Video Ad Insertion Platform Market Outlook:

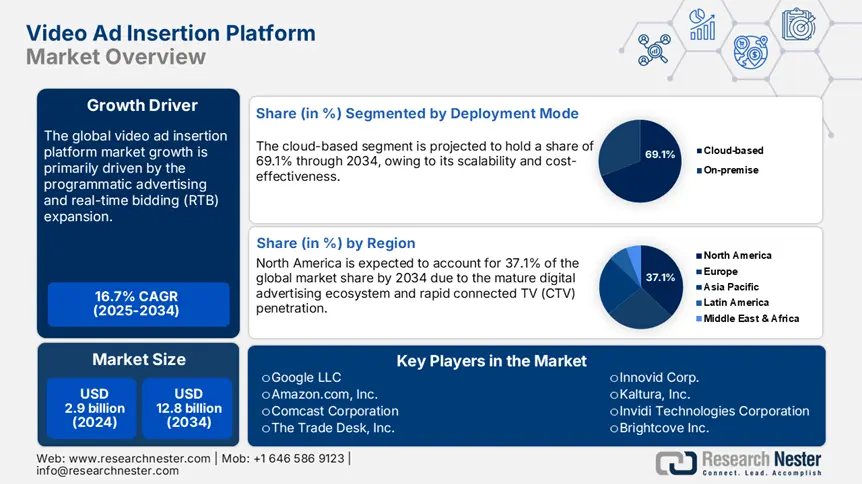

Video Ad Insertion Platform Market size was valued at a USD 2.9 billion in 2024 and is projected to reach USD 12.8 billion by the end of 2034, rising at a CAGR of 16.7% during the forecast period, from, 2025 to 2034. In 2025, the industry size of video ad insertion platforms is estimated at USD 3.4 billion.

The video ad platforms, especially for connected TV and streaming, are set to witness robust technological advancements in the coming years. These platforms require cloud-based software, high-speed edge computing, and specialized hardware for video processing for effective operations. For this, the investments are gaining traction, with spending on information processing equipment reaching USD 150.7 billion in the first quarter of 2024, according to the U.S. Bureau of Economic Analysis.

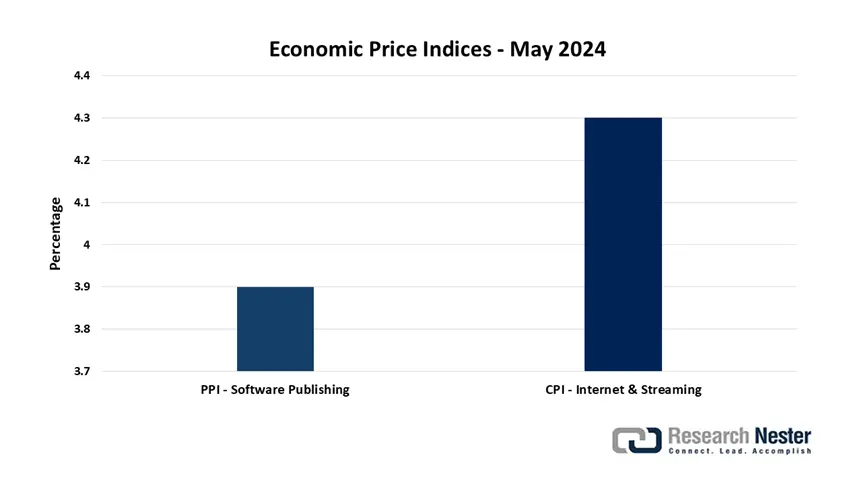

On the cost side, the producer price index (PPI) for software publishing grew by 3.9% year-over-year in May 2024, reflecting modest inflationary pressures across software development and delivery services. The consumer price index (CPI) for internet and streaming services increased by 4.3% over the same period, highlighting consistent end-user consumption and bandwidth usage growth. Overall, these statistics indicate a steady growth in both production costs and consumer demand for streaming services.

Video Ad Insertion Platform Market - Growth Drivers and Challenges

Growth Drivers

- Programmatic advertising and real-time bidding (RTB) expansion: The global spending on programmatic advertising is projected to cross USD 725.5 billion by 2026. The video ads, especially through real-time bidding (RTB), are expected to gain momentum during the forecast period. The U.S. and EU are pushing for clearer practices in programmatic systems, as shown in the FTC’s digital advertising guidelines and the EU’s Digital Markets Act (DMA). Magnite and PubMatic platforms are utilizing automated tools to verify supply chains and build trust with brands. The vendors are also investing in transparent bidding processes to gain advertiser trust and optimizing supply paths to enhance campaign efficiency.

- Growing need for cross-platform measurement and attribution: Businesses need clear, unified metrics to track advertising performance across mobile, desktop, connected TV (CTV), and social media platforms, which is likely to boost the sales of video ad insertion platforms. As the inconsistent measurement methods reduce return on investment (ROI), initiatives, including NIST’s Smart Data Interoperability Framework, are focused on standardizing data exchange across platforms. The leading companies, Google and Nielsen, have already introduced systems that track users across devices using reliable matching methods. The developed markets are leading this shift, with brands seeking detailed analytics to target high-value audiences effectively.

Challenges

- Unclear or fragmented pricing models: The unclear pricing models and multiple intermediaries involved in the dynamic ad insertion are estimated to hinder the market growth in the years ahead. For example, in Japan, new companies focusing on expanding their operations in programmatic business face platform fees upwards of 30.5%, squeezing margins. The study by the World Trade Organization discloses that nearly 42.2% of SMEs struggle to compete due to unclear margin structures. These unstable pricing standards are deterring new entrants and SMEs from expansion and complicating ROI calculations for governments seeking cost-efficient adtech procurement.

- Telecom infrastructure disparities: The lack of proper connectivity networks is poised to hamper the sales of video ad insertion platforms to some extent. The developing economies most often witness low 5G or broadband penetration, which directly restricts real-time ad insertion. The report by the World Trade Organization (WTO) states that South Korea, Sweden, and the U.S. have near-total 5G coverage, while sub-Saharan Africa lags below 25.5%. This also reduces platform reliability and campaign effectiveness. Small-scale enterprises often hesitate to expand their operation in developing markets owing to poor infrastructure and low ROI.

Video Ad Insertion Platform Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

16.7% |

|

Base Year Market Size (2024) |

USD 2.9 billion |

|

Forecast Year Market Size (2034) |

USD 12.8 billion |

|

Regional Scope |

|

Video Ad Insertion Platform Market Segmentation:

Deployment Mode Segment Analysis

The cloud-based segment is projected to capture 69.1% of the global video ad insertion platform market share through 2034. Cloud-based solutions are most sought-after due to their scalability and cost-effectiveness. As per the U.S. Department of Commerce, cloud services spending in media-tech grew by 16.5% in 2024, with digital advertising identified as one of the fastest-growing applications. This highlights that the cloud-based video ad insertion platform producers are likely to earn lucrative gains in the coming years. The cloud infrastructure also supports edge computing for real-time ad insertion, critical for large-scale live events, owing to its flexibility. Furthermore, better integration with AI and analytics engines is poised to push the adoption of cloud-based video ad insertion platforms.

Platform Segment Analysis

The connected TV segment is poised to account for 42.5% of the global market share throughout the forecast period. The cord-cutting trends and rising smart TV penetration are propelling the sales of connected TV platforms. More than 71.5% of U.S. households accessed internet-based TV content in 2024, says the Federal Communications Commission (FCC). This underscores that developed markets are moving towards maturity for connected TV platforms. The feature of connected TV platforms to offer higher viewer engagement and better targeting opportunities through server-side ad insertion (SSAI) is also contributing to their sales growth.

Our in-depth analysis of the global video ad insertion platform market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Mode |

|

|

Platform |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Video Ad Insertion Platform Market - Regional Analysis

North America Market Insights

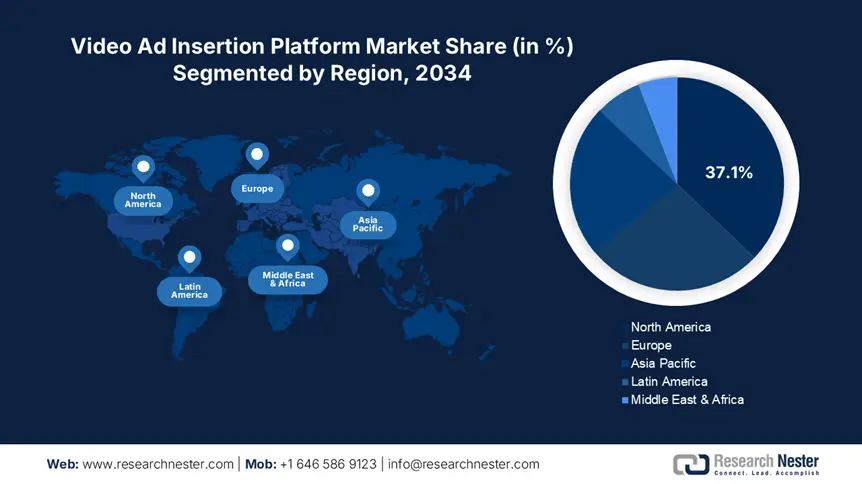

The North America video ad insertion platform market is anticipated to hold 37.1% of the global revenue share by 2034. The mature digital advertising ecosystem and rapid connected TV (CTV) penetration are propelling the sales of video ad insertion platforms. The strong federal investment in broadband and cloud infrastructure is also contributing to the increasing demand for video ad insertion platforms.

