Rheumatoid Arthritis Drugs Market Outlook:

Rheumatoid Arthritis Drugs Market size was over USD 39.31 billion in 2025 and is projected to reach USD 59.89 billion by 2035, growing at around 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rheumatoid arthritis drugs is evaluated at USD 40.83 billion.

The rheumatoid arthritis drugs market is expanding rapidly triggered by the continued global occurrence of the disease among the aging population and ongoing advancements in therapeutics, targeted synthetic disease-modifying antirheumatic drugs (tsDMARDs), and biosimilars. Furthermore, regulatory frameworks across various regions are shaping market dynamics with approvals influencing both drug development and commercialization strategies. For instance, in January 2025, the U.S. FDA approved Journavx (suzetrigine), a non-opioid analgesic to treat moderate to severe acute pain. This approval marks growth for rheumatoid arthritis therapeutics as patients require chronic pain relief to help mitigate symptoms.

Key Rheumatoid Arthritis Drugs Market Insights Summary:

Regional Highlights:

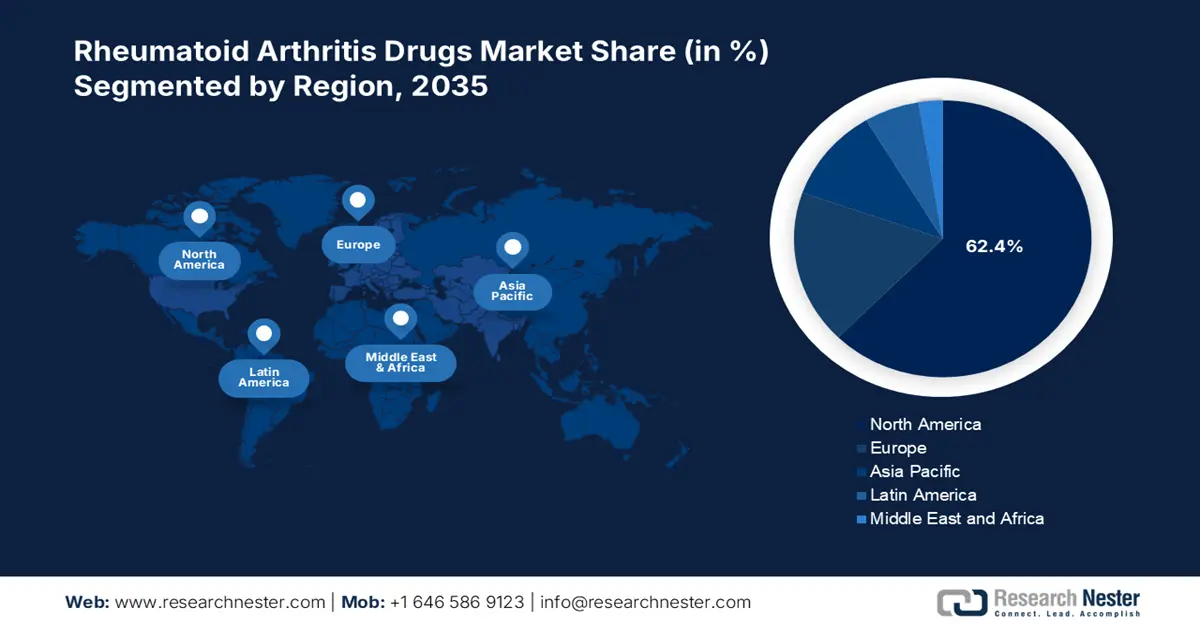

- North America dominates the Rheumatoid Arthritis Drugs Market with a 62.40% share, propelled by rising adoption of targeted therapeutics and advancements in therapies, ensuring strong growth by 2035.

- Asia Pacific’s rheumatoid arthritis drugs market is poised for rapid growth through 2026–2035, driven by RA prevalence, increasing healthcare expenditures, and drug advancements.

