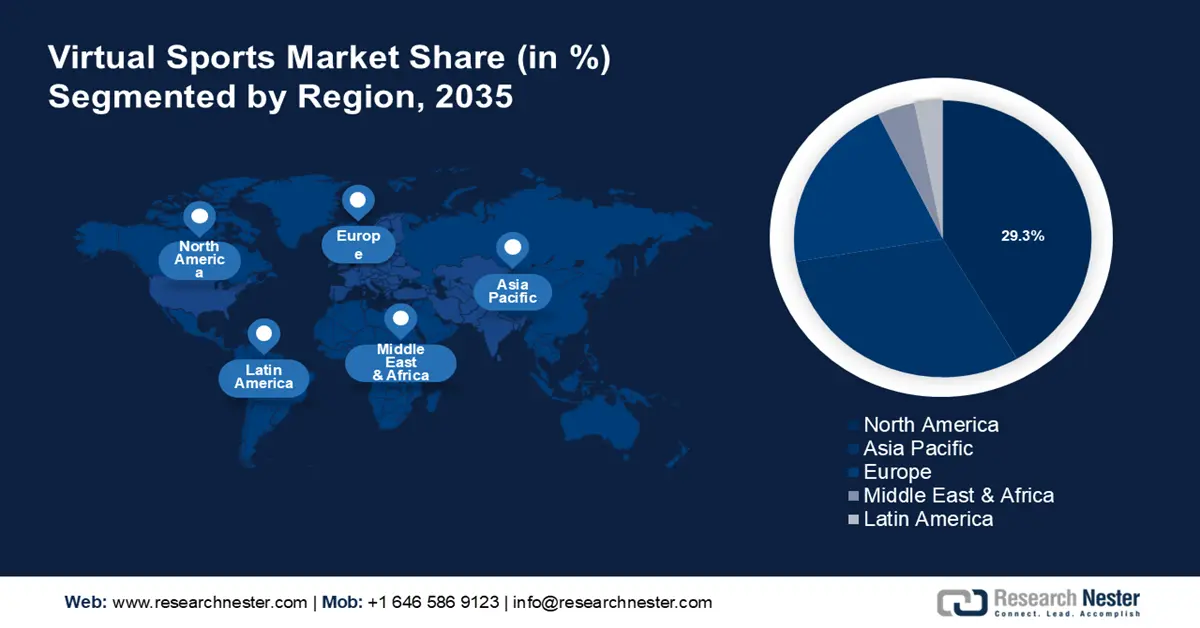

Virtual Sports Market Regional Analysis:

North America Market Insights

North America industry is set to dominate majority revenue share of 29.3% by 2035, due to a strong technological ecosystem, prevalent gaming culture, and rising user interest in immersive virtual experiences.

U.S. is poised to remain a market leader in the virtual sports market in lieu of a robust culture of gaming which has created a dedicated user base and communities for various titles. As per EA, Madden NFL 2024 saw a record increase of 6% in booking and a surge in weekly users. The robust technological infrastructure of the U.S. enables the development of premier virtual sports experiences for users. Another significant driver for growth is the relaxation of regulatory hurdles, as virtual sports betting has been made legal in several states of the country. Additionally, with the Esports scene continuing to thrive in U.S., the country is set to maintain the growth curve in the market.

In Canada, the relaxed regulatory framework along with a strong gaming culture drives the market forward. In 2021, the government legalized single-game sports betting which has boosted the market growth. A robust Esports and gaming ecosystem in the country, with rising disposable income among the population, will continue to assist the market growth.

APAC Market Insights

Asia Pacific is poised for a lucrative market share during the forecast period owing to the considerably large section of the population, robust gaming ecosystem, and increasing internet penetration.

India has seen significant growth in the virtual sports market. The country saw the highest surge during the pandemic with a mammoth rise in esports and virtual sports betting. The largest sports betting platform Dream 11 reported more than 200 million active users in October 2023. Platforms such as Loco and Rooter have been established to capitalize on the rising esports and virtual sports streaming in the country. In 2022, Loco reported more than 100 million views in a live Esports event for Battlegrounds India Mobile. Virtual sports like football are becoming increasingly popular in Esports scenarios in India.

China has a strong gaming ecosystem with PC and mobile games sharing the popularity. In 2024, the South China Morning Post reported that gamers in China increased to 668 million from 666 million in 2022. As per the report, gamers in China spent USD 303 billion on games. Another significant driver is the esports boom in the country with China having the most active Esports players in the world along with the highest game revenues. These factors make China a lucrative market for virtual sports.