Peripheral Neuritis Treatment Market Outlook:

Peripheral Neuritis Treatment Market size is valued at USD 2.1 billion in 2025 and is projected to reach approximately USD 3.5 billion by the end of 2035, growing at a CAGR of around 5.5% during the forecast period, i.e., 2026–2035. In 2026, the industry size of the peripheral neuritis treatment is estimated at USD 2.2 billion.

The increasing rates of diabetic peripheral neuropathic pain (DPNP) constitute a key growth driving factor for the global market. According to a study by NIH in June 2025, 40 to 60% of patients have diabetic neuropathy worldwide. It is anticipated that the figures are expected to reach around 552 million by 2030, and the potential patient population has drastically expanded. As per that report, the use of healthcare resources and costs spikes after being diagnosed, primarily arising from hospitalizations and medications that are a burden in China, where the annual costs incurred by DPNP patients. Treatments comprise gabapentinoids, antidepressants, and physical therapies such as acupuncture, indicative of almost similar needs for pharmacologic and non-pharmacologic interventions across the world.

Peripheral neuritis treatment market is often treated with regular medicine, but it's also common to use extra, non-drug therapies to help manage symptoms and improve recovery. As per a report by January 2023 MDPI, pharmacological treatments currently available in clinics, such as Duloxetine, offer only moderate symptom relief, so practitioners have turned to integrative therapies comprising manipulative approaches, acupuncture, cryotherapy, and tactile stimulation. With strengthening support from a systematic review plus expert consensus, these treatments are deemed mostly safe, feasible, and implementable within the clinical environment in a patient-centric way.

Key Peripheral Neuritis Treatment Market Insights Summary:

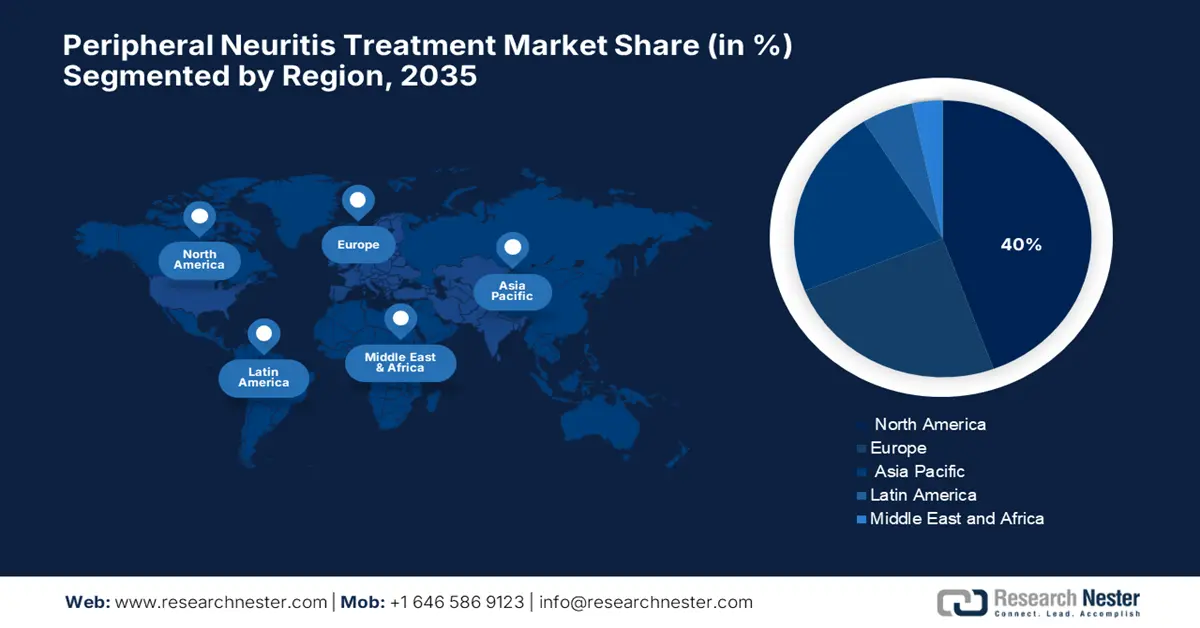

Regional Highlights:

- North America is projected to dominate the peripheral neuritis treatment market with a 42.6% share by 2035, owing to increasing incidences of peripheral neuropathy among elderly adults and growing governmental focus on expanded screening and intervention programs.

