High Temperature Adhesives Market Outlook:

High Temperature Adhesives Market size was valued at USD 5.29 billion in 2025 and is likely to cross USD 10.6 billion by 2035, registering more than 7.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high temperature adhesives is assessed at USD 5.63 billion.

The growth of this market can be attributed to the rising global manufacturing production along with rising popularity of adhesives in the manufacturing process owing to their properties such as strong bonding, durability, and high temperature resistance. The global manufacturing production increased by 7.2% in 2021, exceeding the level pre-pandemic. In 2021, the manufacturing value added share in total GDP increased to 16.9% from 16.2% in 2015. The rising production of manufactured goods is resulting in an increased demand for high temperature adhesives. These adhesives are used for a variety of applications, such as automotive, electrical and electronics, construction, and other industrial applications, where they are needed to withstand high temperatures and provide a strong bond.

In addition to these, factors that are believed to fuel the high temperature adhesives market growth of high temperature adhesives include the increasing demand from end-use industries, such as automotive, healthcare, and electronics, owing to the superior performance of high temperature adhesives over traditional adhesives. Furthermore, the growing need for lightweight, durable, and cost-effective solutions in the automotive industry is expected to further propel the high temperature adhesives market growth of high temperature adhesives. The use of lightweight materials in automobiles has increased in recent years as manufacturers strive to meet fuel efficiency standards. Lightweight materials such as aluminum and composite materials enable manufacturers to reduce the weight of their vehicles, which in turn increases their fuel efficiency. The fuel economy of a vehicle can be improved by 6%-8% by reducing the vehicle's weight by 10%. The use of lightweight components and engines powered by advanced materials could save more than 5 billion gallons of fuel each year by 2030 in a quarter of the U.S. fleet.

Key High Temperature Adhesives Market Insights Summary:

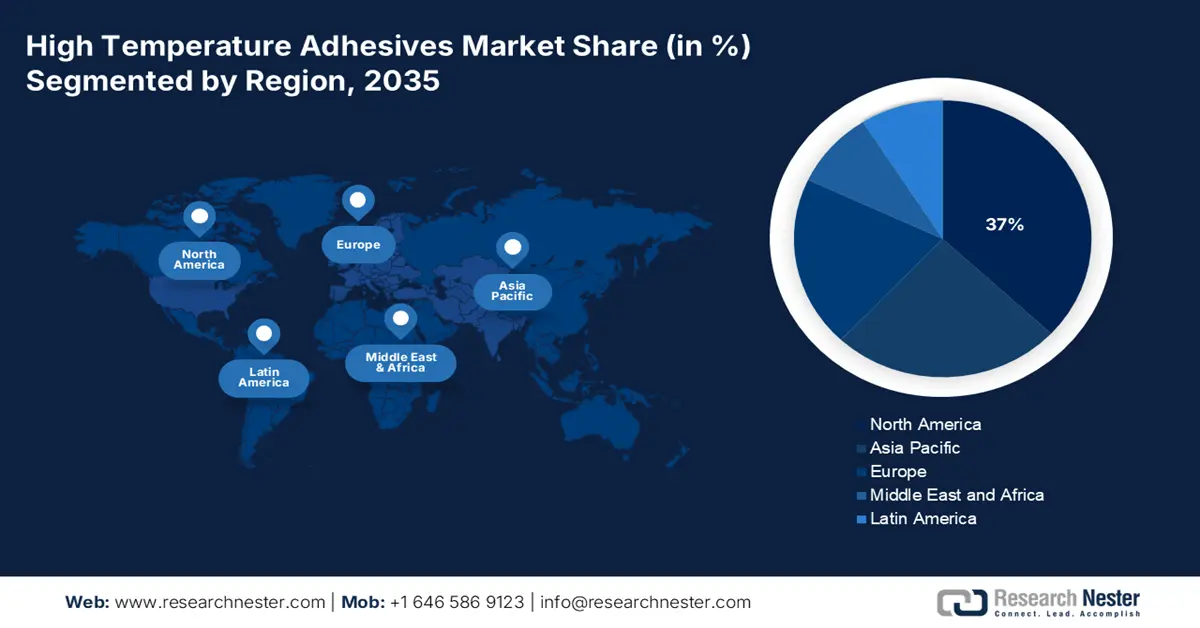

Regional Highlights:

- Asia Pacific high temperature adhesives market will dominate more than 37% share by 2035, rising demand for consumer electronics and increasing vehicular production.

