Web Content Management Market Outlook:

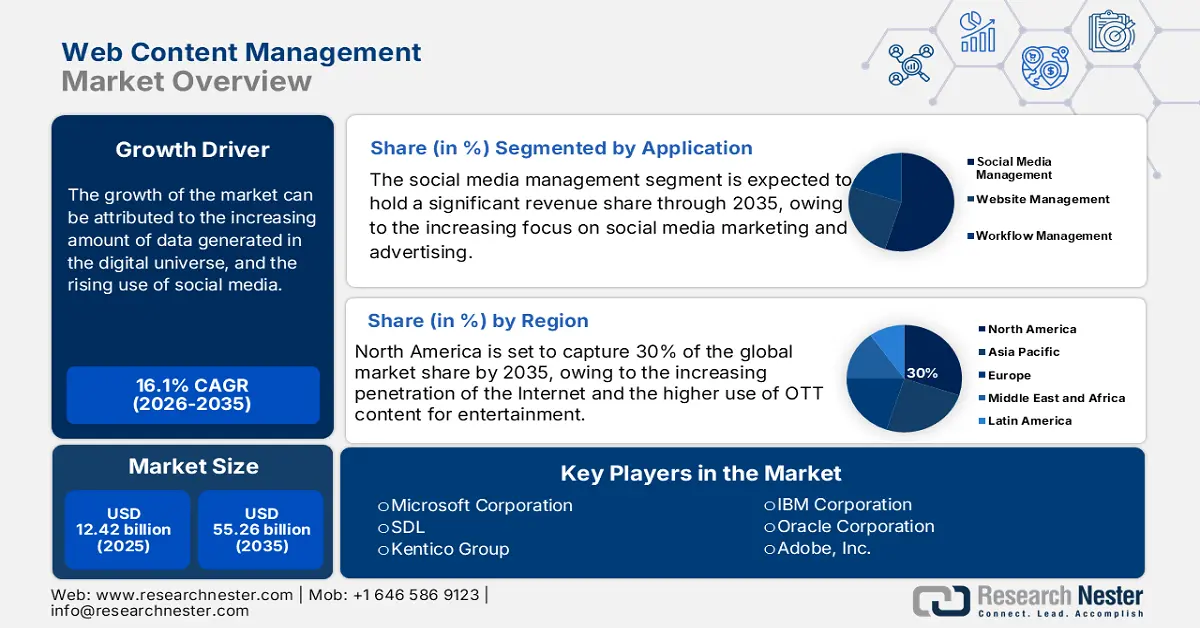

Web Content Management Market size was valued at USD 12.42 billion in 2025 and is expected to reach USD 55.26 billion by 2035, expanding at around 16.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of web content management is evaluated at USD 14.22 billion.

growth of the market can be attributed to the increasing amount of data generated in the digital universe. Managing content gives more control over producing new content, editing current information, and distributing it to others for exploration and usage. Globally, every day, around 4 quintillion bytes of data are created. Moreover, every day, Skype receives nearly 3 billion minutes of calls, and around 5 billion Snapchat videos and photographs are shared. In addition to this, every day, nearly 330 billion emails are sent.

In addition to these, factors that are believed to fuel the web content management market growth of web content management include the rising use of social media. Social media is a type of internet-based communication. Users of social networking sites can hold conversations, share information, and produce web content. India has approximately 315 million Facebook users, making it the country with the largest Facebook audience. In addition, the United States, Indonesia, and Brazil each have 175 million, 119 million, and 109 million Facebook users. On the other hand, TikTok is the fastest-growing social network in the world, with a user growth rate of 100% between 2020 and 2022. Furthermore, Instagram secretly surpassed 2 billion users in 2022, and marketers are still pushing for more Instagram followers. Besides this, the rising penetration of digitalization and 5g services is also expected to augment the web content management market growth.

Key Web Content Management Market Insights Summary:

Regional Highlights:

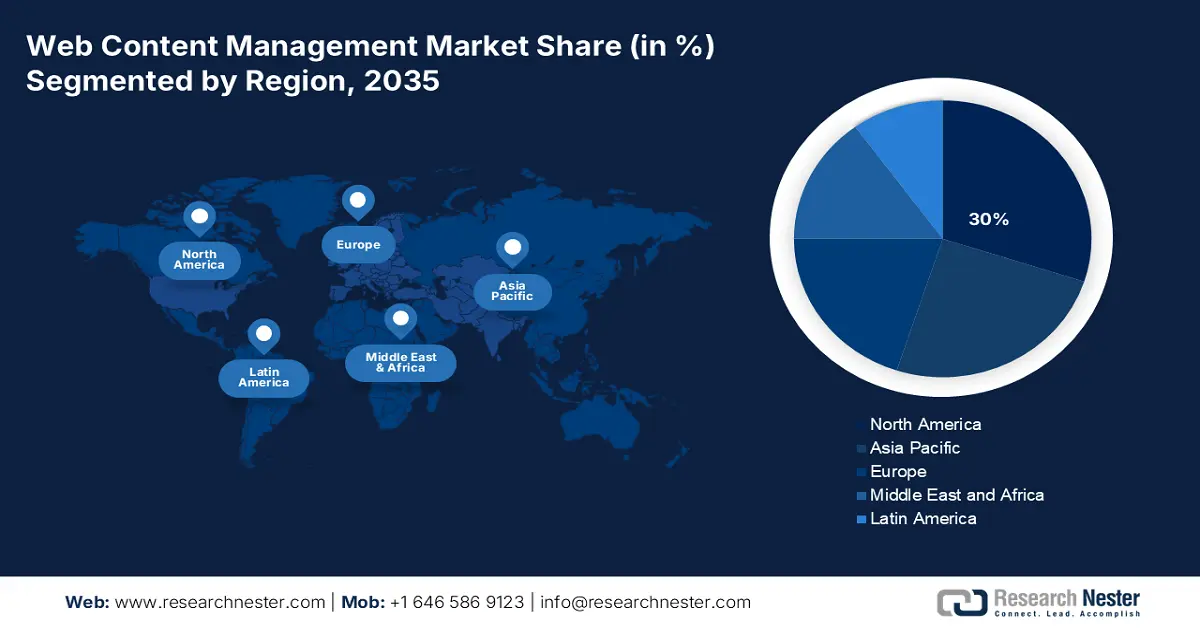

- North America web content management market will hold over 30% share by 2035, increasing penetration of the internet and higher use of OTT content for entertainment.

- Asia Pacific market will secure 28% share by 2035, increasing use of OTT platforms.

Segment Insights:

- The cloud segment in the web content management market is expected to achieve significant share by 2035, driven by rising use of cloud computing and multi-cloud strategies.

- The social media management segment in the web content management market market will secure the largest share, propelled by increasing focus on social media marketing and rising ad spending on platforms over the forecast period 2026-2035.

Key Growth Trends:

- Growing Prevalence of the Internet

- Rise in the Number of People Using Smartphones

Major Challenges:

- Risk Associated with Risk and Privacy

- Data Integration Leads to Software Interoperability

Key Players: Open Text Corporation, Microsoft Corporation, Adobe, Inc., IBM Corporation, Oracle Corporation, Optimizely AB, Acquia, Inc., Sitecore Holding II A/S, SDL, Kentico Group.

Global Web Content Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.42 billion

- 2026 Market Size: USD 14.22 billion

- Projected Market Size: USD 55.26 billion by 2035

- Growth Forecasts: 16.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Singapore, South Korea, Malaysia

Last updated on : 10 September, 2025

Web Content Management Market Growth Drivers and Challenges:

Growth Drivers

- Growing Prevalence of the Internet – With the rising use of Internet, people are more actively consuming the content available on the digital universe. By 2022, nearly 69% of the total population of the world uses the internet which makes up nearly 5 billion people. Moreover, the number of internet users is rising with an annual rate of 4%indicating that every year around 196 million get access to the internet.

- Rise in the Number of People Using Smartphones –Smartphones has played a crucial role in the digital transformation of all developed and developing countries. This in turn has also boosted the use of the web and high generation of content. China, India, and the United States have the most smartphone mobile network subscriptions. The global number of smartphone mobile network subscriptions reached over 7 billion in 2022 and is expected to hit around 8 billion by 2028.

- Increasing Engagement on Social Media – With the increased usage of social media, the need of developing a social media content strategy, managing an editorial calendar and social media analytics, allocating content promotion money, and assessing KPIs have grown. As of November 2022, around 3 billion users equal to approximately 37% of the world's 8 billion population use social media and it accounts for nearly 47% of the world's population aged 13 and up.

- Growing Generation of Data on Web– The higher generation of data on the digital universe has significantly boosted the demand for web content management services. At the start of 2020, the total amount of data on the planet was predicted to be around 44 zettabytes. The quantity of data generated per day is predicted to reach nearly 463 exabytes by 2025.

- Rising Shifting Towards OTT Platform – The OTT platform and online video streaming has significantly contributed to the rise of content on the web and increased the need for web content management. In 2022, around 3 billion individuals used the OTT platform, worldwide. While it is expected that the number of OTT subscribers would reach over 4 billion by 2023.

Challenges

- Risk Associated with Risk and Privacy - While the importance of web security cannot be overstated, defending against web security threats is becoming increasingly difficult. IT security departments have significant obstacles when attempting to secure the web, ranging from preventing assaults to dealing with limited skills and resources. Moreover, the web, and notably the usage of DNS services, are used in 91% of all malware attacks, while email and web together account for 99% of successful breaches.

- Data Integration Leads to Software Interoperability

- Presence of a Huge Amount of Unstructured Data

Web Content Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.1% |

|

Base Year Market Size (2025) |

USD 12.42 billion |

|

Forecast Year Market Size (2035) |

USD 55.26 billion |

|

Regional Scope |

|

Web Content Management Market Segmentation:

Application Segment Analysis

The global web content management market is segmented and analyzed for demand and supply by application into website management, workflow management, and social media management. Out of the three applications of web content management, the social media management segment is estimated to gain the largest Web Content Management market share in the year 2035. The growth of the segment can be attributed to the increasing focus on social media marketing and advertising. Ad spending on social media is steadily increasing. With more marketers spending on advertisements, firms are preparing to allocate larger funds to sponsored marketing techniques to compete. Around 77% of B2B and B2C marketers use retargeting advertisements as part of their Facebook and Instagram advertising campaigns. Furthermore, the rising use of social media is also expected to boost the segment growth. The amount of time internet users spend on social media is currently higher than ever that is around 151 minutes each day. Furthermore, the average user switches between seven different social networks each month.

Deployment Segment Analysis

The global web content management market is also segmented and analyzed for demand and supply by deployment into on-premise, and cloud. Amongst these two segments, the cloud segment is expected to garner a significant share in the year 2035. The growth of the segment is attributed to the rising use of cloud computing and cloud storage. In the United States, cloud services are used by around 94% of businesses. Furthermore, nearly 67% of enterprise infrastructure is currently hosted in the cloud. In addition to this, about 92% of firms have or are planning a multi-cloud strategy. Owing to encryption, the cloud is extremely secure. As a result, information is less accessible to hackers and those who are not authorized to access it. The majority of firms store data in the cloud, and nearly half trust its security and reliability enough to store their most critical data.

Our in-depth analysis of the global web content management market includes the following segments:

|

By Component |

|

|

By Deployment |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Web Content Management Market Regional Analysis:

North American Market Insights

The web content management market in North America is projected to be the largest with a share of about 30% by the end of 2035. The growth of the market can be attributed majorly to the increasing penetration of the internet. At the start of 2023, the internet penetration rate in the United States was approximately 92 percent of the total population. Between 2022 and 2023, the number of Internet users in the United States increased by around 2 million. Furthermore, higher use of OTT content for entertainment is also expected to boost web content management market growth. In 2022, Canada had the highest OTT penetration rate of around 90% followed by New Zealand and the United Kingdom.

APAC Market Insights

The Asia Pacific web content management market is estimated to be the second largest, registering a share of about 28% by the end of 2035. The growth of the Web Content Management Market can be attributed majorly to the increasing use of OTT platforms. India's OTT audience increased by 20% between 2021 and 2022. Almost half of the OTT audience views online videos on free streaming services such as YouTube. The Indian OTT audience universe now numbers 424 million people. In India, 119 million of these are active paid OTT subscriptions. Moreover, in 2019, over 52% of Chinese people watched TV shows on OTT devices, reaching over 611 million people. After mobile phones, OTT devices have become the second largest online video viewing channel for Chinese netizens.

Europe Market Insights

Europe region is anticipated to register substantial growth through 2035. The growth of the market can be attributed majorly to the growing demand for online services. According to the results of the EIB Investment Survey (EIBIS) performed from April to July 2021, 46% of enterprises in the European Union have taken steps to become more digital, such as by providing services online. In addition to this, according to Eurostat, in 2022, 93% of EU households would have internet connectivity, up from 72% in 2011. On the other hand, web content management market growth in Europe is also expected on the account of a higher number of people using smartphones. Between 2023 and 2028 smartphone penetration in Europe is expected to rise steadily by around 5 percentage points. Furthermore, penetration will have increased for the fifth year in a row to around 89 percent.

Web Content Management Market Players:

- Open Text Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- Adobe, Inc.

- IBM Corporation

- Oracle Corporation

- Optimizely AB

- Acquia, Inc.

- Sitecore Holding II A/S

- SDL

- Kentico Group

Recent Developments

-

SDL announced the launch of SDL Tridion, its intelligent content platform. It speeds up digital transformation and delivers next-generation digital experiences to consumers, partners, and workers. It significantly increases automation and bridges content divisions. Moreover, it addresses the problems of content duplication, antiquated methods, isolated information repositories, inefficient content delivery

-

Open Text Corporation announced the launch of the new content services platform OpenText Core Content and OpenText Core Case Management. It provides robust records management, case management, APIs, and connection with popular apps.

- Report ID: 4815

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Web Content Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.