Life Science Reagents Market Outlook:

Life Science Reagents Market size was valued at USD 66.91 billion in 2025 and is set to exceed USD 120.96 billion by 2035, registering over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of life science reagents is estimated at USD 70.58 billion.

A growing percentage of people in the U.S. are coping with several chronic diseases; 42% have 2 or more, and 12% have at least 5, according to CDC research from February 2024. The increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders, along with emerging infectious diseases such as COVID-19, is significantly driving the demand for diagnostic reagents. These conditions require frequent and accurate testing for early detection, disease monitoring, and treatment optimization. Advancements in molecular diagnostics, including PCR, immunoassays, and biomarker detection, are enhancing testing sensitivity and specificity. Growing investment in diagnostics drives demand for high-quality reagents, expanding the life science reagents market.

Furthermore, continuous innovations in biotechnology and genomics are fueling the demand for high-quality reagents essential for molecular biology, genetic sequencing (NGS), and CRISPR-based gene editing. These have revolutionized genetic research, requiring precise and reliable reagents for DNA amplification, enzyme reactions, and fluorescent labeling. As researchers and biotech firms develop advanced therapies and diagnostic tools, the increasing adoption of these innovative technologies is driving demand for high-quality reagents, ultimately expanding the market and supporting breakthroughs in healthcare and biomedical research.

Key Life Science Reagents Market Insights Summary:

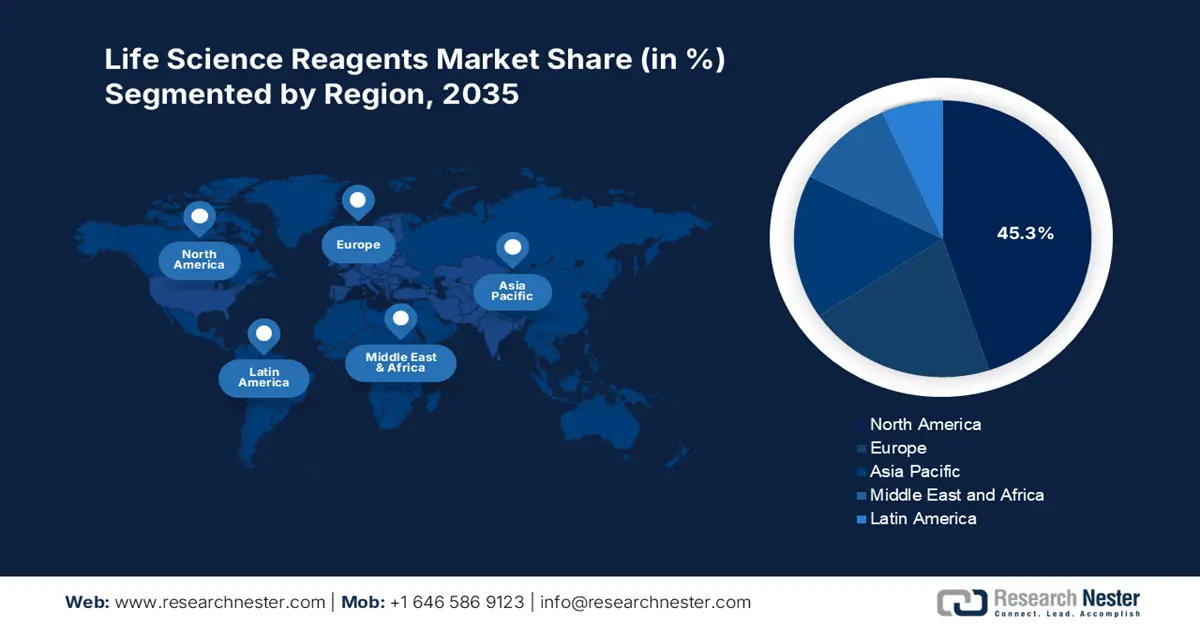

Regional Highlights:

- North America commands a 45.3% share in the life science reagents market, driven by rising prevalence of chronic illnesses and expansion of clinical laboratories, ensuring robust growth through 2035.

- Asia Pacific’s life science reagents market is poised for rapid growth through 2026–2035, driven by adoption of automated diagnostic platforms, AI, and robotics enhancing reagent demand.

Segment Insights:

- The Diagnostic Reagents segment of the Life Science Reagents Market is projected to capture over 32.2% share by 2035, driven by rising disease prevalence and advancements in diagnostic technologies.

- The clinical laboratories segment of the Life Science Reagents Market is anticipated to hold the majority share from 2026-2035, driven by increasing disease prevalence, demand for accurate diagnostics, and advancements in laboratory automation.

Key Growth Trends:

- Growing application in drug discovery and development

- Rise in precision medicine

Major Challenges:

- Short shelf life and storage challenges

- Supply chain disruptions

- Key Players: Merck KGaA, Becton Dickinson and Company, Thermo Fisher Scientific, Roche Holding AG.