Segment Insights:

- The Biologics segment is anticipated to hold a considerable share by 2035, propelled by higher efficacy in reducing inflammation and slowing disease progression.

- The OTC segment is projected to achieve a 62.8% share by 2035, fueled by its availability, convenience, and affordability for consumers.

Key Growth Trends:

- Rising prevalence of rheumatoid arthritis

- Advancements in biological therapies

Major Challenges:

- High cost of targeted therapies

- Stringent regulatory approvals and safety concerns

- Key Players: Johnson & Johnson, Amgen, Pfizer, Novartis, Sanofi.

Global Rheumatoid Arthritis Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 39.31 billion

- 2026 Market Size: USD 40.83 billion

- Projected Market Size: USD 59.89 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (62.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Rheumatoid Arthritis Drugs Market Growth Drivers and Challenges:

Growth Drivers

- Rising prevalence of rheumatoid arthritis: The increasing incidence of RA globally, particularly among the aging population is a major driver for the rheumatoid arthritis drugs market. According to WHO reports in June 2023, approximately 18 million people worldwide are living with RA as of 2019. Additionally, about 70% of cases are among women, and 55% are aged above 55 years old. Moreover, 13 million people experience symptoms affecting body systems with wrists, feet, ankles, knees, etc. which significantly boosts the demand for long-term disease management with targeted therapeutics.

- Advancements in biological therapies: The ongoing advancements in biological drugs are a key driver for the market. These medications have revolutionized the market which works more efficiently than traditional disease-modifying antirheumatic drugs. For instance, in December 2021 the U.S. FDA approved Orencia in combination with a calcineurin inhibitor and methotrexate. It is used to treat moderate to severe RA in adults and juvenile idiopathic arthritis (JIA) in children. Furthermore, the approval of Orencia strengthens its market presence, driving growth and innovation in the market through expanded usage.

Challenges

- High cost of targeted therapies: It is one of the biggest challenges in the global market. The cost of novel therapies remains expensive due to complex research, manufacturing, and patent protections making them less accessible in underdeveloped regions. The cost factor negatively impacts the market expansion as patients struggle with affordability, insurance coverage, and reimbursement policies. The high pricing of RA drugs limits the consumer base and creates disparities in treatment availability worldwide.

- Stringent regulatory approvals and safety concerns: This remains a significant challenge as drugs face strict approval processes to mitigate potential side effects in patients. Regulatory frameworks such as the FDA and EMA require extensive clinical trials, making drug development expensive and time-consuming. Due to compliance barriers, manufacturers pose delayed market entry, restrictions, and withdrawals, limiting their availability to patients and impacting the market expansion

Rheumatoid Arthritis Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 39.31 billion |

|

Forecast Year Market Size (2035) |

USD 59.89 billion |

|

Regional Scope |

|

Rheumatoid Arthritis Drugs Market Segmentation:

Sales channel (Prescription, Over-the-Counter (OTC))

Based on sales channel, the over-the-counter (OTC) segment is set to dominate rheumatoid arthritis drugs market share of around 62.8% by the end of 2035. The segment’s adoption is due to the increasing availability of OTC drugs coupled with their convenience and affordability by the patients. In February 2020 GlaxoSmithKline announced that the FDA has approved Voltaren arthritis pain as an OTC for arthritis pain relief which is the first prescription-strength NSAID topical gel, strengthening the segment’s dominance in the industry.

Molecule (Pharmaceuticals, Biopharmaceuticals)

Based on molecule type, the biologics segment in biopharmaceuticals is anticipated to register a considerable share in the rheumatoid arthritis drugs market in the projected period. The increasing preference for these drugs over conventional treatments is primarily driven by their higher efficacy in reducing inflammation and slowing disease progression. For instance, in November 2023, according to research published by Annals of the Rheumatic Diseases, a study denoted that IL-17 inhibitors are a novel anti-17 monoclonal antibody that significantly reduces arthritis symptoms. This underscores the role of biologics in RA treatment, reinforcing their dominance in the market.

Our in-depth analysis of the global market includes the following segments:

|

Molecule |

|

|

Sales Channel |

|

|

Route of Administration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rheumatoid Arthritis Drugs Market Regional Analysis:

North America Market Analysis

North America rheumatoid arthritis drugs market is set to account for revenue share of more than 62.4% by the end of 2035. The rising adoption of targeted therapeutics, biosimilars, collaborations between organizations, and advancements in targeted therapies leverage RA drugs for their high efficacy. For instance, in September 2024, Eli Lilly and Company and EVA Pharma announced their collaboration to expand access to baricitinib in underdeveloped countries expanding access to arthritis pain relief.

The U.S. dominates the market owing to the rapid adoption of innovative treatments. The strong presence of global pharmaceutical firms, and ongoing research support market expansion making the U.S. a hub for targeted therapeutics. In July 2023, Biocon Biologics launched Hulio Biosimilar to Humira in the U.S. expanding its immunology portfolio and increasing patient access to rheumatoid arthritis treatment. Such initiatives increase the consumer base for the industry, allowing the market to expand in the forecast period.

Canada's market is growing steadily with several collaborative approaches, and public-private partnerships, ensuring a robust RA drug adoption across key sectors. For instance, in August 2024 Nordic Pharma launched NORDIMET (methotrexate) self-injection pen in Canada for the treatment of rheumatoid arthritis. The launch aims to strengthen its pharmaceutical and healthcare ecosystems by fostering innovation and positioning Canada as a competitive hub in global markets.

APAC Market Statistics

The Asia Pacific rheumatoid arthritis drugs market is anticipated to grow at the fastest rate during the forecast period. The market is majorly driven by RA prevalence, increasing healthcare expenditures, and advancements in targeted drugs and biosimilars. Governments in the region actively support affordable treatment options, expanding healthcare coverage and further accelerating targeted drug adoption.

China is a leader in the market supported by the government due to the advancements in treatment procedures and promoting innovation in RA drugs are further accelerating market growth. In October 2024, according to research published in the Journal of Ethnopharmacology, Di-Long shows anti-rheumatoid arthritis effects due to the presence of active peptides from Di-Long inhibit CXCL10/CXCR3 chemotaxis in synovium offering relief from RA. Such advancements in the medication field are anticipated to position China as a key player in the market.

India market is gaining momentum, fueled by access to advanced treatment options. The country's presence of a strong generic pharmaceutical industry enables affordable medications making RA treatment highly accessible. For instance, in February 2020, Lupin announced the launch of Leflunomide tablets post receiving approval from the U.S. FDA to be indicated for the treatment of adults with active rheumatoid arthritis. With continued investments and regulatory approvals, India is poised to emerge as a major contributor to the industry.

Key Rheumatoid Arthritis Drugs Market Players:

- AbbVie

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson

- Amgen

- Pfizer

- Novartis

- Sanofi

- Biogen

- Xbrane

- GNS Healthcare

- Scipher Medicine

- Merck

- Bristol-Myers Squibb

- Eli Lilly

- Gilead Sciences

Companies in the rheumatoid arthritis drugs industry are emphasizing innovation, accessibility, and affordability to cater to diverse industry needs. Companies focus on strategic partnerships and collaborations, and geographical expansion to accelerate adoption and expand market presence. In February 2025 AnaptysBio announced Rosnilimab achieved positive results in the rheumatoid arthritis treatment ensuring safety and efficacy in reducing disease activity. The advancements highlight continuous progress paving the way for improving patient outcomes and driving market expansion.

Some of the prominent market players are:

Recent Developments

- In February 2022, Biogen and Xbrane announced their commercialization and license agreement for CIMZIA (Certolizumab pegol) to potentially treat rheumatoid arthritis.

- In November 2021, GNS Healthcare and Scipher Medicine collaborated to develop the world’s first in silico patient for rheumatoid arthritis aiming to advance precision medicine.

- Report ID: 7392

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rheumatoid Arthritis Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.