Whole Exome Sequencing Market Outlook:

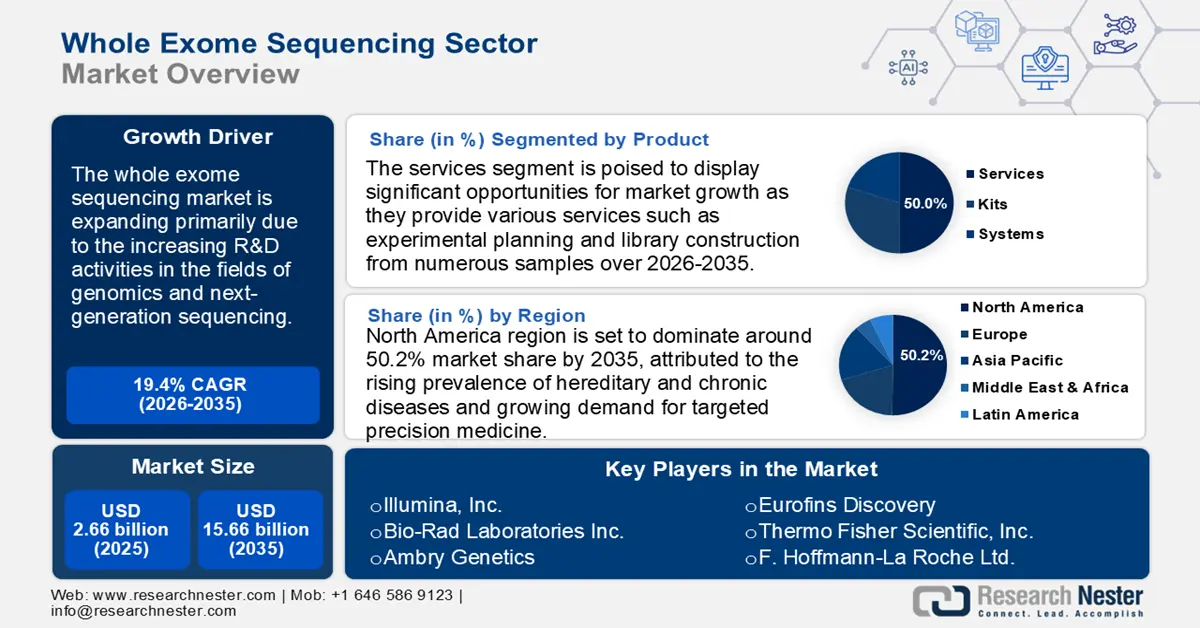

Whole Exome Sequencing Market size was over USD 2.66 billion in 2025 and is poised to exceed USD 15.66 billion by 2035, witnessing over 19.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of whole exome sequencing is estimated at USD 3.12 billion.

The growth of the market can be attributed to growing number of people having genetic mutation. A mutation, often known as a change in a gene, is the cause of more than about 9000 human diseases. About 9 out of every 1000 persons are impacted. According to this, between approximately 60 million and 80 million people worldwide are afflicted by one of these illnesses. Hence, the demand for whole exome sequencing is estimated to increase. Exome sequencing has been proven to be able to identify genetic variants linked to developmental and birth abnormalities. Hence, exome sequencing may allow patients who have a family history of disease or are looking for a diagnosis to explain their symptoms to forego unnecessary diagnostic procedures.

Moreover, the market is also being driven by rising R&D in the fields of genomics and next-generation sequencing. For instance, in May 2022 NanoString Technologies, Inc. released a cloud-based process that enhances the spatial data analysis experience for users of the GeoMx Digital Spatial Profiler and Illumina NextSeq 1000 and NextSeq 2000 sequencing equipment. With the help of this integrated, push-button run planning tool, the geographical analysis of whole transcriptomes and proteome analytes has been made simpler. Hence, the whole exome sequencing market is anticipated to be driven by such advancements. Also, the government spending on R&D for whole exome sequencing is also growing which is also estimated to boost the growth of the market over the forecast period.

Key Whole Exome Sequencing Market Insights Summary:

Regional Highlights:

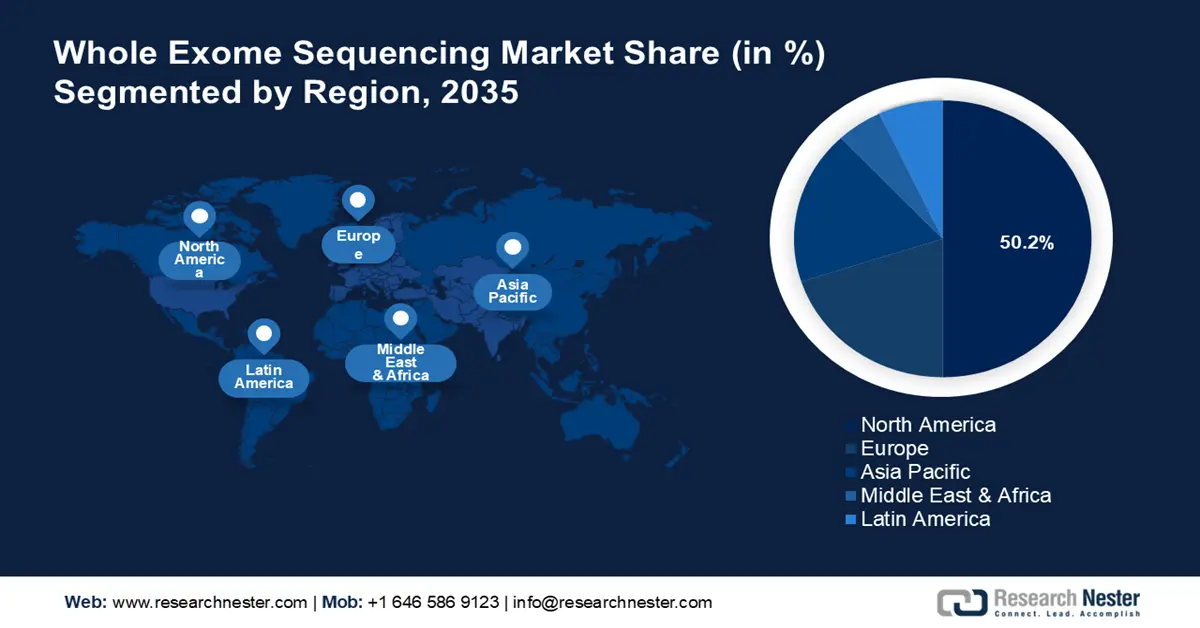

- North America whole exome sequencing market will dominate more than 50.2% share by 2035, attributed to the rising prevalence of hereditary and chronic diseases and growing demand for targeted precision medicine.

- Europe market records the highest CAGR during 2026-2035, attributed to rising HIV and cancer rates, increased use of genetics in medicine, and strategic industry-academic alliances.

Segment Insights:

- The personalized medicine segment in the whole exome sequencing market is anticipated to secure the highest market share by 2035, driven by the increasing prevalence of cancer and the shift toward individualized care.

- The services segment in the whole exome sequencing market is projected to experience significant growth over 2026-2035, driven by growing demand for advanced bioinformatics and sequencing services.

Key Growth Trends:

- Growing Prevalence of Rare Disease

- An Increase in Funding for Genomics Research

Major Challenges:

- Lack of Skilled Professional

- Growing Demand for WGS

Key Players: Illumina, Inc., Bio-Rad Laboratories Inc., Ambry Genetics, Eurofins Discovery, Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche Ltd., Agilent Technologies Inc., BGI Group, Macrogen Inc., Azenta US Inc.

Global Whole Exome Sequencing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.66 billion

- 2026 Market Size: USD 3.12 billion

- Projected Market Size: USD 15.66 billion by 2035

- Growth Forecasts: 19.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (50.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 10 September, 2025

Whole Exome Sequencing Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Prevalence of Rare Disease - According to National Center for Advancing Translational Sciences, one in ten Americans, or 30 million people, are thought to be affected by one of the more than 10,000 identified rare diseases. Heuristic methods, which combine the clinical knowledge gained from earlier unusual disease presentations with the body of medical literature, are a significant part of traditional diagnostic techniques. Several people with rare diseases go years without receiving a diagnosis, and many even pass away. Hence, exome sequencing has made it possible to pinpoint the underlying molecular mechanism of such uncommon and undetected disorders. Therefore, this factor is estimated to boost the growth of the whole exome sequencing market.

-

An Increase in Funding for Genomics Research - The government has announced money for the development of the world's most cutting-edge healthcare system for genomics, which would assist to save lives and enhance health outcomes. The UK's Health and Social Care Secretary announced an investment of about USD 174 million for innovative genomics research in 2022.

- Reduction in Cost of Sequencing - The price of sequencing one million DNA bases—just the raw data from a sequencer—has decreased from over USD 1,100 in 2004 to roughly about USD 0.09 in 2011, and it was more or less at approximately USD 0.02 in 2019.

- Growth in Number of Children Born with Genetic Defect - Birth defects are frequent. A baby with a birth defect is born in the United States every four and a half minutes. This translates to about 110,000 births every year, or approximately 2 out of every 33.

- Upsurge in Healthcare Infrastructure - In 2021, the amount spent on health care in the United States increased by about 3 percent reaching approximately USD 3 trillion, or about USD 12,913 per person.

Challenges

-

Lack of Skilled Professional

-

Whole Exome Sequencing Ethical & Legal Issue

- Growing Demand for WGS - Certain exons may not be captured. Current standard annotations of the human genome may not include the important exon, and using the WES technology currently available, it is simply difficult to cover the entire exome. Hence, disease-causing mutations in these "missing" exons won't be noticed. If the most thorough exon coverage is required, WGS has proven to offer more thorough exome coverage than WES. Hence, this factor is estimated to hinder the growth of the market.

