High Temperature Grease Market Outlook:

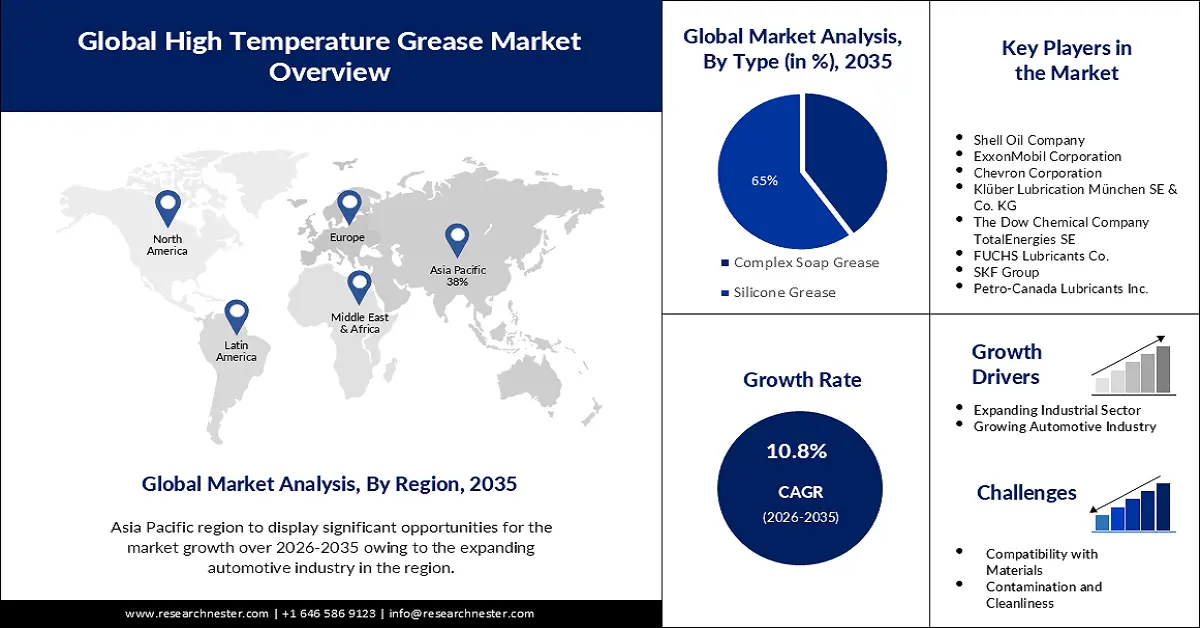

High Temperature Grease Market size was over USD 18.74 billion in 2025 and is poised to exceed USD 52.26 billion by 2035, growing at over 10.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high temperature grease is estimated at USD 20.56 billion.

The increasing industrialization across steel manufacturing, aerospace, automotive, and others is driving the high-temperature grease demand. Lubricating grease has a widespread application in transportation, particularly in passenger vehicles and electrically powered commercial. The U.S. manufacturing sector has showcased steady growth, both annually and monthly. The manufacturing gross output in Q4 2024 was USD 7,309.7 billion, which rose from USD 7,218.3 billion in Q4 2023. Similarly, transportation and warehousing, another market end user, grew from USD 1,765.0 billion to USD 1,850.4 billion in Q4 2024.

Key High Temperature Grease Market Insights Summary:

Region Insights:

