2025-2037 年全球市場規模、預測與趨勢亮點

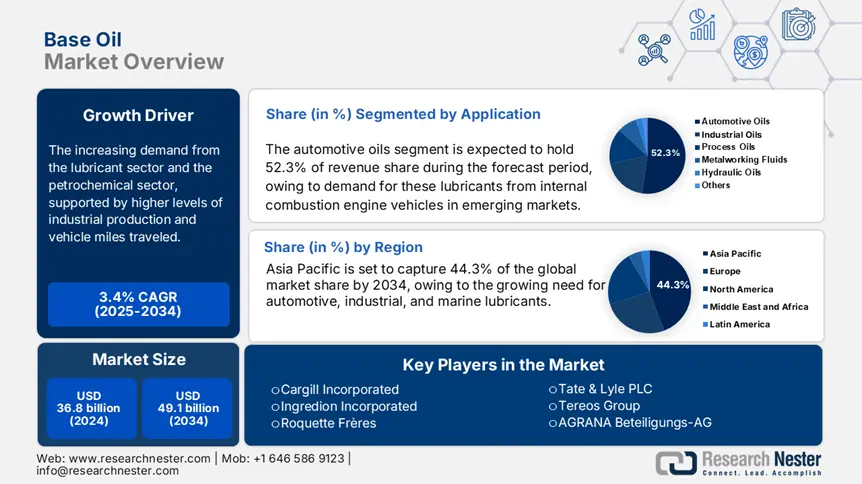

基礎油市場的規模在 2024 年為 226.3 億美元,預計到 2037 年將達到 442.8 億美元,在預測期內(即 2025 年至 2037 年)複合年增長率約為 5.3%增長率。到 2025 年,基礎油產業規模預計為 236.5 億美元。

市場的成長可歸因於世界各地對汽車的需求不斷增長以及車輛引擎技術的進步。對高級潤滑油和引擎油的需求不斷增長,以及對極冷和極熱條件下最佳燃料的需求不斷增長,預計將推動市場成長。基礎油用於製造潤滑油和機油,其中70%至90%的基礎油與30%至10%的化學添加劑混合。汽車和建築行業等最終用戶行業的成長預計將對市場的成長產生積極影響。

基礎油產業:成長動力與挑戰

成長動力

- 對引擎機油和潤滑油的需求不斷成長

- 新興的汽車和建築業

挑戰

- 原油價格波動

- 石油儲備不斷耗盡

基礎油市場:主要見解

| 報告屬性 | 詳細資訊 |

|---|---|

|

基準年 |

2024年 |

|

預測年份 |

2025-2037 |

|

複合年增長率 |

5.3% |

|

基準年市場規模(2024 年) |

226.3億美元 |

|

預測年度市場規模(2037 年) |

442.8億美元 |

|

區域範圍 |

|

基礎油細分

全球基礎油市場按類型分為 I 類、II 類、III 類、IV 類和 V 類,其中,由於 II 類基礎油的商業可行性,預計 II 類基礎油在預測期內將佔據最大的市場份額,因為它們價格實惠且質量更高。該組碳氫化合物是飽和的,這使它們具有更好的抗氧化性能,使它們可用於較舊的引擎。就最終用戶行業而言,由於汽車銷量不斷增長,隨著生活方式的改變和中產階級可支配收入的提高,汽車行業預計將在預測期內佔據最大份額,2020年汽車銷量將超過6500萬輛。車輛數量不斷增加,對機油的需求不斷增長,預計將推動該細分市場的成長。

我們對全球市場的深入分析包括以下細分:

|

依類型 |

|

|

依套用 |

|

|

依最終使用者產業 |

|

Vishnu Nair

全球業務發展主管根據您的需求自訂本報告 — 與我們的顧問聯繫,獲得個人化的洞察與選項。

基礎油業 - 地區概況

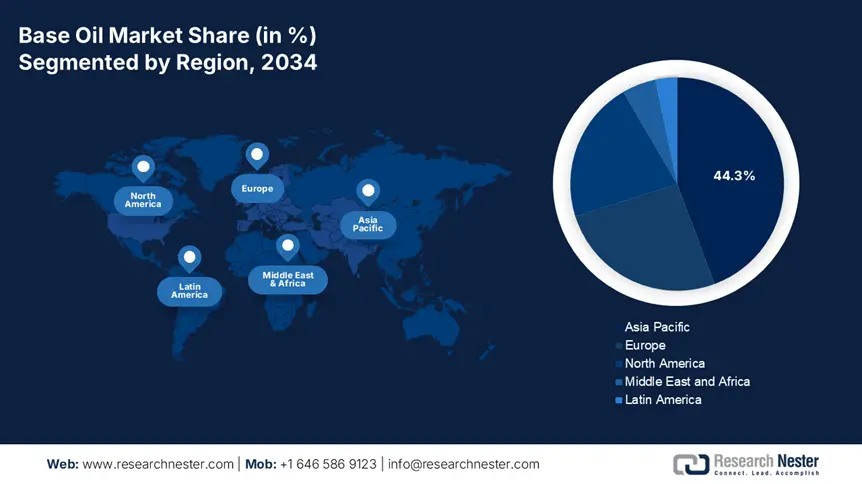

預計到 2037 年,亞太地區工業將佔據最大的收入份額,因為在汽車工業和該地區其他工業活動不斷發展的支持下,汽車引擎製造商對潤滑油的需求不斷增加。此外,該地區發電、採礦和運輸活動的擴大預計將推動市場成長。由於加拿大等國家容易獲得原油,以及該地區汽車工業的不斷發展,預計北美地區的市場將在整個預測期內保持領先的市場份額。加拿大是第四大原油生產國和出口國,2019 年的產量超過 450 萬桶/日。

主導基礎油格局的公司

- 中國石油與天然氣股份有限公司

- 公司概覽

- 商業策略

- 主要產品

- 財務表現

- 關鍵績效指標

- 風險分析

- 近期發展

- 區域業務

- SWOT 分析

- 雷普索爾集團

- 尼納斯 AB

- SK 創新有限公司

- AVISTA OIL 德國有限公司

- Neste Oyj

- 埃克森美孚公司

- 殼牌國際股份有限公司

- Motiva Enterprises LLC

- 雪佛龍公司

最新動態

- 2020 年 5 月 8 日:Nynas AB 推出了一款適用於金屬加工和潤滑油應用的新型基礎油 NYNAS BT 22。此基礎油富含環烷碳,具有最佳化的黏度指數,可提供最大程度的冷卻效果。

- 2020 年 5 月 4 日:Repsol Group 在墨西哥水域連續發現兩個深水石油,淨石油產層各為 150 公尺和 200 公尺。

- Report ID: 3068

- Published Date: Sep 23, 2024

- Report Format: PDF, PPT

- 探索关键市场趋势和洞察的预览

- 查看样本数据表和细分分析

- 体验我们可视化数据呈现的质量

- 评估我们的报告结构和研究方法

- 一窥竞争格局分析

- 了解区域预测的呈现方式

- 评估公司概况与基准分析的深度

- 预览可执行洞察如何支持您的战略