Global Concrete Paving Equipment Market

- An Outline of the Global Concrete Paving Equipment Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Secondary Research

- Primary Research

- Data Triangulation

- SPSS Approach

- Executive Summary

- Global Industry Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- AJAX Engineering Limited

- ALLEN ENGINEERING CORPORATION

- Caterpillar Inc.

- Guntert & Zimmerman Const. Div., Inc.

- HEM Paving Equipment

- Liebherr Group

- Miller Formless Co.

- Power Curbers Companies LLC

- SANY Group

- SCHWING Stetter India

- Terex Corporation

- Wirtgen Group (DEERE & COMPANY).

- XCMG Group

- Zhenjiang Aran Machinery Co., Ltd.

- Global Outlook and Projections

- Global Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Global Segmentation (USD million), 2019-2037, By

- Product, Value (USD Million)

- Slipform Pavers

- Roller Pavers

- Concrete Spreaders

- Batch Pavers

- Others

- Technology, Value (USD Million)

- Manual

- Semi-Automated

- Fully-Automated

- Power Source, Value (USD Million)

- Diesel

- Electric

- Hybrid

- Application, Value (USD Million)

- Road

- Commercial

- Others

- Regional Synopsis, Value (USD million), 2019-2037

- North America Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Europe Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Asia Pacific Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Latin America Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Middle East and Africa Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Product, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Increment $ Opportunity Assessment, 2019-2037

- Segmentation (USD million), 2019-2037, By

- Product, Value (USD Million)

- Slipform Pavers

- Roller Pavers

- Concrete Spreaders

- Batch Pavers

- Others

- Technology, Value (USD Million)

- Manual

- Semi-Automated

- Fully-Automated

- Power Source, Value (USD Million)

- Diesel

- Electric

- Hybrid

- Application, Value (USD Million)

- Road

- Commercial

- Others

- Country Level Analysis, Value (USD million)

- U.S. Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Canada Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Product, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Increment $ Opportunity Assessment, 2019-2037

- Segmentation (USD million), 2019-2037, By

- Product, Value (USD Million)

- Slipform Pavers

- Roller Pavers

- Concrete Spreaders

- Batch Pavers

- Others

- Technology, Value (USD Million)

- Manual

- Semi-Automated

- Fully-Automated

- Power Source, Value (USD Million)

- Diesel

- Electric

- Hybrid

- Application, Value (USD Million)

- Road

- Commercial

- Others

- Country Level Analysis, Value (USD million)

- UK Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Germany Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- France Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Italy Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Spain Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Netherlands Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Russia Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Switzerland Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Poland Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Belgium Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Rest of Europe Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Product, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Increment $ Opportunity Assessment, 2019-2037

- Segmentation (USD million), 2019-2037, By

- Product, Value (USD Million)

- Slipform Pavers

- Roller Pavers

- Concrete Spreaders

- Batch Pavers

- Others

- Technology, Value (USD Million)

- Manual

- Semi-Automated

- Fully-Automated

- Power Source, Value (USD Million)

- Diesel

- Electric

- Hybrid

- Application, Value (USD Million)

- Road

- Commercial

- Others

- Country Level Analysis, Value (USD million)

- China Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- India Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- South Korea Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Australia Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Indonesia Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Malaysia Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Vietnam Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Thailand Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Singapore Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- New Zeeland Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Product, Value (USD Million)

- Overview

- Latin America Market

- Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Increment $ Opportunity Assessment, 2019-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2019-2037, By

- Product, Value (USD Million)

- Slipform Pavers

- Roller Pavers

- Concrete Spreaders

- Batch Pavers

- Others

- Technology, Value (USD Million)

- Manual

- Semi-Automated

- Fully-Automated

- Power Source, Value (USD Million)

- Diesel

- Electric

- Hybrid

- Application, Value (USD Million)

- Road

- Commercial

- Others

- Country Level Analysis, Value (USD million)

- Brazil Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Argentina Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Mexico Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Rest of Latin America Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Product, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Increment $ Opportunity Assessment, 2019-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2019-2037, By

- Product, Value (USD Million)

- Slipform Pavers

- Roller Pavers

- Concrete Spreaders

- Batch Pavers

- Others

- Technology, Value (USD Million)

- Manual

- Semi-Automated

- Fully-Automated

- Power Source, Value (USD Million)

- Diesel

- Electric

- Hybrid

- Application, Value (USD Million)

- Road

- Commercial

- Others

- Country Level Analysis, Value (USD million)

- Saudi Arabia Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- UAE Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Israel Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Qatar Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Kuwait Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Oman Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- South Africa Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Rest of Middle East & Africa Market Value (USD Million), Volume (Million Units), and CAGR & Y-o-Y Growth Trend, 2019-2037F

- Product, Value (USD Million)

- Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Concrete Paving Equipment Market Outlook:

Concrete Paving Equipment Market was USD 1.5 billion in 2025 and is estimated to reach USD 2.8 billion by the end of 2035, expanding at a CAGR of 4.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of concrete paving equipment is assessed at USD 1.6 billion.