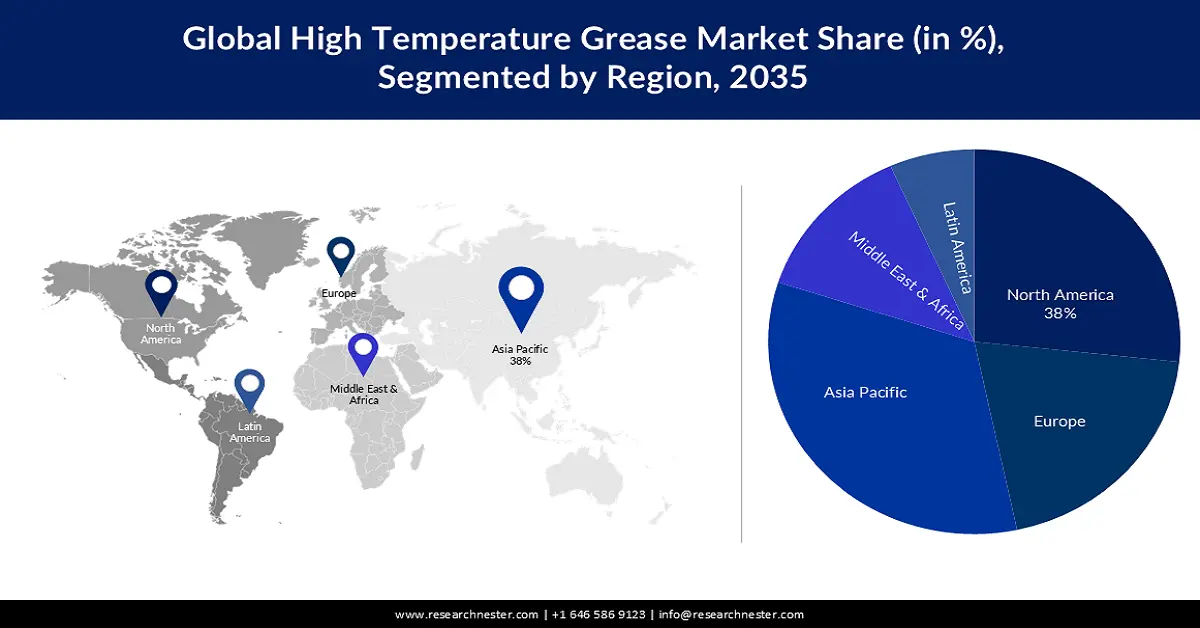

- The Asia Pacific high temperature grease market is expected to command a 38% share by 2035, sustained by the region’s emergence as a global automotive manufacturing hub driven by lower production costs.

- North America is projected to secure the second-largest share by 2035, underpinned by its strong industrial base and expanding demand from advanced automotive, aerospace, and defense applications.

Segment Insights:

- The silicone grease segment in the high temperature grease market is projected to secure a 65% share by 2035, supported by its broad temperature tolerance and strong water-repellent properties.

- The automotive segment is anticipated to capture a substantial share by 2035, bolstered by rising global vehicle production and increasing use of high-temperature greases in automotive systems.

Key Growth Trends:

- Growing automotive industry poses need for high temperature grease

- Semiconductor manufacturing sets a significant demand for perfluoroalkyl and polyfluoroalkyl PFAS based lubricants

Major Challenges:

- Extreme operating conditions

Key Players: Shell Oil Company, ExxonMobil Corporation, Chevron Corporation, Klüber Lubrication München SE & Co. KG, The Dow Chemical Company, TotalEnergies SE, FUCHS Lubricants Co., SKF Group, China Petroleum & Chemical Corporation, Petro-Canada Lubricants Inc.

Global High Temperature Grease Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.74 billion

- 2026 Market Size: USD 20.56 billion

- Projected Market Size: USD 52.26 billion by 2035

- Growth Forecasts: 10.8%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, Turkey

Last updated on : 25 November, 2025

High Temperature Grease Market - Growth Drivers and Challenges

Growth Drivers

-

Growing automotive industry poses need for high temperature grease: The U.S. is among the biggest auto markets and in 2022, light vehicle sales surpassed 11 million units. In 2023, international automakers manufactured 4.9 million vehicles in the country. In 2023, the U.S. light vehicle exports were 1.6 million units, 160,000 medium heavy trucks, and USD 93.7 billion worth of auto parts and components. Light weight truck market share was 79.3% in 2022, a 3.4% surge from 2021. The sector brings in USD 1 trillion, equivalent to 4.8% of the U.S. GDP each year (contributing USD 280 billion in local, state, and federal tax revenues). The U.S. affiliates of most of its foreign-owned automotive businesses support 500,000 U.S. jobs, and the total FDI in the country’s automotive industry was USD 195.6 billion in 2023.