Whole Exome Sequencing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.4% |

|

Base Year Market Size (2025) |

USD 2.66 billion |

|

Forecast Year Market Size (2035) |

USD 15.66 billion |

|

Regional Scope |

|

Whole Exome Sequencing Market Segmentation:

Application Segment Analysis

The global whole exome sequencing market is segmented and analyzed for demand and supply by application into diagnostics, drug discovery & development, personalized medicine, and agriculture & animal research. Out of which, the personalized medicine segment is anticipated to garner the highest revenue by the end of 2035. The growth of the segment can be attributed to growing prevalence of multiple cancer forms. Since, more people than ever before are receiving their initial cancer diagnosis later in life, second cancers are becoming more prevalent. One in about five individuals with a cancer diagnosis have already experienced another type of malignancy in America. Hence, a greater focus is being placed on personalized medicine. Moreover, this is also driven by a fundamental change from the "one size fits all" model for treating individuals with disorders or a propensity for diseases, and towards one that embraces novel approaches, including personalized target medicines, to get the greatest results. In order to profit from personalized treatment, a number of national and international genome initiatives have been launched. In contrast to whole genome sequencing, exome and targeted sequencing offer a compromise between cost and utility.

Product Segment Analysis

The global whole exome sequencing market is also segmented and analyzed for demand and supply by product into systems, kits, and services. Amongst which, services segment is anticipated to have a significant growth over the forecast period. Researchers could devote more time to their work rather than tedious analytical tasks as a result of the sophisticated bioinformatics visualization capabilities given by Next-Generation Sequencing (NGS) and data analysis services. These sequence analysis services provide a variety of services, including experimental planning, library construction from a variety of samples, and downstream DNA sequence analysis. The complexity of a number of bioinformatics-related problems has been reduced for scientists and researchers owing to these services, which have also decreased the amount of time and money required for sequencing and data management. Using whole exome sequencing, which focuses on the most crucial portion of the genome, enables researchers to more effectively utilize sequencing and analytical resources.

Our in-depth analysis of the global whole exome sequencing market includes the following segments:

|

By Product |

|

|

By Technology |

|

|

By Application |

|

|

By End-User

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Whole Exome Sequencing Market Regional Analysis:

North American Market Insights

North America region is set to dominate around 50.2% market share by 2035, attributed to the rising prevalence of hereditary and chronic diseases and growing demand for targeted precision medicine. About half of all Americans (around 45%, or 133 million) experienced at least one chronic illness in 2018, and the number is rising. Chronic illnesses are a particular category of silent illness that, if not treated in a timely manner, could harm individuals irreversibly. Hence, the market for whole exome sequencing in North America is growing. Moreover, next-generation sequencing (NGS) is becoming a potent tool for delivering a deeper and more precise insight at the molecular underpinnings of individual tumors and specific receptors as genomics-focused pharmacology continues to play a greater role in the treatment of various chronic diseases, particularly cancer in North America.

Europe Market Insights

The European whole exome sequencing market is estimated to be the second largest, to have the highest growth over the forecast period. The Human Immunodeficiency Virus (HIV) and rising cancer rates have both had a big positive impact on the European market. The increased use of genetics in medicine has also significantly impacted the next-generation sequencing market in Europe's future expansion. Genome editing, gene synthesis, and next-generation sequencing are just a few of the technologies employed in genomics. Given the consistently falling cost of sequencing and strategic alliances between top corporations and premier research universities, the Germany market accounted for the greatest revenue share. A further factor in this region's market revenue increase is the rising prevalence of genetic diseases.

APAC Market Insights

Additionally, the whole exome sequencing market in Asia Pacific region is estimated to have the significant growth over the forecast period. The growth of the market in this region can be attributed to growing genetic abnormalities in this region. However, given the significant socioeconomic differences in the region and the paucity of research, knowledge, and health policies for those with rare diseases, managing rare diseases is particularly difficult in Asia and the Pacific. The area also struggles with a lack of medical knowledge and momentum when it comes to recognizing and meeting patients' unmet needs. Most crucially, these shortcomings are made worse by the paternalistic health systems in the area, where patients' opinions are rarely valued or heard. Hence, government are taking initiatives in order to spread awareness among people and also investing highly on research & development of exome sequencing.

Whole Exome Sequencing Market Players:

- Illumina, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bio-Rad Laboratories Inc.

- Ambry Genetics

- Eurofins Discovery

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Agilent Technologies Inc.

- BGI Group

- Macrogen Inc.

- Azenta US Inc.

Recent Developments

-

The first blood virological profile of the Chinese population was created in October 2022 by BGI Group, Ruijin Hospital, and Shanghai Jiao Tong University Institute of Translational Medicine using BGI's DNBSEQ sequencing platform. This analysis involved a thorough examination of non-human genetic sequences in the whole genome sequencing (WGS) data of about 10,584 individuals from the China Metabolic Analysis Program (ChinaMAP). The findings, which were published in the journal Cell Discovery, serve as a resource for viral infection epidemiology and prevention.

-

The SEQuoia RiboDepletion Kit, which increases test efficiency by removing pointless ribosomal RNA (rRNA) fragments from an RNA-Seq library, has been introduced by Bio-Rad Laboratories, Inc., a world leader in life science research and clinical diagnostic products.

- Report ID: 4794

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Whole Exome Sequencing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.