Global Virtual Machine Market TOC

- Market Definition

- Market Definition

- Market Segmentation

- Assumptions

- Research Methodology

- Research objective

- Research process

- Executive Summary- Global Virtual Machine Market

- Analysis of Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Regulatory & Standards Landscape

- Impact of COVID-19 on the Virtual Machine Market

- Subscription Model Analysis

- Use Case Analysis

- Cloud Computing

- Support DevOps

- Investigate Malware

- Run Incompatible Software

- Secure Browsing

- Virtual Machine Market – Size Analysis

- Virtual Machine Market – Type Analysis

- Comparative Feature Analysis

- Global Virtual Machine Market Outlook

- Global Virtual Machine Market Overview and Segmentation by:

- Component, 2019-2028F (in USD Million)

- Type, 2019-2028F (in USD Million)

- RAM Storage, 2019-2028F (in USD Million)

- Temporary Storage, 2019-2028F (in USD Million)

- Enterprise Size, 2019-2028F (in USD Million)

- Operating System, 2019-2028F (in USD Million)

- End Users, 2019-2028F (in USD Million)

- Region, 2019-2028F (in USD Million)

- Global Virtual Machine Market Overview and Segmentation by:

- North America Virtual Machine Market Outlook

- Component, 2019-2028F (in USD Million)

- Type, 2019-2028F (in USD Million)

- RAM Storage, 2019-2028F (in USD Million)

- Temporary Storage, 2019-2028F (in USD Million)

- Enterprise Size, 2019-2028F (in USD Million)

- Operating System, 2019-2028F (in USD Million)

- End Users, 2019-2028F (in USD Million)

- Region, 2019-2028F (in USD Million)

- Europe Virtual Machine Market Outlook

- Component, 2019-2028F (in USD Million)

- Type, 2019-2028F (in USD Million)

- RAM Storage, 2019-2028F (in USD Million)

- Temporary Storage, 2019-2028F (in USD Million)

- Enterprise Size, 2019-2028F (in USD Million)

- Operating System, 2019-2028F (in USD Million)

- End Users, 2019-2028F (in USD Million)

- Region, 2019-2028F (in USD Million)

- Asia Pacific Virtual Machine Market Outlook

- Component, 2019-2028F (in USD Million)

- Type, 2019-2028F (in USD Million)

- RAM Storage, 2019-2028F (in USD Million)

- Temporary Storage, 2019-2028F (in USD Million)

- Enterprise Size, 2019-2028F (in USD Million)

- Operating System, 2019-2028F (in USD Million)

- End Users, 2019-2028F (in USD Million)

- Region, 2019-2028F (in USD Million)

- Latin America Virtual Machine Market Outlook

- Component, 2019-2028F (in USD Million)

- Type, 2019-2028F (in USD Million)

- RAM Storage, 2019-2028F (in USD Million)

- Temporary Storage, 2019-2028F (in USD Million)

- Enterprise Size, 2019-2028F (in USD Million)

- Operating System, 2019-2028F (in USD Million)

- End Users, 2019-2028F (in USD Million)

- Region, 2019-2028F (in USD Million)

- Middle East & Africa Virtual Machine Market Outlook

- Component, 2019-2028F (in USD Million)

- Type, 2019-2028F (in USD Million)

- RAM Storage, 2019-2028F (in USD Million)

- Temporary Storage, 2019-2028F (in USD Million)

- Enterprise Size, 2019-2028F (in USD Million)

- Operating System, 2019-2028F (in USD Million)

- End Users, 2019-2028F (in USD Million)

- Region, 2019-2028F (in USD Million)

- Market Share Analysis

- Competitive Structure

- VMware, Inc.

- Oracle Corporation

- IBM Corporation

- Red Hat, Inc.

- Huawei Technologies Co., Ltd.

- Microsoft Corporation

- Citrix Systems, Inc.

- Inspur Group

- New H3C Technologies Co., Ltd.

