Global Construction Equipment Market

- An Outline of the Global Construction Equipment Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Secondary Research

- Primary Research

- Data Triangulation

- SPSS Approach

- Executive Summary

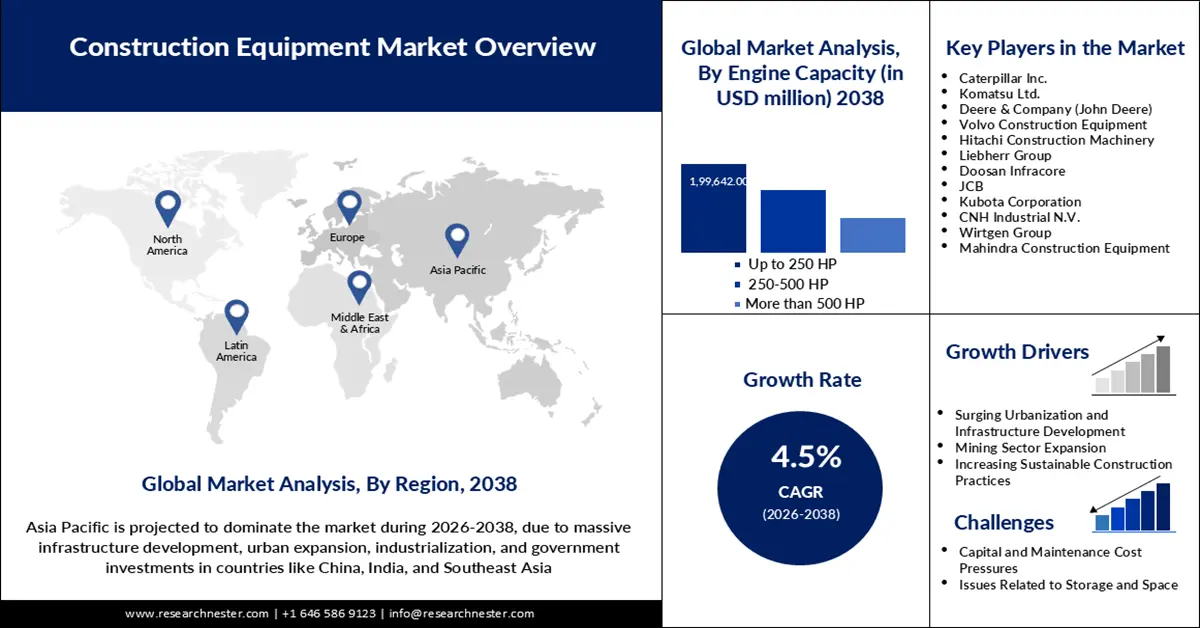

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Technological Advancements

- Up-Coming Technologies

- Growth Outlook

- Pricing Benchmarking

- Risk Analysis

- Value Chain analysis Of Undercarriage Component for Construction Machinery

- Analysis of Undercarriage Company

- Analysis of Undercarriage by Region

- SWOT

- Equipment Category Analysis

- Regional Demand

- Porter’s Five Forces Analysis

- Development News

- Growth Potential for Construction Equipment by Equipment Category Market

- Root Cause Analysis (RCA) for discovering problems of the Global Construction Equipment Market

- Strategic Recommendations in the Construction Equipment Market

- Comparative Positioning

- Equipment Production by Company and Category

- Regional Outlook: Construction Equipment Production Trends (2025–2038)

- Competitive Landscape

- Competitive Model

- Company Market Share

- Business Profile of Key Enterprise

- Caterpillar Inc.

- Deere & Company

- CNH Construction and Infrastructure N.V.

- Doosan Corporation

- Escorts Kubota Limited

- Hitachi Construction Machinery Co., Ltd.

- HD Hyundai Construction Equipment

- J C Bamford Excavators Ltd.

- Komatsu Ltd.

- KUBOTA Corporation.

