Digital Signage Software Market Outlook:

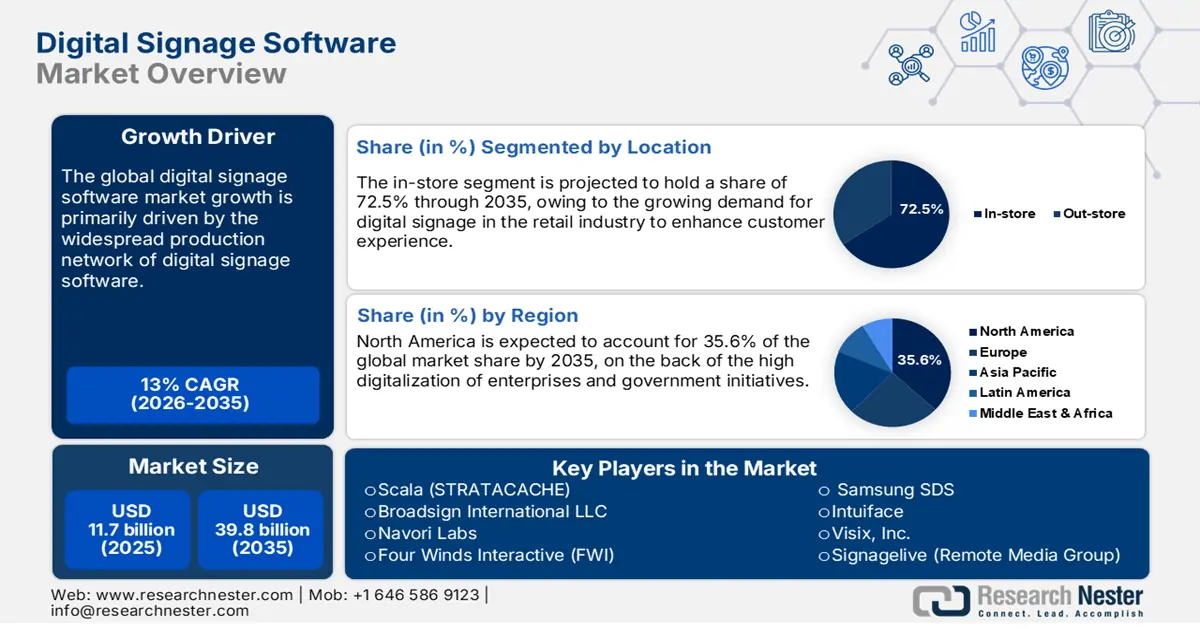

Digital Signage Software Market size was valued at USD 11.7 billion in 2025 and is projected to reach USD 39.8 billion by the end of 2035, rising at a robust CAGR of 13% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of digital signage software is assessed at USD 13.2 billion.

The increasing production network of digital signage software is expected to fuel market growth during the forecast period. The main raw materials, such as display panels and semiconductor modules, required for the production of digital signage software, have a vast availability in various regions. As reported by the Semiconductor Industry Association in July 2023, global sales of semiconductors surpassed 1 trillion in 2022. In 2022, semiconductor companies in the UK generated a revenue of USD 12.9 billion. This forms a foundation for assembling digital signage hardware, showing a consistent dependence upon the worldwide suppliers. These primary raw materials undergo assembly fabrication in original equipment manufacturers or OEMs that are usually situated in the Asia Pacific. However, the software development, crucial for software management, is particularly developed in Europe and North America, with a staggering investment in research and development.

The market is also expected to expand due to the rapid adoption of cloud-based solutions, continuous advancement of display technologies, and consistent development of AI. As reported by the European Commission in December 2023, 42.5% of the enterprises in EU nations adopted cloud services in 2023 for storage, mailing, and software management purposes. The development of AI and display technologies is driven by a wide range of companies and government research institutions operating in different countries, contributing to increasing the market availability of raw materials required for the production of digital signage software. In addition, the integration of advanced versions of the mentioned technologies has led the software to deliver more dynamic and engaging signage experiences to the users.

Digital Signage Software Market - Growth Drivers and Challenges

- Surge in demand from retail and healthcare sectors: The software plays a pivotal role in establishing robust retail services by improving the consumer experience and promoting products in real time. For instance, in June 2024, Walmart announced the availability of digital shelf labels (DSLs) in 2,300 organizational stores by 2026. The digital signage technology is expected to allow the business to enhance customer experience remotely, such as updating product prices on the shelf using a mobile application. Similarly, in the healthcare sector, the software is being highly implemented to include features such as patient checking-in guidance, reducing wait time, and updating wellness tips.