China continues to dominate the global vehicle industry in terms of both manufacturing output and annual sales, with domestic capacity anticipated to cross 35 million vehicles by the end of 2025. The Ministry of Industry and Information Technology data suggests that vehicle sales in 2021 was 26 million, constituting 21.48 million units of passenger vehicles, up by 7.1% from the previous year, whereas the commercial sales were 4.79 million. U.S.-made automobiles exported to China face a 15% tariff under the U.S.-China Phase One Trade Agreement, offering opportunities for U.S. exporters. - Semiconductor manufacturing sets a significant demand for perfluoroalkyl and polyfluoroalkyl PFAS-based lubricants: About 1 trillion semiconductors were sold worldwide in 2023. High demand has provided an impetus to investments to boost chip manufacturing capacity. Owing to the CHIPS and Science Act, the U.S. is projected to garner a larger private investment share in the coming years. In August 2024, several players in the semiconductor ecosystem announced over 90 new projects in the country, which cumulatively reached USD 450 billion in funding across 28 states. SIA estimates that the U.S. share in chip manufacturing (less than 10nm) will account for 28% of global capacity by the end of 2032, capturing 28% of the global CapEx between 2024 and 2032.

In March 2025, SIA disclosed that worldwide semiconductor sales crossed USD 56 billion in January, a 17.9% surge from January 2024’s USD 47.9 billion. Regionally, Y-O-Y sales were up in the U.S. (50.7%), APAC (9.0%), Japan (5.7%), and China (6.5%) but down in Europe (-6.4%). Semiconductor production equipment must operate at extreme environmental conditions such as high temperatures, vacuum conditions, and high UV-light irradiation, thereby requiring high temperature oils, greases, and lubricants to protect moving parts from excessive wear and tear.

The aggressive chemistries used in the process include oxidizers, caustics such as sulfuric acid, tetramethylammonium hydroxide, and hydrogen peroxide, strong acids, reactive gas radicals including fluorine gas and ionized chlorine, and pyrophoric gases comprising phosphine, silane, and arsine. With their superior tribological and rheological properties, PTFE and PFPE are widespread in such high-speed and high temperature use cases.PFAS grease is typically made from polytetrafluoroethylene thickeners and/or micropowders, poly chlorotrifluoroethylene (PCTFE), and synthetic hydrocarbons with PTFE micropowders, and multiply-alkylated cyclopentane (MAC).

Challenges

-

Extreme operating conditions: High-temperature greases are designed to withstand extreme temperatures, pressures, and other harsh operating conditions. However, in certain industries or applications, the conditions might be exceptionally severe, leading to accelerated degradation of the grease and reduced equipment performance. Developing greases that can effectively handle such extreme conditions while maintaining their lubrication properties is a constant challenge for manufacturers.

High Temperature Grease Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.8% |

|

Base Year Market Size (2025) |

USD 18.74 billion |

|

Forecast Year Market Size (2035) |

USD 52.26 billion |

|

Regional Scope |

|

High Temperature Grease Market Segmentation:

Type Segment Analysis

The silicone grease segment in the high temperature grease market is estimated to gain the largest revenue share of 65% by the end of 2035. Silicone grease exhibits excellent performance across a wide temperature range, making it suitable for both high-and low-temperature applications. Silicone greases can withstand temperatures ranging from as low as -40°C (-40°F) to as high as 200°C (392°F). Silicone grease has inherent water repellency, which makes it highly effective in applications exposed to water, moisture, or humidity.

End user Segment Analysis

High temperature grease market from the automotive segment is expected to garner a significant share in the forthcoming years. The global automotive industry has been witnessing steady growth in vehicle production and sales, leading to higher demand for lubricants, including high-temperature greases, used in automotive components and systems. In 2021, the global automotive industry produced over 78 million passenger cars, with China, the U.S., and Japan being the top vehicle-producing countries.

Production, sales, and trade of vehicles by USMCA countries, 2022, in millions of units

|

Country |

Production |

Sales |

Imports |

Exports |

|

The U.S. |

10 |

14.2 |

7.2 |

2.7 |

|

Canada |

1.2 |

1.6 |

1.6 |

1.3 |

|

Mexico |

3.5 |

1.1 |

1 |

3.3 |

|

All USMCA countries |

14.7 |

16.9 |

9.8 |

7.3 |

Source: USITC

Our in-depth analysis of the global high temperature grease market includes the following segments:

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Temperature Grease Market - Regional Analysis

APAC Market Insights

Asia Pacific high temperature grease market is expected to account for the largest revenue share of 38% during the analysis timeline. In its early phases of development, the global automobile industry was primarily centered in established countries like the U.S. and Germany. However, as companies became more standardized, the manufacturing base for most major automobile corporations shifted from developed nations to emerging high temperature grease markets. Due to lower labor costs, standardization has made it feasible to establish production in underdeveloped countries. This shift explains why, in today's world, APAC countries such as China and India have become the primary manufacturing hubs for many global automobile companies.