- Liebherr Group

- Manitou Group

- Volvo Construction Equipment

- Global Construction Equipment Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Construction Equipment Market Segmentation Analysis (2026-2038)

- By Equipment Type

- Heavy Construction Equipment, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Compact Construction Equipment, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038

- By Product

- Earth Moving Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Material Handling Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Concrete and Road Construction Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Others

- By Engine Capacity

- Up to 250 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 250-500 HP, Market Value (USD Million), and CAGR, 2026-2038F

- More than 500 HP, Market Value (USD Million), and CAGR, 2026-2038F

- By Power Output

- <100 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 101-200 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 201-400 HP, Market Value (USD Million), and CAGR, 2026-2038F

- >401 HP, Market Value (USD Million), and CAGR, 2026-2038F

- By Propulsion Type

- ICE, Market Value (USD Million), and CAGR, 2026-2038F

- Electric, Market Value (USD Million), and CAGR, 2026-2038F

- CNG/ LNG, Market Value (USD Million), and CAGR, 2026-2038F

- By Application

- Excavation and Mining, Market Value (USD Million), and CAGR, 2026-2038F

- Lifting and Material Handling, Market Value (USD Million), and CAGR, 2026-2038F

- Earth Moving, Market Value (USD Million), and CAGR, 2026-2038F

- Transportation, Market Value (USD Million), and CAGR, 2026-2038F

- Others

- By End User

- Oil and Gas, Market Value (USD Million), and CAGR, 2026-2038F

- Construction and Infrastructure, Market Value (USD Million), and CAGR, 2026-2038F

- Manufacturing, Market Value (USD Million), and CAGR, 2026-2038F

- Mining, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

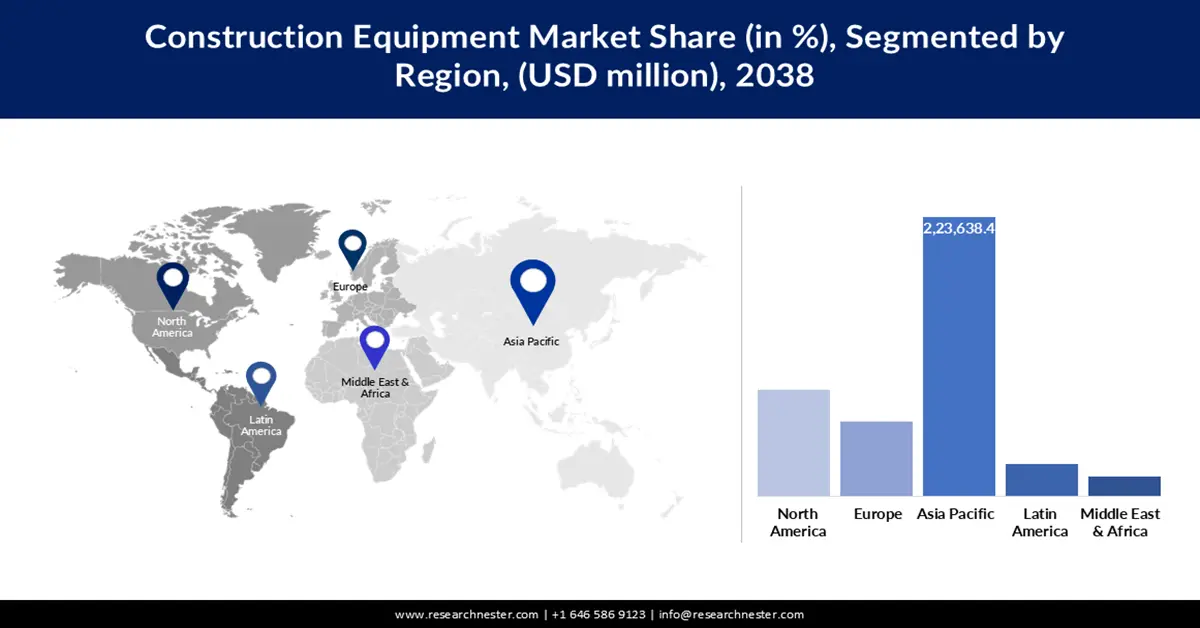

- Regional Synopsis, Value (USD Million), 2026-2038

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Equipment Type

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Segmentation (USD million), 2026-2038, By

- By Equipment Type

- Heavy Construction Equipment, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Compact Construction Equipment, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038

- By Product

- Earth Moving Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Material Handling Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Concrete and Road Construction Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Others

- By Engine Capacity

- Up to 250 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 250-500 HP, Market Value (USD Million), and CAGR, 2026-2038F

- More than 500 HP, Market Value (USD Million), and CAGR, 2026-2038F

- By Power Output

- <100 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 101-200 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 201-400 HP, Market Value (USD Million), and CAGR, 2026-2038F

- >401 HP, Market Value (USD Million), and CAGR, 2026-2038F

- By Propulsion Type

- ICE, Market Value (USD Million), and CAGR, 2026-2038F

- Electric, Market Value (USD Million), and CAGR, 2026-2038F

- CNG/ LNG, Market Value (USD Million), and CAGR, 2026-2038F

- By Application

- Excavation and Mining, Market Value (USD Million), and CAGR, 2026-2038F

- Lifting and Material Handling, Market Value (USD Million), and CAGR, 2026-2038F

- Earth Moving, Market Value (USD Million), and CAGR, 2026-2038F

- Transportation, Market Value (USD Million), and CAGR, 2026-2038F

- Others

- By End User

- Oil and Gas, Market Value (USD Million), and CAGR, 2026-2038F

- Construction and Infrastructure, Market Value (USD Million), and CAGR, 2026-2038F

- Manufacturing, Market Value (USD Million), and CAGR, 2026-2038F

- Mining, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Equipment Type

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Segmentation (USD million), 2026-2038, By

- By Equipment Type

- Heavy Construction Equipment, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Compact Construction Equipment, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038

- By Product

- Earth Moving Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Material Handling Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Concrete and Road Construction Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Others

- By Engine Capacity

- Up to 250 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 250-500 HP, Market Value (USD Million), and CAGR, 2026-2038F

- More than 500 HP, Market Value (USD Million), and CAGR, 2026-2038F

- By Power Output

- <100 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 101-200 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 201-400 HP, Market Value (USD Million), and CAGR, 2026-2038F

- >401 HP, Market Value (USD Million), and CAGR, 2026-2038F

- By Propulsion Type

- ICE, Market Value (USD Million), and CAGR, 2026-2038F

- Electric, Market Value (USD Million), and CAGR, 2026-2038F

- CNG/ LNG, Market Value (USD Million), and CAGR, 2026-2038F

- By Application

- Excavation and Mining, Market Value (USD Million), and CAGR, 2026-2038F

- Lifting and Material Handling, Market Value (USD Million), and CAGR, 2026-2038F

- Earth Moving, Market Value (USD Million), and CAGR, 2026-2038F

- Transportation, Market Value (USD Million), and CAGR, 2026-2038F

- Others

- By End User

- Oil and Gas, Market Value (USD Million), and CAGR, 2026-2038F

- Construction and Infrastructure, Market Value (USD Million), and CAGR, 2026-2038F

- Manufacturing, Market Value (USD Million), and CAGR, 2026-2038F

- Mining, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Equipment Type

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Segmentation (USD million), 2026-2038, By

- By Equipment Type

- Heavy Construction Equipment, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Compact Construction Equipment, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038

- By Product

- Earth Moving Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Material Handling Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Concrete and Road Construction Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Others

- By Engine Capacity

- Up to 250 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 250-500 HP, Market Value (USD Million), and CAGR, 2026-2038F

- More than 500 HP, Market Value (USD Million), and CAGR, 2026-2038F

- By Power Output

- <100 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 101-200 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 201-400 HP, Market Value (USD Million), and CAGR, 2026-2038F

- >401 HP, Market Value (USD Million), and CAGR, 2026-2038F

- By Propulsion Type

- ICE, Market Value (USD Million), and CAGR, 2026-2038F

- Electric, Market Value (USD Million), and CAGR, 2026-2038F

- CNG/ LNG, Market Value (USD Million), and CAGR, 2026-2038F

- By Application

- Excavation and Mining, Market Value (USD Million), and CAGR, 2026-2038F

- Lifting and Material Handling, Market Value (USD Million), and CAGR, 2026-2038F

- Earth Moving, Market Value (USD Million), and CAGR, 2026-2038F

- Transportation, Market Value (USD Million), and CAGR, 2026-2038F

- Others

- By End User

- Oil and Gas, Market Value (USD Million), and CAGR, 2026-2038F

- Construction and Infrastructure, Market Value (USD Million), and CAGR, 2026-2038F

- Manufacturing, Market Value (USD Million), and CAGR, 2026-2038F

- Mining, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Equipment Type

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2038, By

- By Equipment Type

- Heavy Construction Equipment, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Compact Construction Equipment, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038

- By Product

- Earth Moving Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Material Handling Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Concrete and Road Construction Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Others

- By Engine Capacity

- Up to 250 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 250-500 HP, Market Value (USD Million), and CAGR, 2026-2038F

- More than 500 HP, Market Value (USD Million), and CAGR, 2026-2038F

- By Power Output

- <100 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 101-200 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 201-400 HP, Market Value (USD Million), and CAGR, 2026-2038F

- >401 HP, Market Value (USD Million), and CAGR, 2026-2038F

- By Propulsion Type

- ICE, Market Value (USD Million), and CAGR, 2026-2038F

- Electric, Market Value (USD Million), and CAGR, 2026-2038F

- CNG/ LNG, Market Value (USD Million), and CAGR, 2026-2038F

- By Application

- Excavation and Mining, Market Value (USD Million), and CAGR, 2026-2038F

- Lifting and Material Handling, Market Value (USD Million), and CAGR, 2026-2038F

- Earth Moving, Market Value (USD Million), and CAGR, 2026-2038F

- Transportation, Market Value (USD Million), and CAGR, 2026-2038F

- Others

- By End User

- Oil and Gas, Market Value (USD Million), and CAGR, 2026-2038F

- Construction and Infrastructure, Market Value (USD Million), and CAGR, 2026-2038F

- Manufacturing, Market Value (USD Million), and CAGR, 2026-2038F

- Mining, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Equipment Type

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2038, By

- By Equipment Type

- Heavy Construction Equipment, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Compact Construction Equipment, Market Value (USD Million), Volume (Units), and CAGR, 2026-2038

- By Product

- Earth Moving Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Material Handling Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Concrete and Road Construction Machinery, Market Value (USD Million), Volume (Units) and CAGR, 2026-2038F

- Others

- By Engine Capacity

- Up to 250 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 250-500 HP, Market Value (USD Million), and CAGR, 2026-2038F

- More than 500 HP, Market Value (USD Million), and CAGR, 2026-2038F

- By Power Output

- <100 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 101-200 HP, Market Value (USD Million), and CAGR, 2026-2038F

- 201-400 HP, Market Value (USD Million), and CAGR, 2026-2038F

- >401 HP, Market Value (USD Million), and CAGR, 2026-2038F

- By Propulsion Type

- ICE, Market Value (USD Million), and CAGR, 2026-2038F

- Electric, Market Value (USD Million), and CAGR, 2026-2038F

- CNG/ LNG, Market Value (USD Million), and CAGR, 2026-2038F

- By Application

- Excavation and Mining, Market Value (USD Million), and CAGR, 2026-2038F

- Lifting and Material Handling, Market Value (USD Million), and CAGR, 2026-2038F

- Earth Moving, Market Value (USD Million), and CAGR, 2026-2038F

- Transportation, Market Value (USD Million), and CAGR, 2026-2038F

- Others

- By End User

- Oil and Gas, Market Value (USD Million), and CAGR, 2026-2038F

- Construction and Infrastructure, Market Value (USD Million), and CAGR, 2026-2038F

- Manufacturing, Market Value (USD Million), and CAGR, 2026-2038F

- Mining, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Equipment Type

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Construction Equipment Market Outlook:

Construction Equipment Market size was valued at USD 238.9 billion in 2025 and is projected to reach a valuation of USD 424.5 billion by the end of 2038, rising at a CAGR of 4.5% during the forecast period, i.e., 2026-2038. In 2026, the industry size of construction equipment is assessed at USD 248.1 billion.

The market is evolving rapidly, with digitalization and sustainability driving industry innovation. In January 2023, John Deere launched a battery-powered equipment line, which responds to challenges of population growth, shrinking arable land, and rising greenhouse gas emissions. The move signals the end of traditional machines and makes John Deere the leader in innovation. Governments are also investing in infrastructure, as in March 2023, when Singapore launched Changi Airport Terminal 5, fueling demand for road-construction equipment and material handling machines.

One of the lucrative opportunities in the sector is the adoption of advanced operator-aid and safety technologies. Volvo Construction Equipment introduced digital solutions like Lift Assist, Operator Coaching, and Load Ticket in April 2024, which complement one another to enhance productivity and safety. Urbanization and the demand for low-emission equipment are driving partnerships, such as Hitachi's September 2024 partnership with Dimaag-AI for electrified compact excavators with an urban site focus. Cities like Oslo are among the leaders in adopting electric construction equipment, according to the E-Visionary Award for Europe in June 2023. The market is also driven by government regulations for emission-free machinery and by manufacturers' investments in modular and autonomous solutions.

