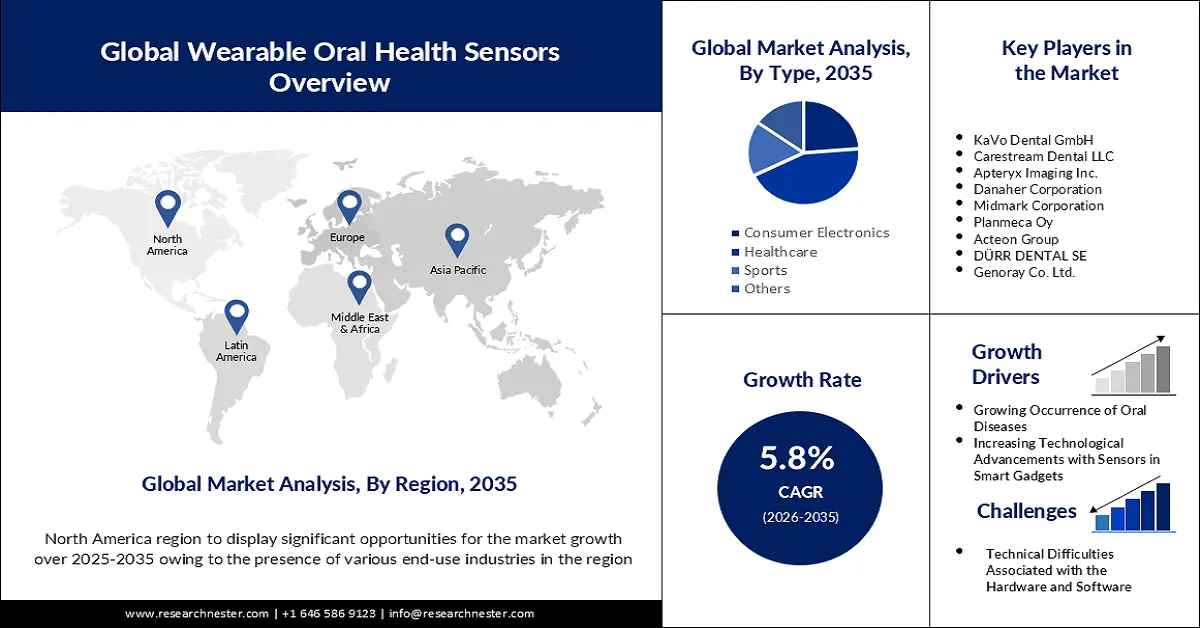

Wearable Oral Health Sensors Market Outlook:

Wearable Oral Health Sensors Market size was valued at USD 11.02 billion in 2025 and is likely to cross USD 19.37 billion by 2035, expanding at more than 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wearable oral health sensors is estimated at USD 11.6 billion.

The growth of the market can be attributed to the Increased prevalence of oral diseases and technological developments with sensors in smart devices. Increasing healthcare expenditure is expected to drive the market over the coming decades.

Rising investment in the healthcare industry leads to the usage of smart medical equipment such as wearable oral health sensors. As per the projections by the Centers for Medicare & Medicaid Services (CMS), the estimated average annual percent change related to National Health Expenditures (NHE) in the U.S. was 5.2% in 2020 as compared to 2019 (4.5%). Furthermore, the National Health Expenditures are projected to reach USD 6,192.5 Billion in 2028, where the per capita expenditure is estimated to touch USD 17,611 in the same year. These are notable indicators that are anticipated to create lucrative business opportunities in the upcoming years.

Key Wearable Oral Health Sensors Market Insights Summary:

Regional Insights:

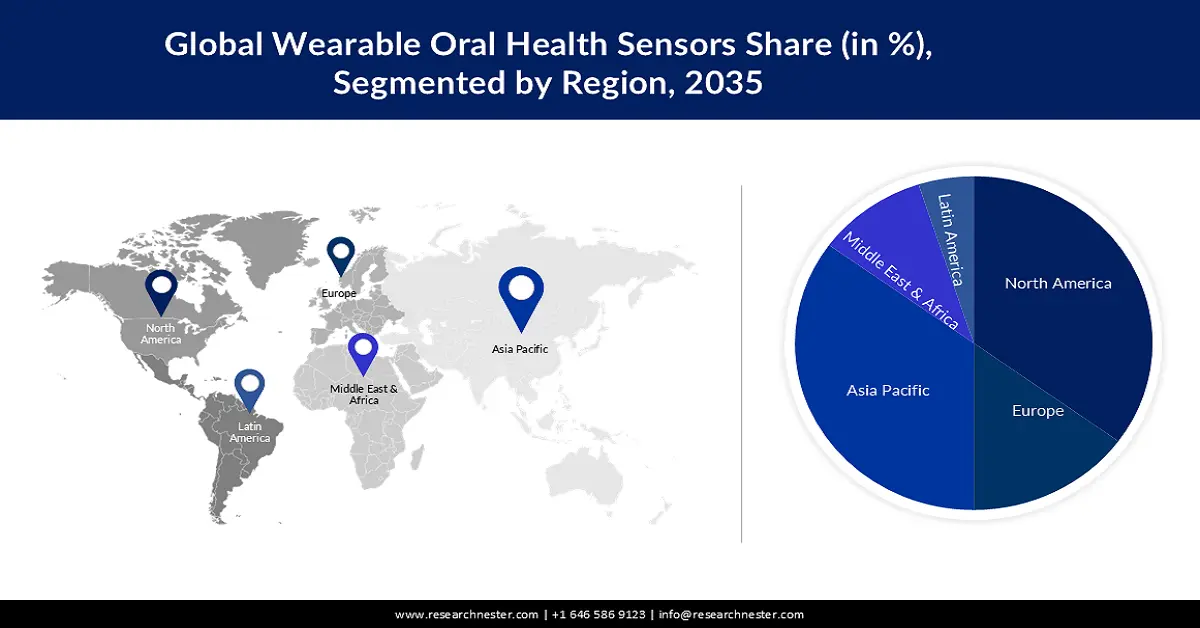

- By 2035, North America is anticipated to secure the largest revenue share in the Wearable Oral Health Sensors Market, propelled by rising dental disorder prevalence and strong healthcare infrastructure.

- Europe is projected to hold a notable share by 2035, supported by expanding wireless technologies and the region’s sizable elderly population.

Segment Insights:

- The healthcare segment is projected to command about a 40% share by 2035 in the Wearable Oral Health Sensors Market, supported by rising adoption of miniaturized smart sensor technologies for real-time oral health monitoring.

Key Growth Trends:

- Growing Occurrence of Oral Diseases

- Expanding the Usage of Modern Digital Technology

Major Challenges:

- Technical Challenges with Hardware and Software

- Expensive Cost of Technologically Sophisticated Sensors

Key Players: Dentsply Sirona Inc., KaVo Dental GmbH, Carestream Dental LLC, Apteryx Imaging Inc., Danaher Corporation, Midmark Corporation, Planmeca Oy, Acteon Group, Dürr Dental SE, Genoray Co. Ltd.

Global Wearable Oral Health Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.02 billion

- 2026 Market Size: USD 11.6 billion

- Projected Market Size: USD 19.37 billion by 2035

- Growth Forecasts: 5.8%

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 19 November, 2025

Wearable Oral Health Sensors Market - Growth Drivers and Challenges

Growth Drivers

Growing Occurrence of Oral Diseases- Cavities (tooth decay), gum (periodontal) disease, and oral cancer are some of the most prevalent conditions affecting our oral health. More than 40% of adults have experienced oral pain in the last year, and more than 80% are expected to have at least one cavity by the age of 34. As a result, the increasing prevalence of oral diseases is predicted to expand the use of wearable oral health sensors in order to deliver enhanced dental care to the patient population.

Expanding the Usage of Modern Digital Technology- The increasing use of advanced digital technologies in daily practice helps dentists provide better patient experience and treatment. Digital dental radiography, which employs specific sensors and software to make digital images of teeth and oral cells, is one instance of such progress. According to current estimates, the worldwide digital technology business is worth approximately $469.8 billion. This figure is predicted to rise to $1,009.8 billion by 2025.

Increased Consumption of Consumer Electronics Worldwide Owing to the Rapid Implementation of Smart Devices- From cellphones to wearable devices, India's consumer electronics usage increased by 8% in 2021 as contrasted with 2019 before the pandemic began. China was predicted to create an overall of USD 250 billion in revenue by the end of 2022. The expanding urban population, associated with a better lifestyle, has generated health and safety consciousness; as a result, electronic and digital gadgets are becoming increasingly prevalent among the populace. The increasing adoption of smartphones and linked devices, in addition to the affordable prices and convenience given by miniaturized electronics, are a few of the factors predicted to increase the global wearable oral health sensors market size throughout the forecast period.

A large number of senior citizens- The population of Americans aged 65 and more is expected to almost double over the next three decades, rising from 48 million to 88 million by 2050.

