Zirconium Market Outlook:

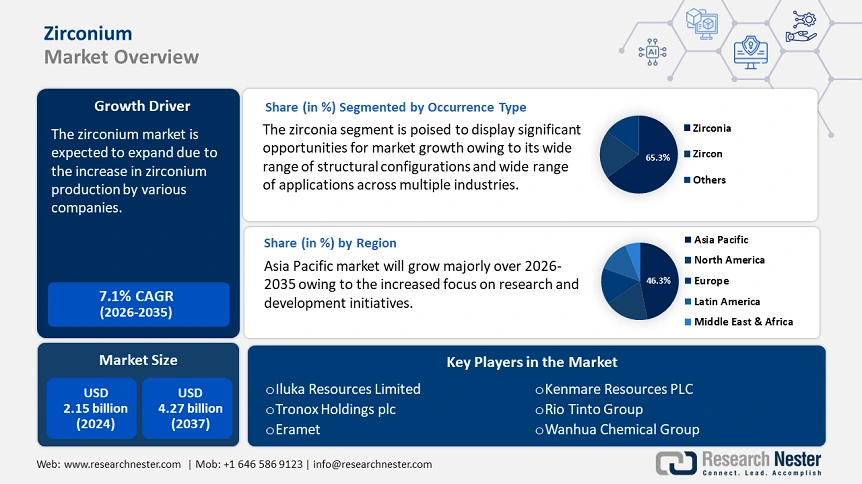

Zirconium Market size was over USD 2.15 billion in 2025 and is poised to exceed USD 4.27 billion by 2035, growing at over 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of zirconium is estimated at USD 2.29 billion.

The global zirconium market is projected to experience substantial growth due to the rising demand for sustainable and reliable energy sources, which has prompted an increased adoption of nuclear energy. Zirconium plays an essential role in the nuclear industry, primarily in the fabrication of reactor components and fuel rods. It functions as a barrier that separates nuclear fuel from the cooling system, thereby preventing the escape of radioactive materials. The demand for zirconium has risen in conjunction with developing and expanding nuclear power reactors, particularly in emerging economies.

In January 2025, the World Nuclear Reaction revealed that with a combined capacity of over 400 GWe, 440 nuclear power reactors are in operation throughout 31 nations including Taiwan. These supplied 2602 TWh, or around 9% of global electricity, in 2023. Moreover, the advancement of innovative reactor designs, such as small modular reactors (SMRs) and next-generation nuclear technologies, presents new opportunities for the utilization of zirconium.

Furthermore, the increase in zirconium production by various companies plays a crucial role in driving zirconium market growth by ensuring a stable and sufficient supply to meet rising global demand from various sectors. As companies invest in advanced extraction and refining technologies, they improve efficiency, lower costs, and improve zirconium purity, making it more accessible for high-performance uses. In 2024, Iluka Resources Limited spent USD 2.3 million on exploration and evaluation activities. Throughout the quarter, drilling was done using a mix of sonic and air-core methods. In Australia, 8,927 meters of drilling were finished, including resource assessments in Victoria and Western Australia. In addition to field mapping and sample initiatives in the Northern Territory, exploration drilling was finished in southwest New South Wales.

The following table illustrates the Iluka Resource Limited’s production capacity of zirconium and its concentrates:

|

Product |

Production capacity in 2023 (kilo tons (kt)) |

Production capacity in 2024 (kilo tons (kt)) |

|

Zircon sand |

239.5 |

158.0 |

|

ZIC2 |

87.5 |

69.2 |

|

Rutile3 |

52.7 |

57.8 |

|

Synthetic rutile |

259.5 |

211.2 |

Source: Iluka Resource Limited

Iluka's quarterly report revealed that zircon sales volumes for the December quarter, inclusive of ZIC, totaled 38 kilotonnes (kt). The overall sales forecast for 2024 is projected to be 230 kt. Sales volumes for premium and standard zircon sand reached 165 kt, reflecting a 12% increase compared to the volumes recorded in 2023. Additionally, ZIC sales volumes of 65 kt represent the entirety of available production for the year.

