Beta Agonist Feed Additives Market Outlook:

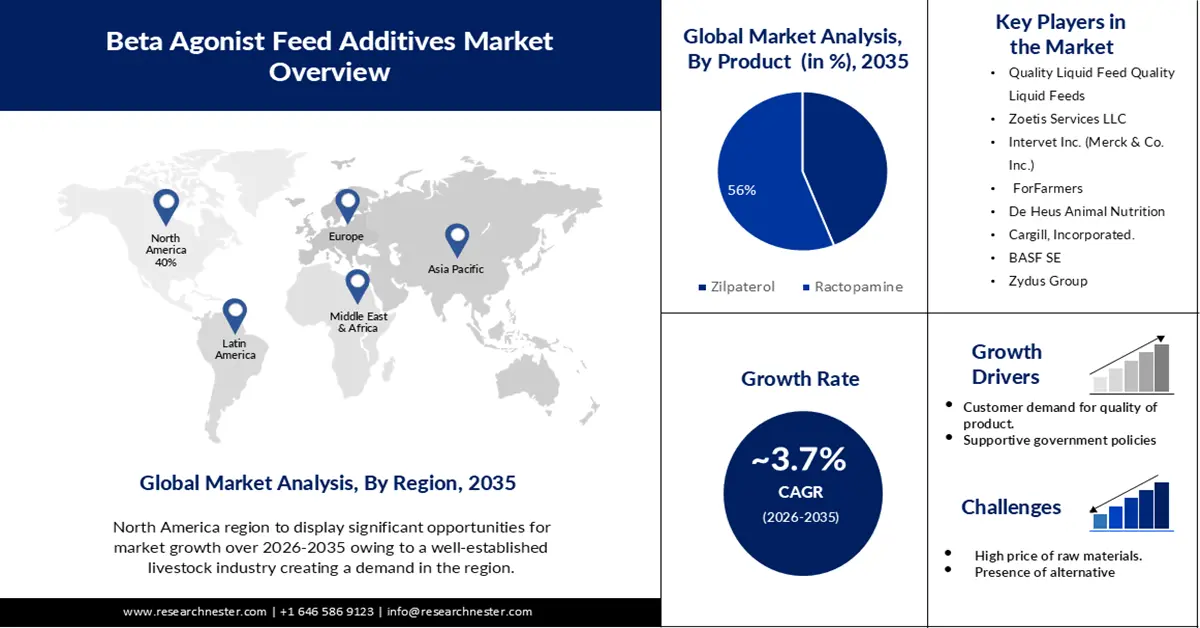

Beta Agonist Feed Additives Market size was over USD 94.98 billion in 2025 and is projected to reach USD 136.59 billion by 2035, witnessing around 3.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of beta agonist feed additives is assessed at USD 98.14 billion.

Escalating global demand for animal protein is propelling the market’s growth. As the population burgeons and dietary preferences shift, there’s an unprecedented surge in the need for meat products. Beta agonist feed additives stand as a solution to meet this demand, enhancing feed efficiency in livestock and poultry. They facilitate rapid weight gain, augment lean muscle development, and optimize feed utilization. This pivotal role in improving production efficiency addresses the pressing need to sustainably boost animal protein output, positioning Beta-agonists as a crucial element in meeting the world’s burgeoning appetite for protein-rich food sources.

Further, beta-agonist improves feed conversion rates in animals, enabling better utilization of feed resources. About 60–80% of fed cattle in the United States are estimated to have been grown using beta-agonists. As feed cost constitute a significant a significant portion of livestock production expenses, the use of these additives to enhance efficiency becomes essential for producers, driving the beta agonist feed additives market growth.

Key Beta Agonist Feed Additives Market Insights Summary:

Regional Highlights:

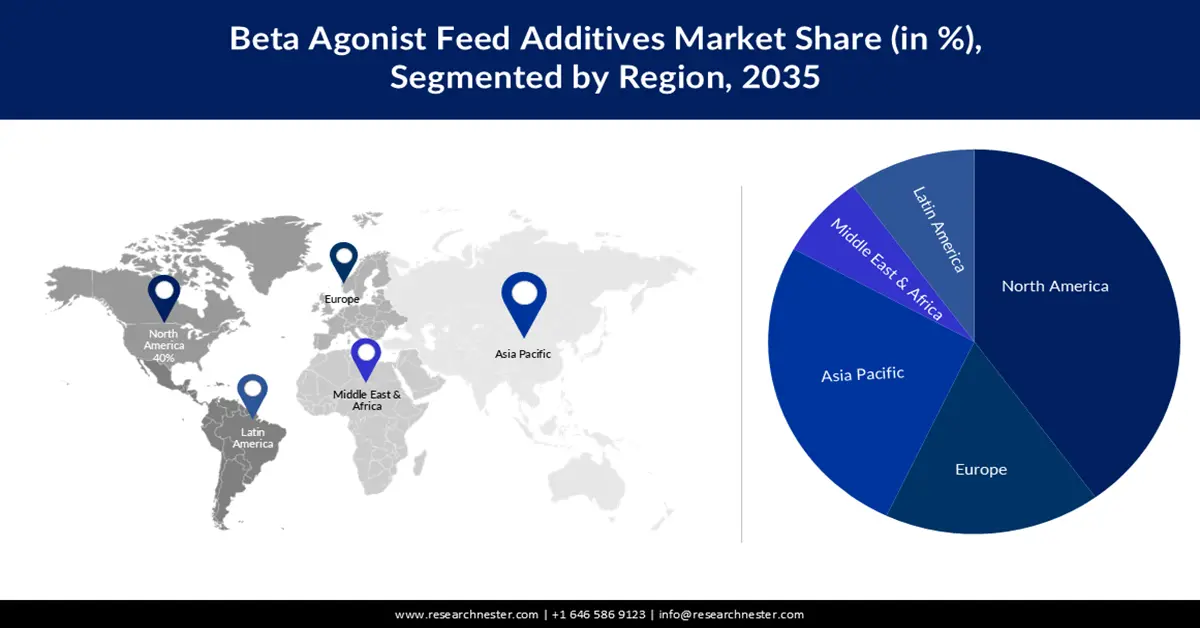

- North America is expected to secure a 40% share of the Beta Agonist Feed Additives Market by 2035 as the region’s firmly regulated yet supportive FDA framework and mature livestock ecosystem bolster the adoption of efficiency-enhancing beta-agonist solutions owing to their approved safe use.

- Asia Pacific is projected to record notable expansion by 2035 as rising protein consumption, growing livestock populations, and increasingly organized animal farming systems accelerate the uptake of beta-agonist feed additives across the region due to rapid urbanization and a strengthening middle-class demographic.

Segment Insights:

- The ractopamine segment is estimated to command a 56% share of the Beta Agonist Feed Additives Market by 2035 as producers increasingly leverage its superior feed efficiency and lean-muscle enhancing properties because of the numerous benefits associated with the product.

- The cattle segment is anticipated to capture a substantial revenue share by 2035 as consistent demand for milk and meat amplifies the adoption of specialized feed additives required to boost livestock productivity owing to the increasing demand for animal-based goods.

Key Growth Trends:

- Technological Advancements in Agriculture

- Regulatory government support

Major Challenges:

- Market Fragmentation

- Fluctuating prices of raw material which raises the overall cost of the product.

Key Players: Quality Liquid Feed Quality Liquid Feeds, Zoetis Services LLC, Intervet Inc. (Merck & Co. Inc.), ForFarmers, De Heus Animal Nutrition, Cargill, Incorporated., BASF SE, Zydus Group, Nutreco, Huvepharma Japan Co., Ltd.

Global Beta Agonist Feed Additives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 94.98 billion

- 2026 Market Size: USD 98.14 billion

- Projected Market Size: USD 136.59 billion by 2035

- Growth Forecasts: 3.7%

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Brazil, Germany, Australia

- Emerging Countries: India, Vietnam, Mexico, Indonesia, Thailand

Last updated on : 19 November, 2025

Beta Agonist Feed Additives Market - Growth Drivers and Challenges

Growth Drivers

- Technological Advancements in Agriculture- Ongoing advancements in agricultural technology, including precision farming and innovative feed formulations, facilitate the efficient use of beta-agonists. These advancements optimize livestock growth, feed conversion rates, and overall productivity, contributing to beta agonist feed additives market growth.

- Regulatory government support- Supportive government policies and regulatory frameworks endorsing the safe and effective use of feed additives in animal husbandry positively impact market growth. Regulatory approvals and guidelines ensure safety, compliance, and consumer confidence, fostering market expansion.

- Globalization and Market Penetration- The globalization of food markets and increased trade opportunities allow for the expansion of beta-agonist additives into new regions. As markets become more interconnected, there’s greater scope for reaching diverse consumer bases, contributing to beta agonist feed additives market growth and penetration.