- Asia Pacific is anticipated to witness the fastest growth during 2026-2035, fueled by rising diabetic populations, expanding clinical trial activities, and heightened healthcare expenditure supporting novel drug introductions.

Segment Insights:

- The oral treatment modalities segment of the peripheral neuritis treatment market is anticipated to account for a 62% share by 2035, propelled by patient inclination toward non-invasive therapies and improved adherence to oral dosing.

- The antiepileptics segment is projected to secure a 34% market share by 2035, driven by growing clinical endorsements and the cost-effectiveness of anticonvulsants in chronic neuropathic pain management.

Key Growth Trends:

- Rising economic burden and unmet treatment needs

- Expansion of evidence-based complementary therapies

Major Challenges:

- Fragmented and non-standardized treatment landscape

- Underinvestment in mechanism-based drug development

Key Players: Pfizer Inc., Eli Lilly & Company, Abbott Laboratories, Janssen Pharmaceuticals (J&J), Novartis AG, Boehringer Ingelheim, GlaxoSmithKline (GSK), Vertex Pharmaceuticals, Glenmark Pharmaceuticals, Lupin Pharmaceuticals, Astellas Pharma, Merck & Co., Teva Pharmaceuticals, Bayer AG, Biogen Inc.

Global Peripheral Neuritis Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.1 billion

- 2026 Market Size: USD 2.2 billion

- Projected Market Size: USD 3.5 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, South Korea, Brazil, Australia

Last updated on : 5 September, 2025

Peripheral Neuritis Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Rising economic burden and unmet treatment needs: The peripheral neuritis treatment market are growing due to the very high economic burden associated with conditions such as Diabetic Peripheral Neuropathic Pain (DPNP), which follows increased hospitalization and medication expenses after diagnosis. According to a study by NIH 2025, in China, acupuncture is administered in nearly 41.63% of cases, signifying the unspecific treatment approaches due to the very few treatment options available. This unmet clinical need is driving demand for advanced guideline-based therapies around the world so that patient outcomes may be improved, and the utilization of healthcare resources may be made economical.

- Expansion of evidence-based complementary therapies: The expanding clinical database for alternative therapies applied in chemotherapy-induced peripheral neuropathy (CIPN) helps enhance the global market growth further in market. According to a January 2023 MDPI report, up to 71% of patients receiving acute treatments like Oxaliplatin or Docetaxel develop chemotherapy-induced peripheral neuropathy (CIPN), which is a key reason why some choose to stop their treatment. This highlights the importance of developing integrative, patient-specific solutions within supportive care pathways for oncology.

- Advancements in diagnostic precision and research investments: Innovations in diagnostic tests and biomarkers continue to contribute to early detection and customized treatment of peripheral neuropathy treatment market. Some gene mutations have been found to cause hereditary neuropathies, with gene-based diagnostic and therapeutic solution development being undertaken by groups such as the Inherited Neuropathies Consortium. This progress is driving global demand for precision medicine, advanced imaging, and neurodiagnostic technologies. Thereby creating demand worldwide for precision medicine, high-end imaging, and neurodiagnostic technologies.