Global Life Science Reagents Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 66.91 billion

- 2026 Market Size: USD 70.58 billion

- Projected Market Size: USD 120.96 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Life Science Reagents Market Growth Drivers and Challenges:

Growth Drivers

-

Growing application in drug discovery and development: Pharmaceutical and biotech companies depend on life science reagents for critical processes such as drug screening, toxicity testing, and biologics production. As demand for novel therapeutics such as monoclonal antibodies, gene therapies, and cell-based treatments rises, the need for specialized reagents grows. These reagents enable precise biomolecular interactions, quality control, and efficacy assessments in drug development. Increased R&D investments, regulatory approvals, and expanding biologics manufacturing are further driving the growth of the life science reagents market.

FDA-approved monoclonal- antibody technologies (2023)

|

mAbs |

Target |

year |

|

Amivantamab |

EGFR |

2021 |

|

Faricimab |

VEGF-A, Ang-2 |

2022 |

|

Glofitamab |

CD20, CD3e |

2023 |

|

Talquetamab |

GPRC5D,CD3 |

2023 |

|

Odrenextamab |

CD20, CD3 |

2024 |

Source: NLM

-

Rise in precision medicine: Personalized medicine is revolutionizing healthcare by leveraging biomarker analysis and molecular diagnostics, all of which require specialized reagents. The growing emphasis on tailored treatment approaches is increasing demand for reagents to enable precise identification of disease markers, optimizing treatment efficacy, and minimizing adverse effects. Thus, as precision medicine adoption expands, biotech and pharmaceutical companies are driving innovations, further fueling the growth of the life science reagents market.

Challenges

-

Short shelf life and storage challenges: Many life science reagents have limited stability and require precise storage conditions, such as refrigeration, freezing, or protection from light, to maintain their effectiveness. In regions with inadequate cold chain logistics and unreliable transportation infrastructure, reagents may degrade before use, leading to inaccurate test results and research failures. This not only increases wastage but also raises costs for laboratories and healthcare facilities. Addressing these challenges requires improved storage solutions and advanced packaging technologies to ensure reagent longevity.

-

Supply chain disruptions: The global life science reagents market relies on intricate supply chains for sourcing raw materials, chemicals, and specialized components. Disruptions caused by geopolitical tensions, pandemics, or trade restrictions can lead to shortages, price volatility, and logistical delays, hampering research and diagnostics. Limited access to critical reagents can slow drug development, genetic testing, and disease diagnosis. To mitigate risks, companies are diversifying supply sources, enhancing local production, and adopting advanced inventory management strategies.

Life Science Reagents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 66.91 billion |

|

Forecast Year Market Size (2035) |

USD 120.96 billion |

|

Regional Scope |

|

Life Science Reagents Market Segmentation:

Product Type (Biological Reagents, Chemical Reagents, Diagnostic Reagents, Laboratory Reagents)

In life science reagents market, diagnostics reagents segment is poised to hold over 32.2% revenue share by the end of 2035. The segment is growing due to rising disease prevalence, increasing demand for early and accurate diagnostics, and advancements in molecular and immunoassay technologies. Growth in personalized medicine, companion diagnostics, and point-of-care testing is also driving demand. Additionally, improved healthcare infrastructure, increased R&D investments, and government initiatives supporting disease detection contribute to market growth. The surge in infectious diseases, chronic conditions, and genetic testing further accelerates the need for high-quality diagnostic reagents.

Composite diagnostic reagents, ne exports by country (2023)

|

Country |

Trade Value (1000 USD) |

Quantity (Kg) |

|

Argentina |

14,238.3 |

462,375 |

|

Philippines |

3,454.9 |

24,601 |

|

Georgia |

3,253.3 |

15,835 |

|

Lebanon |

982.2 |

12,651 |

|

Occ.Pal.Terr |

898.2 |

12,314 |

Source: World Trade Integrated Solution

End users (Pharmaceutical Companies, Biotechnology Companies, Academic and Research Institutes, Clinical Laboratories)

By end user, the clinical laboratories segment is poised to hold the majority of life science reagents market share over the forecast period. The segment’s growth is attributed to increasing disease prevalence, rising demand for accurate diagnostics, and advancements in laboratory automation. Growing investments in healthcare infrastructure, expanding molecular and genetic testing, and a surge in personalized medicine further drive demand. Additionally, government initiatives supporting early disease detection, an aging population requiring frequent testing, and the adoption of high-throughput technologies contribute to the rapid expansion of clinical laboratories worldwide.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

End user |

|

|

Application |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Life Science Reagents Market Regional Analysis:

North America Market Statistics

North America in life science reagents market is predicted to capture over 45.3% revenue share by 2035. According to a February 2024 CDC analysis, 129 million people in the U.S. were reported to have at least one serious chronic illness. The rising prevalence of cancer, diabetes, cardiovascular diseases, and infectious diseases is driving demand for high-quality diagnostic reagents used in PCR, immunoassays, and biomarker detection. Simultaneously, the expansion of clinical laboratories, diagnostic centers, and pointer-of-care testing facilities in North America is accelerating reagent consumption. The emphasis on early disease detection and preventive healthcare further fuels the life science reagents market growth, as healthcare providers increasingly rely on advanced testing solutions to improve patient outcomes and treatment strategies.