- Smart city initiatives and rising urbanization: The smart city projects are becoming common in countries across the Asia Pacific, Europe, and Africa. This is expected to fuel the demand for digital signage software for monitoring of environmental conditions and promotion of sustainability initiatives virtually. The state-of-the-art system is powered by cloud-based digital signage software that connects with mobile applications and city databases. As reported by the Observer Research Institution in September 2025, companies based in China exported smart city systems across 53 Asian, 20 European, and 15 African countries under the Digital Silk Road (DSR) banner. Similarly, in May 2023, the Euro Cities reported the plan of the City Council of Barcelona to integrate a digital twin in city management in collaboration with the Barcelona Regional Agency and the City Council of Barcelona.

- Surge in remote-working models: Rising adoption of remote working settings by companies is influencing a growing demand for digital signage software. As reported by the World Economic Forum in November 2023, 50% of the global population working remotely is in Europe. This indicates an extensive demand for digital signage software in organizations to bridge communication gaps between employees. The need for cost reduction is also influencing companies in different sectors to employ remote working settings, driving demand for digital signage software.

Countries and Factors Influencing Remote Working in 2023

|

Country |

Surge In Remote Working Due to |

|

Denmark |

Strong internet quality, healthcare, and social inclusiveness |

|

Netherlands |

Economic stability |

|

Germany |

An effective balance between the cost of living and quality of life, and affordable internet services |

|

Slovakia |

Strong cybersecurity network |

|

The United Kingdom |

Cost of living, healthcare access, easier communication, and leisure opportunities |

|

Singapore |

Strong digital and physical infrastructure |

|

Switzerland |

Physical security and protection of remote workers |

Challenges

- High costs of digital signage software: Deployment of digital signage software is often challenging for small and medium-scale organizations owing to the high costs of displays, software licenses, installations, and network infrastructure. Several SMEs do not have robust funds to deploy advanced display systems and software. This can hamper the overall adoption of digital signage software and solutions to a certain extent.

- Poor digital infrastructure development: Internet penetration in developing economies is lower compared to developed economies, hindering the adoption of the digital signage software. For example, only 38.9% of the population in Sub-Saharan Africa used the internet in 2022. A large number of countries still lack digital infrastructural development. Thus, adoption of dynamic digital signage can be challenging in the absence of an effective digital infrastructure.

Digital Signage Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13% |

|

Base Year Market Size (2025) |

USD 11.7 billion |

|

Forecast Year Market Size (2035) |

USD 39.8 billion |

|

Regional Scope |

|

Digital Signage Software Market Segmentation:

Location Segment Analysis

The in-store segment is expected to account for a market share of 72.5% during the forecast period, owing to the growing demand for digital signage in the retail industry to enhance customer experience. Chain stores are integrating digital display solutions into their marketing procedure, fueling the demand for digital signage software. In September 2024, Samsung unveiled its involvement in the installation of commercial LED displays in the American flagship store located at the Westfield Century City Mall, Los Angeles. The in-store displays are managed by Good America with the use of the cloud-based MagicINFO digital signage platform of Samsung.

Type Segment Analysis

The video walls segment is anticipated to acquire a revenue of 28.1% by the end of 2035, attributed to the growing demand for immersive visual experiences across different industries. Companies are increasingly deploying video walls in public spaces, accelerating the use of digital signage software for content and multimedia management. Technology companies are also continuously developing video walls, capable of being deployed in public places. For example, in June 2023, Samsung unveiled the Wall for Virtual Production (IVC Model), a new product in the organization's digital signage lineup. The product is enabled with LED walls and real-time visual effects technology, allowing users to reduce time and cost in content management.

Component Segment Analysis

By 2035, the hardware segment is poised to hold a remarkable revenue share, owing to rising demand for displays, screens, and others across several sectors. Companies are investing in the development of hardware technologies required for the effective functioning of digital signage software. Continuous development of display technologies is also driving the dominance of the segment. One such example is the launch of new Neo QLED, MICRO LED, and OLED lineups by Samsung in January 2023. The new product line is delivering a premium experience and wider viewing options to the users of digital signage software.