Mechanism of Action and Efficacy of Oral Pharmacological Agents for Painful Diabetic Peripheral Neuropathy

|

Drug Class |

Mechanism of Action |

Efficacy in RCTs |

|

SNRIs |

Block sodium channels; ↑ norepinephrine, serotonin, dopamine |

Duloxetine FDA-approved. Desvenlafaxine 200 & 400 mg ↑ pain relief (mean BGD in NPRS 1.10 & 0.91). Venlafaxine ER 150–225 mg showed 50% pain reduction vs 27% placebo (p<0.001). |

|

Gabapentinoids |

Block calcium-mediated neurotransmitter release |

Pregabalin FDA-approved. Gabapentin (900–3600 mg/day) ↑ pain relief by 1.2 points NPRS; 900 mg/day no significant effect in 6-week RCT. |

|

Sodium Channel Blockers |

Block voltage-sensitive sodium channels, other ion channels |

Lacosamide 400 mg ↑ pain relief (two 18-week RCTs). Lamotrigine 400/600 mg ↑ pain relief (6-week & 19-week RCTs). Oxcarbazepine 300–1800 mg effective (16-week RCT). Valproic acid 500 mg is effective at 1 month, sustained to 3 months. |

Source: NLM March 2024

Challenges

- Fragmented and non-standardized treatment landscape: The global peripheral neuritis treatment ecosystem remains fragmented to the extent that no universally accepted clinical protocol exists across geographies. In the China-based study, only a subset of treated patients received antidepressants, despite their recognition in international guidelines as a frontline option for managing neuropathic This denotes contradictory provider education, therapeutic inertia, and regulatory inconsistencies, which hinder the unification of market development and thereby hamper the adoption of advanced therapies.

- Underinvestment in mechanism-based drug development: While analgesics and anti-inflammatories remain the top in prescribing, these drugs only serve as symptomatic relief for neuroinflammation or axonal degeneration in the peripheral neuritis treatment market. The market is devoid of disease-modifying agents, and existing R&D pipelines are hamstrung by high failure rates in clinical trials, lack of biomarker validation, and uncertain reimbursement outlooks. With such impediments come lengthier commercialization timelines, and investors are discouraged.

Peripheral Neuritis Treatment Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 3.5 billion |

|

Regional Scope |

|

Peripheral Neuritis Treatment Market Segmentation:

Route of Administration Segment Analysis

Oral treatment modalities are expected to have a gain of 62% share of the route of administration segment in the market by the forecast period. According to the NLM September 2024 report, for the patient groups studied, it was noted that the incidence of CIPN was approximately 68.1% in the first month post-chemotherapy, 60.0% in three months, and 30.0% in six months. These observations underscore the need for CIPN management to be included in clinical treatment protocols and draw attention to the need for appropriate treatment methods on the part of clinicians and pharmaceutical distributors. This is further driven by patient preference for non-invasive therapies and the ease of adherence associated with oral dosing.

Drug Class Segment Analysis

Antiepileptics are expected to gain 34% market share by 2035 in the drug-class segment of peripheral neuritis treatment market. The clinical utility to relieve neuropathic pain, especially chemo-induced and diabetic peripheral neuropathy, leads to the consistent demand for it. Gabapentin and pregabalin continue to dominate the market, as these agents have consistently been added to many formularies and purchased by hospitals, giving anticonvulsants a strategic subsegment for pharmaceutical alliances and market penetration. Increasing clinical endorsements and cost-effectiveness further strengthen the role of antiepileptics in long-term neuropathic pain management.

Application Segment Analysis

The diabetic peripheral neuropathy sub-segment is expected to hold 35% of the market share in 2035. The growth is driven by the trending increase in the global price of diabetes, an aging population, and targeted therapeutics. Stakeholders tend to increasingly put emphasis on strategic alliances and portfolio extension to capture the B2B market segment with high growth opportunities for chronic neuropathic care. Rising healthcare investments and early diagnosis initiatives are also contributing to the sustained expansion of this sub-segment.

