Enterprise File Synchronization & Sharing Platform Market Outlook:

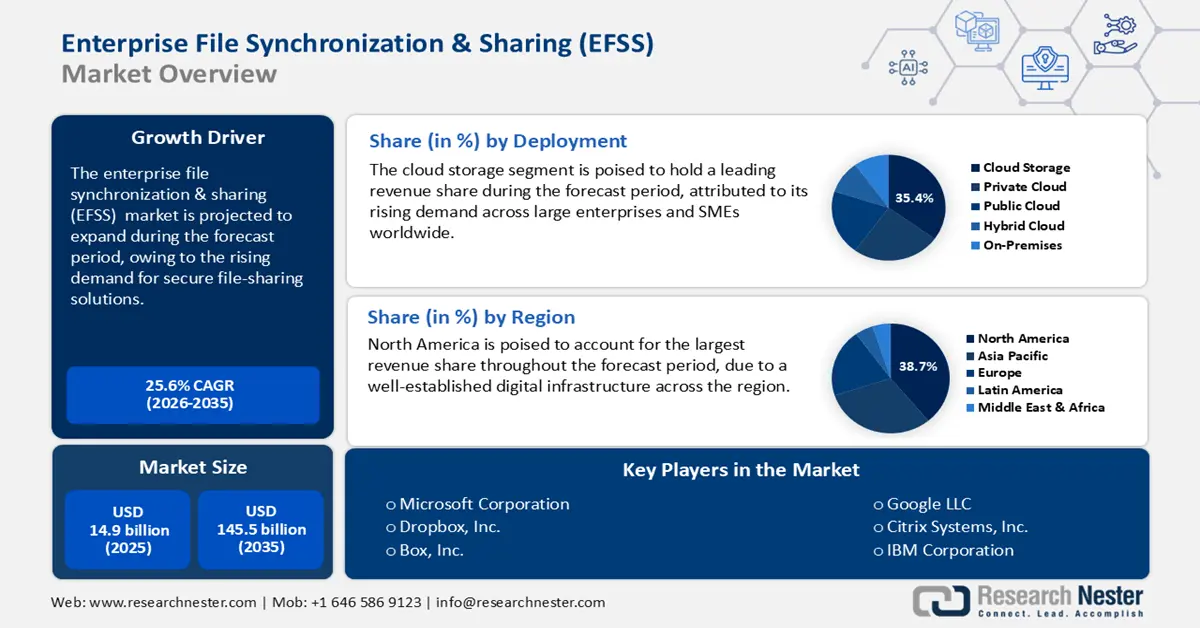

Enterprise File Synchronization & Sharing Platform Market size was valued at USD 14.9 billion in 2025 and is poised to reach USD 145.5 billion by the end of 2035, registering a CAGR of 25.6% between 2026 and 2035. In 2026, the industry size of enterprise file synchronization & sharing is assessed at USD 18.7 billion.

A major factor fueling the growth of the enterprise file synchronization & sharing (EFSS) platform market is the heightened digital transformation across the world, along with the surge in cybersecurity concerns, pushing enterprises to move from traditional file sharing to digital sharing. The Bureau of Economic Analysis states that the U.S. economy grew by 3.3% in the last three months of 2023. The growth was driven by the rise in consumer spending power, as well as by businesses and the government, along with high exports and investments.

People are spending more on services such as dining, vacations, staying at hotels, and healthcare, as well as on goods including medicines, computer software, and recreational items. The private fixed investment in information processing equipment and software stood at USD 1337 billion in the second quarter of 2025, according to the Federal Reserve Bank of St Louis. This highlights the increasing moves in software investments are expected to propel the sales of enterprise file synchronization & sharing solutions in the years ahead.

Key Enterprise File Synchronization & Sharing (EFSS) Platform Market Insights Summary:

Regional Insights:

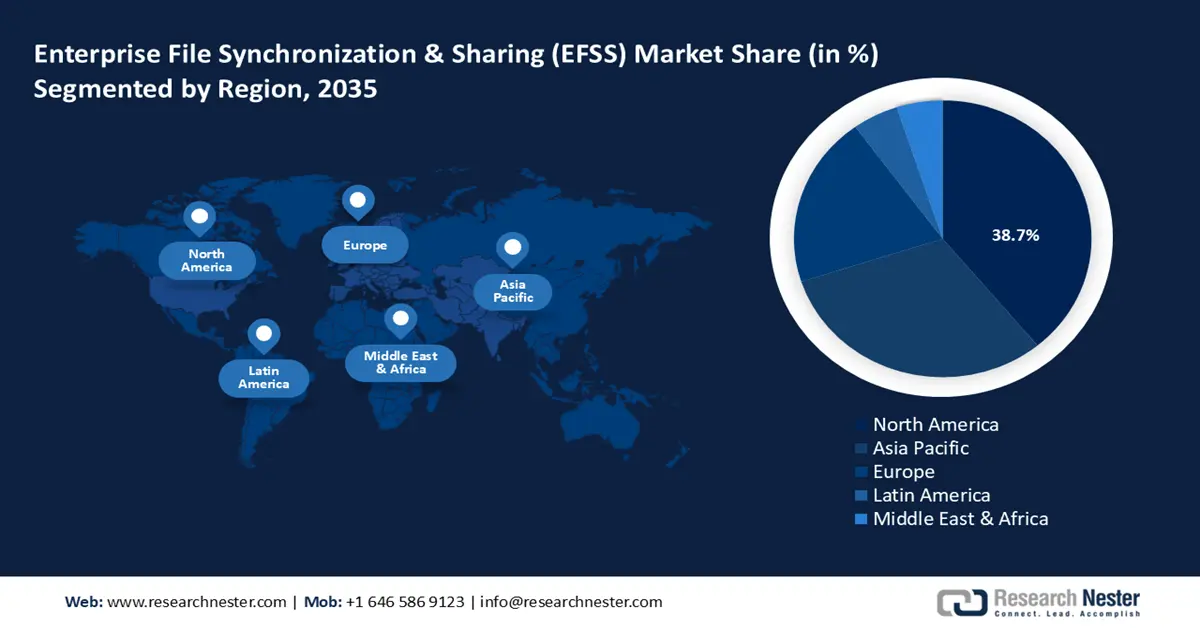

- By 2035, the North America EFSS platform market is set to command a 38.7% share, supported by a well-established cloud infrastructure and escalating compliance requirements imposed by stringent data-protection laws.

- The APAC EFSS platform market is projected to secure a 24.4% revenue share by 2035, stimulated by rising SME adoption and national digitalization initiatives.

Segment Insights:

- By 2035, the cloud storage segment in the enterprise file synchronization & sharing (EFSS) platform market is projected to account for over 35.4% share, propelled by accelerating digital transformation across industries.

- Across 2026–2035, the enterprise mobility segment is expected to expand rapidly, sustained by the widening use of mobile devices for work-related activities that necessitate secure file synchronization.

Key Growth Trends:

- Expansion of remote work, bolstering demand for EFSS solutions

- Escalating cybersecurity and compliance requirements

Major Challenges:

- Data sovereignty complexities

- Lack of interoperability between EFSS and legacy on-premise systems

Key Players: Microsoft Corporation, Dropbox, Inc., Box, Inc., Google LLC, Citrix Systems, Inc., IBM Corporation, OpenText Corporation, Acronis International GmbH, Egnyte, Inc., Syncplicity LLC (Axway), CTERA Networks Ltd., Thru, Inc., Nextcloud GmbH, Northbridge Secure Systems, Inspire-Tech Pte Ltd., Fujitsu Limited, Hitachi, Ltd., NTT Data Corporation, NEC Corporation, Ricoh Company, Ltd.

Global Enterprise File Synchronization & Sharing (EFSS) Platform Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.9 billion

- 2026 Market Size: USD 18.7 billion

- Projected Market Size: USD 145.5 billion by 2035

- Growth Forecasts: 25.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: – United States, China, Germany, United Kingdom, Japan

- Emerging Countries: – India, South Korea, Australia, Singapore, Brazil

Last updated on : 22 August, 2025

Enterprise File Synchronization & Sharing Platform Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of remote work, bolstering demand for EFSS solutions: A prime contributing factor to the enterprise file synchronization & sharing (EFSS) platform market growth is the shift towards the requirement for secure as well as efficient file-sharing platforms. According to the U.S. Bureau of Labor Statistics discloses that in 2023, around 41% of the employees in the professional, scientific, and technical services were working remotely. The estimate highlights that the pre-pandemic figures still have a high number, which drives the demand for EFSS solutions. In addition, the remote work is not a trend limited to the U.S. alone, but globally, the percentage has risen after the pandemic. This trend is poised to boost the demand for EFSS solutions in the coming years.