Growing awareness among the people for fitness- According to a survey, 84% of people in India believe health awareness has increased after the Covid-19 pandemic.

Challenges

- Technical Challenges with Hardware and Software

- Expensive Cost of Technologically Sophisticated Sensors Production of Electronic Devices Is Interrupted Due to Covid-19- The coronavirus outbreak had a tremendous impact on manufacturing and production hubs, causing all enterprises to close for several weeks. Electronics production was hampered due to work constraints and inadequate supplies in the company. Furthermore, because the finished products had not been delivered for sale, the companies continued to manufacture, stifling market growth during the projection period.

Wearable Oral Health Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 11.02 billion |

|

Forecast Year Market Size (2035) |

USD 19.37 billion |

|

Regional Scope |

|

Wearable Oral Health Sensors Market Segmentation:

End-user Segment Analysis

The global wearable oral health sensors market is segmented and analyzed for demand and supply by end-user into healthcare, sports, consumer electronics, and others. Out of these, the healthcare segment is estimated to gain the largest market share of about 40% in the year 2035. The worldwide wearable oral health sensors market was expected to be dominated by the healthcare segment in 2022. With increased knowledge about medical services, there is a growing demand for smart sensor technologies and surveillance devices that can sense and provide feedback to consumers about their oral health state for greater safety. Considering smaller forms of sensors are more versatile and can be placed in a range of devices to gather data in real-time, miniaturizing health sensors is estimated to result in major gains in their application. In addition, Rockley Photonics reported in September 2021 that the business had increased the spectrum of potential uses for its non-invasive biomarker sensor technology to enable a broader range of medical equipment and systems.

Our in-depth analysis of the global market includes the following segments:

|

By Distribution Channel |

|

|

By Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wearable Oral Health Sensors Market - Regional Analysis

North American Market Insights

North America industry is poised to account for largest revenue share by 2035, on the back of the growing occurrence of dental disorders, high healthcare expenditure, and the strong presence of healthcare manufacturers in the region. As per the United States Centers for Medicare & Medicaid Services, the total healthcare spending of the country increased by 4.6 percent in 2019, reaching USD 3.8 trillion. The total health spending accounted to be 17.7 percent of the total GDP share of the US. Also, Government assistance in providing consultation as well as knowledge via digital platforms in remote places is expected to aid in market growth. Moreover, The region's huge market share can be ascribed to the region's high rate of adoption of sophisticated products, substantial reimbursement coverage, and the arrival of new firms with innovative technology.

Europe Market Insights

Moreover, the wearable oral health sensors Market in Europe is also expected to grab a notable share in the market owing to the reduced cost of sensors, the growing expansion of wireless technology, and the large number of elderly people in the region. Based on Statista's 2021 data, Europe has the highest share of old people (19%). Furthermore, Germany has contributed the most to Europe's old population, with 17.78 million. Apart from these, rising consciousness among the people for fitness and easy availability of medical applications are also assessed to expand this region’s market in the near future. Moreover, As per the GSMA, 474 million individuals (86% of the population) in Europe registered for mobile services in 2021, with that figure predicted to climb to 480 million by 2025. Such advancements in consumer electronics are expected to fuel industry expansion even further.

APAC Market Insights

During the projection period, the Asia Pacific wearable oral health sensors market is anticipated to occupy a large market share. The existence of a big population, as well as a rise in consumer expenditure on oral hygiene, is projected to have an impact on the industry's growth. With increased consumer knowledge and interest in smart devices, there is expected to be plenty of potential for wearable oral health sensor. However, elevated costs of goods may have an impact on consumption from the middle-class population. Major periodontitis, unaddressed dental caries, and missing teeth rank 77th, 80th, and 81st, respectively, in the top 100 disorders affecting DALYs in China. On average, these three disorders resulted in the loss of 224 healthy years per 100,000 people. Therefore, the rising prevalence of oral diseases is predicted to expand the use of wearable oral health sensors in the Asia Pacific.

Wearable Oral Health Sensors Market Players:

- DENTSPLY SIRONA Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- KaVo Dental GmbH

- Carestream Dental LLC

- Apteryx Imaging Inc.

- Danaher Corporation

- Midmark Corporation

- Planmeca Oy

- Acteon Group

- DÜRR DENTAL SE

- Genoray Co. Ltd.

Recent Developments

KaVo Dental GmbH Imaging released its brand new KaVo IXS sensor featuring size 1 and size 2 sensors. The device is claimed to be more durable, reliable and automated than several other sensor options available in the market.

- Report ID: 3346

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wearable Oral Health Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.