Our in-depth analysis of the market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Component |

|

|

Resolution |

|

|

Location |

|

|

Signage Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Signage Software Market - Regional Analysis

North America Market Insights

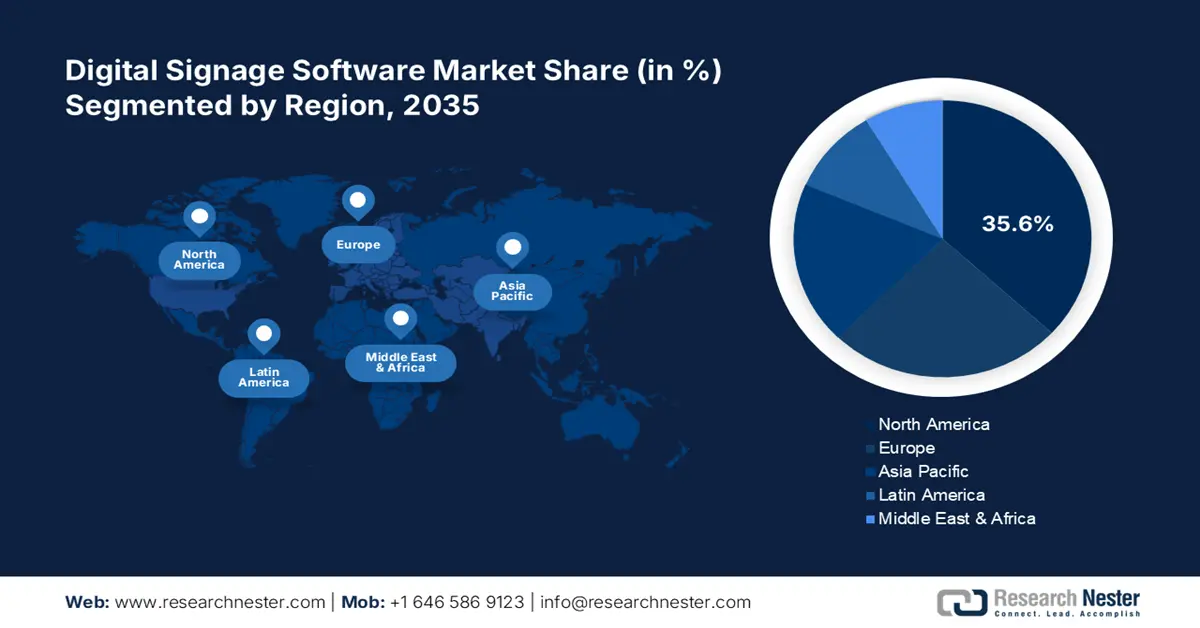

North America digital signage software is anticipated to acquire the largest market share of 35.6% by the end of 2035, owing to the high digitalization of enterprises, indicating the probability of an increasing adoption. The availability of high-speed internet connectivity across the region indicates an opportunity to manage content, enabling real-time updates, and gaining utmost control over displays. For instance, in October 2024, the federal government allocated funding of USD 42.4 billion under the Broadband Equity, Access, and Deployment Program (BEAD), to enable affordable, reliable, and high-speed throughput internet coverage throughout. This is likely to encourage potential users to adopt the use of digital signage software as a convenient option.

The digital signage software market in the U.S. is set to register a rapid CAGR throughout the forecast timeline, on account of government-sponsored initiatives for smart cities. This is expected to accelerate the adoption of virtual displays in public places. The increasing smart city initiatives in the U.S. is expected to fuel the adoption of digital signage software for the enhancement of efficiency, communication, and public engagement. In addition, rising demand for integrated visual solutions across several organizations from various sectors is expected to accelerate the adoption of digital signage software in the coming years.

Canada market is projected to witness a robust CAGR between 2026 and 2035, owing to various federal ICT strategies. The government has announced several subsidies for businesses to encourage further advancement of digital signage, likely to lead to an increased adoption of advanced digital signage software. For example, in October 2023, the government of Canada announced an investment of USD 1.75 million to support L Squared Digital signage in upgrading communication platforms, creating 15 skilled jobs, and expanding globally. With the global expansion of key players associated with the market, the market is also projected to grow extensively.

