- In November 2025, B&R introduced a next-gen Smart Camera that brings advanced artificial intelligence directly into the machine control loop. With integrated edge AI capabilities, the new camera enables real-time vision processing, dynamic model switching, and hybrid AI-rule-based inspection, all without halting production or requiring external hardware.

- In September 2025, Axis Communications introduces a new bispectral PTZ, AI-powered bullet cameras, multilayer radars, and a smart air quality sensor with two-way audio, advancing integrated, intelligent security solutions for complex environments.

- In July 2025, Hikvision announced the launch of its new DeepinViewX-Series Bullet Cameras, powered by the advanced Guanlan large-scale AI models. These smart cameras are designed to provide better perimeter protection with longer video content analysis (VCA) range and fewer false and repeated alarms.

Smart Camera Market Outlook:

Smart Camera Market size was valued at USD 5.1 billion in 2025 and is projected to reach USD 17.7 billion by the end of 2035, rising at a CAGR of 13.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of smart camera is evaluated at USD 5.7 billion.

The demand for the smart camera market is based on the public sector investments and regulatory mandates that continue to underpin the deployments of smart cameras across the public safety, transportation, and critical infrastructure environments. These standalone vision systems, which combine sensor processing and communication for decentralized image analysis, are seeing expanded adoption driven by industrial automation and the pursuit of zero-defect manufacturing in sectors such as electronics and automotive. Further, the integration into non-industrial applications such as intelligent traffic systems is broadening the market scope. The government's public funding underpins this growth. For example, the report from the U.S. Department of Transportation in September 2025 indicates that under the Highway Safety Improvement Program, nearly USD 3.177 billion was allocated in 2025, with an increasing portion directed towards the intelligent transportation systems utilizing vision technology.

Highway Safety Improvement Program (USD billion)

|

|

FAST Act (extension) |

Infrastructure Investment and Jobs Act (IIJA) |

||||

|

Fiscal year (FY) |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

|

Contract authority |

2.407 |

2.980 |

3.044 |

3.110 |

3.177 |

3.246 |

Source: U.S. Department of Transportation September 2025

Besides, the report from the Urban Institute in April 2024 notes that the state and local governments spent more than USD 135 billion on policing and public safety activities in 2021, creating a stable funding environment for camera-enabled surveillance evidence capture and situational awareness systems. Industrial and workplace monitoring applications also contribute materially to the smart camera market demand. The U.S. Bureau of Labor Statistics data in January 2025 recorded 2.6 million non-fatal workplace injuries and illnesses in 2023, prompting increased adoption of visual monitoring systems to support compliance risk mitigation and incident documentation across manufacturing, logistics, and utilities. At the federal level, agencies such as OSHA continue to emphasize employer accountability and recordkeeping, indirectly supporting the procurement of automated visual monitoring tools in regulated facilities.

Key Smart Camera Market Insights Summary:

Regional Insights:

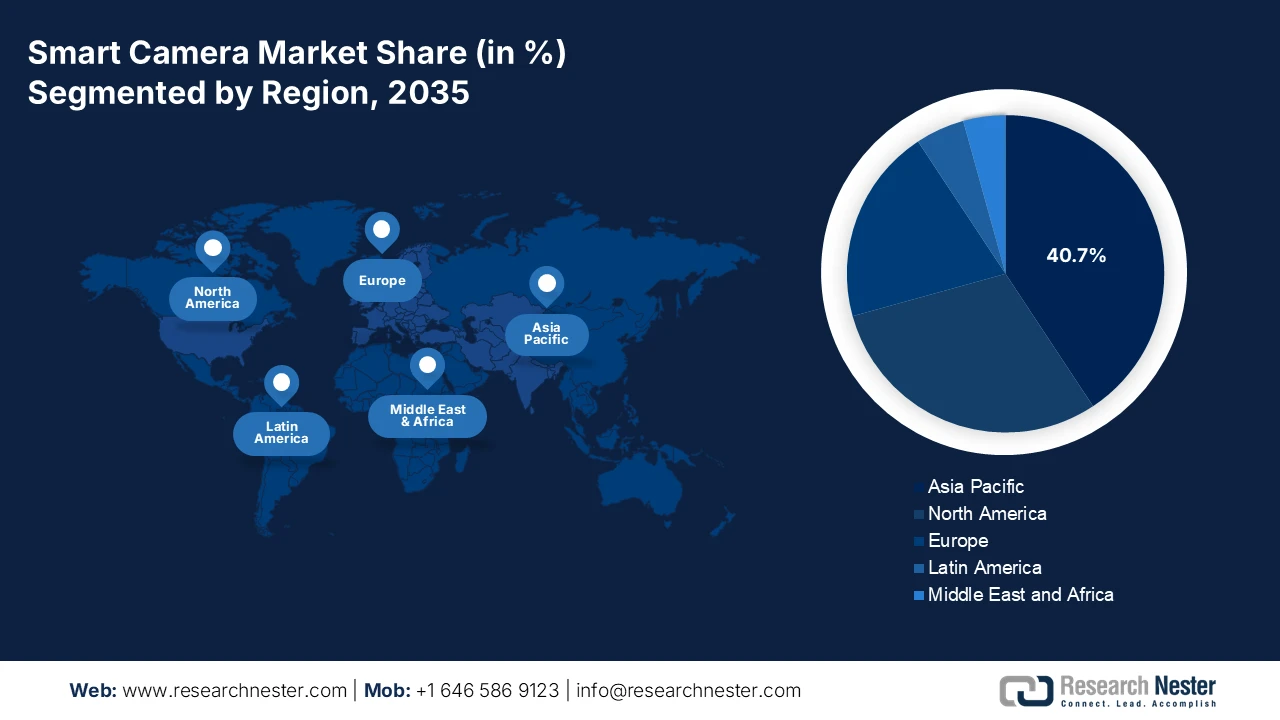

- Asia Pacific is projected to dominate with a 40.7% revenue share by 2035 in the smart camera market, supported by large-scale government-led smart city programs, accelerated industrial automation, and expansive digital infrastructure investments.

- North America is anticipated to register the fastest growth through 2026–2035 at a CAGR of 11.6%, fueled by rapid adoption of AI- and IoT-enabled security systems and the modernization of transportation and industrial infrastructure.

Segment Insights:

- Within the application segment, the security & surveillance sub-segment in the smart camera market is projected to account for a 32.4% share by 2035, supported by escalating requirements for public safety, infrastructure security, and commercial loss prevention.

- AI-enabled / deep learning cameras are anticipated to lead the technology segment over the 2026–2035 period, underpinned by accelerating industrial automation and rising investments in real-time edge analytics and intelligent decision-making capabilities.

Key Growth Trends:

- Smart city programs and digital urban infrastructure investments

- Adoption of intelligent security and automated monitoring systems

Major Challenges:

- Rapid technological obsolescence and high R&D costs

- Stringent and evolving data privacy regulations

Key Players: Axis Communications, Bosch Security Systems, Hanwha Techwin, Hikvision, Dahua Technology, Sony, Canon, Panasonic, Avigilon, FLIR Systems, Ambarella, Nikon, Vivotek, Uniview, Basler AG, IDIS, Honeywell International, MOBOTIX, Cisco Systems, Infineon Technologies.

Global Smart Camera Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.1 billion

- 2026 Market Size: USD 5.7 billion

- Projected Market Size: USD 17.7 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 22 January, 2026

Smart Camera Market - Growth Drivers and Challenges

Growth Drivers

- Smart city programs and digital urban infrastructure investments: National and municipal smart city initiatives are the demand driver for the smart camera market. The World Bank data in March 2025 estimates that 7 in 10 people will live in cities, which will account for nearly 70% of the global population by 2050. This increases the pressure on governments to deploy scalable digital monitoring systems. Governments are funding smart city programs that integrate cameras into traffic management, utilities oversight, and public service delivery. For example, the European Commission supports urban digitalization via cohesion policy and Horizon Europe funding, which prioritizes the data-driven city management and safety. Smart cameras serve as the data collection nodes within these initiatives, enabling a real time monitoring and analytics.

