Xerostomia Therapeutics Market Outlook:

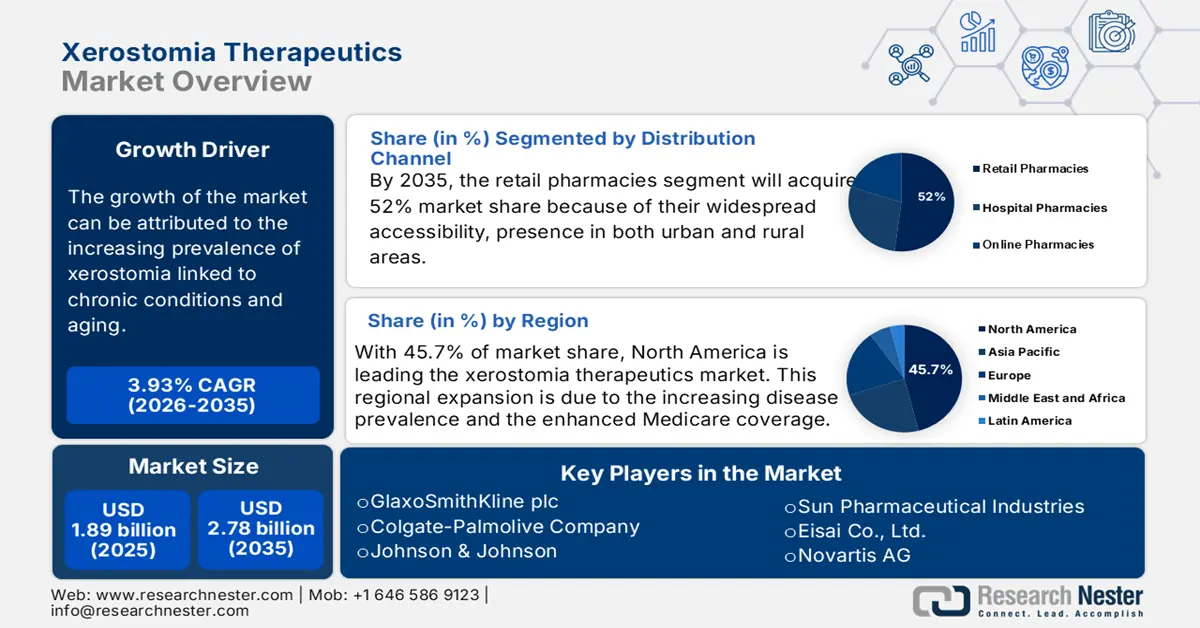

Xerostomia Therapeutics Market size was valued at approximately USD 1.89 billion in 2025 and is projected to reach around USD 2.78 billion by the end of 2035, rising at a CAGR of approximately 3.93% during the forecast period 2026-2035. In 2026, the xerostomia therapeutics is evaluated at USD 1.97 billion.

The research and development in the market are mainly focused on regenerative solutions with advancing formulations. The advent of gene therapy, mainly AAV-mediated options for the delivery, is under clinical trials. Simultaneously, efforts are being made in cell therapy that include stromal cell infusions. Additionally, progenitor cell research and tissue engineering biobanks are enabling predictive models. In the coming years, results from the ongoing trials amalgamated with the advancements in organoid-based screening. These factors are projected to shape the modern therapeutics in xerostomia.

Additionally, the supply chain of the market plays a prominent role in revolutionizing the trajectory of growth. The supply chain for the market majorly depends on the availability of APIs such as cevimeline, along with the stem cell lines for emerging cell therapies. Hospitals and online pharmacy networks are widely spreading their reach. Also, the availability of efficient cold chain logistics is crucial to ensure the viability of the product. Market players and governments are working hand in hand to make a resilient and well-coordinated supply chain to ensure the timely availability and accessibility of next-generation regenerative therapies.

Key Xerostomia Therapeutics Market Insights Summary:

Regional Insights:

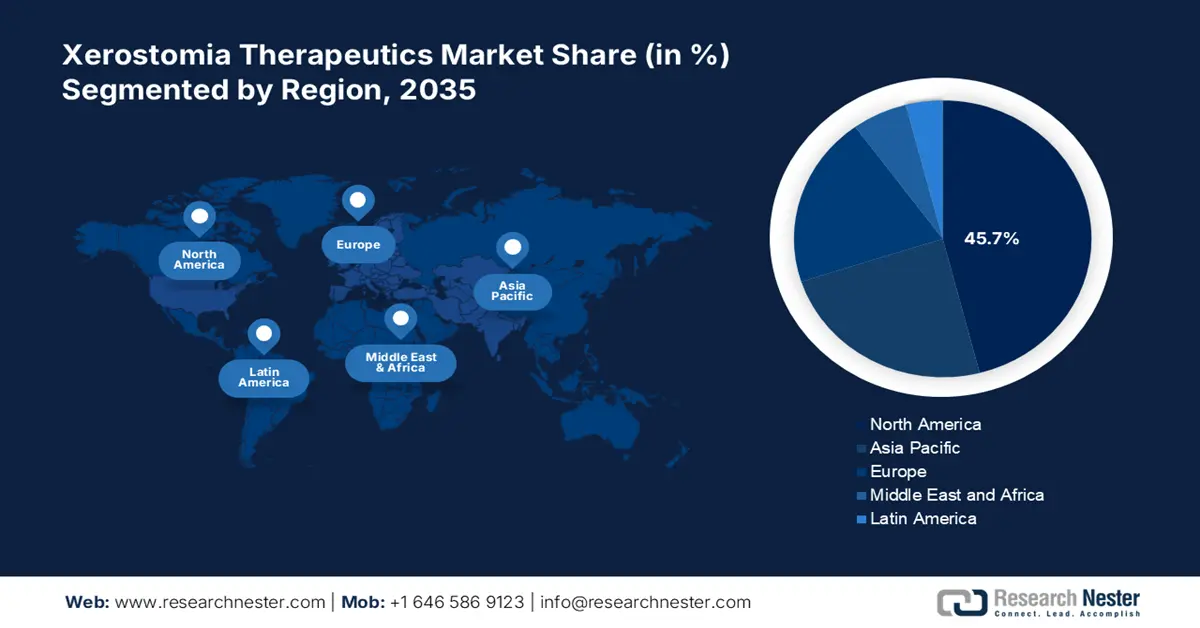

- North America is predicted to hold a 45.7% share by 2035 in the Xerostomia Therapeutics Market, driven by rising disease prevalence and enhanced Medicare coverage.

- Europe is anticipated to capture 28.3% share during the forecast period, impelled by an aging population and heightened awareness among healthcare professionals.

Segment Insights:

- The salivary stimulants segment is expected to account for 42.8% share during the forecast period, owing to the persistent prevalence of Sjögren’s syndrome.

- The cholinergic agonists segment is projected to register substantial growth by 2035, propelled by its affordability, aging demographics, and the generic boom in emerging countries.

Key Growth Trends:

- Increasing prevalence of xerostomia linked to chronic conditions and aging

- Rising cases of radiation-induced xerostomia in cancer survivors

Major Challenges:

- Barriers in regulatory procedures

Key Players: 3M Company, Colgate-Palmolive Co., Cumberland Pharmaceuticals Inc., GlaxoSmithKline Plc, Sun Pharmaceutical Industries Ltd., among others.

Global Xerostomia Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.89 billion

- 2026 Market Size: USD 1.97 billion

- Projected Market Size: USD 2.78 billion by 2035

- Growth Forecasts: 3.93% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.7% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, Japan, France, Canada

- Emerging Countries: India, China, Brazil, Mexico, South Korea

Last updated on : 10 September, 2025

Xerostomia Therapeutics Market - Growth Drivers and Challenges

Growth Drivers

- Increasing prevalence of xerostomia linked to chronic conditions and aging: It has been witnessed that xerostomia is usually observed in patients with diabetes and Sjogren’s syndrome. According to data published by the World Health Organization in 2024, there are almost 830 million people in the world suffering from diabetes. Additionally, the global surge of the geriatric population is predicted to increase the burden of xerostomia. These demographic trends are ensuring that there will be a large pool of patients, making the xerostomia therapeutics a highly pertinent segment of the healthcare sector.

- Rising cases of radiation-induced xerostomia in cancer survivors: With the surge in incidences of head and neck cancers, the need for xerostomia therapeutics is also rising. The radiation used in standard treatment damages the salivary glands, resulting in xerostomia that worsens the quality of life. According to data published by the Cleveland Clinic in 2024, about 4.5% of the cancer diagnoses globally are head and neck cancers. Additionally, the recognition of the radiation-induced xerostomia is acting as a catalyst for the market growth and bringing innovative methodologies in clinical trials.

- Growing role of digital health and diagnostics: The digital health technologies are emerging as a supportive driver for the market growth. The rising use of wearable devices, saliva sensors, and various other AI-enabled diagnostic biomarkers is aiding healthcare practitioners in detecting in a better way. For example, in cancer patients, the early detection of subclinical xerostomia enables the early commencement of preventive measures. Both the biotech and pharmaceutical firms are joining hands with IT companies in the health sector to amalgamate effective solutions into care pathways. These factors are encouraging the adoption of new products and propelling the market growth.

Challenge

- Barriers in regulatory procedures: The major challenge causing hindrance to the market is the delays in terms of the stringent regulatory frameworks. For example, PMDA in Japan and FDA in the U.S. backlog for medical devices such as electrostimulation tools pushed the launch to further years, making it challenging for xerostomia manufacturers to leverage the therapeutics.

Xerostomia Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.93% |

|

Base Year Market Size (2025) |

USD 1.89 billion |

|

Forecast Year Market Size (2035) |

USD 2.78 billion |

|

Regional Scope |

|

Xerostomia Therapeutics Market Segmentation:

Treatment Type Analysis

The salivary stimulants segment is anticipated to register the largest share of 42.8% in the market during the forecast period. The dominance of this segment is highly attributed to the continuous and rigorous occurrence of Sjögren’s syndrome among the worldwide population. According to data published by the National Institutes of Health in 2023, 4 million people were living with Sjögren’s syndrome. Government organizations such as the FDA prioritized chewable cevimeline, extending its contribution for the segment’s leadership by reducing dosing frequency and improving compliance.

Drug Class Segment Analysis

The cholinergic agonists segment is projected to register considerable growth in the xerostomia therapeutics market by 2035. The growth in the segment is primarily subject to its affordability, the aging demographics, and the generic boom in emerging countries. Doctors are considering the drug as 1st line treatment in the emerging markets, owing to the low cost of dosages. Companies such as Sun Pharma and CSPC Pharma control a major part of Asia’s pilocarpine supply with a focus on cutting prices. These factors are propelling the demand for the segment during the forecasted period.

Distribution Channel Segment Analysis

Among the distribution channels, retail pharmacies are predicted to hold the largest share of 52% by 2035. This dominance of the sub-segment is propelled by their widespread accessibility, presence in both urban and rural areas. Also, the ability to provide both over-the-counter and prescription products makes retail pharmacies the preferred choice for most patients. The sub-segment growth is also attributed to the presence of robust supply chain relationships. This makes the retail pharmacies a go-to channel for users who are seeing therapeutics related to xerostomia.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Treatment type |

|

|

Drug Class |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Xerostomia Therapeutics Market - Regional Analysis

North America Market Insights

North America is a key player in the xerostomia therapeutics sector, projected to register a significant share of 45.7% in 2035. The leadership of the region is attributed to the increasing disease prevalence and the enhanced Medicare coverage. Additionally, the region’s advanced healthcare systems act as a catalyst for the adoption of the novel therapies. This further ensures widespread access to the treatment, aiding the growth of the market in the region. Also, there is rising awareness among the population, which is further augmenting the growth of the market.

In the U.S., the growth is augmented by the rising aging population in the country. Also, the increasing cases of diabetes and cancer treatments contribute to the rising demand for xerostomia therapy. The country is a hub for innovations in therapeutic strategies that include the development of novel formulations of the drugs for improving patient compliance. These factors contribute to the growth of the market in the country, acknowledging the requirement of a diverse patient pool, which is consistently rising.

Asia Pacific Market Insights

The growth of the market in the region is set to witness the highest growth owing to the presence of a large population base. Various conditions, such as Parkinson’s disease and cancer, are highly prevalent in the region, leading to higher cases of xerostomia. The region has a wider range of therapeutic options, providing more customized solutions. Additionally, the rising investment by prominent pharmaceutical companies in conducting exhaustive research and development, mainly for targeting radiation-induced xerostomia. Collectively, these factors are making a conducive environment for the sustained growth of the market.

In India, the growth of the market is driven by the rising cases of cancer and increasing advancements in pharmaceutical research. According to data published by the National Institutes of Health in 2022, the projected number ratio of cancer in the country was 100.4 per 100,000 of the population. Various government programs are endeavoring to enhance the healthcare infrastructure and access to treatments. Moreover, the market is also promoted by the rising partnerships and collaborations between the companies involved in making new drugs for xerostomia treatment.

Europe Market Insights

Europe is projected to grow at a lucrative rate, with a share of 28.3% in the xerostomia therapeutics market during the assessed time frame. The region benefits from a substantial number of assorted and aging population, which outstretches the significance of the market. The region is at the forefront of innovations with high annual health expenditure. Also, public and healthcare professional awareness about xerostomia and its underlying causes has led to better diagnosis and treatment. Therefore, these factors utterly support market development in the region.

The U.K. is one of the largest contributors to growth in the regional xerostomia therapeutics market, capturing a significant share of the Europe market. Also, the country has a high prevalence of cases related to cancer. According to the World Cancer Research Fund in 2021, there were 395,181 cases of cancer. Also, campaigns by organizations such as the British Dental Association are raising public awareness about oral health, resulting in the higher demand for dry mouth relief products and further augmenting the market growth.

Key Xerostomia Therapeutics Market Players:

- GlaxoSmithKline plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Colgate-Palmolive Company

- Johnson & Johnson

- Sun Pharmaceutical Industries

- Eisai Co., Ltd.

- Novartis AG

- Pfizer Inc.

- Bayer AG

- Procter & Gamble

- Takeda Pharmaceutical

- Sanofi S.A.

- AstraZeneca plc

- Merck & Co., Inc.

- Hikma Pharmaceuticals PLC

- CSL Limited

- LG Chem Ltd.

- Cipla Ltd.

- Dabur India Ltd.

- Duopharma Biotech Berhad

- Aspen Pharmacare Holdings

The presence of both established and emerging players in the industry is fostering a standard landscape for the market to escalate. Global leaders such as GSK, Colgate-Palmolive, and Johnson & Johnson are leading the market with their brand recognition and extensive distribution. Besides, emerging nations such as India and Malaysia are witnessing growth owing to the presence of generic manufacturers such as Sun Pharma and Cipla. Further, firms are focused on research in saliva substitutes and investments in terms of biotech solutions to capture niche markets.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, MeiraGTx Holdings plc announced the advancement of its AAV2-hAQP1 gene therapy program, targeting radiation-induced xerostomia. The therapy aims to restore salivary gland function by delivering the aquaporin-1 (AQP1) gene.

- In May 2025, a novel cell therapy developed by the Program for Advanced Cell Therapy, a collaboration between UW Health and the UW School of Medicine and Public Health, received Fast Track designation from the U.S. FDA. This therapy is made to treat xerostomia caused by radiation therapy and is currently undergoing Phase 1 clinical trials at the UW Health.

- Report ID: 2959

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Xerostomia Therapeutics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.