Southeast Asia (ASEAN) plays a significant role in the global automotive market, with key countries including Malaysia, Indonesia, the Philippines, Thailand, Singapore, and Vietnam, contributing to the region’s economic growth. The automotive market in ASEAN is poised for steady growth, driven by rising demand for private vehicles and favorable economic conditions. Thailand is identified as the primary auto hub, with key investments from China-based OEMs such as Great Wall Motor and BYD. The country aims to produce 725,000 electric vehicles (EVs) annually by 2030. Indonesia is well-known for its copious nickel resources and has attracted substantial investments in EV production. Key projects constitute BYD’s USD 1.3 billion factory and Hyundai’s battery cell facility in Karawang. Vietnam's local brand, VinFast, led battery electric vehicle (BEV) sales in 2023, reflecting the country’s growing focus on EV adoption.

China, once considered a niche industry and previously referred to as “ppt造车” (a term for companies with ambitious visions and presentations but lacking in mass production), electric vehicles (EVs) have now achieved widespread acceptance in the country. This rapid growth in the China high temperature grease market was fueled by the Made in China 2025 strategy, which identified key sectors for industrial expansion. Since 2009, the government has heavily subsidized the new energy vehicle (NEV) sector, with support amounting to an unprecedented USD 21 billion in 2022, significantly accelerating the growth trajectory of China’s NEVs.

The growth has been both rapid and intense. By 2022, global NEV sales soared to 10.824 million units, representing a 61.6% year-on-year increase. China played a dominant role in this high temperature grease market, with its NEV sales, which accounted for an impressive 63.6% of the global market share. According to the IMD, of the total EV sales volume in 2022, 42% came from internally incubated subsidies by domestic automotive manufacturers, 30% originated from new companies, and 28% were from joint ventures.

North America Market Insights

The high temperature grease market in North America is projected to hold the second-largest share during the forecast period. North America has a diverse and robust industrial sector, including manufacturing, automotive, aerospace, and energy, which drives the demand for high-temperature greases in various applications. North America is a leading hub for automotive research and innovation, resulting in the development of advanced vehicles that require high-temperature greases to withstand extreme operating conditions. The aerospace and defense sectors in North America receive substantial investments, leading to increased demand for high-temperature greases in aviation, defense, and space applications.

U.S. is the second largest manufacturing country after China. In 2023, the sector contributed USD 2.3 trillion to the GDP, amounting to 10.2 % of cumulative GDP, as per the National Institute of Standards and Technology (NIST). Direct and indirect value addition was 17.1 % of GDP. The U.S.'s 6th ranking (2023 Ipsos National Brands Index) as a brand suggests its dominant positioning. The producer prices for all manufacturing surged by 33.4% between 2020 and 2022.

High Temperature Grease Market Players:

- Shell Oil Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ExxonMobil Corporation

- Chevron Corporation

- Klüber Lubrication München SE & Co. KG

- The Dow Chemical Company

- TotalEnergies SE

- FUCHS Lubricants Co.

- SKF Group

- China Petroleum & Chemical Corporation

- Petro-Canada Lubricants Inc.

The high temperature grease landscape is in flux, with businesses navigating intricate roadblocks, innovating relentlessly, and forging strategic alliances to ensure a competitive yet sustainable future. Automotive industry’s focus on EV manufacturing stands as a testament to greases and lubricant adoption and foresight to sustainable growth. The high temperature grease market developments are delivered in the context of a government-supported emphasis on manufacturing, construction equipment, and the auto sector as key elements of the global industrial strategy. Some of the prominent players include:

Recent Developments

- In February 2025, Petroking Petroleum Hebei Co., Ltd. announced the launch of high-performance greases designed especially for automotive and industrial applications. These greases offer better durability, low friction, and extended equipment life.

- Report ID: 5121

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Temperature Grease Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.