Wound Care Market Outlook:

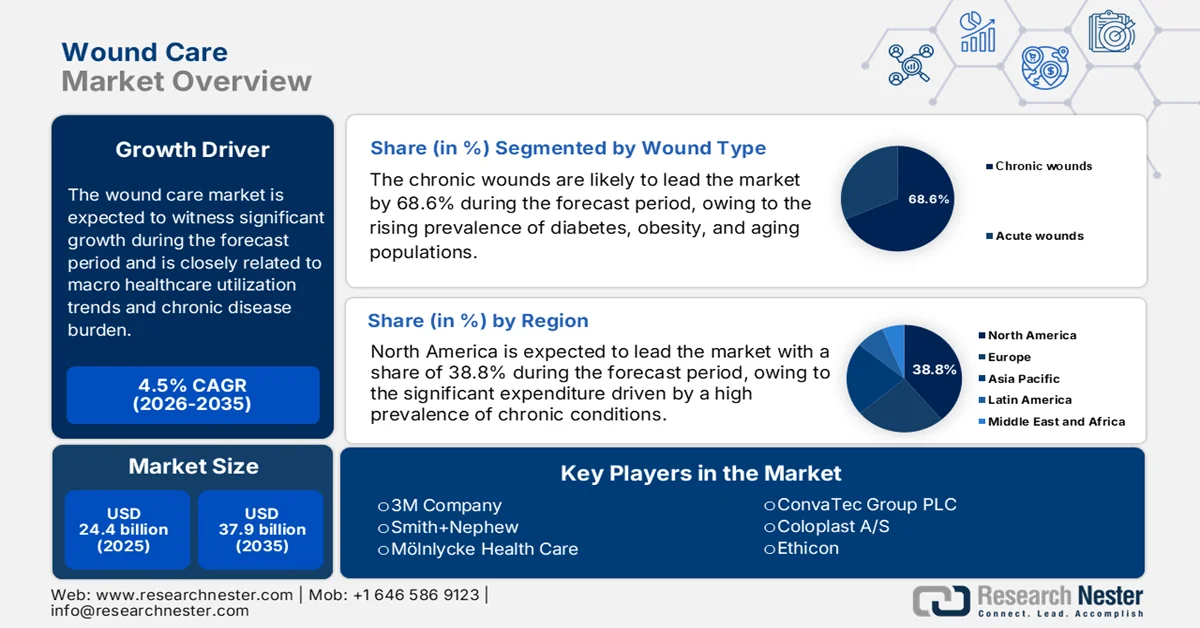

Wound Care Market size was valued at USD 24.4 billion in 2025 and is projected to reach USD 37.9 billion by the end of 2035, rising at a CAGR of 4.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of wound care is estimated at USD 25.5 billion.

The wound care market is closely tied to macro healthcare utilization trends, chronic disease burden, and institutional care delivery volumes rather than consumer-led demand. Further, the government and multilateral health data show a sustained increase in wound incidence associated with diabetes, vascular disease, aging populations, and surgical procedures. According to the NLM study in January 2024, nearly 38.4 million people of all ages had diabetes, with diabetic foot complications remaining a major driver of chronic wound treatment across hospitals, outpatient clinics, and long-term care facilities. Besides, the non-healing wounds and wound-related infections contribute materially to inpatient admissions and extended lengths of stay, increasing pressure on hospital procurement budgets and care standardization. Moreover, the WHO February 2025 data highlights that the global population aged 60 years and older is expected to double in the upcoming years, directly expanding the demand for institutional wound management in elder care and post-acute settings.

Moreover, the wound care is increasingly scrutinized via cost of care and outcomes frameworks. The U.S. Medicare program allocates several billion dollars annually to wound-related treatments, with CMS data indicating that chronic wounds affect nearly 8.2 million Medicare beneficiaries, generating estimated annual expenditures reaching USD 2.5 billion for hospital outpatient fees, based on the NLM study in January 2023. Besides the government-backed initiatives, which emphasize reducing the preventable wound complications via standardized protocols and early intervention, mainly in hospital-acquired pressure injuries and post-surgical wounds. Overall, the market remains anchored to demographic shifts, chronic disease prevalence, and healthcare system efficiency mandates, with procurement decisions increasingly influenced by the evidence-based outcomes and long-term cost containment priorities rather than discretionary spending.

Key Wound Care Market Insights Summary:

Regional Highlights:

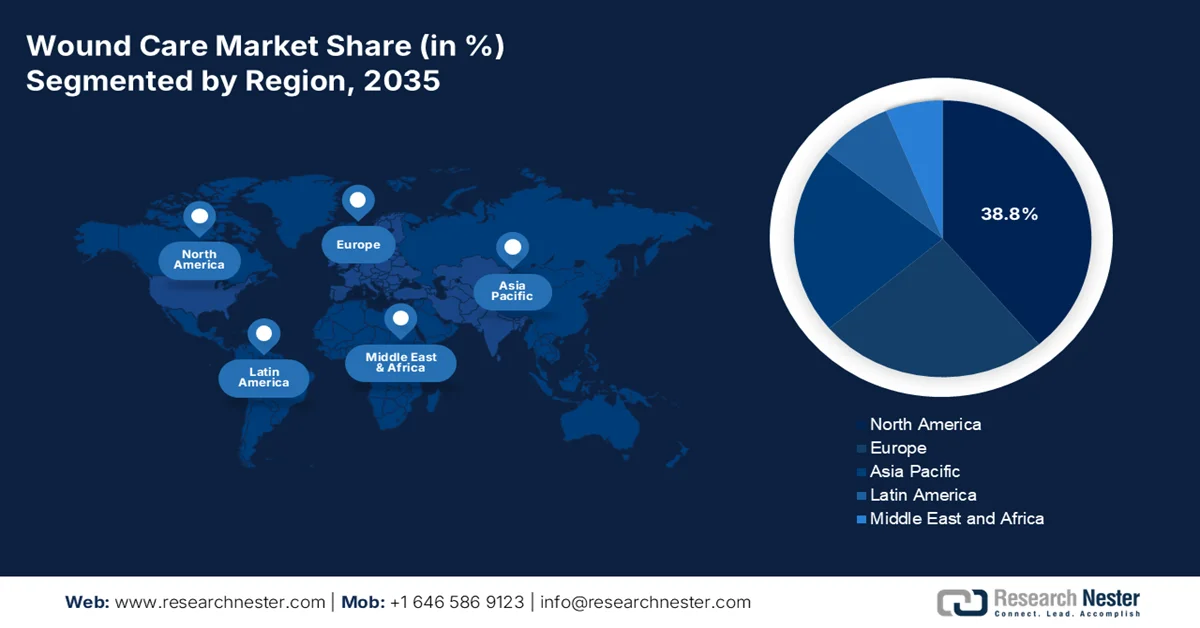

- North America in the wound care market is projected to secure a 38.8% revenue share by 2035, propelled by the high prevalence of chronic conditions, aging demographics, and value-based reimbursement models accelerating outpatient and home care adoption.

- Asia Pacific is anticipated to emerge as the fastest-growing region by 2035, fueled by the escalating diabetes burden, expanding healthcare access, and rapid demographic aging across major economies.

Segment Insights:

- In the wound care market, the chronic wounds segment is projected to capture a dominant 68.6% share by 2035, driven by the escalating prevalence of diabetes, obesity, and aging populations increasing the incidence of non-healing ulcers and pressure injuries.

- The direct sales segment is anticipated to maintain the leading revenue share by 2035, stimulated by bulk institutional procurement of advanced wound care products and the need for clinical training, customized solutions, and long-term healthcare partnerships.

Key Growth Trends:

- Rising government expenditure on chronic disease management

- Aging population and public long term care funding

Major Challenges:

- High regulatory hurdles and clinical evidence requirements

- Complex supply chain and sourcing of raw materials

Key Players: 3M Company (U.S.), Smith+Nephew (UK), Mölnlycke Health Care (Sweden), ConvaTec Group PLC (UK), Coloplast A/S (Denmark), Ethicon (U.S.), Baxter International (U.S.), Integra LifeSciences (U.S.), Hartmann Group (Germany), B. Braun Melsungen AG (Germany), Cardinal Health (U.S.), Medline Industries, LP (U.S.), Medtronic plc (Ireland), Paul Hartmann AG (Germany), Hollister Incorporated (U.S.), Organogenesis Holdings Inc. (U.S.), MiMedx Group, Inc. (U.S.), Lohmann & Rauscher (Germany), KCI (part of 3M) (U.S.), Derma Sciences (U.S.)

Global Wound Care Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.4 billion

- 2026 Market Size: USD 25.5 billion

- Projected Market Size: USD 37.9 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 11 February, 2026

Wound Care Market - Growth Drivers and Challenges

Growth Drivers

- Rising government expenditure on chronic disease management: The public spending on chronic diseases is a primary driver of wound care demand, as non-healing wounds are closely linked to diabetes, cardiovascular disease, and obesity. According to the World Health Organization data in November 2024, diabetes affected over 830 million people in 2022. Diabetic foot ulcers represent a major cause of hospital admission and amputations. Moreover, the chronic wound treatment accounts in billion in Medicare spending, driven by the prolonged treatment cycles and repeat care episodes. Moreover, the NLM study in January 2023 indicates that 70% of the healthcare expenditures are due to the rising number of chronic diseases, directly increasing the demand for wound care management in hospitals. These spending patterns are prioritizing early intervention to reduce downstream costs, driving the market.

- Aging population and public long term care funding: The demographic aging is structurally expanding the wound care market demand. The WHO October 2025 report indicates that the global population aged 60 and above will reach 2.1 billion by 2050. The older populations exhibit a higher incidence of pressure injuries, venous leg ulcers, and post-surgical wound complications. In the U.S., the spending on the long-term care exceeded a significant billion, much of it is directed towards nursing facilities and home healthcare providers, where the wound management is routine. Similar trends are observed across Japan and Europe, where the government reimbursement frameworks increasingly highlight the pressure injury prevention and treatment. This demographic shift ensures predictable volume-driven demand from institutional buyers.

- Rising trauma and road injury burden: The government data on trauma and injury care indicate a sustained need for acute wound management. According to the UNDRR 2025 data, road traffic injuries cause 1.19 million deaths annually, with tens of millions more requiring emergency and surgical care. The pubic trauma systems mainly in low and middle-income countries are expanding the capacity to manage the injury related wounds. Moreover, the Partnership for Analytics Research in traffic Safety data in January 2025 indicates that nearly 2.38 million injury crashes were reported in the U.S. in 2022, all requiring varying levels of wound intervention. Moreover, the government-funded emergency care systems remain a consistent source for the market demand, mainly for acute and trauma-related applications.

Challenges

- High regulatory hurdles and clinical evidence requirements: Entering the advanced market mainly with bioactive products or devices requires a strict FDA or EMA pre-market approval, demanding extensive and costly clinical trials. Further, the new entrants lack the capital for this multi-year process. Many top players invest highly on the multiple randomized controlled trials to secure their 510(k) clearance and establish clinical credibility against top competitors.

- Complex supply chain and sourcing of raw materials: Advanced dressings require high-purity specialized materials such as collagen, superabsorbent polymers, and more. Disturbances can halt production. For example, during the pandemic, many faced shortages in the non-woven fabrics and adhesives. A top company with vertically integrated manufacturing has an advantage. New company entrants must secure reliable, cost-effective supplies for these critical inputs, adding complexity.

Wound Care Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 24.4 billion |

|

Forecast Year Market Size (2035) |

USD 37.9 billion |

|

Regional Scope |

|

Wound Care Market Segmentation:

Wound Type Segment Analysis

In the wound type segment, chronic wounds is projected to be the dominant sub-segment and poised to hold the share value of 68.6% by 2035. The segment is driven by the rising prevalence of diabetes, obesity, and ageing populations. According to the NLM study in October 2025, the wounds that are not healed in 4 to 12 weeks are considered chronic wounds. The key chronic wounds include diabetic foot ulcers, venous leg ulcers, and pressure injuries. The enormous clinical and economic burden of these non-healing wounds solidifies their leading revenue position. Further, the high incidence of foot ulcers directly fuels the sustained demand for advanced wound management products and therapies aimed at preventing costly complications such as amputations. The management of chronic wounds represents a critical and expanding focus for healthcare systems worldwide.

Distribution Channel Segment Analysis

Within the distribution channel segment, the direct sales are leading the segment in the market, defined by the manufacturers selling large volume contracts directly to the hospitals, integrated delivery networks, and Group Purchasing Organizations. This channel dominates due to the bulk procurement of high-value advanced wound care products and therapies, such as negative pressure wound therapy systems and bioengineered skin substitutes, which require clinical training and support. The efficiency and cost negotiation power of direct contracts for institutions make this the primary route to market. Besides the direct sales, enable manufacturers to provide customized solutions, on-site clinical education, and post-sales technical support that are significant for the optimal product adoption and outcomes. The long-term partnerships and contract renewals with large healthcare systems are further boosting the dominance of this channel in the market.

End user Segment Analysis

The end user segment is led by the hospitals and acute care clinics that serve as the central hubs for treating complex, severe, and post-surgical wounds. This sub-segment captures the highest revenue due to the high volume of inpatient surgical procedures, emergency trauma cases, and the management of advanced chronic wound complications that require specialized equipment and staff. Hospitals are the key adopters of costly and advanced technologies such as NPWT and biologic skin substitutes. According to the CDC June 2025 report, the rate of injury-related visits in the U.S. emergency department was nearly 43.5 million, with a proportion involving wounds requiring professional care, demonstrating the consistent and substantial patient flow driving the hospital-based wound care product consumption.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Wound Type |

|

|

End user |

|

|

Distribution Channel |

|

|

Application |

|

|

Purchase Pattern |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wound Care Market - Regional Analysis

North America Market Insights

The North America wound care market is dominating and is expected to hold the regional revenue share of 38.8% by 2035. The market is defined by the high technological adoption and significant expenditure driven by a high prevalence of chronic conditions. The key drivers include an aging population, rising rates of diabetes and obesity, leading to complex wounds such as diabetic foot ulcers, and well established advanced surgical sector. Besides, the dominant trend is the shift from inpatient to outpatient and home care settings, propelled by the value-based reimbursement models from the CMS, aiming to minimize readmissions and total cost of care. This fuels the demand for the advanced portable devices and dressing suitable for self-care. The market is growing significantly, with the regulatory policies directly influencing the product adoption based on clinical and economic evidence.

The U.S. market is shaped by the federal healthcare spending, chronic disease burden, and increasing adoption of advanced therapies for complex wounds. According to the CDC January 2026 data, nearly 40.1 million people were diagnosed with or undiagnosed diabetes in the U.S. in 2023, sustaining high demand for chronic wound management across hospitals and home care settings. From a spending perspective, Medpac data in July 2025 indicated that Medicare spending reached 35% of the total home health expenditure, supporting the wound care delivery outside acute settings. Further, the rising clinical trials related to wound care are driving the market and actively boosting the demand. Moreover, the FDA approvals, such as FILSUVEZ in 2023 and ZEVASKYN in 2025 for epidermolysis bullosa related to the wounds, highlight the growing regulatory and payer recognition of high-cost specialty wound indications, expanding the market beyond the traditional chronic wounds.

Clinical Trial Alignment with Global Wound Care Market

|

Study / Intervention |

Trial Design & Scale |

Wound Care Market Sub-Segment |

Primary Demand Driver |

Target Care Setting |

|

Topical Tetrachlorodecaoxide (TCDO) |

Single-center, randomized controlled trial; 66 patients; 12-week follow-up |

Topical wound therapeutics / adjunctive wound care |

Government pressure to reduce chronic wound burden and treatment costs in public hospitals |

Public hospitals, outpatient clinics, low-resource settings |

|

Cold Atmospheric Plasma (CAP) – Plasana One® |

Multicenter, randomized controlled trial; 60 patients + ancillary pressure ulcer cohort; 20-week follow-up |

Advanced wound care devices / energy-based therapies |

Public investment in infection control, faster healing, and home-based care models |

Hospitals, home healthcare, community nursing services |

|

DEBRICHEM® (CHEMfoot Study) |

Multicenter, open-label RCT; 242 patients across 6 French centers |

Wound debridement / diabetic foot ulcer management |

Government focus on reducing amputations, hospitalizations, and antibiotic use |

Tertiary hospitals, diabetic foot clinics |

Source: Clinical Trials.gov

The public healthcare funding, population aging, and the rising burden of chronic diseases managed within provincially funded systems are driving the market in Canada. According to Statistics Canada in September 2024, nearly 7.6 million people are aged above 65, a key driver for pressure injuries, venous leg ulcers, and post-surgical wound care in hospitals and long-term care facilities. Besides, the NLM study in March 2023 indicates that over 5.7 million people in the country are living with diagnosed diabetes in 2023, significantly increasing the incidence of chronic and diabetic foot wounds. Moreover, the 2026 Canadian Medical Association data highlights that the total health expenditure is estimated to be USD 344 billion in 2023, with hospitals and home care representing major cost centers where wound management is routine. Overall, the market is growing steadily with the demand for wound solutions across acute and community care settings.

APAC Market Insights

The Asia Pacific market is the fastest-growing globally and is driven by the expansive healthcare access, rising medical standards, and significant demographic shifts. The primary catalyst is the epidemic rise in diabetes, with the international diabetes federation nothing the region is home to over half of the world’s diabetic population, leading to a surge in complex diabetic foot ulcers. Coupled with a rapidly aging society in countries such as China and Japan, this creates a substantial chronic wound burden. A key trend is the dual track market evolution, the rapid adoption of advanced technologies in mature economies, and the expansion of basic and affordable wound care in high-volume, price-sensitive emerging markets such as India and Indonesia. Further, the market is also seeing growth in e-commerce and telehealth platforms for wound care consultation and product distribution, particularly in Southeast Asia.

The market in India is driven by the public health initiatives, a rising chronic disease burden, and expanding access to hospital and home-based care. According to the NLM March 2024 study, non-communicable diseases account for over 60% of the total deaths in India, with diabetes and vascular disorders contributing significantly to chronic wound incidence. Moreover, the NLM May 2025 study has indicated that in 2021, nearly 101 million adults living with diabetes sustained a strong demand for diabetic foot ulcer management across both public and private hospitals. Further, the Ayushman Bharat PMJAY program provides health coverage, increasing access to surgical and post-acute wound care services in secondary and tertiary care facilities. These factors show that there is a strong demand for wound care solutions in India’s hospital networks and community healthcare settings.

The Japan market is underpinned by the universal health insurance coverage, rapid population aging, and high utilization of hospital and community-based care services. According to the World Economic Forum data in September 2023, one-third of the population in the country is above 65 years, which is 36.23 million. This drives the higher incidence of post surgical wounds care across the acute and long-term care settings. Besides, in April 2023, Gunze Medical has strengthened its wound care sales channels in Japan, highlighting a sustained institutional demand and the importance of well-established distribution networks to serve hospitals and home visit nursing providers. This expansion aligns with the stable reimbursement schemes and supports a continued market growth driven by the demographic and care delivery trends.

Recent Wound Care Product Launches in Japan

|

Date |

Company |

Product / Initiative |

Market Entry or Strategic Action |

|

April 1, 2024 |

Gunze Limited |

Expansion of wound care sales channel |

Strengthened domestic sales channel in Japan; expanded distribution footprint across Japan, USA, and China |

|

August 1, 2023 |

Kaken Pharmaceutical |

NexoBrid |

Commercial launch in Japan under exclusive marketing and distribution agreement |

|

July 11, 2024 |

AMS BioteQ (Taiwan) |

SIPSIP Foam Wound Dressing |

Obtained PMDA Class I medical device sales permit, officially entering Japan |

|

January 4, 2023 |

Gunze Medical |

EPIFIX |

Entered exclusive distribution agreement to accelerate market penetration |

Source: Gunze, MediWound, AMS Bioteq, Mimedx

Europe Market Insights

The wound care market in Europe is growing steadily and is defined by the advanced but cost-conscious healthcare environment, advanced regulatory frameworks, and significant demographic pressures. The key driver is the rapid growth in the aging population, which has one of the highest proportions of individuals, leading to increased prevalence of chronic wounds. Moreover, the rising rates of diabetes and obesity are also boosting the region's market growth. Additionally, the focus on cost containment and health technology assessment by the national health services and insurers mandates the robust clinical and economic evidence for product adoption and reimbursement. Innovation is directed towards the products that reduce the treatment costs and prevent complications. The market is also shaped by the medical device regulations and EMA for the advanced therapy medical products. The market growth is propelled by a strategic push toward decentralized care and telehealth, supported by the EU digital health initiatives to manage chronic conditions.

The Germany market is driven by the health insurance reimbursement and the rising aging population. Further, the sustained chronic disease and injury burden managed within the hospital and home care settings are also fueling the market growth. According to the NLM study in March 2024, around 8.7 million people in Germany were living with diabetes in 2022, supporting a steady demand for diabetic foot ulcer and chronic wound management under publicly reimbursed care pathways. Moreover, the Federal Ministry of Transport data in August 2024 reported nearly 2,839 road traffic fatalities in 2023, highlighting the continued need for trauma and post acute wound treatment across the emergency and rehabilitation services. Besides, on the supply side, the June 2023 launch of Epicite Balance by JeNaCell for chronic low to medium exuding wounds underscores active supplier participation aligned with the hospital and home care procurement channel. Together, these factors show a stable demand for wound care solutions in the country.

Recent Wound Care Product Launches in Germany

|

Company |

Product |

Market Entry / Approval Timeline |

Product Type |

|

JeNaCell, an Evonik company |

epicite balance |

Launched June 2023 |

Wound dressing |

|

Flen Health |

Flaminal hydro, Flaminal forte |

Launched October 2023 |

Topical wound care products (pharmacy-only medicines) |

|

PMI – The Wound Healing Company |

SUPRATHEL |

MDR approval in 2023 (reported Jan 2025) |

Advanced wound dressing / medical device |

Source: Evonik, Flen Health, PMI

The wound care market in UK is driven by NHS funding, an aging population, and the high burden of chronic wounds both in community settings and hospitals. According to the NLM study in January 2025, nearly 3.8 million people in the country are affected by acute or chronic wounds annually, creating a substantial demand for hospital outpatient and district nursing services. Moreover, as per the report from the Diabetes Research and Wellness Foundation in June 2024, over 4.4 million people are living with diabetes, supporting the growing need for diabetic foot ulcer management. Besides the recent launch of Convatec’s ConcaNiox in April 2025, an antimicrobial and antibiofilm nitric oxide therapy shown to stimulate the DFU healing by up to 60%, reflects the market adoption of advanced therapies and highlights the ongoing investment in innovative wound care solutions within publicly funded care pathways.

Key Wound Care Market Players:

- 3M Company (U.S.)

- Smith+Nephew (UK)

- Mölnlycke Health Care (Sweden)

- ConvaTec Group PLC (UK)

- Coloplast A/S (Denmark)

- Ethicon (U.S.)

- Baxter International (U.S.)

- Integra LifeSciences (U.S.)

- Hartmann Group (Germany)

- B. Braun Melsungen AG (Germany)

- Cardinal Health (U.S.)

- Medline Industries, LP (U.S.)

- Medtronic plc (Ireland)

- Paul Hartmann AG (Germany)

- Hollister Incorporated (U.S.)

- Organogenesis Holdings Inc. (U.S.)

- MiMedx Group, Inc. (U.S.)

- Lohmann & Rauscher (Germany)

- KCI (part of 3M) (U.S.)

- Derma Sciences (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M Company is a dominant player in the wound care market uses its material science expertise to innovate advanced dressings such as silicon adhesives and proprietary foam technologies. Strategically, 3M solidified its leadership by acquiring Acelity and its KCI subsidiaries, creating a comprehensive portfolio that spans advanced wound dressings, allowing it to offer integrated solutions across the care spectrum.

- Smith+Nephew maintains a top position in the wound care market via a focus on high-growth advanced wound management. Its strategy revolves around innovation in biologics, NPWT, and digital health. Key initiatives include the launch of portable NPWT systems such as PICO and the development of skin substitutes.

- Molnlycke Health Care is the top player in the wound care market, renowned for its evidence-based approach and premium brands such as Mepilex. In the wound care market, the company's strategy focuses on the surgical and acute wound segments, indicating cost-effectiveness studies to demonstrate value to healthcare providers. The company has made annual sales of 2,064 million euros in 2024.

- ConvaTec Group PLC holds a substantial share in the chronic wound care market, mainly with advanced products such as AQUACEL dressings with Hydrofiber technology. Its strategic initiatives are centered on innovation, market expansion, and optimizing its supply chain. Moreover, the company is extending its geographic footprint in emerging markets.

- Coloplast A/S has a strong presence in the wound care market via its Biatain portfolio of foam dressings. The company’s strategy is deeply connected to its core ostomy care business, allowing for bundled solutions for patients with complex multiple needs. In 2024, the company experienced an organic growth of 7%.

Here is a list of key players operating in the global market:

The global market is highly concentrated and is dominated by large multinational companies from Europe and the U.S., such as 3M and Smith+Nephew, as these players use extensive R&D and global distribution. Strategic initiatives are heavily focused on innovation in advanced products and also in smart or digital wound monitoring solutions. The key players are actively pursuing mergers, acquisitions, and geographic expansions, mainly in the high-growth emerging markets, to boost the portfolio and market access. For example, Solventum in December 2025 has announced that it had completed the acquisition of Acera Surgical, which is a privately held bioscience company focused on developing and commercializing fully engineered materials for the regenerative wound care. Moreover, the strong players from Japan and South Korea, alongside growing manufacturers from India and Malaysia, intensify competition by offering a cost effective alternatives, pushing the entire sector toward more efficient and accessible advanced wound care.

Corporate Landscape of the Wound Care Market:

Recent Developments

- In January 2026, Beiersdorf has expanded its Health Care business portfolio with the launch of Second Skin Protection Spray Plaster and Second Skin Protection Liquid Plaster Concentrate under the Hansaplast, Elastoplast, and CURITAS brands. These wound care formats target one of the largest categories’ untapped segments.

- In July 2025, Sanara MedTech Inc. announced the launch of its wound care provider pilot program through its subsidiary, Tissue Health Plus, LLC, a first-of-its-kind, value-based wound care offering designed for payers and risk-bearing entities, as well as value-based primary care companies.

- In April 2025, AVITA Medical, Inc., a leading therapeutic acute wound care company, announced the U.S. commercial launch of Cohealyx, a collagen-based dermal matrix branded by AVITA Medical and co-developed with Regenity Biosciences. Cohealyx is designed to facilitate cellular migration and revascularization, thereby providing an ideal wound bed for definitive closure.

- Report ID: 4823

- Published Date: Feb 11, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wound Care Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.