- Adoption of intelligent security and automated monitoring systems: The public sector agencies are increasingly funding AI-enabled visual systems to improve situational awareness, reduce manual oversight, and support data-driven decision making. According to the report from the DHS 2023, the use of advanced sensing automation and analytics to secure border transportation networks and critical infrastructure, with the DHS's wide technology and modernization spending exceeding USD 97.3 billion, of which USD 56.7 billion is net discretionary funding. Similarly, the European Commission promotes AI-supported security and automation under its Digital Europe Programme, allocating over EUR 7.5 billion to digital transformation, including AI-enabled monitoring systems. These investment reflects a shift from passive surveillance toward automated detection event classification and real-time response. For suppliers, this trend favors the smart camera market that integrates AI processing, edge analytics, and systems interoperability, aligning procurement decisions with government mandates for scalable automated security infrastructure.

- Climate adaptation and disaster monitoring program: Climate resilience spending is increasingly relevant to the demand for the smart camera market. Governments are funding disaster preparedness and response systems that rely on real-time visual data. The U.S. Federal Emergency Management Agency and the World Meteorological Organization emphasize the role of monitoring infrastructure in flood, wildfire, and storm management. Camera systems are deployed along coastlines, dams, highways, and urban areas to support early warning and damage assessment. As climate related disaster increase in frequency, these programs are becoming permanent budget lines rather than ad hoc expenditure supporting sustained procurement cycles for smart camera solutions.

Challenges

- Rapid technological obsolescence and high R&D costs: The core value of smart cameras shifts from hardware to embedded AI algorithms requiring continuous capital-intensive R&D. A company’s competitive edge can be erased within a product cycle by a competitor’s more efficient chipset or superior analytics. The top players address this challenge by investing heavily to develop their AI systems on a chip, a commitment untenable for smaller players in the smart camera market. This relentless innovation cycle creates a significant barrier to sustainable market presence.

- Stringent and evolving data privacy regulations: Navigating the global patchwork of data privacy laws is a complex, costly hurdle. Non-compliance risks severe fines and reputational damage. Manufacturers must embed Privacy by Design principles, such as on-device processing and data anonymization. The leading players in the smart camera market tackle this by building data protection directly into their cameras and advocating for standardized frameworks, turning regulatory adherence into a marketable feature for privacy-conscious clients in regulated industries.

Smart Camera Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 5.1 billion |

|

Forecast Year Market Size (2035) |

USD 17.7 billion |

|

Regional Scope |

|

Smart Camera Market Segmentation:

Application Segment Analysis

Within the application segment, the security & surveillance sub-segment is the dominating segment in the smart camera market and is expected to hold the share value of 32.4% by 2035. The segment is driven by the relentless demand for public safety, critical infrastructure protection, and commercial loss prevention. Its dominance is reinforced by the global shift from reactive recording to proactive AI-powered threat detection and behavioral analytics, which are central to smart city initiatives. This evolution is creating an integrated ecosystem where cameras function as the intelligent nodes within the broader IoT security platforms. A clear indicator of this growth is the substantial U.S. federal investment in related technologies. According to the International Trade Administration data in January 2025, India’s video surveillance is expected to reach USD 7.12 billion by 2030, with a CAGR of 10.10% during the period from 2025 to 2030. This data highlights the rising demand for surveillance solutions that rely on smart camera infrastructure.