The concrete paving equipment market is expanding due to growing cities and increasing urban infrastructure. The demand for efficient and sustainable solutions is driving this growth. According to the World Bank Organization, approximately 4.4 billion people live in cities, or 56% of the world's population. By 2050, the urban population is predicted to have more than doubled from its current level, with approximately seven out of ten people living in cities. Concrete paving equipment has revolutionized the construction industry, especially for constructing roads and pavements. Due to these machines 27% premium to make this infrastructure low-emission and resilient to the effects of climate change. These needs are driven by consistent city growth and the need to adapt to and mitigate climate change. With the spread of concrete precisely and uniformly, large-scale building projects now take less time and effort.

Key Concrete Paving Equipment Market Insights Summary:

Regional Highlights:

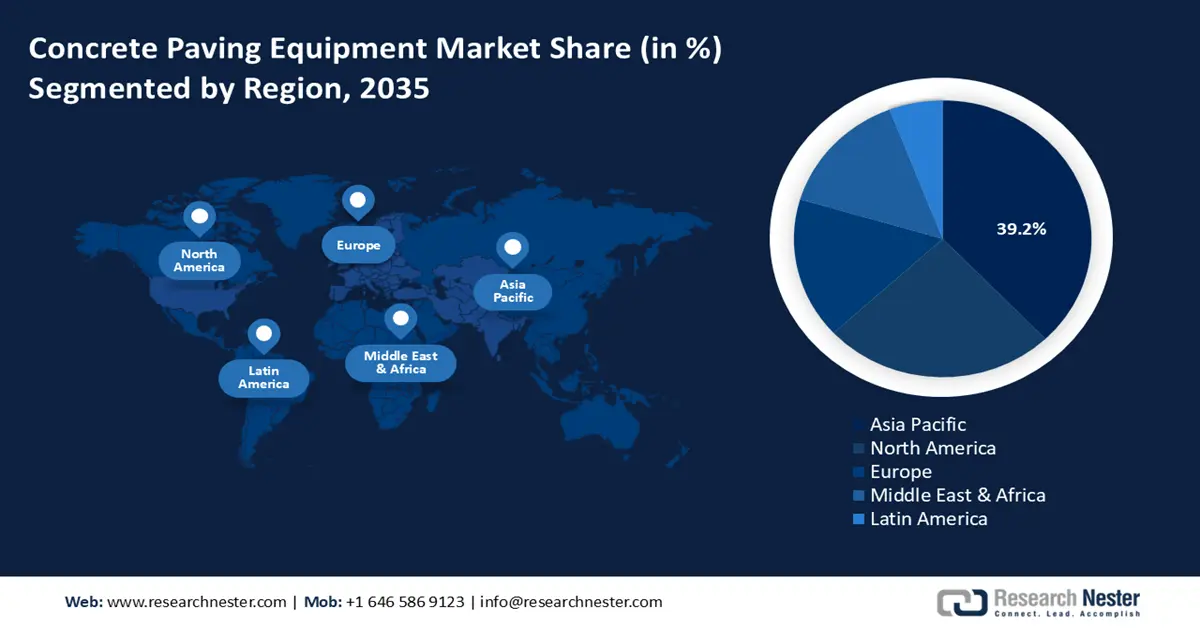

- The Asia Pacific Concrete Paving Equipment Market is expected to secure the largest 39.2% share by 2035, supported by extensive infrastructure investments and rapid urbanization across emerging economies.

- North America is projected to maintain a significant share through 2035, owing to substantial public and private sector investments in urban and transportation infrastructure.

Segment Insights:

- The semi-automated segment of the Concrete Paving Equipment Market is projected to command a 45.9% share by 2035, propelled by its versatility in handling multiple project types while optimizing cost and control efficiency.

- The slipform pavers segment is anticipated to account for a 42.8% share by 2035, driven by growing adoption of automation to enhance construction efficiency and deliver durable, sustainable infrastructure solutions.

Key Growth Trends:

- Increasing adoption rates of electric and hybrid paving machines

- Growing focus on workplace safety

Major Challenges:

- Fluctuating raw material prices

- High initial and maintenance cost

Key Players: Wirtgen Group, Gomaco Corporation Inc., Bid-well (Terex Corporation), Power Curbers Companies LLC, Guntert & Zimmerman, Besser, Sany Heavy Industries Co., Ltd., Caterpillar, Deere & Company, Xuzhou Construction Machinery Group Co., Ltd., Shimizu Corporation, KAJIMA CORPORATION, Nippon Concrete Industries Co., Ltd.

Global Concrete Paving Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 2.8 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Germany, Japan

- Emerging Countries: Indonesia, Vietnam, Mexico, Brazil, South Korea

Last updated on : 6 October, 2025

Concrete Paving Equipment Market - Growth Drivers and Challenges

Growth Drivers

- Increasing adoption rates of electric and hybrid paving machines: As developing nations focus on building and upgrading their transportation networks, the demand for eco-friendly and sustainable paving solutions is increasing. For instance, rural road connectivity in India has been greatly improved under the Pradhan Mantri Gram Sadak Yojana (PMGSY). 7,65,601 km (94%) of the 8,10,250 km of approved road length have been built under this program. In addition, as part of its efforts to maintain a modern economic system with enhanced inter-area transport architecture and greater traffic capacity, in 2022, China presented a plan defining key goals for a national road network.

Therefore, the demand for advanced paving technology is increasing as the construction industry adopts greener methods due to stricter environmental laws. Low-emission and fuel-efficient equipment, like electric and hybrid paving machines, is becoming more popular as governments worldwide implement emission limitations on construction machinery. Due to this, manufacturers are capitalizing on this trend by offering electric and hybrid pavement machines to support government initiatives and meet the increasing demand for sustainable solutions in developing nations. - Growing focus on workplace safety: To minimize the risk of musculoskeletal problems and enhance overall performance, ergonomics focuses on creating tools and equipment that match the user's body and actions. Ergonomics-focused custom concrete tools consider adjustability, weight distribution, grip, and vibration reduction. There is potential for more advancements in the design of ergonomic custom tools for the concrete industry as construction site fatalities grow worldwide. The International Labor Organization reports that construction sites around the globe see at least 60,000 fatal incidents each year, accounting for one in every six workplace fatalities.

Therefore, to reduce accidents and injuries on construction sites, manufacturers are integrating safety measures like seat belts, rollover protection systems, and enhanced visibility into their designs. Also, wearable technologies like exoskeletons or smart gloves may lessen strain and stress by giving workers' muscles and joints more support. - Integration of advanced technologies: Concrete paving equipment is progressively integrating automation and cutting-edge technology such as telematics, GPS, and artificial intelligence. These devices decrease human error, increase operating efficiency, and improve precision. Higher quality construction results can be achieved by using automated paving equipment, which can perform duties more accurately and consistently. Furthermore, predictive maintenance and improved field decision-making are made possible by the application of AI and machine learning. In large-scale infrastructure projects where accuracy and efficiency are crucial, this tendency is especially advantageous.

Growth of Diesel between 2022 and 2023

|

Country |

2022 |

2023 |

Growth |

Growth (%) |

|

U.S. |

7B |

.33B |

326M |

4.65% |

|

Germany |

3.62B |

3.82B |

199M |

5.49% |

|

France |

1.67B |

2.51B |

849M |

51% |

|

Sweden |

1.7B |

2.42B |

646M |

36.5% |

|

UK |

1.87B |

2.05B |

187M |

10% |

Source: OEC

Challenges

- Fluctuating raw material prices: Price fluctuations for raw materials, especially steel, aluminum, and rubber, have a big effect on the market for concrete paving equipment. These components are essential to the production of paving machinery. This price volatility is caused by several factors that have a direct impact on manufacturing costs, including tariffs, geopolitical tensions, and interruptions in the global supply chain. Due to this uncertainty, manufacturers find it difficult to maintain stable prices, which frequently drives up end users' equipment costs.

- High initial and maintenance cost: Concrete paving machines such as pavers, slip form, pavers, and texture curing machines are complex and specialized equipment that require significant upfront investments. Additionally, these machines require regular maintenance, repairs, and replacement of parts, which can be costly and time-consuming. Therefore, this factor will hinder the growth of the concrete paving equipment market.

Concrete Paving Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 2.8 billion |

|

Regional Scope |

|

Concrete Paving Equipment Market Segmentation:

Technology Segment Analysis

The semi-automated segment will gain the largest share of 45.9% by 2035. Semi-automated alternatives provide a compromise by automating repetitive jobs while maintaining human control for complicated procedures, whereas fully automated equipment frequently comes with high costs. Moreover, these machines have movable settings that accommodate various project needs and are made to work with different materials and surfaces. This adaptability eliminates the need for numerous specialized machines by allowing construction companies to use the same machinery for various projects, from urban streets to highways. As a result, semi-automated equipment's adaptability makes it useful for contractors working on several paving projects.

Product Segment Analysis

The slipform pavers segment will garner a 42.8% market share by 2035. Innovations in the construction sector improve operational efficiency and lessen dependency on labor-intensive, traditional methods as demands change. This change highlights the market's trend toward greater automation, satisfying the need for long-lasting, high-quality, and environmentally friendly infrastructure projects worldwide. Cost-effectiveness is becoming a concern for construction organizations, and they are seeking equipment that lowers labor expenses, minimizes material waste, and speeds up project completion. For instance, in February 2022, to meet the unique requirements of North American construction enterprises, Wirtgen Group created the Wirtgen SP 102i, an affordable inset slipform paver. The two-tracked paver can handle common concrete paving applications such as building and repairing roads and paved areas, expanding airport infrastructure, and paving in commercial and residential locations.

Power Source Segment Analysis

The diesel segment is expected to secure a significant share of revenue in the global concrete paving equipment market by 2035, attributed to its exceptional power output, durability, and appropriateness for heavy-duty construction activities. Diesel-powered machinery continues to be the preferred option in extensive infrastructure projects due to its operational efficiency and dependability. Volvo Construction Equipment stands out as a prominent player providing diesel-powered concrete paving machinery recognized for its high performance, durability, and energy efficiency. Their diesel-engine pavers, including the Volvo P7820D ABG, are engineered for heavy-duty infrastructure endeavors, integrating advanced control systems with robust output to guarantee consistent paving quality and fuel efficiency—rendering them ideally suited for challenging construction settings across the globe.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Product |

|

|

Technology |

|

|

Power Source |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Concrete Paving Equipment Market - Regional Analysis

APAC Market Insights

The Asia Pacific concrete paving equipment market will hold the largest market share of 39.2% in 2035. Rapid urbanization and infrastructure development in the region are driving market growth. Countries such as China and India are investing considerably in infrastructure projects to sustain their growing economies and populations. For instance, through the Belt and Road Initiative (BRI), the People's Republic of China (PRC) allocated USD 679 billion for infrastructure projects in five important infrastructure sectors between 2013 and 2021. Also, in India, the Minister of Road Transport and Highways inaugurated 15 national highway projects totaling USD 1.7 billion in June 2022. There are currently large-scale road construction, highway development, and urban planning initiatives in progress to enhance transportation networks and connectivity. This rise in infrastructure projects necessitates the use of advanced paving equipment to manage large construction projects efficiently.

In South Korea, as businesses seek technologically advanced and efficient machinery to increase output, the growing demand to modernize and replace outdated equipment is fueling market expansion. Also, the growing awareness and adoption of environmentally friendly practices, which promote the use of cutting-edge, eco-friendly construction equipment, are escalating the demand for concrete paving equipment. At the same time, the development of smart cities and the incorporation of digital technologies into building projects are driving the need for specialist equipment and propelling the market's expansion. HD Hyundai Infracore's DEVELON Fleet Management system facilitates the remote oversight of construction machinery, such as excavators and articulated dump trucks, thereby improving operational efficiency and user convenience. So far, this solution has been implemented across 65,000 units of HD Hyundai Infracore construction equipment globally, leveraging an IoT system founded on advanced ICT (Information and Communications Technology).

In China, the market for concrete paving equipment is propelled by swift urbanization, substantial investments in infrastructure, and government initiatives aimed at the development of smart cities and sustainable construction practices. The growing need for durable, efficient, and environmentally friendly paving machinery to facilitate extensive road and highway projects further accelerates this growth. SANY Heavy Industry, a prominent manufacturer in China, provides state-of-the-art concrete paving equipment that is engineered for high performance and energy efficiency. Their SSP Series Multifunction Paver features a maximum paving thickness of 50 cm, a paving capacity of 900 tons per hour, and a paving width of up to 10 meters. These machines are designed to function continuously in high-temperature conditions, guaranteeing durability and reliability for large-scale infrastructure endeavors.

North America Market Insights

The North American market for concrete paving equipment will hold a notable share in the forecast period. The need for concrete paving equipment is being fueled by large investments in urban development and infrastructure in the region. To handle growing urban populations and economic activity, both the public and private sectors are concentrating on improving roads, highways, and public transportation networks.