- Escalating cybersecurity and compliance requirements: The enterprise file synchronization & sharing (EFSS) platform sales are expected to grow at a high pace due to the rapid rise in cybersecurity threats worldwide. The Operational Riskdata eXchange Association (ORX) reveals that in October 2023, more than 2,500 organizations and over 66,369,100 individuals were impacted by the MOVEit data breaches. Similarly, PowerSchool, which serves more than half of the U.S. school districts, experienced a ransomware attack in December 2024, causing theft of sensitive data. Such incidents are creating a profitable environment for EFSS solution manufacturers.

- Federal investment in tech infrastructure modernization: The booming public spending on technology upgradation is likely to open lucrative doors for EFSS platform manufacturers. In May 2024, the U.S. General Services Administration disclosed that the Technology Modernization Fund’s USD 12 million investment is set to enhance services and efficiency in the Education, Commerce, and State departments. This grant aids the Department of Commerce in updating operations at over 150 National Weather Service offices around the globe. As government IT spending rises, federal contractors are also investing in EFSS solutions to stay aligned with procurement requirements. This public sector demand is anticipated to lead to the broader market acceleration.

Challenges

- Data sovereignty complexities: A significant challenge in the EFSS sector is the variance in data residency laws across multiple regions. Some of such data residency laws are the European Union’s General Data Protection Regulation (GDPR), Canada’s PIPEDA, and Brazil’s LGPD. Several surveyed cloud service providers in the U.S. are facing a barrier in scaling up due to data localization constraints.

- Lack of interoperability between EFSS and legacy on-premise systems: In emerging economies and government entities, the phasing out of legacy platforms has been comparatively slow. This creates a hurdle in the integration of EFSS solutions. Legacy systems often lack secure gateways that can facilitate seamless file synchronization, creating vulnerabilities to security. Many healthcare providers in the U.S. face challenges in implementing secure EFSS solutions due to the risk of inconsistency in data access.

Enterprise File Synchronization & Sharing Platform Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

25.6% |

|

Base Year Market Size (2025) |

USD 14.9 billion |

|

Forecast Year Market Size (2035) |

USD 145.5 billion |

|

Regional Scope |

|

Enterprise File Synchronization & Sharing Platform Market Segmentation:

Deployment Segment Analysis

The cloud storage segment is estimated to hold a leading revenue share of over 35.4% in the enterprise file synchronization & sharing (EFSS) platform market, owing to the ongoing digital transformation across industries, especially in the space of cloud computing. In 2023, nearly 42.5% of the EU enterprises invested in cloud computing services, according to the European Commission report. The move is predicted as enterprises scale up their efforts to bolster security along with scalability. By the end of 2023, major organizations reported a steady growth in cloud storage adoption, creating profitable opportunities converging with the EFSS platform sector.

Application Segment Analysis

The enterprise mobility segment is poised to register a rapid expansion throughout the forecast timeline. Currently majority of employees in industries such as healthcare, retail, and BFSI are leveraging mobile devices for work-related tasks. The expanding access to enterprise data has ensured a rise in demand for secure file synchronization, bolstering the demand for EFSS solutions. For instance, leading U.S. healthcare providers are implementing EFSS solutions to secure patient record sharing across multiple devices, whilst maintaining compliance with HIPAA.

Another supporting factor of the segment growth is the rising prevalence of multi-factor authentication (MFA), remote wipe capabilities, and data loss prevention (DLP) integrated with EFSS platforms for enterprise mobility use cases. The success has ensured that enterprise mobility emerges as a promising segment within the enterprise file synchronization & sharing platform market.

Operation Size Segment Analysis

The large enterprises are expected to hold the highest revenue share throughout the projected timeframe. These organizations are investing heavily in enterprise file synchronization & sharing solutions for the convergence of compliance, security, and fulfilling operational efficiency needs. The strict regulatory pressure from GDPR, HIPAA, and FedRAMP is also pushing the adoption of enterprise file synchronization & sharing platforms. The need for advanced encryption, audit trails, and region-specific data hosting is opening lucrative opportunities for next-gen enterprise file synchronization & sharing solution producers.

Our in-depth analysis of the EFSS platform market includes the following segments:

|

Segment |

Subsegments |

|

Deployment |

|

|

Application |

|

|

Operation Size |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Enterprise File Synchronization & Sharing Platform Market - Regional Analysis

North America Market Insights

The North America EFSS platform market held a 38.7% revenue share by the end of 2035. The market’s expansion is attributed to a well-established cloud infrastructure. Additionally, the region has stringent data protection laws, such as Canada’s PIPEDA and CCPA (California Consumer Privacy Act), requiring improvements in file-sharing solutions. The U.S. federal funding for cybersecurity and infrastructure is allocated more than USD 2 billion in FY25, which directly benefits the deployment of EFSS platforms across multiple sectors, ranging from BFSI to healthcare. With the complexity of cybersecurity increasing, the regional market is poised to maintain a leading demand for EFSS solutions throughout the forecast timeline.

The U.S. enterprise file synchronization & sharing (EFSS) platform market benefits from the proactive integration of digital solutions across multiple enterprises, creating a sustained demand for EFSS solutions. Additionally, the supportive government regulations in the U.S. boost the market growth. Two such regulatory practices are the Digital Government Strategy, the Federal Cloud Computing Strategy (FedRAMP), and the modernization mandates pushed by Executive Order 14028 in May 2021. In addition, the majority of enterprises in the country are moving critical workload to the cloud, and the demand for EFSS solutions is expected to further proliferate across workspaces.

APAC Market Insights

The APAC EFSS platform market is poised to register the fastest revenue share of 24.4% throughout the forecast period. A major driver of the regional market is poised to be a surging demand from SMEs. Two major initiatives within the region are the Digital India initiative and the Cloud Computing Development Plan of China, which have bolstered the deployment of EFSS platforms. Also, more than half of enterprises in India have implemented cloud-based document sharing platforms between 2022 and 2024. Lastly, the region has some of the highest densities of mobile users, creating a high demand for secure file-sharing solutions.

The China enterprise file synchronization & sharing (EFSS) platform market is slated to exhibit sustained growth during the anticipated timeline. Two recent laws in China impact the sector’s growth curve, i.e., the Data Security Law of 2021 and the Personal Information Protection Law (PIPL) in 2022. These laws mandate companies to adopt local, secure EFSS solutions. Additionally, as per the Cyberspace Administration of China, the demand for localized EFSS vendors is increasing due to the compliance requirement with cross-border data transfer laws. The market is also poised to benefit from the 14th 5-year plan (2021-2025) that supports data collaboration between the burgeoning tech and manufacturing sectors.

Europe Market Insights

The Europe enterprise file synchronization & sharing (EFSS) platform market is projected to capture a significant share throughout the study period. The stringent regulatory compliance requirements and rising cybersecurity concerns are fuelling the sales of enterprise file synchronization & sharing platforms. The region’s push for digital workplace transformation is also contributing to the EFSS solution sales growth. The General Data Protection Regulation (GDPR) is estimated to remain the primary driver, compelling organizations to adopt EFSS platforms with advanced encryption, audit trails, and data residency options.

Germany leads the sales of EFSS platforms, supported by its robust manufacturing base and highly regulated industries. The strong national data protection policies also contribute to the increasing adoption of enterprise file synchronization & sharing solutions. At least 37% of the 45,000 exchange servers in the country are vulnerable to cyber threats, per the Federal Office for Information Security (BSI). Also, the Industrie 4.0 initiatives, backed by the Federal Ministry for Economic Affairs and Climate Action (BMWK), are driving EFSS adoption in manufacturing and engineering sectors. Overall, investing in Germany is poised to offer lucrative returns in the years ahead.

Key Enterprise File Synchronization & Sharing (EFSS) Platform Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dropbox, Inc.

- Box, Inc.

- Google LLC

- Citrix Systems, Inc.

- IBM Corporation

- OpenText Corporation

- Acronis International GmbH

- Egnyte, Inc.

- Syncplicity LLC (Axway)

- CTERA Networks Ltd.

- Thru, Inc.

- Nextcloud GmbH

- Northbridge Secure Systems

- Inspire-Tech Pte Ltd.

- Fujitsu Limited

- Hitachi, Ltd.

- NTT Data Corporation

- NEC Corporation

- Ricoh Company, Ltd.

The EFSS platform market is led by technology giants such as Microsoft, Dropbox, Google, Citrix, etc. These companies are leveraging integrated productivity suites to offer EFSS solutions against the backdrop of heightened demand. Strategic initiatives impacting the market include Microsoft’s integration of AI capabilities into OneDrive and Box’s partnership with Google Cloud. Additionally, firms such as Acronis and Nextcloud are emphasizing data sovereignty to comply with regulations such as GDPR. The table below highlights the major players in the market.

Recent Developments

- In May 2025, Box, Inc. introduced AI-driven features into its EFSS platform. The latest AI agents are set to transform end users' work with the content.

- In April 2024, Microsoft announced major improvements to its popular OneDrive platform. The advancements focused on improved collaboration tools and integration with Microsoft 365. The updates are poised to improve the user experience in file synchronization.

- Report ID: 686

- Published Date: Aug 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Enterprise File Synchronization & Sharing (EFSS) Platform Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.