Our in-depth analysis of the global peripheral neuritis treatment market includes the following segments:

|

Segment |

Sub-segments |

|

Type |

|

|

Therapeutic Method |

|

|

Route of Administration |

|

|

Drug Class |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Peripheral Neuritis Treatment Market - Regional Analysis

North America Market Insight

North America region is poised to dominate around 42.6% market share by 2035. Burgeoning incidences of peripheral neuropathy, most notably in elderly adults, are generating a significant market for diagnostic and therapeutic tools. Higher rates in U.S. cohorts (NHANES, ARIC) possibly entail a greater demand for early screening tools such as monofilament testing. Governmental interest is increasing, with specific potential for policy changes leading toward a broader scope of PN screening beyond diabetes populations. More changes in funding and R&D are going into idiopathic PN causes and non-diabetic interventions, while peer pricing remains competitive with rises in public health awareness and clinical demand.

U.S. market is growing steadily. There is an alarmingly high and rising prevalence of peripheral neuropathies, especially among adults aged ≥70, including those without diabetes. With an enlarging disease burden, market considerations for PN diagnostics and interventions also grow. As per a study by Foundations for Peripheral Neuropathy, January 2023, NIH spends 210 million USD on peripheral neuropathy each year. Federal health agencies could fund expanded screening, whereas academic centers focus research and development on idiopathic PN. This strong association with age, race, and duration of diabetes should be considered in targeted programs and cost-effective clinical strategies on a nationwide scale.

The market for peripheral neuritis treatment in Canada is increasing, due to growing neuropathies and awareness about new therapies. High treatment costs and scarce specialized care remain deterrents to treatment access. Diagnostic advancements and early treatment plans will further drive growth for this market. The public health system aids better management of the patient course, while clinical investigations are on their way to promising therapeutic discoveries. However, according to the NLM October 2022 report, the pain reduction in patients varies from a 30 to 50% reduction, and the remaining are roughly 50%, refractory to treatment. This signifies an urgent need for further effective and accessible treatment options within the landscape of Canada's evolving neuropathic care.

Asia Pacific Market Insight

Asia Pacific is expected to be the fastest-growing market during the forecast period. Asian regions for peripheral neuritis treatment, particularly in the treatment of diabetic peripheral neuropathic pain (DPNP), have seen considerable development with the introduction of mirogabalin, a new gabapentinoid. To increase this growth further, it may besupported by increasing trends in clinical trial activities, coupled with growing populations of diabetic patients and rising expenditure on health care. Diagnosis and early intervention are further accelerated by government-sponsored awareness campaigns and infrastructure development.

The market for peripheral neuritis treatment in China is growing. According to a study by NIH June 2025, owing to the DPNP being prevalent among 57.2% of the type 2 diabetic population. The analgesics, with the highest prescription rate of 48.44%, are followed by anti-inflammatory drugs at 47.16% and acupuncture at 16.02%. The health-care costs for patients increased tremendously from 4,112.94 CNY to 7,489.36 CNY per year postdiagnosis. Government insurance accounts for 60.25% coverage of patients, thereby inculcating affordability and access. Treatment is concentrated in Tier 2 and Tier 3 hospitals and is based on their advanced care. Somewhat limited but growing R&D attempts aim at combining these physical therapies to give the best treatment results.

The peripheral neuropathy market in India is growing owing to increased incidents of diabetes and its associated complications, such as diabetic peripheral neuropathy. The increase in awareness and government programs supporting the early screening and treatment has created demand for the various neuropathic therapeutics, which include analgesics, antioxidants, and neuroprotective agents. Certain new agents designed to have positive effects on nerve regeneration and pain relief are subject to clinical trials. In Indian markets, pricing is competitive as the generics hold the majority of the share, as they are looked upon as the cheapest.

Europe Market Insight

The peripheral neuritis treatment market in Europe is expected to grow considerably during the forecast period. According to Eurostat November 2024, among the EU countries, Germany (12.6%), France (11.9%), and Austria (11.2%) had the highest healthcare expenditure in present as per the GDP in 2022. This highlights the importance of using standardized scoring tools for accurately assessing neurological disability, which can guide appropriate treatment decisions and help evaluate the impact on patients. Incorporating these supports the need for advanced diagnostics and targeted therapies in the market by early intervention and improved patient outcomes.

UK market experiences an inflow of funds from international research collaborations, especially among leading countries such as Germany and the Netherlands. The market experiences an inflow of funds from international research collaborations. Its huge collaborations with the US team, Canadian territories, and Qatar drive innovation and clinical trial activity in the field. Growth in the UK market is driven by widening awareness and demand for treatment, with ongoing trials for the various forms of peripheral neuritis. Pricing is somewhere between the treatment armory and what the healthcare system might be able to reimburse.

The peripheral neuritis treatment market in Germany is increasing based on clinical research, collaborative networks, and a well-established health-care system. The country emphasizes neurology and endocrinology, ensuring that it nurtures the development of diagnostic tools and treatments relating to the management of diabetic-related neuropathies. According to Eurostat November 2024, Germany had the highest healthcare expenditure valued at 489 billion euros in 2022 among the EU countries. Other growth-promoting factors include increased awareness, early diagnosis programs, and investment in personalized medicine. The regulatory framework and health insurance coverage promote greater patient access to these new therapies. Besides, when it comes to participation in multinational clinical trials, Germany is a key player, further strengthening its position in orchestrating treatment standards and influencing regional market trends.

Historical Healthcare Expenditure for Countries in Europe

|

Year |

Germany (€ million) |

France (€ million) |

Italy (€ million) |

Spain (€ million) |

Netherlands (€ million) |

Sweden (€ million) |

|

2014 |

322,775 |

247,767 |

144,317 |

93,831 |

70,964 |

48,043 |

|

2015 |

338,638 |

251,497 |

146,613 |

98,363 |

72,956 |

49,212 |

|

2016 |

352,397 |

256,712 |

147,963 |

99,729 |

74,352 |

50,601 |

|

2017 |

370,023 |

264,935 |

150,697 |

104,103 |

75,884 |

51,774 |

|

2018 |

386,123 |

270,562 |

153,790 |

106,321 |

77,552 |

54,021 |

|

2019 |

407,025 |

276,520 |

155,524 |

120,093 |

80,542 |

56,421 |

|

2020 |

431,941 |

279,815 |

159,892 |

123,690 |

86,952 |

60,421 |

|

2021 |

466,713 |

307,568 |

170,278 |

130,661 |

96,862 |

59,160 |

|

2022 |

488,677 |

313,574 |

175,719 |

131,114 |

98,367 |

59,110 |

Source: Eurostat, November 2024

Key Peripheral Neuritis Treatment Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eli Lilly & Company

- Abbott Laboratories

- Janssen Pharmaceuticals (J&J)

- Novartis AG

- Boehringer Ingelheim

- GlaxoSmithKline (GSK)

- Vertex Pharmaceuticals

- Glenmark Pharmaceuticals

- Lupin Pharmaceuticals

- Astellas Pharma

- Merck & Co.

- Teva Pharmaceuticals

- Bayer AG

- Biogen Inc.

Therapeutic and treatment companies dominate the peripheral neuritis treatment market, with a robust portfolio of neuropathic pain treatments and a massive global marketing and distribution network. Companies are contributing heavily to ongoing R&D and also maintain diversified pipelines. Companies such as Glenmark and Lupin are focusing on generics to be sold in price-sensitive markets, while companies such as Astellas and Eisai keep the investments steady in neurology-related therapy. The competitive environment is a mix of giants of the pharmaceutical past with regionally strong companies heading toward innovation and access.

Here is a list of key players operating in the global market:

Recent Developments

- In April and January 2024, Vertex Pharmaceuticals advanced suzetrigine (Journavx), an oral non-opioid NaV1.8 inhibitor, into Phase III trials for diabetic peripheral neuropathic pain, marking major progress in non-opioid treatments for chronic neuropathic conditions.

- In July 2024, Artelo Biosciences following the FDA IND application clearance for ART26.12, a selective FABP5 inhibitor for chemotherapy-induced peripheral neuropathy, a high-throughput setup of the Phase 1 trial is underway, with results expected to be reported by H1 2025.

- Report ID: 4378

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.