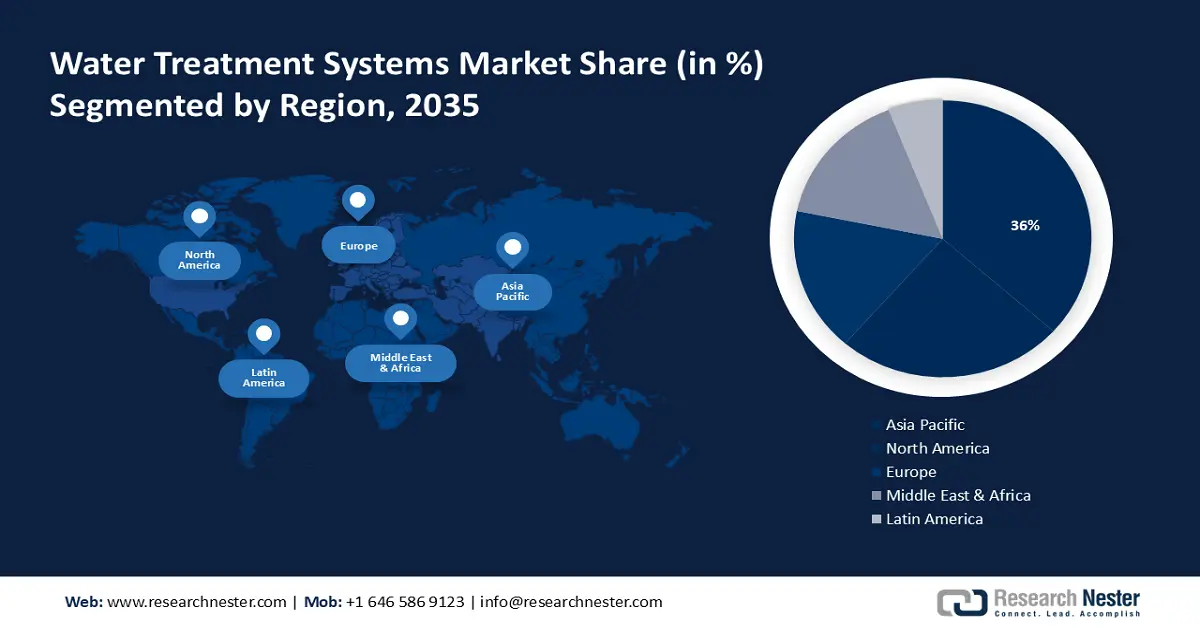

Water Treatment Systems Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to dominate majority revenue share of 36% by 2035. The region's rising levels of water contamination are to blame for the expansion. Also, it is expected that the region's limited access to a clean drinking water supply will contribute to the increased use of water treatment technology. Furthermore, the nation's point-of-use systems have become increasingly popular at home due to inadequate treatment infrastructure at municipal treatment facilities.

The water treatment systems market is poised to grow at a rapid rate in China led by the growing installment of water treatment systems in residential and commercial. Reverse osmosis, disinfection, and distillation systems are examples of water treatment systems that are predicted to see an increase in demand across a range of end-use industries due to the rapid expansion of industrial activity and rising levels of water pollution. For instance, about 70% of the nation's rivers and lakes are unsuitable for human use due to toxic human and industrial waste dumping, which has contaminated up to 90% of the groundwater in the nation.

In Korea, the water treatment systems market is projected to grow substantially during the forecast timeline. The market is growing in the nation owing to the several initiatives taken by the government to support water treatment and filtration processes. For instance, in 2023, South Korea declared the beginning of a new project to design wastewater treatment facilities that will automate management and operation through the use of artificial intelligence (AI) technologies.

The demand for water purifiers in both the household and commercial sectors is being driven by environmental concerns about single-use plastics and the carbon footprint of water purifying procedures. These factors are responsible for the market's rise in Japan.

North America Market Insights

By 2035, North America region is anticipated to hold the second position owing to the high uptake of water treatment systems among consumers. Moreover, the expansion of the water treatment systems market is driven by the presence of large-scale commercial producers and their well-established distribution networks. The industrial share of water treatment systems (point of use) and water filter use are further driven by the strong growth of regional commercial sectors including banking, telecom, and IT.

The water treatment systems market is growing in the United States due to the growing adoption of various water treatment systems in the residential sector to treat wastewater. According to a recent report by the US Environmental Protection Agency, septic systems in the US provide service to over 60 million people. Septic or other decentralized treatment systems service about one-third of all new construction.

In Canada, the water treatment systems market is slated to grow significantly influenced by the growing population and surge in construction projects. For instance, Canada, which has more than 40 million citizens as of 2024, is ranked 37th in the globe in terms of population. It makes up around 0.5% of all countries worldwide.