Zero Trust Architecture Market Outlook:

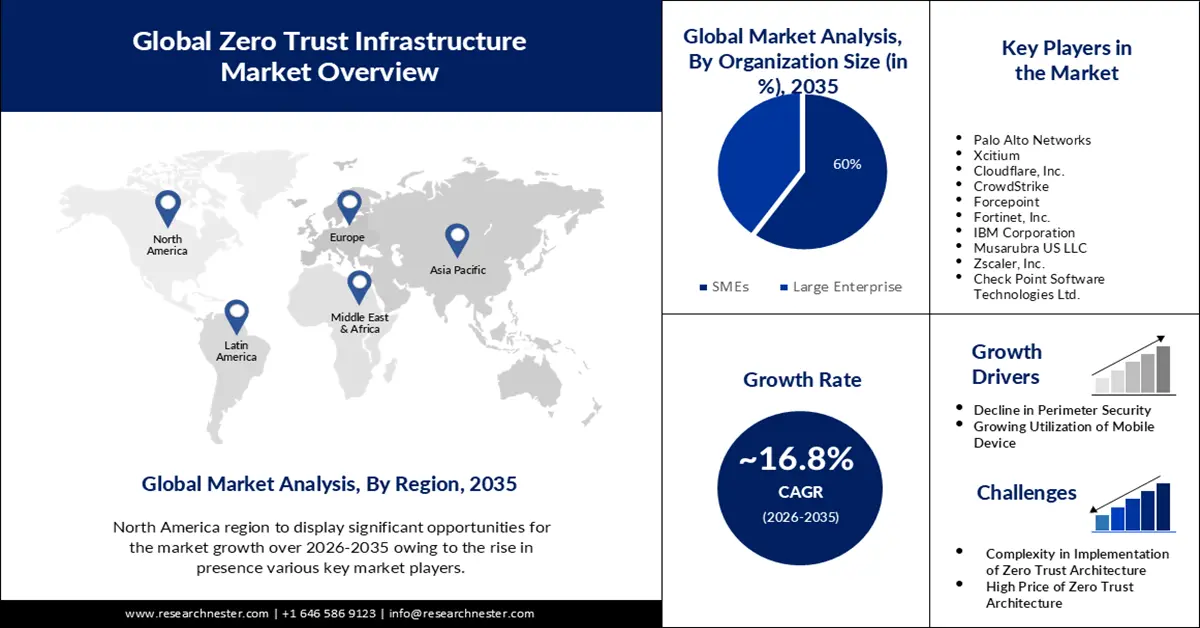

Zero Trust Architecture Market size was over USD 30.63 billion in 2025 and is poised to exceed USD 144.74 billion by 2035, growing at over 16.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of zero trust architecture is estimated at USD 35.26 billion.

The major factor in encouraging the market revenue is growing remote working. Remote work environments have grown increasingly common, as evidenced by over 11% of full-time employees that work from home in 2023. At the same time, an approximately 27% of workers have adjusted to a hybrid work style. However, this has also increased the prevalence of cybercrime.

Over 97% of remote workers reported using a personal device for work each day, according to a recent study, hence is estimated that they might be the target of about 66% of business-impacting cyberattacks. Therefore, the need for zero trust architecture is predicted to rise over the coming years. Furthermore, compliance requirements emphasize privacy and data protection significantly. Zero trust architecture enables businesses satisfy regulatory compliance requirements and safeguard sensitive data by offering improved security controls and visibility. Hence, this factor is also projected to boost the zero trust architecture market expansion.

Key Zero Trust Architecture Market Insights Summary:

Regional Highlights:

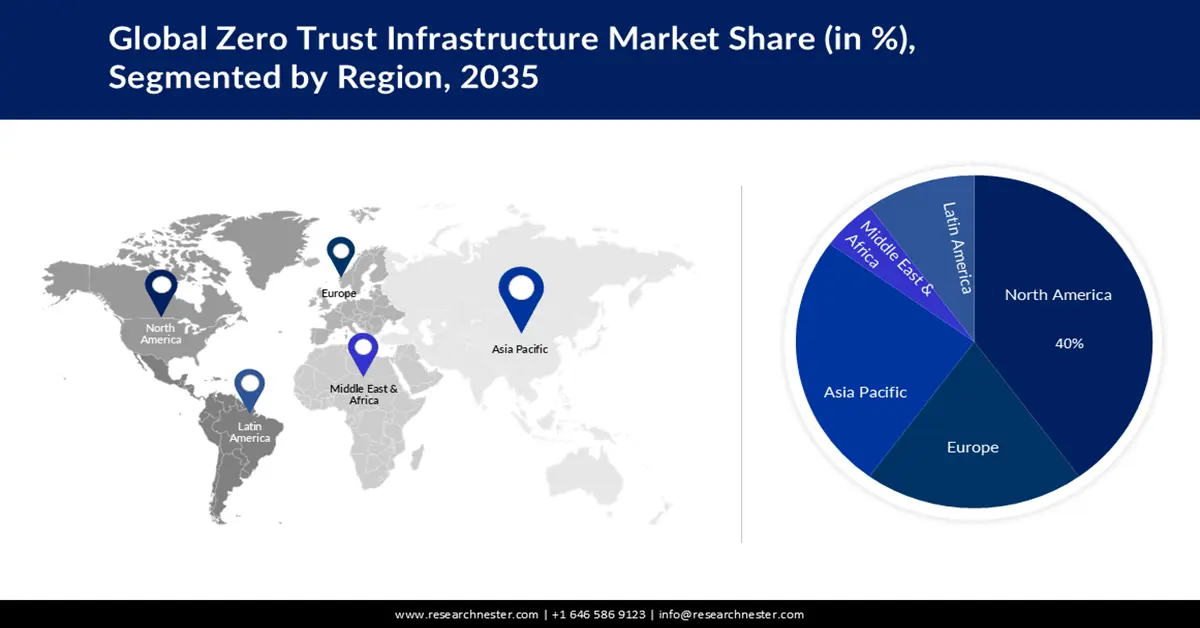

- North America zero trust architecture market will dominate around 40% share by 2035, driven by key market players, technology adoption, and government efforts.

- Europe market will exhibit notable growth during the forecast timeline, driven by growing adoption of zero trust infrastructure and strict data privacy laws.

Segment Insights:

- The smes segment in the zero trust architecture market is projected to capture a 60% share by 2035, driven by the rising number of SME businesses and increasing cyberattacks on small enterprises.

- The retail & e-commerce segment in the zero trust architecture market is projected to witness robust growth through 2035, driven by increasing security concerns due to cloud, mobile commerce, and sensitive customer data.

Key Growth Trends:

- Decline in Perimeter Security

- Growing Utilization of Mobile Devices

Major Challenges:

- Complexity in Implementation of Zero Trust Architecture

- High Price of Zero Trust Architecture

Key Players: Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Akamai Technologies, Inc., Symantec Corporation (Broadcom Inc.), Check Point Software Technologies Ltd., Microsoft Corporation, Okta, Inc., Zscaler, Inc., CrowdStrike Holdings, Inc.

Global Zero Trust Architecture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.63 billion

- 2026 Market Size: USD 35.26 billion

- Projected Market Size: USD 144.74 billion by 2035

- Growth Forecasts: 16.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Zero Trust Architecture Market Growth Drivers and Challenges:

Growth Drivers

- Decline in Perimeter Security - The modern workplace dynamics of cloud computing, and remote work are making traditional perimeter-based security inadequate. As the workforce gets more connected, the idea of a well-defined network border is becoming less and less relevant. According to the traditional security approach, users who have access to the network frequently have unrestricted access to all resources inside the perimeter, which creates openings for lateral attacker movement. This problem is addressed by zero trust security, which applies strict access controls and authentication procedures to all access points, irrespective of user location or device. By limiting access to those who truly need to know, data breaches are less likely to occur. The transition from perimeter-based security to Zero Trust is becoming essential for improved protection as organizations adjust to changing cybersecurity threats.

- Growing Utilization of Mobile Devices - Global mobile smartphone usage was over 6 billion in 2021; predictions indicate that by 2022, this figure is expected to increase to about 7 billion. The global mobile user count is expected to reach close to 8 billion by 2025. Furthermore, many employees have switched to remote or telework options to carry out their everyday work tasks as a result of the pandemic. Since mobile devices are portable, using specific work apps from home and responding to emails quickly are made easier, as is participating in virtual meetings. When the primary computing devices at remote sites malfunction, they also act as backup devices. Mobile devices have become another endpoint linked to company resources in this new environment, and if they are stolen or compromised, the entire enterprise might be in danger. By implementing cybersecurity strategies that avoid presuming implicit confidence, continuous monitoring, and restricted access to enterprise resources based on resource criticality, user and device identity, and posture, ZTAs can lessen this impact.

- Rising Demand for Online Shopping - The fact that customers are no longer limited to one physical store or a few hundred in a mall is the driving force behind the massive global growth of e-commerce. They may currently shop at whatever store they like since a multitude of market places give them access to a vast array of choices and brands. Customers also prefer eCommerce since it makes it easier for them to compare costs and take advantage of the greatest deals from various sellers. However, with the cyber-attack the privacy of customers might hinder which is why online businesses are adopting zero trust architecture.

Challenges

- Complexity in Implementation of Zero Trust Architecture - It may be difficult to set up a zero trust architecture framework; it involves a lot of preparation, coordination, and interaction with the security infrastructure already in place. Creating the required controls and procedures, classifying assets, and setting trust boundaries may all be difficult tasks for organizations. Some organizations might decide never to use zero trust architecture or might postpone deployment due to its difficulty. Organizations may employ a phased strategy to overcome execution issues and complexity. Establishing limits for trust and progressively classifying assets are good places for organizations to start. To create a well-thought-out Zero trust architecture approach, organizations can consult with security specialists or seek advice from seasoned professionals.

- High Price of Zero Trust Architecture

- Lack in Preferred Infrastructure for Zero Trust Infrastructure

Zero Trust Architecture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.8% |

|

Base Year Market Size (2025) |

USD 30.63 billion |

|

Forecast Year Market Size (2035) |

USD 144.74 billion |

|

Regional Scope |

|

Zero Trust Architecture Market Segmentation:

Vertical Segment Analysis

The retail & e-commerce segment is predicted to account for 30% share of the zero trust architecture market over the coming years. The retail and eCommerce industries are seeing a sharp increase in the use of Zero Trust Architecture as a result of a number of compelling factors. These include the handling of high-value assets and data by the industry, including product and sensitive customer data, which are easy targets for cyberattacks. Additionally, as cloud computing, mobile commerce, and the Internet of Things become more commonplace in retail and eCommerce organizations, security concerns increase, making this a wise defensive tactic. Strict compliance mandates including GDPR and PCI DSS also force these companies to put in place extensive security safeguards, with zero trust providing a strong foundation. Additionally, retailers and eCommerce companies are becoming more conscious of the advantages of protecting the data and technology that facilitate its uptake.

Organization Size Segment Analysis

The SMEs segment is predicted to account for 60% share of the zero trust architecture market over the forecast period. This growth of the segment is set to be encouraged by the rising number of SME businesses. Globally, there were projected to be over 331 million SMEs in 2021-a marginal increase over the 327 million recorded in 2019. Within the given time frame, the most recent year had the greatest number of SMEs. It is an erroneous that only large companies have to be concerned about security. Cyberattacks are becoming more frequent, and trends in cybercrime affect both large and small enterprises. Moreover, since large number of SMEs business are now operating online the risk of cyber attack increases. As a result, the need for zero trust infrastructure is projected to rise in SMEs businesses.

Our in-depth analysis of the global zero trust architecture market includes the following segments:

|

Deployment Type |

|

|

Organization Size |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Zero Trust Architecture Market Regional Analysis:

North American Market Insights

The North America zero trust architecture market is projected to gather the highest revenue share of about 40% during the coming years. This growth of the market in this region is estimated to be encouraged by the rise in the presence of various key market players. Furthermore, the developed economy in this region, led by the United States, is notable for its propensity to adopt and embrace cutting-edge technology, network automation, and the proliferation of cloud-based services, all of which have fueled the market for zero trust security. Moreover, the government in this region is also initiating various efforts in order to encourage the adoption of zero trust architecture which might also boost the market growth.

European Market Insights

The zero trust architecture market is set to have notable growth during the forecast period. The growth of this region’s market is poised to be influenced by the growing adoption of zero trust infrastructure. Compared to about 24% in 2020, over two-thirds of European organizations have started creating a zero trust strategy. Furthermore, Europe nations highly prioritize data privacy which is why their interest in zero infrastructure is predicted to grow in the coming years. Additionally, Europe has launched one of the strictest laws including GDPR in order to reduce cyber-attacks which also influence market demand.

Zero Trust Architecture Market Players:

- Palo Alto Networks

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Xcitium

- Cloudflare, Inc.

- CrowdStrike

- Forcepoint

- Fortinet, Inc.

- IBM Corporation

- Musarubra US LLC

- Zscaler, Inc.

- Check Point Software Technologies Ltd.

Recent Developments

- September 19, 2023: Leading global cybersecurity company Palo Alto Networks announced that it has been ranked as a leader in The Forrester WaveTM: Zero Trust Platform Providers, Q3 2023 study. Forrester claims that Zero Trust platforms (ZTPs) provide a consistent, all-encompassing method for operationalizing the ZT technology ecosystem, hence enabling Zero Trust (ZT) business and security outcomes.

- January 19, 2023: The leading supplier of cutting-edge endpoint protection solutions to the cybersecurity sector, Xcitium, recently announced a partnership with Carrier SI, a top supplier of commercial voice and data communication solutions. As Carrier SI's preferred endpoint protection solution and trusted cyber advisor, Xcitium is the only cyber security provider to achieve premier designation.

- Report ID: 5754

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Zero Trust Architecture Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.