- North America market will account for 24% share by 2035, increasing demand for lightweight materials in the construction and transportation industries.

Segment Insights:

- The electrical and electronics segment in the high temperature adhesives market is expected to hold a 31% share by 2035, driven by increasing demand for high-end electronic gadgets requiring durable high-temperature adhesives.

- The epoxy adhesive segment in the high temperature adhesives market is anticipated to secure a 28% share by 2035, driven by epoxy's superior adhesion, chemical resistance, and rising exports in automotive and construction industries.

Key Growth Trends:

- Increasing Green Building Construction Projects

- Growing Acceptance of Electric Vehicles Worldwide

Major Challenges:

- Increasing Green Building Construction Projects

- Growing Acceptance of Electric Vehicles Worldwide

Key Players: 3M, Avery Dennison Corporation, DELO Industrial Adhesives, H.B.Fuller Company, Permabond LLC, Permatex, Dow, EpoxySet Inc., Flexible Ceramics Inc., PPG Industries Inc.

Global High Temperature Adhesives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.29 billion

- 2026 Market Size: USD 5.63 billion

- Projected Market Size: USD 10.6 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

High Temperature Adhesives Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Green Building Construction Projects - It was estimated that over 60% of the projects undertaken by 46% of firms in 2021 were green building projects. In addition, 35% of companies intend to build green in existing buildings and renovations. Green building construction helps to reduce energy consumption, increase energy efficiency, and reduce the environmental impact of building construction. High temperature adhesives are often used in green building construction as they help to reduce the amount of energy needed to bind materials together and can help to reduce the environmental impact of the building.

- Growing Acceptance of Electric Vehicles Worldwide- In the period 2012-2021, approximately 17 million electric vehicles were sold worldwide. In 2021, the number of electric vehicles (EVs) sold doubled from previous years to reach 6.6 million. As of 2021, nearly ten percent of global car sales were electric. The total number of electric vehicles sold across India in February 2023 was 5%, up from 3% in February 2022. High temperature adhesives provide superior resistance to high temperatures and aggressive fuels that are typically found in electric vehicles. They also provide superior bonding strength and vibration resistance, making them ideal for use in electric vehicles.

- Rising Demand for Electronics Such as Laptops, Smartphones - There were 220 million laptops shipped worldwide in 2020. 60% of laptops worldwide are shipped by Lenovo, Dell, and HP combined. As of 2019, there are 6 billion unique mobile users in the world, of whom 2.60 billion use smartphones. Electronic components such as CPUs, GPUs, and memory chips require high temperature adhesives to bond them to the motherboard and other components. As the demand for electronics increases, so too does the demand for high temperature adhesives.

- Rapidly Expanding Aerospace and Defense Industry - It was observed that exports from the aerospace and defense industry increased by 11% in 2021 to total USD 100 billion. Compared to 2020, the aerospace and defense industry generated USD 700 billion in revenue in 2021. High temperature adhesives are essential for aerospace and defense applications, such as jet engines, which require superior adhesion and strength in order to withstand the extreme temperatures and pressure.

- Increasing Use of Advanced Medical Devices - According to WHO estimates, there are more than 7000 generic device groups on the world high temperature adhesives market, containing more than 2 million types of medical devices. As medical device manufacturers continue to strive for smaller and more efficient products, they are increasingly turning to high temperature adhesives. These adhesives are highly durable, temperature resistant and have excellent bonding properties, making them ideal for use in medical devices.

Challenges

- Stringent environmental regulations - Environmental regulations limit the amount of hazardous substances that can be used in the production of high-temperature adhesives. This reduces the number of potential products that can be produced and limits the growth of the high temperature adhesives market.

- Rising raw material costs

- Lack of awareness of the product

High Temperature Adhesives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 5.29 billion |

|

Forecast Year Market Size (2035) |

USD 10.6 billion |

|

Regional Scope |

|

High Temperature Adhesives Market Segmentation:

Adhesive Resin Type Segment Analysis

The global high temperature adhesives market is segmented and analyzed for demand and supply by adhesive resin type into epoxy, silicone, polyurethane, acrylic and other resin types. Out of these, the epoxy segment is estimated to gain the largest market share of about 28% in the year 2035. The growth of the segment can be attributed to the epoxy's superior adhesion, excellent chemical resistance and wide temperature range make it an ideal adhesive for many applications. Additionally, its low shrinkage, good gap filling properties and fast curing time are some other factors that are contributing to its growing popularity in the market. Moreover, rising exports of epoxy adhesives owing to the increasing demand for epoxy adhesives in the automotive and construction industries is projected to drive segment growth. A recent update to export data reveals that in 2023, 138 India exporters exported epoxy adhesive to 327 buyers for 1.2K shipments. With 9,600 shipments, South Korea is the top exporter of Epoxy adhesive followed by the US with 7,720 and China at the 3rd spot with 5,120.