Technology Segment Analysis

AI-enabled / deep learning cameras represent the core technological driver, fundamentally transforming the smart camera market’s value proposition from simple video capture to intelligent data generation. This sub-segment’s leadership is cemented by its ability to perform real-time analytics at the edge, such as facial recognition anomaly detection and object classification, enabling automated decision-making across industries. The push for industrial efficiency and automation is a primary accelerant. Statistical evidence of this adoption surge is found in government-tracked business investment. As per the Capital Economics Limited 2022 data, the expenditure on AI solutions increases at an annual rate of 19.5 percentage highlighting the rapid capital expenditure flowing into the foundational technologies that power smart cameras.

End user Segment Analysis

Under the end user segment, the commercial and industrial sector is leading in the smart camera market and is characterized by its vast scale and diverse operational use cases that deliver clear ROI. In commercial settings such as retail, smart cameras drive revenue via customer behavior analytics and inventory management, while in industrial environments, they are critical for process automation, quality control, and worker safety. The segment’s growth is directly tied to the broader digital transformation and industrial 4.0 initiatives. The government data confirms this robust investment trend. The U.S. Census Bureau’s Annual Capital Expenditure Survey shows that the spending by U.S. businesses on information and communication technology equipment, a category encompassing smart camera systems, reached a significant investment reflecting the massive ongoing capital deployment into the digital tools that define this segment.

Our in-depth analysis of the smart camera market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Resolution |

|

|

Connectivity |

|

|

Application |

|

|

End user |

|

|

Offering |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Camera Market - Regional Analysis

APAC Market Insights

The Asia Pacific smart camera market is the largest and is poised to hold the revenue share of 40.7% by 2035. The market is driven by the massive government-led smart city initiatives, rapid industrial automation, and extensive infrastructure development. China’s national surveillance and smart city projects, such as Safer Cities and Xueliang, represent the world’s most extensive deployments, creating an unparalleled scale. Japan and South Korea are driven by the advanced manufacturing and consumer electronics requiring high-precision machine vision. The key regional trend is the strong push for sovereign technology stacks, with governments favoring domestic manufacturers, which shapes the competitive dynamics. The integration of AI for facial recognition, traffic analysis, and industrial quality inspection is standard, with the growth further fueled by the rising urban populations and significant public-private investments in digital infrastructure.

The China smart camera market is dominated by the massive state-driven public security projects such as Safe Cities and Sharp Eyes. This creates an unparalleled scale and demand for integrated surveillance networks with advanced AI analytics for facial recognition and behavior monitoring. The scale is immense; for example, the report from Radio Free Asia in March 2025 indicates that the city of Chongqing has nearly installed 27,900 surveillance cameras and 245 sensors to keep tabs on residents. Further, the government spending is centralized and strategic, often favoring domestic manufacturers to build sovereign technology stacks. According to the Center for China Analysis and Strategy, March 2025 data, the national public security expenditure reached 1.44 trillion yuan in 2023, a portion of which directly funds the expansion of the technological upgrade of the nationwide video surveillance infrastructure that underpins these programs.

The government urban modernization and security initiatives primarily Smart Cities Mission and the Safe City projects are driving the India smart camera market. The Smart Cities Mission drives municipal-level deployment of integrated command and control centers fed by the networks of AI-enabled cameras for traffic management and surveillance. According to the data from the Digital Sansad in 2024, the Smart Cities Mission had completed 1,25,105 crore worth projects, and 1551 projects are at work order stage, with the public safety and smart mobility being core components. This substantial time-bound capital expenditure directly translates into procurement and installation of smart camera systems across cities, creating a consistent multi-year demand pipeline. Further, India exports USD 8.84 million worth of cameras rising the demand for manufacturing smart camera solutions.

North America Market Insights

The North America smart camera market is the fastest growing and is expected to grow at a CAGR of 11.6% during the forecast period 2026 to 2035. The market is defined by the advanced technological adoption and significant investment in security and automation infrastructure. The U.S. and Canada are the dominant players in the region. The primary demand drivers include the expansion of intelligent transportation systems, the integration of AI and IoT in industrial settings, and the critical need to modernize infrastructure against both cyber and physical threats. The robust data privacy regulations and cybersecurity mandates are shaping the product development, requiring embedded security features. A primary regional trend is the function of the camera as a data collection node for applications ranging from retail traffic analysis to predictive maintenance in manufacturing.

