the National and Local Co-Built Humanoid Robotics Innovation Center further enable testing and validation.

Europe Market Insights

The search and rescue robots market in Europe is actively expanding and is driven by the region’s focus on civil protection and defense modernization. The key demand drivers include the escalating frequency and severity of natural disasters such as floods and wildfires that have prompted substantial EU-wide investments in disaster risk management technologies via mechanisms. The primary market trend is the push for standardized interoperable robotic systems that can be deployed seamlessly across national borders during major emergencies. This is supported by the collaborative R&D programs under the European Defense Fund, which co-finance the development of next-gen robotic platforms for both the military and civilian first responders. The increasing integration of AI for autonomous navigation in complex environments and the use of robots for Chemical, Biological, Radiological, and Nuclear (CBRN) threat detection are shaping product development.

Germany’s dominance in the search and rescue robots market is underpinned by its unparalleled industrial manufacturing base, deep R&D expertise, and systematic approach to civil protection. The report from the GTA in 2025 indicates that Germany is the fifth-largest robot market in the world and is the home of the largest robot market in Europe. This data point is a powerful validation of Germany’s market leadership. The country’s dense ecosystem of industrial robotics manufacturers and integrators provides a direct technological foundation and supply chain advantage for developing robust, reliable SAR platforms. Further, Germany’s Vds Schadeverhutung publishes guidelines for firefighting and rescue equipment, influencing the technical standards that domestic manufacturers are primed to meet, thereby shaping both the domestic and broader market in Europe.

Service Robot Sales in 2024

|

Robot Category |

Units Sold |

Growth Rate |

Primary Applications |

|

Mobile Robots (Transport/Logistics) |

103,000 |

+14% |

Goods/cargo transport |

|

Hospitality Robots |

42,000 |

- |

Room service, guest assistance |

|

Agricultural Robots |

20,000 |

+6% |

Planting, harvesting |

|

Professional Cleaning Robots |

25,000 |

+34% |

Large-scale cleaning operations |

|

Search & Rescue/Security |

3,128 |

+19% |

Emergency response, security |

|

Medical Robots |

6,200 |

+36% (2023 base) |

Surgeries, diagnostics |

Source: GTAI 2025

The UK search and rescue robots market is shaped by the government-backed robotics adoption programs, emergency response modernization, and safety-driven automation priorities. The public investment in the robotics infrastructure is being channeled via the national centers and sector-focused initiatives that support the deployment-ready systems for hazardous and remote environments. The report from Tech UK in June 2025 notes that the National Robotarium, established with £22.4 million in public capital funding, is a key enabler, supporting robotics applications relevant to emergency response, offshore operations, and public safety missions. Further, the UK government’s offshore wind expansion target of GW by 2030 is driving the demand for autonomous inspection and intervention robots that reduce human exposure to high-risk rescue scenarios.

Key Search and Rescue Robots Market Players:

- Boston Dynamics (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teledyne FLIR (U.S.)

- Lockheed Martin (U.S.)

- Northrop Grumman (U.S.)

- L3Harris Technologies (U.S.)

- General Dynamics (U.S.)

- Aerovironment (U.S.)

- QinetiQ (UK)

- Elbit Systems (Israel)

- Shark Robotics (France)

- Tecdron (Italy)

- ICOR Technology (Canada)

- Roboteam (Israel)

- Hydronalix (U.S.)

- Mitsubishi Heavy Industries (Japan)

- DJI (China)

- SMP Robotics (Russia)

- ECA Group (France)

- Tekever (Portugal)

- Thales Group (France)

- Boston Dynamics is the dominating player in the search and rescue robots market leverages its unparalleled expertise in advanced mobility and dynamic autonomy. The company’s strategic initiative focuses on adapting its quadruped and humanoid platforms, such as Sport and Atlas, for disaster response. By integrating advanced sensors and AI for navigation in complex unstructured environments, Boston Dynamics aims to build robots capable of performing dangerous tasks, enhancing safety and situational awareness.

- Teledyne FLIR is a dominant force in the search and rescue robots market and is built on vertical integration and comprehensive solution offerings. Following its acquisition of Endeavor Robotics and FLIR systems, the company now provides a full spectrum of unmanned ground and aerial systems equipped with advanced thermal imaging and chemical detection sensors. The company has made sales of USD 5,670 in 2024.

- Lockheed Martin is leading the search and rescue robots market and applies its system integration and aerospace expertise to develop large-scale multi-domain robotic solutions. The company’s strategic focus is on autonomy, interoperability, and human-machine teaming. Initiatives such as developing AI-driven command and control systems aim to create coordinated robot squads to operate in GPS-denied environments.

- Northrop Grumman competes in the search and rescue robots market by emphasizing high-endurance integrated unmanned systems mainly for defense and public safety applications. Its strategic initiatives center on developing maritime and aerial robotics with advanced sensor suits for wide area search. A key focus is on the MQ-8 Fire Scout and other UAVs equipped for long-duration missions, providing real-time data fusion and communication relays.

- L3Harris Technologies in the search and rescue robots market leverages its core strengths in communication systems, sensing, and mission-critical networks. The company’s strategic initiative is centered on the connected robot concept, ensuring seamless, secure data links between robot operators and command centers in degraded communication networks. As of January 2025, the company has made a revenue of USD 2,347 million with an operating margin 12.5%.

Here is a list of key players operating in the global search and rescue robots market:

The search and rescue robots market is competitive and fragmented, and is led by the established defense and aerospace giants from Europe and the U.S. alongside agile specialists. The landscape is defined by the strategic partnerships with the government agencies and first responders, continuous R&D for autonomy and sensor fusion, and a focus on interoperability. The key players are aggressively integrating AI and machine learning for the real time data analysis while expanding into the adjacent markets such as public safety and critical infrastructure inspection. Consolidation is evident, as seen with the active acquisition to offer comprehensive robotic solutions. The recent development in the search and rescue robots market is the report from the International Federation of Robotics in October 2025, stating that nearly 3,128 search and rescue robots were sold in 2024, indicating the rising demand for the robots in the defense and construction sectors.

Corporate Landscape of the Search and Rescue Robots Market:

Recent Developments

- In October 2025, Revolute Robotics, which builds fully autonomous ground and aerial robots, has raised USD 1.9 million in new funding to accelerate its mission to deploy across inspection, security, and defense teams. The round was led by ANIMO Ventures and Ascend, with participation from several high-profile angel investors.

- In December 2024, Zebra Technologies announced its intention to acquire Photoneo, a leading developer and manufacturer of 3D machine vision solutions. The 3D segment of the Machine Vision market is the fastest growing, and this acquisition will further accelerate Zebra’s presence in the category.

- Report ID: 3699

- Published Date: Jan 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Search and Rescue Robots Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.