- Hewlett Packard Enterprise Development LP

- Analyst Recommendation

Virtual Machine Market Outlook:

Virtual Machine Market size was valued at USD 13.5 billion in 2025 and is projected to reach USD 49.3 billion by the end of 2035, rising at a CAGR of 15.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of virtual machine is estimated at USD 15.5 billion.

The global virtual machine market is poised for exceptional growth over the forecasted years owing to the rapid adoption of cloud computing, hybrid IT environments, increased investments, and AI-driven workloads. In this regard, Arch in April 2025 announced that it has officially closed a USD 13 million Series A funding round, which was led by Pantera Capital, with participation from other strategic investors, to build Bitcoin’s programmable financial infrastructure. The company also mentioned that its ArchVM virtual machine enables Turing-complete smart contracts and complex off-chain computations directly on Bitcoin’s layer 1, without any bridges or custody risks. This funding will accelerate engineering, security audits, developer tooling, and ecosystem growth, whereas Arch aims to unlock Bitcoin’s full potential for DeFi, NFTs, DAOs, and other composable applications while maintaining its foundational security and liquidity.

Furthermore, enterprises rely on virtualization to optimize resource utilization, reduce hardware costs, and enable the deployment of applications across on-premises and cloud infrastructures. Simultaneously, the rise of multi-cloud and hybrid cloud strategies is also fueling market expansion. In December 2025, Amazon introduced Graviton5 processors, Trainium3 UltraServers, and an expanded Nova model family, boosting cloud performance, AI training speed, and energy efficiency at AWS re: Invent 2025. The event also introduced frontier agents' autonomous AI assistants for development, security, and DevOps, and new Bedrock and SageMaker AI capabilities for faster model customization. In addition, AWS AI factories enable enterprises to deploy high-performance AI infrastructure in their own data centers, combining AWS chips, networking, and services by meeting regulatory and data sovereignty requirements.

Key Virtual Machine Market Insights Summary:

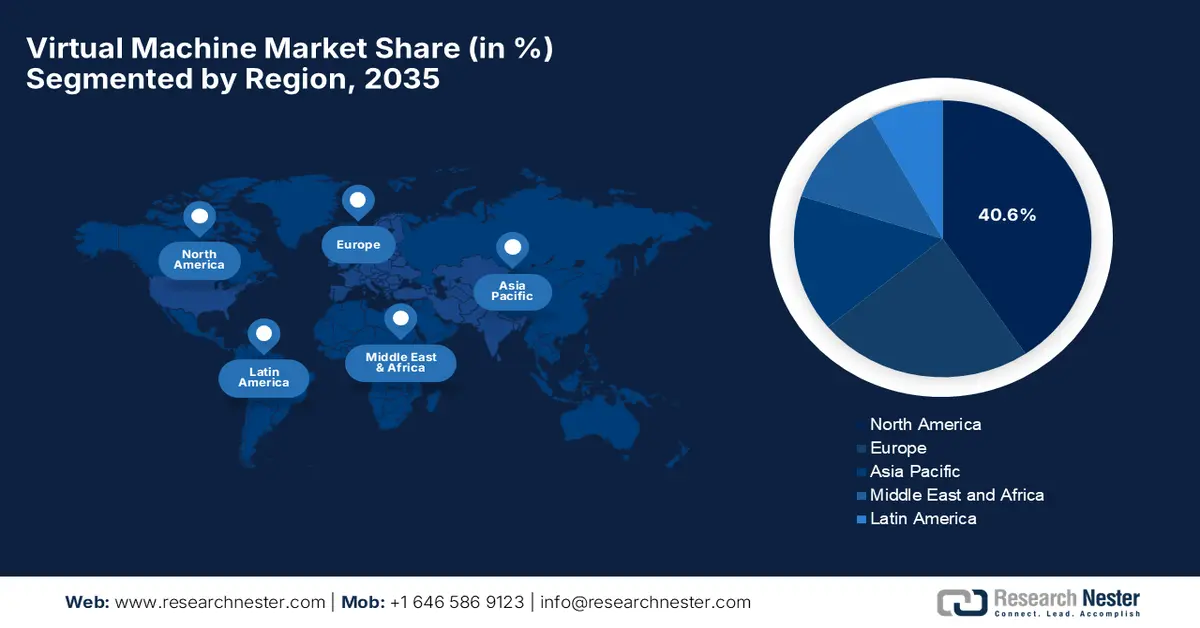

Regional Highlights:

- North America is projected to command a 40.6% revenue share by 2035 in the virtual machine market, underpinned by strong cloud provider presence and regulatory-backed cybersecurity frameworks accelerating enterprise cloud spending.

- Asia Pacific is anticipated to emerge as the fastest-growing region over 2026–2035 as governments and enterprises intensify cloud-native adoption and digital transformation initiatives to manage complex workloads efficiently.

Segment Insights:

- The small and medium-sized enterprises (SMEs) segment is forecast to account for a dominant 73.8% share by 2035 in the virtual machine market, fueled by rising adoption aimed at streamlining IT infrastructure and enhancing cost effectiveness.

- By 2035, the system virtual machines segment is set to expand at a notable pace as enterprises and public sector data centers increasingly prioritize resource efficiency and consolidation.

Key Growth Trends:

- Rapid adoption of cloud computing

- Scalability, flexibility & cost efficiency

Major Challenges:

- Security and data privacy concerns

- Performance and resource optimization challenges

Key Players:VMware, Inc., Microsoft Corporation, Amazon Web Services, Inc., Google LLC, Oracle Corporation, IBM Corporation, Citrix Systems, Inc., Huawei Technologies Co., Ltd., Nutanix, Inc., Red Hat, Inc., Cisco Systems, Inc., Dell Technologies Inc., Hewlett Packard Enterprise Co., Alibaba Cloud, Tencent Cloud

Global Virtual Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.5 billion

- 2026 Market Size: USD 15.5 billion

- Projected Market Size: USD 49.3 billion by 2035

- Growth Forecasts: 15.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Singapore, Australia

Last updated on : 5 January, 2026

Virtual Machine Market - Growth Drivers and Challenges

Growth Drivers

- Rapid adoption of cloud computing: Organizations across the globe are migrating workloads to cloud platforms such as AWS, Azure, and Google Cloud, where VMs are recognized to be the foundational infrastructure components driving consistent growth in the market. In this context, Unilever in April 2023 reported that it had completed one of the largest cloud migrations in the consumer goods industry, thereby moving its entire IT infrastructure to Microsoft Azure in just 18 months with a very minimal disruption. This cloud-only approach efficiently enhances operational efficiency and innovation, which in turn encourages faster product launches, improved customer service, and the use of AI and digital technologies like factory digital twins. Furthermore, the migration also supports Unilever’s sustainability goals by reducing its carbon footprint through the exit of on-premises data centers.

- Scalability, flexibility & cost efficiency: VMs allow multiple workloads on a single physical server, improving resource utilization and reducing hardware, energy, and maintenance costs. This ability to scale up or down based on demand drives adoption in data centers and enterprise IT, which is contributing to the overall expansion of the virtual machine market. Google Cloud in April 2025 announced its enhancements to Google Cloud VMware Engine, allowing enterprises to run VMware-based virtual machines on Google Cloud with 18 additional node shapes at Google Cloud Next 2025. In addition, this expansion enables organizations to scale and tailor infrastructure more precisely to workload demands. Furthermore, by offering more options to right-size deployments, enterprises can optimize performance and reduce costs effectively.

- Remote Work and digital transformation: The shift toward remote and hybrid working models has increased the need for remote access to enterprise applications and secure virtual desktops. VMs provide centralized, secure environments accessible from anywhere, accelerating uptake in the market. According to the World Economic Forum report, which was published in January 2024, it was observed that the number of worldwide digital jobs that can be performed remotely is expected to grow by about 25% by the end of 2030, reaching approximately 92 million roles. It also stated that this growth is highly driven by technology and higher-wage positions such as software developers and financial risk specialists. Furthermore, the rise of these remote-capable digital jobs highlights a major work, expanding opportunities for employers globally, hence efficiently driving demand for virtual machines and cloud infrastructure.

Challenges

- Security and data privacy concerns: This is the major obstacle for the virtual machine market since the VMs are susceptible to security threats, such as hypervisor attacks, malware, data breaches, and lateral movement across virtual networks. In this regard, the shared physical infrastructure in multi-tenant environments can expose the sensitive workloads to vulnerabilities if isolation is not properly maintained. Simultaneously, the data stored within VMs or transmitted across networks must comply with regulations such as GDPR, HIPAA, and industry-specific standards. Therefore, maintaining robust access controls, encryption, and regular vulnerability assessments is critical but can be resource-intensive, making it challenging for small-scale firms to operate in these critical scenarios.

- Performance and resource optimization challenges: The virtual machine market is facing severe challenges in terms of optimal performance since it requires careful allocation of CPU, memory, storage, and network bandwidth to prevent any bottlenecks. Also, over-provisioning resources can lead to higher costs, whereas under-provisioning can degrade application performance and user experience. The existence of workload spikes, latency-sensitive applications, and high I/O demand is complicating resource management. In addition, multi-tenant and hybrid cloud deployments often require real-time monitoring and predictive analytics to dynamically balance workloads. Furthermore, VM sprawl, where idle or unnecessary virtual machines accumulate, can waste resources and reduce operational efficiency, which can be challenging for enterprises that lack sufficient expertise or tooling.

Virtual Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.5% |

|

Base Year Market Size (2025) |

USD 13.5 billion |

|

Forecast Year Market Size (2035) |

USD 49.3 billion |

|

Regional Scope |

|

Virtual Machine Market Segmentation:

Organization Size Segment Analysis

In the virtual machine market, the small and medium-sized enterprises (SMEs) segment is expected to capture the largest revenue share of 73.8% over the forecasted years. The segment’s dominance is highly driven by increased adoption with a prime focus on streamlining IT infrastructure and cost effectiveness. In July 2025, the U.K. government revealed that its SME Digital Adoption Taskforce final report (2025) outlines a clear strategy to support small and medium-sized enterprises in adopting productivity-enhancing digital technologies, which include cloud computing, CRM, and resource planning software. The report also notes that digital adoption can boost competitiveness, employee productivity, and national productivity. Furthermore, it includes a 10-step action plan for government initiatives, guidance, and public-private partnerships to drive SME growth through technology adoption, hence denoting a wider segment scope.

Type Segment Analysis

By the end of 2035, the system virtual machines will grow at a significant rate in the market since they are widely used in enterprise and public sector data centers for resource efficiency and consolidation. Simultaneously, the government cloud computing strategies emphasize virtualization for cost and performance gains in agency IT infrastructure, supporting system VM proliferation. Broadcom, in August 2025, announced that VMware Cloud Foundation (VCF) 9.0 is currently an AI-native platform, which is enabling enterprises to run secure, scalable private clouds with integrated AI services at VMware Explore 2025. In this context, VCF allows organizations to deploy AI workloads efficiently using GPU-accelerated infrastructure, streamline model deployment, and offer Private AI as a service, by also supporting non-AI workloads on the same unified platform. Furthermore, this innovation enhances developer productivity and cost-effectiveness, making virtualization central to modern private cloud and enterprise AI adoption.