Europe Market Insights

Europe digital signage software market is anticipated to account for a significant revenue share between 2026 and 2035, on account of the surge in demand for real-time communication, retail expansion, and rising digitization across several sectors. Rapid smart city infrastructure development, driven by different regulatory initiatives, is likely to increase the adoption of the digital signage software. As reported by the European Commission, an annual funding of USD 140.9 million was raised by Horizon Europe for the development of smart cities. With the rapid advancement of AI and ML, the opportunity of managing more personalized content for the target audience of the end use industries of the software fuels the market growth.

Germany is expected to emerge as an expanding digital signage software market at a high CAGR from 2026 to 2035, due to the growing adoption of Industry 4.0 and smart factories. The government is significantly encouraging the adoption of new technologies, including digital signage software for real-time monitoring of manufacturing processes and enhancing safety in the same. Moreover, increasing investments in digital infrastructure by German retailers and growing use of digital signage for digital out-of-home (DOOH) are expected to increase the demand for digital signage software in the coming years.

In the UK, the market is expected to flourish rapidly during the forecast period, due to innovation in the retail sector, public sector digitization, and tremendous efforts towards smart cities. For instance, Transport for London (TfL) included 1,100 advanced signage units across 25 boroughs, with Bexleyheath and Croydon emerging as the latest locations enabled with the technology. In the retail sector, a wide range of organizations are investing in the adoption of digital signage to install in different departments, support seasonal marketing campaigns, and generate inspirational content that can enhance the customer journey. The incorporation of digital signage in transportation and retail management is expected to accelerate the use of digital signage software.

Asia Pacific Market Insights

The digital signage software market in the Asia Pacific is projected to acquire a significant share by the end of 2035, owing to growing preference for tailored marketing content among consumers from different industries. The use of digital signage software facilitates the generation of marketing content tailored to the needs of the target audience. Similarly, smart city initiatives across the region are expected to fuel the market growth in the near future. Moreover, rapid adoption of cloud-based platforms is expected to boost the adoption of digital signage software during the forecast period.

China market is estimated to experience a robust CAGR during the forecast period, attributed to the rapid expansion of 5G infrastructure. With rapid 5G infrastructure development, the efficiency and capability of digital signage software are likely to improve. As reported by People’s Daily Online in September 2025, around 4.6 million 5G base stations were established across China as of August 2023. The involvement of a vast number of key market players within the country is expected to fuel the market growth through the development of relevant hardware technologies.

India is anticipated to emerge as an expanding digital signage software market at a high CAGR during the forecast timeline, with the rapid advancement of IoT and AI technologies. The integration of these technologies is expected to convert signage into smart tools for communication. The rising deployment of advanced digital technologies, especially in the retail sector, is expected to boost the use of digital signage software. Growing preference for cloud adoption across the country is also expected to drive the demand for digital signage software significantly. As reported by the India Brand Equity Foundation in January 2024, government organizations in the country are frequently adopting cloud services for the improvement of service delivery, reducing expenses, and enabling data-driven governance.

Key Digital Signage Software Market Players:

- Scala (STRATACACHE)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Broadsign International LLC

- Navori Labs

- Four Winds Interactive (FWI)

- Samsung SDS

- Intuiface

- Visix, Inc.

- Signagelive (Remote Media Group)

- Sony Professional Solutions

- YCD Multimedia

- Onelan (A Sharp Company)

- Mvix Digital Signage

- PADS4 (NDS)

- Amscreen

- Revel Digital

The competitive landscape of the digital signage software market is rapidly evolving as established key players, IT giants, and new entrants are investing in cloud-based technologies. Key players in the market are focused on software that caters to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position.

Below is the list of the key players dominating the global digital signage software market:

Recent Developments

- In February 2025, LG Electronics U.S. and BrightSign LLC initiated a partnership for the development of a series of LG ultra-high-definition digital signage displays. The displays are compatible with BrightSignOS.

- In January 2025, Samsung launched a newly developed 32-inch Color E-Paper (EM32DX model) and expanded the organizational portfolio of the digital signage solutions that are energy-efficient. The design of the product is lightweight, incorporates digital ink technology, and is capable of delivering ultra-low power consumption.

- In January 2024, LG Electronics launched LG Business Cloud as its 1st cloud-based digital platform at Integrated Systems Europe (ISE) 2024. This platform provides B2B clients with remote device management and digital signage CMS services, enhancing operational efficiency and creating new opportunities in the digital signage software market.

- Report ID: 4822

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Signage Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert