Virtual Client Computing Market Outlook:

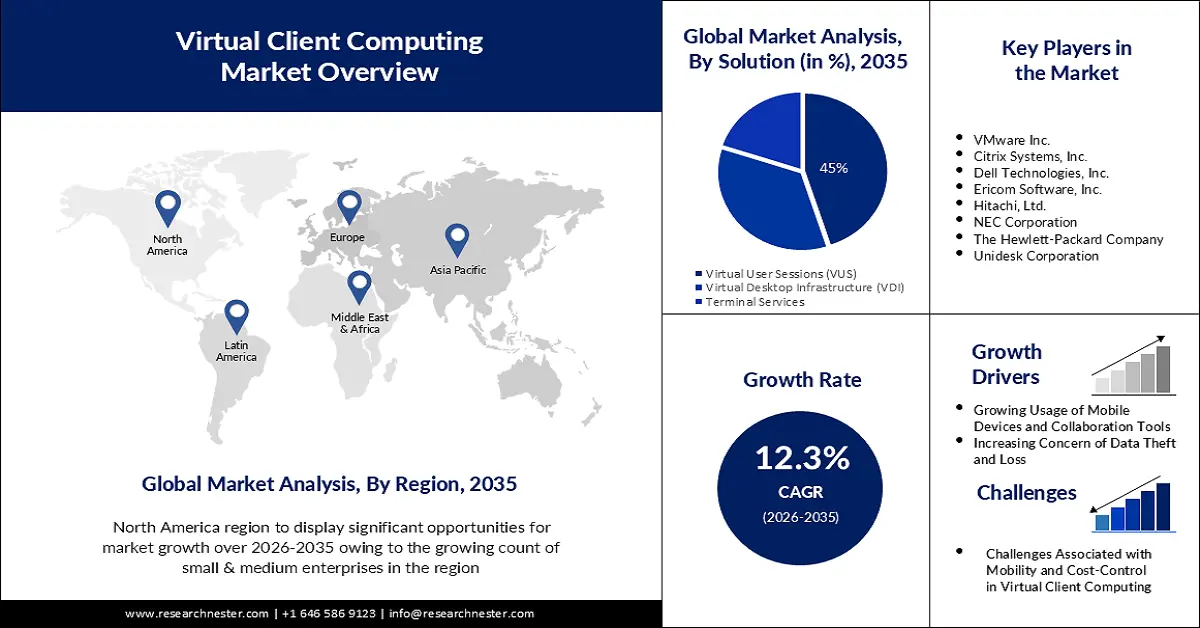

Virtual Client Computing Market size was over USD 20.4 billion in 2025 and is projected to reach USD 65.08 billion by 2035, witnessing around 12.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of virtual client computing is assessed at USD 22.66 billion.

The reason behind the growth is impelled by the increasing adoption of mobile devices. Over the past five years, there have been roughly 4% annual growth in the global smartphone user base driven by the falling cost of cell phones, the widespread use of data and internet services in both urban and rural locations, and the accessibility of reasonably priced high-speed networks. For instance, by 2030, more than 90% of smartphones will be in use worldwide, up from around 75% in 2022.

The growing demand for secure IT infrastructure across the globe is believed to fuel the market growth. This has led to a rise in the need for virtual client computing as it helps in disaster recovery solutions by providing a data backup facility to quickly restore the data.

Key Virtual Client Computing Market Insights Summary:

Regional Highlights:

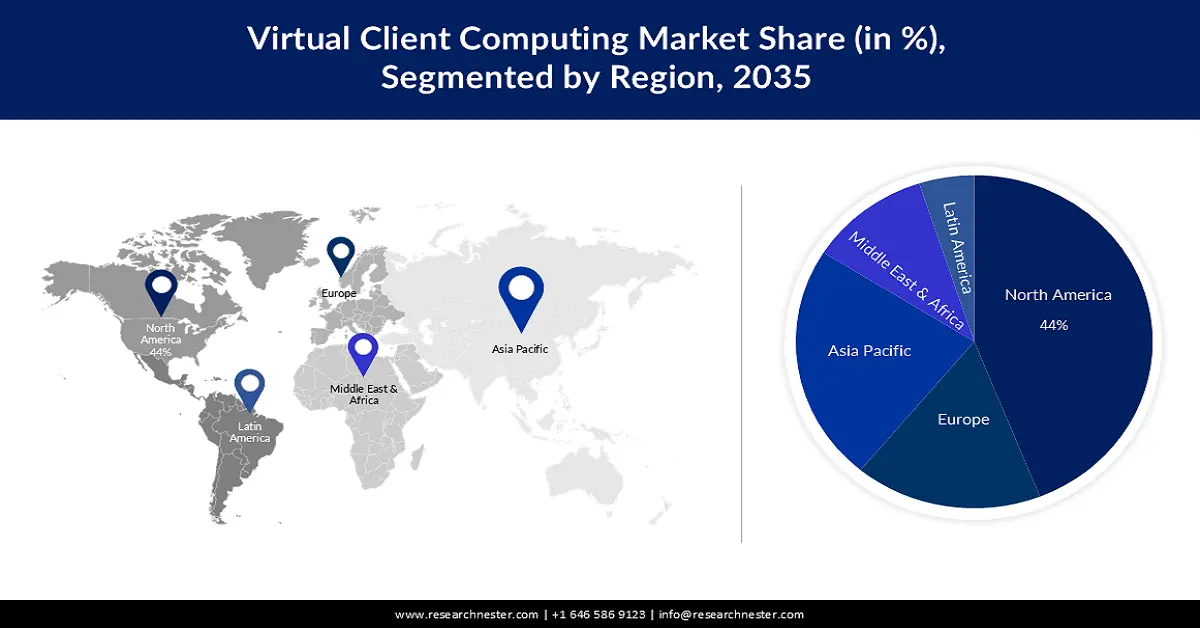

- North America is projected to secure a 44% revenue share by 2035 in the virtual client computing market, impelled by the growing count of small & medium enterprises.

- The Asia Pacific region is anticipated to emerge as the second-largest market by 2035, supported by the rising need for cloud and data center services.

Segment Insights:

- The virtual user sessions (VUS) segment is expected to command a 45% share by 2035 within the virtual client computing market, propelled by the growing adoption of VUS desktops.

- The IT & telecom segment is poised to capture a notable market share through 2035, sustained by its expanding use of desktop and application virtualization to enable secure remote computing functionality.

Key Growth Trends:

- Growing Usage of Mobile Devices and Collaboration Tools

- Increasing Concern of Data Theft and Loss

Major Challenges:

- Associated with Mobility and Cost Control in Virtual Client Computing

Key Players: Microsoft Corporation, VMware Inc., Citrix Systems, Inc., Dell Technologies, Inc., Ericom Software, Inc.

Global Virtual Client Computing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.4 billion

- 2026 Market Size: USD 22.66 billion

- Projected Market Size: USD 65.08 billion by 2035

- Growth Forecasts: 12.3%

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Indonesia, Australia

Last updated on : 20 November, 2025

Virtual Client Computing Market - Growth Drivers and Challenges

Growth Drivers

- Growing Usage of Mobile Devices and Collaboration Tools - Mobile devices and a variety of collaboration tools are rapidly being utilized to communicate with other teams across platforms and devices, boosting the demand for virtual client computing since it is required for mobile device compatibility and collaboration support. The global number of mobile devices is predicted to reach over 18 billion by 2025. Further, more than 70% of workers used collaboration tools for work in 2021.

- Increasing Concern of Data Theft and Loss- Virtual client computing reduces the risk of data theft a severe security and privacy breach that can have disastrous repercussions by centralizing data on servers.

- Growing Digital Transformation- Businesses becoming more invested in gathering data to expand, and there has been a surge in the use of cloud computing and digital transformation techniques that involve utilizing the cloud, doing extensive data analysis, and setting up devices for internet access.

- Surging Popularity of Remote Work- The foundation of technology for remote work is virtual client computing since it provides all the advantages of the cloud and provides a sophisticated environment at a lesser cost with easier desktop and application management.

Challenges

- Challenges Associated with Mobility and Cost-Control in Virtual Client Computing - Cost control in cloud computing refers to the proactive monitoring and optimization of costs associated with cloud resources and services the relevance of this has increased since cost containment is a primary concern for all types of organizations. Moreover, an important consideration when moving a virtual computer between IP subnets is mobility which is one of the main obstacles to overcome since it imposes various obstacles to the performance of running programs owing to extremely fluctuating network conditions. Additionally, in a virtualized environment, granting access to a huge population in a single instance is often found challenging owing to issues with antivirus, botting, and authentication.

- Compatibility issues may consist of instance support, picture formats, and OS versions which can result in hardware malfunctioning, and error messages

- The requirement for robust and high-speed network infrastructure can act as a barrier

Virtual Client Computing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.3% |

|

Base Year Market Size (2025) |

USD 20.4 billion |

|

Forecast Year Market Size (2035) |

USD 65.08 billion |

|

Regional Scope |

|

Virtual Client Computing Market Segmentation:

Solution Segment Analysis

The virtual user sessions (VUS) segment in the virtual client computing market is estimated to gain a robust revenue share of 45% in the coming years owing to the owing to growing adoption of VUS desktops. Session-based desktop software, or Virtual User Session (VUS), operates on servers and generates a virtualized operating system user interface that may be distributed to non-native environments and can stream a single program to almost any device, independent of platform. Moreover, it is a software solution that enables numerous users to view a single program at once and is an advanced server-based computing platform that can accommodate numerous users running the same operating system by creating a shared environment. Organizations typically utilize VUS desktops to provide remote access to applications and data in a regulated and centralized environment and with the use of virtual client computing users can access their system from different locations which provides flexibility.

Additionally, the term virtual desktop infrastructure (VDI) refers to a technology that hosts desktop environments on a central server allows users to access their desktops from any location, and offers cloud-based or on-premises virtual desktop hosting.

End Use Industry Segment Analysis

The IT & telecom segment in the virtual client computing market is set to garner a notable share shortly. The IT industry benefits greatly from virtual client computing since it permits remote work while preserving productivity and clear communication regardless of endpoint or location, the software also enables the virtualization of desktops and applications to offer safe computing functionality.

Deployment Segment Analysis

Virtual client computing market from the on-premise segment is anticipated to garner a noteworthy share in the coming years. On-premise hosting enables organizations to choose from a choice of providers, including Citrix, VMware, and Microsoft, for their virtualization software whereby users get direct, fast access to their virtual desktops, deliver predictable costs, and minimize latency.

Our in-depth analysis of the global market includes the following segments:

|

Deployment |

|

|

Solution |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Virtual Client Computing Market - Regional Analysis

North American Market Insights

The virtual Client Computing market in North America industry is set to hold largest revenue share of 44% by 2035 impelled by the growing count of small & medium enterprises. The emergence of internet marketplaces, the rate of new business development, and the durability of consumer spending have all contributed to the growth of small businesses in the region which has led to a greater need for cloud computing services. Additionally, the United States and Canada are increasingly embracing cloud computing owing to the presence of key players such as Oracle, Google, and others in the market resulting in a higher demand for virtual client computing in the area.

According to estimates, as of 2023, there were more than 32 million small enterprises in the US, accounting for roughly 99% of all US businesses.

APAC Market Insights

The Asia Pacific virtual client computing market is estimated to be the second largest, during the forecast timeframe led by the growing need for cloud and data center services. Businesses in the area are increasingly adopting cloud and data center services as a result of fast digital transformation across numerous industries, as it reduces cost and enhances efficiency. For instance, India is one of the data center hubs with the quickest growth rates, owing to its booming digital economy, extensive internet access, and adoption of 5G networks over 4G.

Virtual Client Computing Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- VMware Inc.

- Citrix Systems, Inc.

- Dell Technologies, Inc.

- Ericom Software, Inc.

- Hitachi, Ltd.

- NEC Corporation

- The Hewlett-Packard Company

- Unidesk Corporation

Recent Developments

- The Hewlett-Packard Company introduced New HPE ProLiant Gen11 servers that provide a cloud operating system and give businesses easy-to-use, reliable, and optimized computing resources that are perfect for AI, analytics, cloud-native applications, virtualization, and desktop infrastructure (VDI).

- Dell Technologies, Inc. along with Intel announced to deliver of end-user devices, together with the "best in class" cloud model to assist in digitally transforming businesses operating in a hybrid workplace by learning more about the unique demands of individuals in the post-pandemic hybrid period.

- Report ID: 3984

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Virtual Client Computing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.