In the U.S. smart camera market, demand is increasingly shaped by industrial automation requirements and workforce constraints across manufacturing-intensive sectors. The June 2023 launch of Omron’sF440 smart camera highlights how the U.S. based OEMs and manufacturers are prioritizing the compact, self-contained vision systems that reduce the integration complexity while supporting higher inspection throughput. Industries such as the life sciences, food processing, logistics, and semiconductor manufacturing are under pressure to inspect multiple products simultaneously, driving the demand for higher resolution flexible vision platforms. This trend aligns with broader U.S. manufacturing modernization efforts where automation is used to offset skilled labor shortages and improve consistency in quality control.

Some Recent Advancements in Smart Cameras in U.S.

|

Year |

Company |

Advancements |

|

March 2022 |

Qualcomm |

Expanded Vision Intelligence Platform with Qualcomm QCS7230; enables end-to-end IoTaaS solutions for enterprises, cities, and spaces to enhance safety and protection via smart cameras |

|

October 2023 |

TP-Link (Tapo) |

Launched Tapo Wire-Free Magnetic Indoor/Outdoor Security Camera (MagCam); provides Wi-Fi connectivity, day/night visibility, magnetic mounting, and addresses common security camera limitations for full home coverage |

|

November 2025 |

Vivint |

Announced Outdoor Camera Pro (Gen 3) with Behavior Based Smart Deter Technology; integrates RADAR, AI, premium components, and optimized camera tuning for superior outdoor video security |

Source: Qualcomm, TP-Link (Tapo), Vivint

The Canada smart camera market is shaped by the substantial public investment in the smart city programs, border security, and digital government initiatives. A key primary trend is the deployment of integrated surveillance systems for critical infrastructure and border monitoring led by the federal bodies such as the Public Safety Canada and the Canada Border Services Agency. The smart cities challenge a federal program as catalyzed the investment in the IoT deployments, including intelligent traffic and public space monitoring solutions in municipalities. Additionally, Transport Canada's November 2023 report states that Canada’s National Trade Corridors Fund is a USD 4.6 billion investment to strengthen transportation infrastructure, with the funding directed towards technologies that improve fluidity and security, incorporating smart vision systems at ports and borders. The trend towards enhancing cross-border security and trade efficiency is a major demand driver focused on urban mobility and safety.

Europe Market Insights

The Europe smart camera market is driven by the confluence of stringent regulatory frameworks, substantial EU-level funding for digital and security infrastructure, and a strong industrial base pursuing automation. The key demand stems from the region’s focus on enhancing public safety, modernizing transportation networks under initiatives such as the Trans European Transport Network, and advancing Industry 4.0 manufacturing. A significant driver is the EU’s push for strategic autonomy in critical technologies, influencing procurement in sensitive sectors. The data privacy regulations, primarily the General Data Protection Regulation shapethe product development mandating features such as on-device processing and robust cybersecurity. This regulatory environment, with cross-border projects for smart cities and border management, creates a stable, high-value market where compliance and interoperability are as critical as technological performance.

The large-scale investment in artificial intelligence that supports automation, mobility, and industrial quality control drives the Germany smart camera market. Bosch’s report in July 2025 announced that the company plans to invest more than €2.5 billion in AI by 2027, underscoring the strategic role of AI-enabled sensing in automotive and manufacturing applications. The use cases highlighted by Bosch, such as safer automotive driving and reliable quality inspection in factories, depend heavily on camera-based systems for real-time visual data capture and analysis. As a leading supplier to Germany’s automotive and industrial base, Bosch’s AI pathway signals the sustained demand for the smart cameras integrated with edge processing and analytics. This investment aligns with Germany’s broader Industry 4.0 agenda, where the manufacturers focus on intelligent inspection and automation to improve productivity and address skilled labor constraints, supporting steady growth in smart camera adoption.