- Consumer Demand for Quality and Nutritional Value- Consumers increasingly seek high-quality meat products with desirable attributes like lean cuts and improved nutritional profiles. Beta agonist feed additives contribute to producing meat that meets these demands, aligning with consumer preferences and driving market growth.

Challenges

- Market Fragmentation – The presence of various alternatives and substitutes for beta-agonist additives in animal feed, such as other growth promoters or alternative feeding strategies, leads to a fragmented market. Competing products and solutions pose challenges in market penetration and establishing a competitive edge.

- Fluctuating prices of raw material which raises the overall cost of the product.

- Stringent regulations and concerns regarding the safety of beta-agonists in food production pose a challenge.

Beta Agonist Feed Additives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.7% |

|

Base Year Market Size (2025) |

USD 94.98 billion |

|

Forecast Year Market Size (2035) |

USD 136.59 billion |

|

Regional Scope |

|

Beta Agonist Feed Additives Market Segmentation:

Product Segment Analysis

The ractopamine segment is estimated to hold 56% share of the of the global beta agonist feed additives market by 2035, because of the numerous benefits associated with the product. The amino acid ractopamine has been shown to stimulate lean muscle growth. About 80% of all beef, swine, and turkeys grown in the US are fed ractopamine (RAC). In addition, it is more efficient than zilpaterol and enables livestock to grow rapidly while consuming less feed. As a result, more lean meat is found in cattle which is projected to drive the growth of this segment over the forecast period.

Animal Type Segment Analysis

The cattle segment in the beta agonist feed additives market is anticipated to garner significant revenue share. The segment will develop as a result of consumer demand for cow products, such as milk and meat, which are important sources of protein for diets. Dairy products and milk are in constant demand. Cattle therefore need to be given all the necessary minerals, trace elements, and health supplements for improved growth performance to meet the increasing demand for animal-based goods. Regular animal diets produce more, but to boost the cattle's general health and productivity, certain feed additives need to be added. All these factors are responsible for the segment’s growth.

Our in-depth analysis of the global beta agonist feed additives market includes the following segments:

|

Product |

|

|

Animal Type |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Beta Agonist Feed Additives Market - Regional Analysis

North American Market Insights

North America industry is anticipated to hold largest revenue share of 40% by 2035. The region showcases a robust and evolving landscape driven by several factors. Beta-agonists have been approved by the US Food and Drug Administration to be used in feeding stuffs that is considered safe, this provided for a propelling impact on the industry. Further, with a well-established livestock industry, the region experiences a substantial demand for efficient feed solutions. Beta agonist additives are crucial in enhancing feed efficiency, promoting lean muscle growth, and meeting the high demand for meat products.

APAC Market Insights

Asia Pacific beta agonist feed additives market is slated to garner significant growth by 2035. The region represents a dynamic landscape characterized by a wide range of opportunities. Rapid urbanization, burgeoning populations, and a rising middle class drive the escalating demand for protein-rich diets across the region. This surge in demand for meat products fuels the adoption of beta-agonist feed additives, aimed at enhancing livestock growth and feed regulatory. In addition, the demand for beta-agonist feed additives in this region is driven by a large number of livestock and an extensive animal feeding requirement. The demand for beta-agonist feed additives in that region is also driven by the emergence of an organized market, a high level of awareness about better animal farming practices, and rural economies.

Beta Agonist Feed Additives Market Players:

- Elanco Animal Health Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Quality Liquid Feed Quality Liquid Feeds

- Zoetis Services LLC

- Intervet Inc. (Merck & Co. Inc.)

- ForFarmers

- De Heus Animal Nutrition

- argill, Incorporated.

- BASF SE

- Zydus Group

- Nutreco

Recent Developments

- To tackle one of the most important opportunities for society this decade—mitigating climate change by lowering greenhouse gas emissions from farming—Elanco Animal Health Incorporated and Royal DSM have formed a strategic cooperation. Elanco is the sole license holder in the United States for the development, production, and marketing of Bovaer® for dairy and beef cattle.

- A groundbreaking, long-term strategic research and commercial agreement has been announced by Nutreco and BiomEdit to provide livestock farmers with cutting-edge and genuinely new feed additives created by microbiome technology. Through the agreement, the most cutting-edge microbiome biotech firm for animal health, BiomEdit, and Nutreco Exploration (NutEx), Nutreco's team tasked with developing patented ultra-specialty ingredients to promote its aim of Feeding the Future, are brought together.

- Report ID: 3159

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Beta Agonist Feed Additives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.