Whisper Valve Market Outlook:

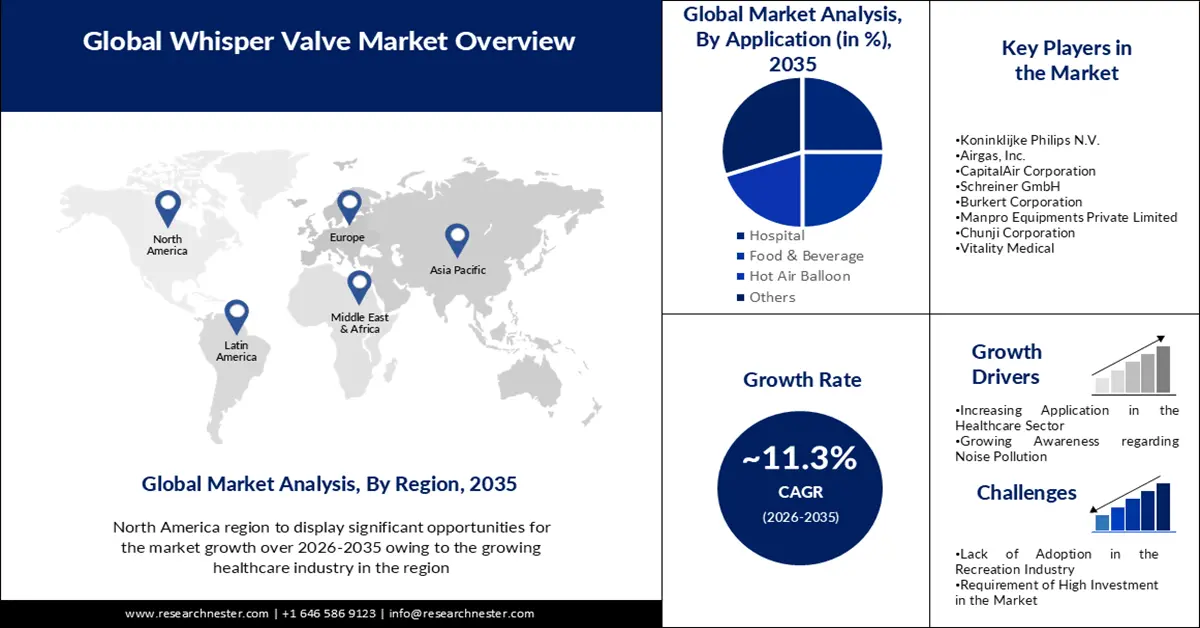

Whisper Valve Market size was valued at USD 120.88 billion in 2025 and is likely to cross USD 352.62 billion by 2035, expanding at more than 11.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of whisper valve is estimated at USD 133.17 billion.

The growth market is driven by the growing demand for whisper valves in the oil and gas industry. Whisper valves are commonly used in the oil and gas industry to regulate fluid flow in pipelines, refineries, and processing plants. As demand for oil and gas continues to grow, demand for whisper valves is also expected to grow. Furthermore, Natural gas is becoming an increasingly important energy source, with demand expected to grow at an annual rate of 1.6% through 2040, according to the IEA. As the oil and gas industry invests in new infrastructure to support natural gas production and transportation, the need for whisper valves is increasing.

Moreover, the growing focus on energy efficiency is another significant factor expected to drive the growth of the market in the forecast period. Whisper valves are designed to operate with minimal noise and vibration, helping reduce energy consumption and improve process system efficiency. As energy costs continue to rise, many businesses are looking for ways to reduce their energy consumption and improve their bottom line, driving demand for whisper valves. Additionally, many governments around the world have introduced regulations to reduce their energy consumption and greenhouse gas emissions. For instance, the European Union has introduced a Building Energy Performance Directive that obliges member states to develop strategies to improve the energy efficiency of their buildings.

Key Whisper Valve Market Insights Summary:

Regional Highlights:

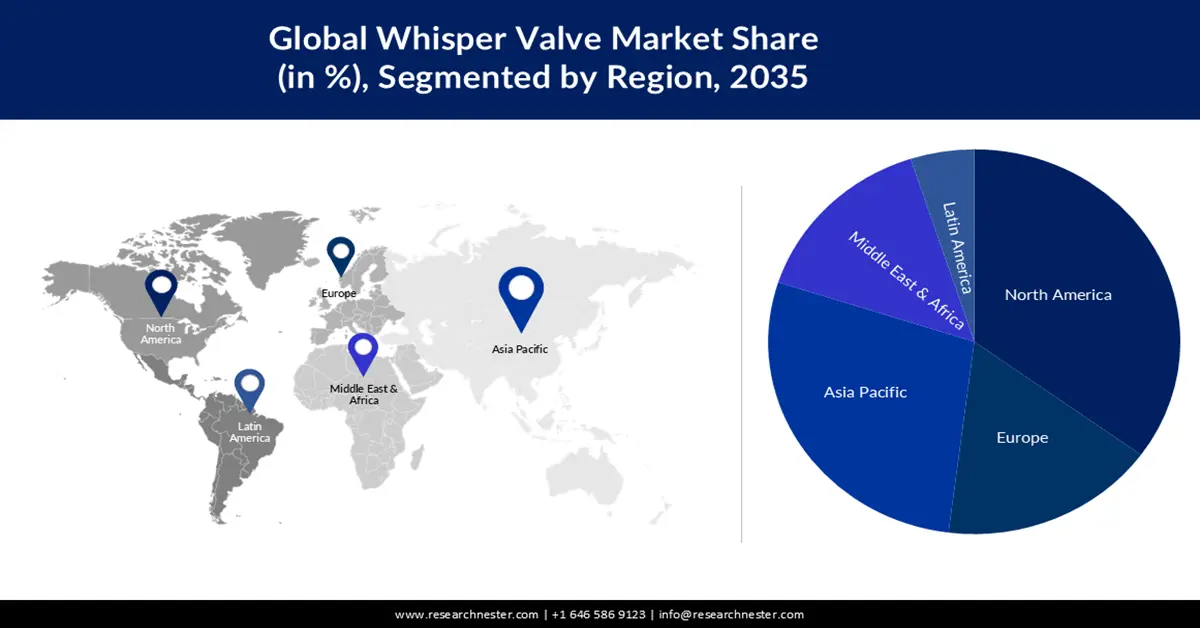

- By 2035, the North America region is expected to command the largest share of the whisper valve market, underpinned by rising healthcare-sector demand.

- The Asia Pacific region is projected to record noteworthy growth through 2035, supported by increasing adoption of advanced medical technologies.

Segment Insights:

- The medical segment is anticipated to secure the largest share by 2035 in the whisper valve market, propelled by the growing prevalence of respiratory diseases.

- The food & beverage segment is set to attain a significant share by 2035, enabled by stringent hygiene and contamination-control regulations.

Key Growth Trends:

- Increasing Application in the Healthcare Sector

- Growing Awareness regarding Noise Pollution

Major Challenges:

- Complex Installation and Maintenance Requirement

- Lack of Adoption in the Recreation Industry

Key Players: Started Health Care Private Limited, Koninklijke Philips N.V., Airgas, Inc., CapitalAir Corporation, Schreiner GmbH, Burkert Corporation, Manpro Equipments Private Limited, Chunji Corporation, Vitality Medical, Middlesex Gases & Technologies, Inc.

Global Whisper Valve Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 120.88 billion

- 2026 Market Size: USD 133.17 billion

- Projected Market Size: USD 352.62 billion by 2035

- Growth Forecasts: 11.3%

Key Regional Dynamics:

- Largest Region: North America (Largest Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 21 November, 2025

Whisper Valve Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Application in the Healthcare Sector - In recent years, the use of whisper valves in healthcare has increased. These valves are used in medical gas delivery systems such as oxygen therapy and anesthesia delivery systems to regulate gas flow with minimal noise and vibration. This increases the patient’s comfort and reduces the risk of equipment failure. According to a study published in the Journal of Clinical Anesthesia, using Whisper valves in anesthesia systems can reduce the occurrence of anesthesia-induced coughing and improve patient comfort during the induction of anesthesia.

- Growing Awareness regarding Noise Pollution – Increasing awareness of noise pollution is one of the factors driving the whisper valve market. Noise pollution is a major environmental and health concern, and industry is increasingly adopting noise abatement measures to minimize its impact. Whisper valves are designed to minimize noise and vibration, making them an effective solution for noise reduction in industrial processes. Several studies have shown the effects of noise pollution on human health, including hearing impairment, hypertension, and cardiovascular disease. In response, governments and regulators around the world have enacted regulations to reduce noise pollution. For instance, the U.S. Environmental Protection Agency (EPA) sets noise level limits for various industrial, commercial, and residential areas, and businesses must comply with these regulations to avoid penalties.

- Rising Adoption of Industrial Automation - Whisper valves are commonly used in automated process control systems that can be controlled remotely using computers and other electronic devices. As the adoption of industrial automation continues to increase, the demand for whisper valves is also expected to increase. According to a report by the International Federation of Robotics, global sales of industrial robots will grow by 11% in 2020, with the largest markets being China, Japan, and the United States.

- Growing Demand in Oil and Gas Industry - Whisper valves are commonly used in the oil and gas industry to regulate fluid flow in pipelines, refineries, and processing plants. As demand for oil and gas continues to grow, demand for whisper valves is also expected to grow. For instance, in 2021 Samson AG announced that it had won a contract to supply whisper valves to a new offshore oil and gas project in the North Sea. The order value has exceeded USD 5 million, demonstrating the growing demand for Whisper valves in the oil and gas industry.

Challenges

- Complex Installation and Maintenance Requirement - Whisper valves can be more complex to install and maintain than other types of control valves, which can increase the cost and time required for installation and maintenance. This can be a major challenge for organizations that need to minimize downtime and run processes efficiently.

- Lack of Adoption in the Recreation Industry

- Requirement of High Investment in the Market

Whisper Valve Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.3% |

|

Base Year Market Size (2025) |

USD 120.88 billion |

|

Forecast Year Market Size (2035) |

USD 352.62 billion |

|

Regional Scope |

|

Whisper Valve Market Segmentation:

Application Segment Analysis

The global whisper valve market is segmented and analyzed for demand and supply by application into medical, food & beverage, hot-air balloon, and others. Out of these, the medical segment is anticipated to hold the largest market share by the end of 2035. Whisper valves are used in a variety of medical devices such as ventilators, portable ventilators, and anesthesia systems to regulate gas and airflow with minimal noise and vibration. Whisper valves are commonly used in respiratory therapy to regulate airflow in devices such as ventilators and oxygen concentrators. For instance, the World Health Organization reports that respiratory diseases are the second leading cause of death worldwide, killing an estimated 3 million people each year. As the prevalence of respiratory diseases continues to increase, so does the demand for respiratory equipment such as ventilators, nebulizers, and oxygen concentrators. These devices often use whisper valves for precise control.

After the medical segment, the food and beverage segment is anticipated to hold a significant market share by the end of 2035. Whisper valves are used in food and beverage processing equipment to regulate the flow of liquids such as water, milk, and other beverages. They are commonly used in pipelines, tanks, and other fluid-handling systems. Moreover, the food and beverage segment is subject to strict quality and safety regulations, especially regarding hygiene and contamination control. Whisper valves help ensure compliance with these regulations by precisely controlling the flow of liquids and gases and minimizing the risk of contamination

Our in-depth analysis of the global market includes the following segments:

|

By Gauge Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Whisper Valve Market - Regional Analysis

North American Market Insights

North America industry is anticipated to account for largest revenue share by 2035, impelled by increasing demand for whisper valves in the healthcare sector. This can be attributed to the increasing demand for whisper valves in the healthcare sector, backed by the surge in organ transplant surgeries. As per the data by the U.S. Health Resources & Services Administration, more than 40,000 organ transplants were performed in 2021, while over 106,076 people including, men, women, and children were on the national transplant waiting list. The manufacturing sector in North America, especially in the United States, is growing rapidly. Whisper valves are increasingly used in manufacturing processes to precisely control the flow of liquids and gases, reduce waste and improve efficiency. Furthermore, in North America, there is a growing interest in energy efficiency and sustainability, especially in the development of government policies and initiatives aimed at reducing greenhouse gas emissions. Whisper valves play a key role in achieving energy efficiency by reducing energy consumption and minimizing waste.

APAC Market Insights

The market in the Asia Pacific region is estimated to witness noteworthy growth over the forecast period owing to the increasing adoption of advanced technology in the medical industry, along with the presence of major manufacturers in the region. China is one of the largest and fastest-growing markets in the Asia-Pacific region, driven by a rapidly growing industrial sector. The Chinese government's focus on energy efficiency and environmental sustainability is also boosting the demand for whisper valves in the region. Asia-Pacific is a hub for innovation, especially in the areas of automation and digitization. Whisper valves can be easily integrated into digital control systems for more precise control of liquid and gas flows. This has increased the demand for whisper valves in various industries. Concerns about climate change and rising energy costs are driving an increased focus on energy efficiency in the Asia-Pacific region. Whisper valves help improve energy efficiency by precisely controlling liquid and gas flows, reducing energy consumption, and minimizing waste.

Europe Market Insights

The market in the Europe region is anticipated to hold a significant market share in the forecast period. The European whisper valve market is growing steadily owing to factors such as increasing demand for energy-efficient solutions, growing awareness of noise pollution, and the presence of an established industrial sector. Germany is Europe's largest and most mature market for whisper valves, driven by its strong industrial sector and commitment to energy efficiency and environmental sustainability. The country is home to some of the world's leading whisper valve manufacturers, and its advanced manufacturing sector offers significant growth opportunities for whisper valve suppliers.

Whisper Valve Market Players:

- Started Health Care Private Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Koninklijke Philips N.V.

- Airgas, Inc.

- CapitalAir Corporation

- Schreiner GmbH

- Burkert Corporation

- Manpro Equipments Private Limited

- Chunji Corporation

- Vitality Medical

- Middlesex Gases & Technologies, Inc.

Recent Developments

- Airgas Inc. is purchasing wind power for its Air Separation Unit (ASU) in Texas. Airgas will evaluate new local renewable energy sources for other ASUs and primary production units.

- Philips to expand its network of clinical partners in Belgium, France, the UK, and Israel. The partner sites include Royal Brompton Hospital, Hôpital Erasme, Ziekenhuis Oost-Limburg (ZOL), Genk Medical Center, and Carmel Medical Center.

- Report ID: 4054

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Whisper Valve Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.