The U.S. government actively supports life sciences through funding, tax incentives, and initiatives such as the Cancer Moonshot and Precision Medicine initiative, driving innovation in reagent-based diagnostics and therapeutics. About 90% of the USD 4.1 trillion spent on health care each year goes toward monitoring and treating mental health issues and chronic illnesses, according to CDC research released in February 2024. Additionally, collaborations between biotech firms, reagent manufacturers, and research institutions accelerate advanced reagents development. Mergers and acquisitions expand product portfolios and distribution, driving demand for high-quality reagents in research and clinical applications.

The expanding biopharmaceutical and biotech sector in Canada is focused on drug development, biologics, and cell-based therapies and is driving demand for reagents used in drug screening, toxicity testing, and biologics production. The Government of Canada invested over USD 2.3 billion in 41 projects in the biomanufacturing, vaccine, and pharmaceuticals ecosystem, bolstering domestic pandemic response capabilities and life science innovation, according to a study released in December 2024. These investments and industry advancement collectively boost the need for specialized reagents, accelerating growth in the country’s life science reagents market.

APAC Market Analysis

The APAC life science reagents market is established to garner the fastest CAGR over the forecast period. The rising demand for healthcare services has driven the expansion of clinical laboratories and diagnostics centers across the region. The adoption of automated diagnostic platforms, AI, and robotics is enhancing efficiency and accuracy in research and diagnostics. High-throughput screening, automated liquid handling, and digital pathology solutions rely on a steady supply of reagents. This technological advancement and laboratory automation are significantly increasing reagent demand, fueling the growth of the life science reagents market.

A growing network of hospitals, clinical laboratories, and diagnostic centers in China is boosting the need for high-quality reagents, particularly in molecular diagnostics and immunoassays. A report from the NLM in August 2023 highlighted that the country had 12,000 public hospitals, with more than half being county hospitals. Additionally, China has an advanced biopharmaceutical industry, focusing on monoclonal antibodies, cell therapies, and regenerative medicine, and requires specialized reagents for stem cell research, gene therapy, and tissue engineering. These developments are significantly propelling the surge of the life science reagents market.

The pharmaceutical and biotech facilities in India are experiencing rising demand in drug discovery, biologics, biosimilars, and vaccine production, which are driving demand for reagents in drug screening, toxicity testing, and biologics manufacturing. Additionally, in the last 2 decades, FDI inflows in India surged by about 20 times. As stated in January 2025 by the Department for Promotion of Industry and Internal Trade (DPIIT). Increasing foreign investments and strategic partnerships in life sciences are fostering innovation and improving reagent availability. Collaborations between domestic biotech firms, reagent manufacturers, and global research institutions are further strengthening the market, accelerating advancements in research and diagnostics, and fueling the growth of the life science reagents market in India.

Key Life Science Reagents Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- Becton Dickinson and Company

- Thermo Fisher Scientific

- Roche Holding AG

- SigmaAldrich Corporation

- Qiagen N.V.

- BioRad Laboratories

- Agilent Technologies

- General Electric Company

- Promega Corporation

- Luminex Corporation

- F. HoffmannLa Roche AG

- PerkinElmer

- Danaher Corporation

Key companies are driving innovation in the life science reagents market by developing advanced reagents for molecular diagnostics, genomics, and biopharmaceutical research. They are investing in automation, AI-driven analysis, and high-throughput technologies to enhance efficiency and accuracy. The demand for personalized medicine, regenerative therapies, and next-generation sequencing is pushing companies to create specialized reagents. Additionally, strict regulatory standards and increasing R&D funding are encouraging continuous improvements in quality, reproducibility, and application diversity. Some of the companies are:

Recent Developments

- In January 2025, Bio-Rad launched Vericheck ddPCR kits for AAV2 and AAV8, enabling precise capsid and genome titer analysis, advancing gene therapy research, and driving a surge in the life science reagents industry.

- In September 2024, QIAGEN launched 100 new digital PCR assays on its QIAcuity platform, enhancing cancer, genetic disorders, infectious diseases, and environmental research. Integrated with GeneGlobe, it advances precision in life science reagents.

- Report ID: 7220

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Life Science Reagents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.