End-user Segment Analysis

The global high temperature adhesives market is segmented and analyzed for demand and supply by end user industry into electrical and electronics, building and construction, automotive, medical devices and instruments, aerospace and defense and others. Out of these, the electrical and electronics segment in market is estimated to gain the significant market share of about 31% in the year 2035. The growth of the segment can be attributed to the growing demand for high-end electronic gadgets such as smartphones, televisions, and laptops. As a result of the growing number of people embracing technology and the availability of more affordable and feature-rich devices. Additionally, the increasing need for better performance and durability of these gadgets has driven the demand for high temperature adhesives. There is an increasing demand for high temperature adhesives as they are better able to withstand the heat generated by the complex circuitry of these devices and provide a secure bond between the components. Furthermore, they are more able to withstand the high temperatures generated during the manufacturing process, as well as provides a long-lasting bond between the components, thereby increasing the life and performance of the device.

Our in-depth analysis of the global market includes the following segments:

|

By Adhesive Resin Type |

|

|

By Polymer Type |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Temperature Adhesives Market Regional Analysis:

APAC Market Insights

The high temperature adhesives market Asia Pacific, amongst the market in all the other regions, is projected to be the largest with a share of about 37% by the end of 2035. The growth of the market can be attributed majorly to the rising demand for consumer electronics along with increasing vehicular production. The growing adoption of high temperature adhesives in these sectors, and the increasing awareness about the properties of high temperature adhesives are some of the key factors driving the growth of the market in the region. A total of 22,933,230 vehicles were produced by the Indian automobile industry in April 2021 to March 2022, comprising passenger cars, commercial vehicles, three-wheelers, two-wheelers, and quadricycles. Furthermore, the total number of vehicles produced and sold in China in January 2023 was 1,594,000 units and 1,649,000 units, respectively. High temperature adhesives offer beneficial properties such as higher strength, better heat resistance and improved durability compared to traditional adhesives. This makes them ideal for use in vehicles and automobiles, where these properties are essential for ensuring the longevity and reliability of the vehicle.

North American Market Insights

The North America high temperature adhesives market is estimated to be the second largest, registering a share of about 24% by the end of 2035. The growth of the market can be attributed majorly to the increasing demand for lightweight materials in the construction and transportation industries owing to the focus on reducing greenhouse gas emissions in region. This has increased the demand for high temperature adhesives which are capable of bonding lightweight materials. Additionally, the increasing focus on the development of smart cities in the region is expected to fuel the market growth over the forecast period. Smart cities have a number of components that require the use of high temperature adhesives, such as electronic components, sensors, and other building materials. As more cities invest in developing smart infrastructure, the demand for high temperature adhesives is expected to increase.

Europe Market Insights

Europe region is expected to observe significant growth till 2035. The region has the highest demand for high temperature adhesives owing to the presence of advanced manufacturing technologies that require the use of high temperature adhesives. Furthermore, the region is home to some of the world's leading automotive and aerospace manufacturers that are increasingly looking for high temperature adhesives to meet their stringent requirements. These manufacturers require high temperature adhesives for applications such as bonding composites, metals, and plastics in extreme temperature conditions. The superior performance of these high temperature adhesives makes them ideal for the rigorous demands of these industries.

High Temperature Adhesives Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Avery Dennison Corporation

- DELO Industrial Adhesives

- H.B.Fuller Company

- Permabond LLC

- Permatex

- Dow

- EpoxySet Inc.

- Flexible Ceramics Inc.

- PPG Industries Inc.

Recent Developments

-

DELO Industrial Adhesives has introduced the DELO MONOPDX HT2999 adhesive, which was specifically developed for automotives and mechanical engineering applications. This new adhesive offers a high temperature resistance up to 150°C, as well as a low viscosity and fast curing time.

-

The new medical adhesive by 3M can stick to the skin for up to 28 days and is intended to be used with a broad range of health monitors, sensors, and long-term wearables. The adhesive is unique on account of its water-resistant properties, allowing it to stay on the skin even during showering and swimming. It is also designed to be hypoallergenic and to minimize irritation and inflammation.

- Report ID: 4812

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Temperature Adhesives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.