Key Construction Equipment Market Insights Summary:

Regional Highlights:

- Asia Pacific is projected to capture 43.2% share by 2038 in the construction equipment market, driven by urbanization, infrastructure investment, manufacturing growth, and the adoption of electric and autonomous machinery supported by favorable government policies

- North America is expected to grow at a CAGR of 4.4% through 2038, fueled by infrastructure spending, rising equipment rentals, and localized manufacturing expansions to meet mining, urban development, and commercial construction demands

Segment Insights:

- Earth-Moving Machinery Segment in the construction equipment market is projected to hold 61% share through 2038, driven by its critical role in infrastructure, mining, and large-scale development projects, supported by innovations in operator safety, cab design, and adoption of autonomous and electric models

- 201–400 HP Equipment Segment is expected to secure a significant market share by 2038, fueled by sustained demand for bulldozers, heavy-duty excavators, and cranes, along with advancements in machine control systems and precision engineering

Key Growth Trends:

- Digital and remote technologies are driving demand for construction equipment

- Improvements in automation and electrification technologies

Major Challenges:

- Rising hurdles due to steel price volatility

- Increasing regulatory pressures to lower emissions

Key Players: Komatsu Ltd., Deere & Company (John Deere), Volvo Construction Equipment, Hitachi Construction Machinery, Liebherr Group, Doosan Infracore, JCB, Kubota Corporation, CNH Industrial N.V., Wirtgen Group, Mahindra Construction Equipment

Global Construction Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 238.9 billion

- 2026 Market Size: USD 248.1 billion

- Projected Market Size: USD 424.5 billion by 2038

- Growth Forecasts: 4.5% CAGR (2026-2038)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.2% share by 2038)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 19 August, 2025

Construction Equipment Market - Growth Drivers and Challenges

Growth Drivers

- Digital and remote technologies are driving demand for construction equipment: One of the key market drivers is the acceleration of remote and digital technologies in construction operations. Komatsu's April 2025 launch of Smart Construction Remote on all new orders of guidance and control systems is reducing downtime and enabling predictive maintenance. This digitalization is also improving job site efficiency and safety, and aiding in overcoming skilled labor shortages. Volvo CE's April 2025 launch of Load Assist and Operator Coaching tools is also leading the way in how real-time feedback and networked equipment are increasing productivity and billing accuracy. As contractors transition to smarter machines, digitalization will drive steady market growth.

- Improvements in automation and electrification technologies: Another driver is the increasing automation and electrification of heavy machinery. Kawasaki Heavy Industries introduced an autonomous excavator system using 3D design data and LiDAR in November 2024, enhancing efficiency and reducing reliance on skilled labor. The rollout of autonomy haulage systems is gaining traction. For example, in February 2025, Heidelberg Materials partnered with Pronto to deploy AHS to over 100 trucks globally. These technologies are reducing operator scarcity and improving site safety, while the shift toward electrification is driven by partnerships like BYD and XCMG's December 2024 battery system partnership for construction equipment.

Challenges

- Rising hurdles due to steel price volatility: One of the drivers is the price volatility of steel, impacting procurement and manufacturing of equipment. The U.S. average steel price of May 2025 stood at USD 884 per metric ton, influencing cost structures along the supply chain. Volatility forces OEMs to reengineer sourcing strategies and lengthens project schedules. Companies must balance material costs against the need for innovation and sustainability, with a leaning toward transferring part of the cost to end-users. Disruptions to global supply chains and fluctuations in raw material demand increase the complexity of the issue.

- Increasing regulatory pressures to lower emissions: Another challenge is mounting regulatory pressure for emission reduction and sustainable operations. In January 2025, Oslo mandated all city-run construction projects to operate emission-free, leading to stunning declines in noise pollution and air quality impacts. This new policy is generating demand for low-emission and electric equipment, but it also increases builders' compliance costs. Firms must spend on R&D to maintain pace with evolving standards, and firms that do not will jeopardize access to key urban markets. Transitioning to cleaner fleets involves significant capital and operating shifts.

Construction Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2038 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 238.9 billion |

|

Forecast Year Market Size (2038) |

USD 424.5 billion |

|

Regional Scope |

|

Construction Equipment Market Segmentation:

Product Segment Analysis

The earth-moving machinery segment is predicted to hold 61% of the market share through 2038, as its inimitable application in infrastructure, mining, and mega development projects continues to drive it forward. Komatsu updated its crawler excavator cab in July 2024 with improved safety and visibility elements, allowing increased productivity and operator comfort. Earth moving equipment is irreplaceable in excavations to site preparation, and continued innovation in cab design and automation is driving segment growth. The segment growth is bolstered by investment in autonomous and electric models to pursue sustainability goals.

Power Output Segment Analysis

The 201-400 HP segment that includes equipment, such as bulldozers, heavy-duty excavators, and cranes, is anticipated to register a significant market share in the global construction equipment market. The consistent demand for the mentioned equipment fuels the growth of the segment in the global market. Involvement of organizations in the further development of equipment like excavators also fuels the growth of the segment. For instance, in July 2023, Liebherr collaborated with Leica Geosystems to extend its machine control systems’ range for the 8th-generation crawler excavator models.

Engine Capacity Segment Analysis

The up to 250 HP segment is predicted to hold a 44.1% market share by 2038, mirroring the wide uptake of mid-range machines by light industrial, commercial, and residential customers. In April 2025, Manitou Group launched two electric telehandlers, the MT 1440e and MT 1840e, with a 63 kWh lithium-ion battery to run them throughout the day. The up to 250 HP range strikes a balance between power, maneuverability, and energy efficiency, which underpins its strong market position. As the market for versatile, environmentally friendly equipment grows, the up to 250 HP segment will also continue to expand.

Propulsion Type Segment Analysis

The ICE segment is expected to expand at a significant CAGR during the forecast period and continue to carry its dominance in the global construction equipment market due to its higher power output. Continuous innovation to make ICE increasingly sustainable also fuels the segment’s growth. One such example is Toyota’s announcement of Hydrogen Powertrain Technology for a Pilot Program in November 2023 in Australia. The new powertrain technology offers ultra-low tailpipe emissions of CO2, which is the latest step of Toyota towards its decarbonization agenda.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Product |

|

|

Power Output |

|

|

Engine Capacity |

|

|

Propulsion Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Construction Equipment Market - Regional Analysis

APAC Market Insights

The APAC construction equipment industry is anticipated to account for a 43.2% share in the global market during the forecast period as a result of increasing urbanization, infrastructure investment, and manufacturing expansion. In April 2025, Komatsu reported that it will increase Asia, Europe, and North America crawler excavator production, increasing capacity as regional demand grows. The market is also benefiting from green construction-friendly government policies and the adoption of electric and autonomous equipment. Technology partnerships and local production are supporting low-cost, high-performance equipment solutions.

China market is evolving rapidly, and there is strong demand for green, efficient, and high-technology machinery. BYD partnered with XCMG in December 2024 to develop next-generation battery systems for construction equipment, driving the electrification proposition. Chinese manufacturers are investing in the high-volume production and export of electric and hybrid models, and state policy is encouraging the adoption of low-emission machinery in urban projects. The market's emphasis on innovation and sustainability is driving growth and international competitiveness.

India construction equipment market is in a growth phase, driven by urbanization, infrastructure development, and green initiatives. Tata Hitachi launched the electric EX 210LC excavator in March 2025, further accelerating the country's move towards green urbanization. The government's focus on affordable housing, smart cities, and emission reductions is driving demand for electric, compact, and modular machines. Local manufacturers are ramping up production and R&D to meet evolving needs, making India a significant regional market player.

North America Market Insights

North America is set to rise at a CAGR of 4.4% during the forecast period, with infrastructure spending, equipment rental expansion, and manufacturing expansion. United Rentals reported an 8% year-over-year growth in rental revenue in April 2025, fueled by strong demand in commercial buildings. The U.S. Department of the Interior's June 2025 expenditure of over USD 13 million on mine land reclamation grants is also driving demand for equipment used in mining projects. Furthermore, JCB and other manufacturers are doubling factory capacity in Texas to address localized demand, while Canadian firms are investing in modular and green equipment for urban development.

The U.S. market is seeing a demand boom for electrified and autonomous machinery, driven by infrastructure investment and sustainability needs. In April of 2024, Caterpillar invested in Lithos Energy in an effort to accelerate the development of battery systems for construction equipment to drive low-emission fleets. The market is also seeing growth in off-site and modular building, with NREL's April 2025 modular home project showing the need for specialized equipment. These trends are solidifying the U.S. as a construction equipment innovation and adoption leader.

Canada construction equipment market is expanding steadily, with a focus on sustainability and city infrastructure. Sany Heavy Industry opened its first Indonesian factory in April 2025, but domestic production is being augmented as well by Canadian firms to meet demand for efficient, eco-friendly equipment. Government subsidies on green building and modular housing are driving the use of electric and hybrid equipment. The market is also fueled by investment in resource and mining initiatives, with a growing emphasis on operator safety and digitalization.

Europe Market Insights

Europe is anticipated to expand at a robust pace between 2026 and 2038, driven by urbanization, emissions control, and digitalization, pushing demand. Oslo's June 2023 win of the E-Visionary Award recognized the city as a pioneer of electric construction equipment. European governments are mandating zero-emission equipment for government projects, driving demand for electric and hybrid. Spending on smart cities and infrastructure replacement is also driving the market, with contractors adding more digital capability to enhance productivity and compliance.

Germany market is expanding with a focus on high-level automation, safety, and sustainability. In November 2024, Kawasaki Heavy Industries introduced an autonomous excavator system, employing 3D design data and LiDAR for precision and reduced dependence on labor. German manufacturers are investing in digital cab upgrades and emissions-technology engines, and government projects increasingly specify environmentally friendly equipment. The market's focus on quality, innovation, and regulatory compliance is fueling consistent growth and global competitiveness.

The UK construction sector is seeing strong demand for off-site and modular construction, as seen in December 2022 when Volumetric Building Companies delivered a 10-storey modular hotel in London. The trend is driving demand for heavy-duty lifting and assembly gear. The UK government's affordable housing and city regeneration plans are driving investment in electric, autonomous, and compact machines. Manufacturers are responding with next-generation digital controls and safety technologies, making the UK the top in adoption and innovation in construction equipment.

Key Construction Equipment Market Players:

- Caterpillar Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Komatsu Ltd.

- Deere & Company (John Deere)

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Liebherr Group

- Doosan Infracore

- JCB

- Kubota Corporation

- CNH Industrial N.V.

- Wirtgen Group

- Mahindra Construction Equipment

The market is highly competitive, with global leaders competing on the grounds of electrification, automation, and digitalization to take the lead. A significant development occurred in April 2025, when Caterpillar partnered with Luminar, which incorporated dual Iris LiDAR sensors into Cat Command autonomous hauling trucks. The step boosts safety, productivity, and efficiency in quarry and aggregate production. The sector also sees increased investment in battery technology, as in Caterpillar's December 2024 investment in Lithos Energy for high-performance battery packs. With increasing regulatory pressures and customer demands, competition will rise, fueling additional innovation in sustainability, automation, and digital building solutions.

Here are some leading companies in the construction equipment market:

Recent Developments

- In May 2025, HD Hyundai Construction Equipment inaugurated a smart factory at its Ulsan Campus. The facility integrates advanced technologies to streamline production and logistics, aiming to serve as a global manufacturing hub for cutting-edge construction machinery and to improve export capacity and responsiveness to market needs.

- In April 2025, Case Construction Equipment unveiled five new machines, including two compact wheel loaders (one electric), two motor graders, and a small articulated loader with a telescopic arm. The launch also featured upgrades to existing machines, enhancing operator control, visibility, and comfort, and reflecting the company’s commitment to sustainability and innovation.

- In January 2025, Volvo Construction Equipment launched an all-new lineup of articulated haulers, including the new A50 model. The range features advanced electronic systems, upgraded cabs, and proprietary transmissions, marking the company’s largest product renewal in decades and reinforcing its leadership in the articulated hauler segment.

- In January 2025, JCB introduced a new range of Stage 5 emission-compliant construction equipment in India. The lineup features Roll-over Protective Structure (ROPS) technology for enhanced operator safety and signals a shift toward stricter environmental standards, with older models being phased out.

- Report ID: 1425

- Published Date: Aug 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Construction Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.