Posted Date : 15 October 2025

Posted by : Akshay Pardeshi

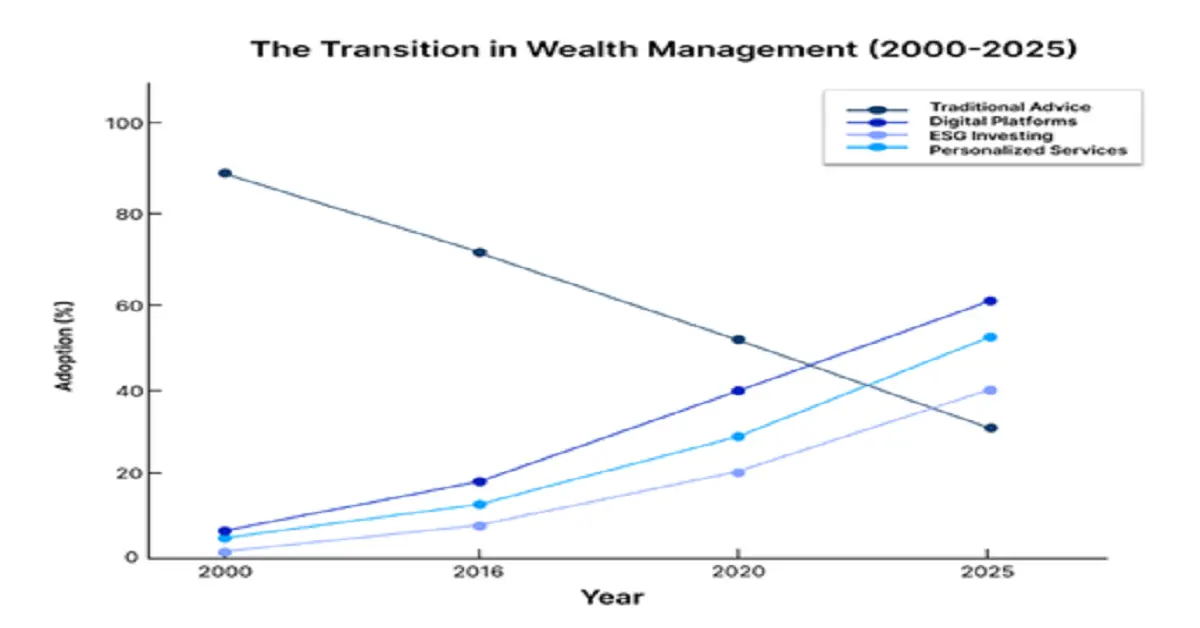

The wealth management industry is going through a strategic shift, driven by a new generation of investors who are reshaping how wealth is created, managed, and preserved. These investors, primarily Millennials, Gen Z, and tech-savvy individuals, are bringing fresh perspectives, demanding innovative solutions, and using technology to redefine traditional wealth management practices. This blog studies the key drivers behind this change, the role of new investors, and the emerging new trends defining the forthcoming period of wealth management.

The Rise of New Investors

Younger generations are quickly becoming a major force in the investment world. As Millennials (born 1981–1996) and Gen Z (born 1997–2012) begin to inherit and build wealth, they are changing the priorities of the financial industry. A 2021 report by Cerulli Associates projects that roughly $84 trillion in wealth will be passed from Baby Boomers and the Silent Generation to their children and grandchildren over the next two decades in the U.S. alone. This major transfer, often known as the Great Wealth Transfer, is bringing a new set of values to the forefront. Unlike previous generations, these younger investors are digital natives. They expect seamless, intuitive, tech-enabled experiences and are looking for platforms that are flexible and align with their personal beliefs.

A 2023 Bank of America survey revealed that 62% of Millennial and Gen Z investors prefer handling their investments through digital platforms, compared to just 29% of Baby Boomers. As a result, wealth management firms are under surging pressure to modernize their services and adopt digital tools that match client expectations.

Technology as a Game Changer

Technology plays the main role in the shift towards a more agile and inclusive wealth management model. New investors are drawn to platforms that offer automation, affordability, and convenience. The rise of digital tools from robo-advisors to mobile apps has made financial planning more accessible than ever before.

- Robo-Advisors and Automated Smart Investing: Robo-advisors are set to become a cornerstone for modern wealth management, especially for younger investors with smaller portfolios. They are especially attractive to young and first-time investors, offering low-cost entry, personalized risk assessment, and convenient mobile access. Platforms like Betterment, Wealthfront, and Robinhood provide automated, algorithm-driven investment management with low fees and minimal human intervention. According to a 2024 report by Research Nester, the global robo-advisory market is projected to reach $1.8 trillion in assets under management (AUM) by 2027, rising at a CAGR of 15.4%. Betterment, for instance, allows users to begin investing with as less as $10, highlighting a marked contrast to traditional firms that often require more than $250,000 to open a managed account.

- AI-Powered Personalization: AI is changing the delivery of financial advice. By accessing data such as spending behavior, investment preferences, and market trends, AI can create personalized recommendations in real time. A 2023 Deloitte study revealed that 68% of wealth management firms are investing in AI to improve their client services. Among younger investors, 82% say they prefer AI-powered insights to more traditional methods. Platforms like Wealthsimple use AI not just for portfolio management but also to offer tax-efficient strategies like tax-loss harvesting. In addition, AI chatbots and virtual assistants are becoming common, providing round-the-clock support without the need for in-person consultations.

- Demand for Responsible and Sustainable Investing: Investors now are not just focused on financial returns; they want their investment to support causes they care about. Hence, Environmental, Social, and Governance (ESG) investing has become a top priority for younger generations. A 2024 report by Research Nester highlighted that 87% of millennial investors are prioritizing sustainable investing, social responsibility, and ethical governance, surpassing the average of 57% across all age groups. These investors want their portfolios to reflect their thoughts, whether that means supporting renewable energy, promoting diversity and inclusion, or encouraging ethical governance. In addition, financial institutions are responding to this shift. Firms like BlackRock and Vanguard have launched ESG-themed funds, while robo-advisors such as Wealthfront allow users to customize their portfolios to consider socially responsible investments.

- The Move To Financial Education: New investors are more proactive about financial education than previous generations. They aim to understand the markets, investment strategies, and financial planning principles rather than depending purely on advisors. A 2023 Charles Schwab survey found that 74% of Gen Z investors spend time researching investments online, as compared to 49% of Baby Boomers. They prefer to understand what is happening with their money and make informed decisions on their own. This trend has increased the growth of educational tools and communities. Apps like Acorns and Stash combine micro-investing with easy-to-understand lessons about money management. Social media platforms, YouTube and TikTok, have also become knowledge hubs for financial literacy, with many influencers and creators sharing tips and ideas on budgeting, investing, and wealth-building strategically. Financial firms are joining the movement, too.

- The Role of Cryptocurrency and Alternative Investments: Cryptocurrency and alternative assets are gaining popularity among new investors, further pioneering traditional wealth management. A 2024 survey revealed that 41% of Americans aged 18–29 have invested in, traded, or used cryptocurrency, as compared to just 13% of those aged 50 and older. To many young investors, Bitcoin and Ethereum symbolize both technological innovation and a safeguard against conventional financial systems. Apps like Coinbase and Binance make it easy to buy, hold, and trade digital currencies. Meanwhile, decentralized finance (DeFi) platforms enable users to earn yield or provide liquidity in exchange for returns. Beyond crypto, new investors are also depending on real estate crowdfunding, collectibles, and peer-to-peer lending to diversify their portfolios. While traditional wealth management firms have been slow to adopt these trends, some are starting to respond. For example, Fidelity launched a Bitcoin ETF in 2022, and Morgan Stanley now provides select clients with cryptocurrency exposure.

- Blending Digital Tools with Human Advice: Although new investors love automation and mobile tools, many still see value in speaking to a real person, especially when making complex decisions. This has led to the rise of hybrid advisory models, which integrate digital platforms with access to licensed financial advisors. Companies such as Vanguard and Charles Schwab have introduced services that provide low-cost human advisory support along with digital portfolio management. Vanguard’s Personal Advisor Services, for example, pairs clients with certified financial planners for a fraction of the traditional cost. This model provides the best of both worlds: tech efficiency with a human touch.

Challenges and Opportunities for the Wealth Management Industry

The transition in wealth management represents both challenges and opportunities for firms. On one hand, firms must invest in technology, retrain advisors, and adjust to evolving client expectations. According to a 2023 survey, 58% of wealth management executives quote digital disruption as their biggest concern for the next 10 years. On the other hand, the rise of new investors represents a substantial growth opportunity. By adopting digital transformation, granting ESG options, and prioritizing financial education, firms can attract and keep younger clients. Additionally, the rise of fractional investing, where investors can buy partial shares of stocks or ETFs, has reduced barriers to entry, expanding the client base for wealth managers.

Looking Ahead

Wealth management is entering a new era shaped by a different kind of investor, one who is tech-savvy, values-driven, and eager to be actively involved in their financial journey. Technology has made wealth-building tools more accessible, while changing values are expanding the definition of investment success beyond just returns. To thrive in this environment, firms must move quickly. They need to offer meaningful, tech-enabled experiences that meet modern expectations while still providing trustworthy advice and human support when needed.

Contact Us