Vertical Segment Analysis

The BFSI segment in terms of vertical will capture a lucrative revenue share in the virtual machine market over the forecasted years. The VMs are highly essential in optimizing IT infrastructure, and they allow the worldwide financial institutions to manage a high amount of data even more efficiently. Simultaneously, the virtual machines also support enhanced security and compliance, which are critical requirements in the BFSI sector. They enable scalability and flexibility, allowing institutions to quickly adapt to changing workloads and customer demands. In addition, VMs also help reduce operational costs by improving resource utilization and minimizing hardware dependency. Furthermore, their role in disaster recovery and business continuity strengthens their adoption across banks and financial service providers. Therefore, the presence of all of these factors responsibly positions the segment at the forefront of generating revenue in this sector.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Organization |

|

|

Type |

|

|

Vertical |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Virtual Machine Market - Regional Analysis

North America Market Insights

In the global virtual machine market, North America is expected to capture the largest revenue share of 40.6% over the forecasted years. The region’s prominence in this field is backed by the presence of cybersecurity regulations, cloud leaders. Also, it's continuously upgrading its technological infrastructure, coupled with increased adoption of cloud spending, which is also propelling market growth. Red Hat, in May 2025, announced the public preview of Red Hat OpenShift virtualization on Microsoft Azure, enabling organizations to streamline the migration of virtual machines to a scalable, cloud-native platform. It is delivered as a self-managed operator within Azure Red Hat OpenShift, wherein the solution allows enterprises to manage virtual machines and containers together across a consistent hybrid cloud environment. Further, by simplifying operations, accelerating VM migration, and optimizing resources, the offering helps organizations modernize legacy virtualization.

The U.S. is the frontrunner in the regional market, primarily driven by high IT spending, an advanced business ecosystem, and an enhanced approach towards digital transformation. The country represents a very mature IT infrastructure, which positions it as a predominant leader in this field. In July 2025, Platform9 announced that it had entered into a partnership with Commvault to integrate advanced data protection capabilities into Platform9 Private Cloud Director, strengthening cyber resilience for enterprise private clouds. Besides, the integrated solution delivers agentless VM backup and recovery, application-consistent backups, granular file recovery, and disaster recovery across virtual machines and Kubernetes workloads. In addition, by combining Platform9’s enterprise-grade virtualization features with Commvault’s trusted data protection, organizations can securely modernize and protect mission-critical private cloud environments.

Canada is efficiently growing in the virtual machine market as organizations across various industries opt for cloud computing and digital transformation initiatives. Enterprises in the country are leveraging virtual machines to modernize their IT infrastructure and support hybrid and multi-cloud environments. In this regard, IBM in April 2025 announced that it has expanded its cloud infrastructure in the country by inaugurating a new cloud multizone region in Montreal, complementing its Toronto MZR, to support regulated industries with secure, high-performance cloud solutions. These MZRs provide access to IBM Power Virtual Server, VMware Cloud Foundations, and IBM WatsonX AI, thereby enabling organizations in the country to deploy and manage virtual machines and AI workloads locally by ensuring compliance with data sovereignty and privacy regulations. Hence, these advancements offer scalable, hybrid cloud capabilities, low-latency connectivity, and enterprise-grade security.

APAC Market Insights

Asia Pacific is likely to register the fastest growth in the international virtual machine market owing to the rapid adoption of cloud-native technologies and digital transformation initiatives across countries. Governments across the region are encouraging data localization and secure infrastructure adoption, whereas most of the enterprises are deploying VMs to manage complex workloads. In July 2025, Microsoft reported that Airlock Digital, which is an Australia-based cybersecurity company, migrated 600 virtual machines from CentOS 7 to Ubuntu 24.04 LTS on Microsoft Azure with support from Canonical, achieving faster, more secure operations. It also mentioned that this migration improved performance and reduced costs by allowing automated management, simplified infrastructure, and standardized virtual machines across deployments, hence contributing to overall market growth.

In China, the virtual machine market is efficiently growing, shaped by the government’s push for digital sovereignty and self-reliant cloud infrastructure. Leading domestic cloud providers are offering VM solutions that support AI, big data, and enterprise applications, thereby allowing organizations to maintain strict regulatory compliance and leverage virtualization technologies. In April 2022, Alibaba Cloud and VMware announced the launch of the next-generation Alibaba Cloud VMware Service in the country, providing enterprises with a hybrid cloud platform to migrate and modernize workloads with lower costs and risk. It also mentioned that the service integrates VMware’s cloud technologies with Alibaba Cloud’s infrastructure, offering enterprise-grade compute, storage, and networking, along with unified management for both VMs and containers. Furthermore, it supports enhanced security, disaster recovery, and compliance with China’s cybersecurity regulations, also enabling faster application modernization through Kubernetes and native Alibaba Cloud services.

India’s virtual machine market is progressing rapidly on account of expanding IT services, startups, and e-commerce platforms. Organizations in the country are utilizing VMs to scale compute resources on demand, whereas the cloud service providers are making it suitable VM offerings to meet the diverse business needs. In this context, Neon Cloud in April 2025 announced the launch of its cloud platform in the country with a data center in Gurgaon, to offer virtual machines, Kubernetes, and soon GPU services, along with storage, backups, and network management solutions. The company aims to empower businesses in India with scalable, enterprise-grade cloud infrastructure without any sort of vendor lock-in or hidden costs. Furthermore, Neon Cloud is focused on startups and SMBs, thereby enabling digital transformation and supporting AI/ML workloads with future GPU offerings.

Europe Market Insights

Europe has a strong hold in the market, positively influenced by stringent data privacy regulations, such as GDPR, which require enterprises to adopt secure and compliant virtualization solutions. Simultaneously, the rising cloud adoption and the heightened demand for computing solutions are also propelling continued market progression in the region. In December 2025, HPE announced updates to its GreenLake cloud and Morpheus software to deliver advanced virtualization, AI, and hybrid cloud capabilities. At Discover Barcelona 2025, it also mentioned the innovations, which include zero-trust security, automated network provisioning, Kubernetes and container support, and integrated data protection for virtual machines. In addition, collaborations with NVIDIA enhance AI adoption and data intelligence, whereas new HPE StoreOnce and Alletra solutions ensure high-performance, resilient, and secure operations across enterprise workloads.

The increasing adoption of virtual machines to modernize legacy IT systems and support Industry 4.0 initiatives is the key factor behind the robust growth of the virtual machine market in Germany. The market is also witnessing higher adoption in manufacturing and automotive sectors, where secure and reliable virtualization is highly essential for industrial automation and predictive analytics. In November 2025, Scaleway announced a new cloud availability zone in Germany, which is a public tender win with the City of Copenhagen, and participation in the ECB’s digital euro project. The company provides fully operated cloud infrastructure supporting virtual machines, AI workloads, and secure data management, aligning with EU governance and digital sovereignty standards. Hence, such milestones solidify Scaleway’s role in delivering high-performance, transparent, and sovereign cloud services across Europe.

France’s market is growing due to the presence of financial services, government, and healthcare sectors, which are looking for resilient, hybrid cloud infrastructure. Organizations across the country are implementing VMs to ensure business continuity and enable secure multi-cloud integration, while mainly focusing on regulatory compliance. In September 2025, OVHcloud announced that it had launched public VCF as-a-Service, which is a fully managed VMware solution that is aimed at SMEs and MSPs, enabling scalable deployment and modernization of virtual machine workloads while also controlling costs. It is built on VMware Cloud Director, and the service offers adjustable resources, pre-configured images, along with integrated Veeam backup for secure, high-performance operations. Further, with a 99.95% SLA, unmetered bandwidth, and ISO 27001-certified datacenters, OVHcloud ensures reliable, sustainable cloud infrastructure for businesses.

Key Virtual Machine Market Players:

- VMware, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Google LLC (U.S.)

- Oracle Corporation (U.S.)

- IBM Corporation (U.S.)

- Citrix Systems, Inc. (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Nutanix, Inc. (U.S.)

- Red Hat, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Dell Technologies Inc. (U.S.)

- Hewlett Packard Enterprise Co. (U.S.)

- Alibaba Cloud (China)

- Tencent Cloud (China)

- VMware, Inc. is recognized as the pioneer in virtualization and a dominant leader in the virtual machine sector. The company offers a broader portfolio of products, such as hypervisors, cloud-native virtualization solutions, and management tools, which also include vSphere, vSAN, and VMware Cloud Foundation. In addition, VMware is focused on hybrid and multi-cloud deployments, emphasizing workload migration, automation, and security.

- Microsoft Corporation has a product portfolio that spans Hyper-V and its extensive integration with Azure virtual machines. Besides, Hyper-V enables businesses to run Windows and Linux VMs with strong security, scalability, and enterprise management features. Further, Microsoft leverages Azure’s global cloud footprint to provide flexible, on-demand VM services for diverse workloads, including AI, analytics, and enterprise applications.

- Amazon Web Services, Inc. is identified to be yet another dominant force in this field and is a leading provider of virtual machine instances through its EC2 platform. It also offers a wide variety of instance types optimized for compute, memory, and storage-intensive workloads. In addition, Amazon Web Services continuously innovates with custom processors such as Graviton5, advanced networking, and security features, which are allowing it to maintain a competitive edge in the market.

- Google LLC provides VM services through Compute Engine, which delivers customizable virtual machines optimized for performance, scalability, and security. Simultaneously, Google is also emphasizing integration with its cloud-native ecosystem, including AI, big data, and containerized workloads. The company is differentiating itself through high-performance networking, innovative infrastructure, and support for live migration of VMs, which is positioning it as a predominant leader in this field.

- Oracle Corporation is a key player in this market through Oracle Cloud Infrastructure and its support for enterprise-grade virtual machines. Oracle is focused on high-performance computing, security, and cost-efficient VM solutions for mission-critical workloads such as databases, ERP, and analytics. Expanding Arm-based VM offerings, enhancing bare-metal and virtualized compute options, and tightly integrating VM services with Oracle’s software suite are a few strategies opted by the firm to secure a stronger market position.

Below is the list of some prominent players operating in the global market:

The global market is witnessing intense competition among the pioneers in terms of performance, scalability, and integration with cloud-native services. Leaders such as VMware and Microsoft are continuously making innovations in hypervisor technologies and hybrid cloud support, whereas AWS and Google leverage expansive infrastructure to deliver scalable VM instances. In October 2025, Veeam Software announced that it acquired Securiti AI for USD 1.725 billion by unifying data resilience with data security posture management, privacy, governance, and AI trust across hybrid and multi-cloud environments. It also stated that this combined platform enables enterprises to secure, recover, and manage all data, including virtual machine workloads, by safely unlocking AI value through a single command center. Hence, this strategic move strengthens Veeam’s leadership in data protection and AI-ready infrastructure, providing organizations with enhanced business resilience, compliance, and governance for critical workloads.

Corporate Landscape of the Virtual Machine Market:

Recent Developments

- In December 2025, AWS introduced Graviton5-based Amazon EC2 M9g virtual machine instances, which will deliver up to 25% higher performance and improved price efficiency over the previous generation. These VMs represent 192 cores, a larger cache, enhanced networking and storage bandwidth, and support scalable general-purpose, compute-intensive, and memory-intensive workloads.

- In October 2025, QNAP announced the virtual machine high availability beta in Virtualization Station 4.1, allowing users to experience automatic VM protection and switchover between NAS devices with minimal downtime.

- In August 2025, Broadcom announced that it was named a strategic vendor for Walmart’s virtualization software, deploying VMware Cloud Foundation to unify and secure Walmart’s global cloud and edge operations to enhance scalability, simplify workload portability.

- In September 2024, Parallels launched Parallels Desktop 20 for Mac by introducing AI-ready virtual machines, which are designed for secure, offline AI application development. The release includes macOS Sequoia and Windows 11 24H2 support, a new enterprise management portal, and enhanced virtualization features for Windows, macOS, and Linux VMs.

- Report ID: 739

- Published Date: Jan 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Virtual Machine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.