In the U.S., the need for office and storage space has increased due to the expansion of commercial sectors such as food and consumer products. For instance, with an estimated USD 635 billion, the U.S. consumer goods market—which includes consumer packaged goods—was the biggest in the world in 2019. This has had a major impact on the building sector and the demand for concrete paving equipment, which is long-lasting and aesthetically pleasing. The advantages of employing pavement for flooring in construction are becoming more widely known as a result of households' rising standards of living.

Moreover, in Canada, newer equipment with automated safety features is gaining momentum due to a focus on worker safety on the construction site. Repetitive or difficult jobs are handled by fully automated technology, particularly in high-stress or dangerous settings. End-user industries seek technologically sophisticated, fuel-efficient equipment to meet global construction needs, accelerating the growth of concrete paving equipment in the nation. Wirtgen Group, a prominent producer of construction machinery, provides state-of-the-art concrete paving equipment that corresponds with Canada's focus on automation and safety. Their slipform pavers, including the SP 64i, feature intelligent machine control systems that improve precision and efficiency. These machines are engineered to comply with the rigorous safety standards mandated in Canadian construction projects. Wirtgen's dedication to innovation fosters the industry's transition towards safer and more efficient paving solutions.

Europe Market Insights

The European concrete paving equipment market is experiencing steady growth, propelled by an increase in infrastructure projects and urban development. This growth is bolstered by technological innovations in paving machinery and a rising demand for durable road surfaces. Additionally, government initiatives aimed at promoting sustainable construction play a significant role in the market's expansion throughout the region.

Germany is anticipated to capture the largest revenue share in the European concrete paving equipment market by 2035. This growth is driven by extensive highway renovations and investments in environmentally friendly infrastructure. The prominent German company Wirtgen Group is recognized for its innovative paving equipment, including the AutoPilot system, which enhances efficiency and precision in construction. Wirtgen Group, a leading German firm, specializes in advanced concrete paving equipment such as slipform pavers and the AutoPilot system, which significantly improve precision, efficiency, and sustainability in large-scale infrastructure projects.

The UK is projected to attain a substantial revenue share in Europe’s market by 2035. This growth is attributed to urban renewal initiatives and the adoption of advanced construction technologies. Power Curbers, a key industry player, provides versatile slipform pavers like the 5700-D4, which are extensively utilized in tight urban settings and complex paving projects.

European Trade Value in 2023

|

Leading Exporter |

Export Value |

Share |

|

U.S. |

3.82B |

20.4% |

|

France |

2.51B |

13.4% |

|

Poland |

2.42B |

12.9% |

|

Sweden |

2.42B |

12.9% |

|

UK |

2.05B |

11% |

Source: OEC

Key Concrete Paving Equipment Market Players:

- Wirtgen Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Gomaco Corporation Inc.

- Bid-well (Terex Corporation)

- Power Curbers Companies LLC

- Guntert & Zimmerman

- Besser

- Sany Heavy Industries Co., Ltd.

- Caterpillar

- Deere & Company

- Xuzhou Construction Machinery Group Co., Ltd.

- Shimizu Corporation

- KAJIMA CORPORATION

- Nippon Concrete Industries Co., Ltd.

Leading producers of concrete paving equipment market differentiate for their capacity to innovate, create robust and long-lasting equipment, and uphold a significant global footprint. These businesses make significant R&D investments to bring cutting-edge technology like automation, telematics, and environmentally friendly solutions that improve equipment efficiency and lessen their impact on the environment. To guarantee optimum equipment performance and customer satisfaction, top manufacturers also emphasize after-sales support, offering comprehensive service networks, training, and spare parts availability. Furthermore, these businesses frequently have joint ventures and strategic alliances that help them reach a wider audience and successfully respond to local demands.

Recent Developments

- In December 2024, at World of Concrete 2025, the Wirtgen Group presented a world premiere. With the help of the fully modular construction concept, Wirtgen introduced the SP 33 concrete paver in two configurations that allow for the paving of drainage and gutter profiles, rectangular profiles, concrete safety barriers up to 1.3 m (52 in) high, and monolithic concrete profiles like curbs and berms.

- In January 2022, at World of Concrete 2022, GOMACO unveiled the GOMACO GP3 slipform paver, a new intelligent concrete paving technology. It can slipform up to 30 feet in width. Although it comes in two-track and four-track pavers, the four-track variant that was on exhibit included various new improvements.

- Report ID: 6931

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Concrete Paving Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.