Key Zirconium Market Insights Summary:

Regional Highlights:

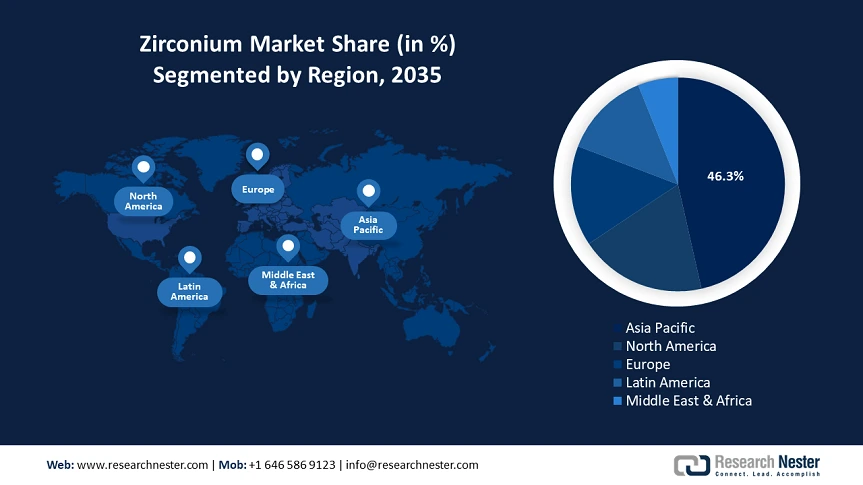

- Asia Pacific leads the Zirconium Market with a 46.3% share, driven by a strong industrial base, rapid urbanization, and the expansion of the nuclear energy industry in Asia Pacific, especially in China and Australia, ensuring growth through 2026–2035.

Segment Insights:

- Zirconia occurrence type segment is projected to dominate with over 65.3% market share by 2035, driven by its versatility in advanced ceramics, fuel cells, and dental prosthetics.

- The Zircon Flour/Milled Sand segment of the Zirconium Market is projected to hold a significant share through 2035, propelled by its wide-ranging applications in foundry, ceramics, and refractory sectors due to zircon's high-temperature tolerance.

Key Growth Trends:

- Increasing application in diverse industries

- Expanding zirconium extraction operations

Major Challenges:

- Limited supply sources

- Stringent laws

- Key Players: Iluka Resources Ltd., Tronox Holdings plc, Eramet, Kenmare Resources PLC, Rio Tinto Group, Wanhua Chemical Group, BASF SE, Lightbridge Corporation, Huntsman International LLC, Evonik Industries AG.

Global Zirconium Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.15 billion

- 2026 Market Size: USD 2.29 billion

- Projected Market Size: USD 4.27 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Japan, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Zirconium Market Growth Drivers and Challenges:

Growth Drivers

- Increasing application in diverse industries: These cutting-edge ceramics, which are well-known for their exceptional mechanical, electrical, and thermal qualities, are used in a variety of fields, such as electronics, medical devices, and aerospace. Zirconium-enriched ceramics are ingeniously incorporated into vital aircraft components such as turbine blades, using their strong mechanical capabilities and resilience in high-temperature conditions.

Zirconium-infused ceramics are emerging as a promising zirconium market niche as the aerospace industry persistently seeks lightweight, high-performance materials. Zirconium-infused ceramics are highly valued in the electronics industry due to the growing need for ceramics with dielectric qualities, especially in capacitors and insulating components. The unquenchable need for zirconium-based ceramics is supported by the unrelenting rise in electronics manufacturing and the introduction of innovative technologies.

Additionally, as a result of their remarkable strength and biocompatible nature, zirconium-based ceramics play a significant role in the medical field in the form of dental implants and prosthetics. There are more opportunities for zirconium market expansion due to the booming healthcare industry and the growing need for cutting-edge medical equipment. When combined, these industries' use of zirconium-based innovative ceramics is expected to grow steadily and open up incredible opportunities in the zirconium market. - Expanding zirconium extraction operations: As countries invest in developing new deposits and increasing production capacity, the global zirconium supply chain strengthens, reducing reliance on limited sources and mitigating supply chain disruptions. Therefore, the expansion of zirconium extraction operations globally is a significant factor driving the zirconium market growth. The U.S. Geological Survey reported that in 2023, the amount of zirconium mineral concentrates produced by mines worldwide rose to over 1.6 million tons. There were active advanced exploration and development projects in Australia, Madagascar, Mozambique, Senegal, Tanzania, and other countries to produce zirconium mineral concentrates.

The table below highlights the zirconium output and deposits in 2023:

|

Country |

Zirconium Mine Production (thousand metric tons, gross weight) |

Zirconium Reserves (thousand metric tons) |

|

U.S. |

100 |

500 |

|

Australia |

500 |

55000 |

|

China |

140 |

72 |

|

Indonesia |

90 |

- |

|

Kenya |

30 |

18 |

|

Madagascar |

30 |

2300 |

|

Mozambique |

90 |

1500 |

|

Senegal |

50 |

2600 |

|

Sierra Leone |

30 |

290 |

|

South Africa |

400 |

5600 |

|

Other Countries |

140 |

5700 |

|

World Total |

1600 |

74000 |

Source: U.S. Geological Survey

- Increasing global commerce of zirconium: Zirconium’s unique properties, such as high corrosion resistance and heat tolerance, make it indispensable in sectors such as nuclear, ceramics, and aerospace. The international trade of zirconium ensures that regions lacking domestic production can access this critical resource, thereby supporting their industrial activities. For instance, the expected global demand for zircon sand is 1.2 million tons for both 2021 and 2022. Compared to 2019 and 2020, this is a 20% increase. This surge in demand underscores the importance of global trade in meeting the needs of various markets and applications, driving the growth and stability of the zirconium market.

Exporter

Export Revenue of Zirconium (USD million)

Importer

Import Revenue of Zirconium (USD million)

U.S.

179

U.S.

89.5

France

153

South Korea

48.4

China

37.5

Canada

40.6

Germany

31.8

China

36.6

Sweden

13.2

Germany

36.3

Source: OEC

As per the Observatory of Economic Complexity analysis, with USD 472 million in overall trade, zirconium ranked 1048th in the world in 2023. Zirconium exports increased by 5.22% between 2022 and 2023, from USD 449 million to USD 472 million. Zirconium trade accounts for 0.0021% of global trade.

Challenges

- Limited supply sources: Zirconium is mostly dependent on a small number of important suppliers, most of whom are located in South Africa and Australia. Because of this concentrated supply chain, the zirconium market is vulnerable to interruptions from a variety of sources. First, the extraction and export of zirconium ores may be disrupted by geopolitical upheaval in certain source locations, which could result in market shortages. Zirconium accessibility may be further limited by regulatory changes and restrictions placed on mining operations in these nations, which would increase market volatility. Furthermore, the market is susceptible to price fluctuations due to its strong reliance on a small number of sources. Zirconium price changes can be caused by supply and demand imbalances as well as outside economic variables, which can affect consumer pricing and production costs.

- Stringent laws: Zirconium consumption has long been a significant concern due to the associated health risks, which could hinder zirconium market growth during the projected period. Exposure to zirconium may lead to adverse skin reactions, lung irritation, and eye irritation. Various regulatory bodies continuously monitor the appropriate use and impact on human health. For instance, the Occupational Safety and Health Administration (OSHA) has established an exposure limit of 5 mg/m³. Such stringent regulations governing the use of zirconium may impede the market's expansion throughout the forecast period.

Zirconium Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 2.15 billion |

|

Forecast Year Market Size (2035) |

USD 4.27 billion |

|

Regional Scope |

|

Zirconium Market Segmentation:

Occurrence Type (Zircon, Zirconia, Others)

Zirconia segment is projected to account for zirconium market share of more than 65.3% by the end of 2035. As a result of its wide range of structural configurations and wide range of applications across multiple industries, zirconia has a significant market presence. Its malleability and versatility make it an attractive option for applications ranging from advanced ceramics to fuel cells, dental prosthetics, and electronic components. Since it can meet the diverse needs of various sectors, zirconia is the preferred choice and holds a sizable portion of the zirconium market.

The creation and functionality of zirconia crowns have also been greatly enhanced by developments in dental technology and materials. The efficiency and accuracy of creating zirconia crowns have also been enhanced by the development of advanced milling equipment and sintering ovens, which guarantee precise sizing and contouring of zirconia restorations for a precise fit and superior marginal integrity.

Application (Zircon Flour/Milled Sand, Zircon Opacifier, Refractories (Zirconia), Zircon Chemicals, Zircon Metal)

The zircon flour/milled segment in zirconium market is predicted to garner a significant share during the assessed period. As a result of its wide range of applications across several end-user industries, the zircon flour/milled sand segment holds a substantial zirconium market share in the zirconium industry. Zircon flour is widely used in the foundry, ceramics, and refractory sectors due to its exceptional ability to tolerate high temperatures and its great refractoriness. Additionally, it plays a crucial part in the synthesis of zirconium compounds, which are essential parts of modern ceramics and nuclear reactors. This segment's dominance and strong demand within the market are firmly established by its adaptability and essential significance in these many sectors.

Our in-depth analysis of the global market includes the following segments:

|

Occurrence Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Zirconium Market Regional Analysis:

APAC Market Statistics

Asia Pacific zirconium market is predicted to capture revenue share of over 46.3% by 2035. Due to several unique variables, the Asia Pacific region dominates the zirconium industry. The region's strong industrial base and rapid urbanization are major factors driving demand for zirconium-based materials in a variety of industries, such as electronics, construction, and the automotive sector. Notably, Asia Pacific is a key player in the rapidly expanding nuclear energy industry, which increases the use of zirconium in nuclear applications. The region enjoys abundant zirconium reserves, particularly in China and Australia, and their active participation in zirconium mining and refining solidifies Asia Pacific's dominant position in the world zirconium market.

As the world’s largest producer of zirconium-based nuclear fuel components, China is investing heavily in its nuclear power sector to reduce reliance on coal and meet carbon neutrality goals. The Information Technology and Innovation Foundation revealed that China is constructing fast neutron reactors (FNRs), a different kind of fourth-generation reactor whose design more intentionally makes use of the fissile U-235 isotope found in most reactors as well as uranium-238.51 FNRs are referred to as fast breeder reactors (FBRs) if they are built to generate more plutonium than they consume in terms of uranium and plutonium.52 CNNC plans to launch a second FBR by 2026 after connecting a 600 MW FBR to the grid in 2023. Additionally, the country plans to develop 150 additional nuclear reactors between 2020 and 2035; 27 are presently being built, with an average construction duration of seven years per reactor—much faster than most other countries.

Additionally, the booming construction and ceramics industries drive demand for zirconium-based materials such as zirconia, widely used in tiles and sanitary ware. Furthermore, the nation’s dominance in zirconium ore refining and processing, coupled with government policies supporting advanced materials and high-tech industries, strengthens domestic supply chains and reduces dependence on imports.

Moreover, in India, the expanding nuclear power sector, driven by government initiatives to enhance energy security, is a major factor fueling zirconium consumption, as metal is essential for nuclear fuel cladding. The aerospace and defense sectors also contribute to the demand due to zirconium’s high resistance to corrosion and heat. Rising infrastructure projects and technological advancements further boost the market. Additionally, government policies promoting domestic mining and processing of rare minerals are strengthening India’s zirconium market.

North America Market Analysis

North America zirconium market is expected to grow at a significant rate during the projected period. As a result of its distinctive features, the region's thriving aerospace and defense industry is a significant user of zirconium. The sophisticated healthcare sector in North America also depends on zirconium for medical implants, which raises demand even more. The continent's dominance can be ascribed to its advanced zirconium production technology and well-established manufacturing infrastructure. Additionally, the emphasis on eco-friendly and sustainable methods complements zirconium's recyclability, which supports its employment in a variety of applications.

Zirconium is also essential for nuclear reactor components, which account for a large portion of the zirconium market share in the U.S.’s thriving nuclear industry. Also, the need is further supported by the fact that the nation's ceramics sector depends on zirconium compounds to produce ceramics, refractories, and other materials. The U.S. is also a center for technological growth, which has resulted in the creation of novel zirconium-based products. The demand for zirconium is expected to increase, especially in the nation, as the global economy improves and infrastructure projects pick up steam, solidifying its position as the dominating mineral in North America. Moreover, according to the U.S. Geological Survey, zirconium mineral concentrate imports into the U.S. fell sharply in 2023. South Africa, Senegal, and Australia remained the top importers of zirconium mineral concentrates. South Africa and Australia were the top exporters of zirconium mineral concentrates worldwide.

Key Zirconium Market Players:

- Iluka Resources Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tronox Holdings plc

- Eramet

- Kenmare Resources PLC

- Rio Tinto Group

- Wanhua Chemical Group

- BASF SE

- Lightbridge Corporation

- Huntsman International LLC

- Evonik Industries AG

With several competitors striving for market share and recognition, the zirconium market's competitive landscape presents a dynamic and varied environment. Major players in the market constantly attempt to set themselves apart through innovative products, strategic alliances, and product uniqueness. High capital expenditures and strict regulations are two examples of zirconium market entry barriers that add to the current level of competition. Agile company strategies are also necessary to remain relevant and competitive in light of changing consumer preferences and market trends. Technological developments also have an impact on the landscape, enabling businesses that use innovative solutions a competitive advantage.

Below is a list of key players leading the zirconium market:

Recent Developments

- In January 2025, Lightbridge Corporation, an advanced nuclear fuel technology company, announced a significant milestone in its innovative nuclear fuel development efforts by successfully performing a co-extrusion demonstration of a coupon sample consisting of a depleted uranium and zirconium alloy with an outer cladding made of nuclear-grade zirconium alloy material at Idaho National Laboratory.

- In November 2024, Eramet Grande Côte in Diogo, Senegal, teamed up with JUWI Renewable Energies, a global renewable energy firm, to create an off-grid solar photovoltaic (PV) and battery storage solution for large-scale industrial operations. The 20 MWp solar and 11 MWh battery project, which has completed financial close, aims to reduce the mine's reliance on heavy fuel oil, improve production stability, and aid in decarbonization efforts.

- Report ID: 7315

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Zirconium Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.