The rising spending on national security, policing, and smart cities is driving the UK smart camera market. According to the OEC 2023 data, the UK camera imports valued at USD 89.6 million indicate sustained demand for camera hardware that underpins the smart camera deployment across security, transportation, and industrial applications. The public sector spending on transport safety, smart city programs, and critical infrastructure protection continues to drive the procurement of camera-based monitoring systems, while private sector adoption in the logistics and manufacturing sectors supports the additional volume. This import dependence highlights the structurally open market for the smart camera suppliers and system integrators, with growth tied to ongoing digital infrastructure investments and automation initiatives.

Key Smart Camera Market Players:

- Axis Communications (Sweden)

- Bosch Security Systems (Germany)

- Hanwha Techwin (South Korea)

- Hikvision (China)

- Dahua Technology (China)

- Sony (Japan)

- Canon (Japan)

- Panasonic (Japan)

- Avigilon (Motorola Solutions) (U.S.)

- FLIR Systems (Teledyne) (U.S.)

- Ambarella (U.S.)

- Nikon (Japan)

- Vivotek (Taiwan)

- Uniview (China)

- Basler AG (Germany)

- IDIS (South Korea)

- Honeywell International (U.S.)

- MOBOTIX (Germany)

- Cisco Systems (U.S.)

- Infineon Technologies (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Axis Communications is a foundational leader in the network video and smart camera market, driving the shift from analog to IP. Their strategic initiative focuses on deep integration of AI analytics at the edge, embedding cybersecurity by design, and fostering an open developer platform to enable a vast ecosystem of third-party analytics and solutions for professional installations.

- Bosch Security Systems competes in the high-end smart camera market by emphasizing built-in intelligence, data privacy, and unparalleled reliability. Their key strategy involves the intelligent IoT, where cameras with onboard video analytics feed into a holistic building management system, creating automated data-driven security and operational efficiencies for critical infrastructure and enterprise clients.

- Hanwha Techwin has become a major player in the global smart camera market via aggressive innovation and value-driven solutions. Their strategic pillars include developing a comprehensive suite of the AI powered cameras championing open standards such as the ONVIF for interoperability and competing directly with the market leaders by offering advanced features at competitive price points across all market segments. As per the 2024 annual report, the company has made a total sales of USD 61.3 billion.

- Hikvision is a dominant volume leader in the global smart camera market, using massive R&D scale and vertical integration. Their core strategy involves saturating the market with an incredibly wide and deep product portfolio featuring ever-advancing AI algorithms while aggressively expanding into adjacent smart city and industrial IoT applications beyond traditional security. As of December 2024, the company has made a total revenue of RMB 24,148,421,603.36

- Dahua Technology is another global powerhouse in the smart camera market, known for driving the adoption of AI and deep learning in cost-effective devices. Their strategic focus is on Dahua 2.0, which pivots from hardware vendor to solution provider, offering industry-specific AI suites to create actionable business intelligence from video data.

Here is a list of key players operating in the global smart camera market:

The global smart camera market is intensely competitive and fragmented, with the leadership shared among established imaging giants, semiconductor firms, and specialized AI vision companies. The key players from the U.S., East Asia, and Europe compete on innovation in AI algorithms, sensor technology, and system integration. Strategic initiatives are heavily focused on vertical-specific solutions, strategic partnerships with the IoT and cloud platforms, and acquisitions to consolidate AI and edge computing capabilities. For example, in October 2025, ZKTeco announced that it had acquired 55% Stake in Longzhiyuan Technology Co., Ltd. to enhance its smart outdoor solutions. The drive towards autonomous systems and smart cities is further fueling the R&D investments and ecosystem alliances to capture the growth in this data-driven market.

Corporate Landscape of the Smart Camera Market:

- Report ID: 346

- Published Date: Jan 22, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Camera Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.