In the U.S., the sales of video ad insertion platforms are driven by the presence of advanced broadband infrastructure and extensive federal investment in digital expansion. The growing shift towards connected TV is also expected to have a positive influence on the market growth. The FCC’s Affordable Connectivity Program and NTIA’s BEAD initiative are opening new delivery channels for video advertising. In 2023, more than 2.1 million U.S. households gained access to video platforms through federal broadband programs.

Europe Market Insights

The Europe rm market is projected to capture 26.5% of global revenue share throughout the study period. The regulatory alignment on digital ad standards and increasing reliance on programmatic advertising are propelling the sales of video ad insertion platforms. The robust digital shift is also accelerating the adoption of compliant ad tech solutions. The countries in the region are investing in AI-powered contextual targeting and server-side ad insertion (SSAI) as consumer behavior shifts to mobile and OTT platforms. Germany, France, and the Nordics are some of the key marketplaces for video ad insertion platform producers.

Germany is commanding the highest revenue share in the Europe market, owing to several structural and policy factors. Digital infrastructure investments exceeded €21.1 billion in 2023, contributing to the high production of video ad insertion solutions. Bitkom and the BMDV reveal that nearly 7.2% of the country’s ICT budget was spent on adtech solutions, especially video ad optimization, real-time targeting, and CTV integration. The rise in public-private investment partnerships is poised to double the revenues of key players in the years ahead.

Country-Specific Insights

|

Country |

2023 Budget Allocation to Video Ad Insertion |

2020 Allocation |

Current Market Demand (Est. €) |

|

United Kingdom |

6.6% of the digital infrastructure budget |

5.0% |

€1.2 billion |

|

Germany |

7.2% of the national ICT budget |

5.7% |

€1.3 billion |

|

France |

6.7% of ICT expenditure |

4.9% |

€940.5 million |

APAC Market Insights

The Asia Pacific market is foreseen to increase at a CAGR of 16.5% between 2025 and 2034, owing to mass digitization and rising OTT consumption. The extensive government investments in cloud, AI, and broadband infrastructure are also contributing to the increasing adoption of video ad insertion platforms. China, Japan, India, and South Korea are the most profitable marketplaces for video ad insertion platform producers. These countries are witnessing a surge in programmatic advertising and mobile video consumption.

The China market is driven by the massive ICT infrastructure and the fast-growing base of OTT viewers. The spending on video ad insertion platforms crossed USD 6.5 billion in 2023. Also, more than 5.3 million enterprises integrated video ad insertion platforms during the same year. The shift towards cloud infrastructure in both public and private sectors is expected to drive the overall market growth. The digital economy initiatives are also set to propel the sales of video ad insertion platforms in the coming years.

Country-Specific Insights

|

Country |

Gov. Budget to Video Ad Platforms (2024) |

Adoption (Businesses) |

|

Japan |

$2.9B (4.0% of ICT budget) |

1.5M+ platforms integrated |

|

India |

$1.7B (2023); +66% since 2015 |

4.8M businesses |

|

Malaysia |

$511M (2023); +90% since 2013 |

1.2M businesses |

|

South Korea |

$2.0B (2023) |

62.5% of digital campaigns |

Key Video Ad Insertion Platform Market Players:

- Google LLC (YouTube Ads)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon.com, Inc. (Amazon Ads)

- Comcast Corporation (FreeWheel)

- The Trade Desk, Inc.

- Roku, Inc. (OneView)

- Magnite, Inc.

- Publicis Groupe (Epsilon, Publicis Media)

- RTL Group (via Smartclip)

- Innovid Corp.

- Kaltura, Inc.

- Invidi Technologies Corporation

- Brightcove Inc.

- Tonton Digital Sdn Bhd

- YuppTV

The market is led by dominating companies that focus on large-scale cloud infrastructure and advanced AI for dynamic ad targeting. The digital shift is also attracting numerous SMEs and new companies to expand their operations in this field. The leading companies are employing both organic and inorganic strategies to earn high gains. Partnerships with CTV OEMs, cloud migration, and investments in contextual AI are propelling the revenues of key market players. Some of the industry giants are expanding their operations in emerging markets to get subsidy benefits and boost profit margins through untapped opportunities.

Here is a list of key players operating in the global market:

Recent Developments

- In May 2024, Comcast’s FreeWheel launched AdView+, an AI-enhanced video ad decision-making engine. This solution supports real-time bidding across SSAI (server-side ad insertion) in both live and on-demand video environments.

- In February 2024, Amazon Ads introduced interactive video ad formats for Fire TV and Prime Video. This enables real-time viewer engagement, such as product clicks and voice-prompted purchases.

- In January 2024, Trade Desk deployed a deep learning model named Koa 2.0 for predictive ad targeting. This move contributed to the enhanced video ad conversion rates by 19.5%, per the company’s quarterly results.

- Report ID: 3904

- Published Date: Jul 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Video Ad Insertion Platform Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert