Veterinary Injectable Devices Market Outlook:

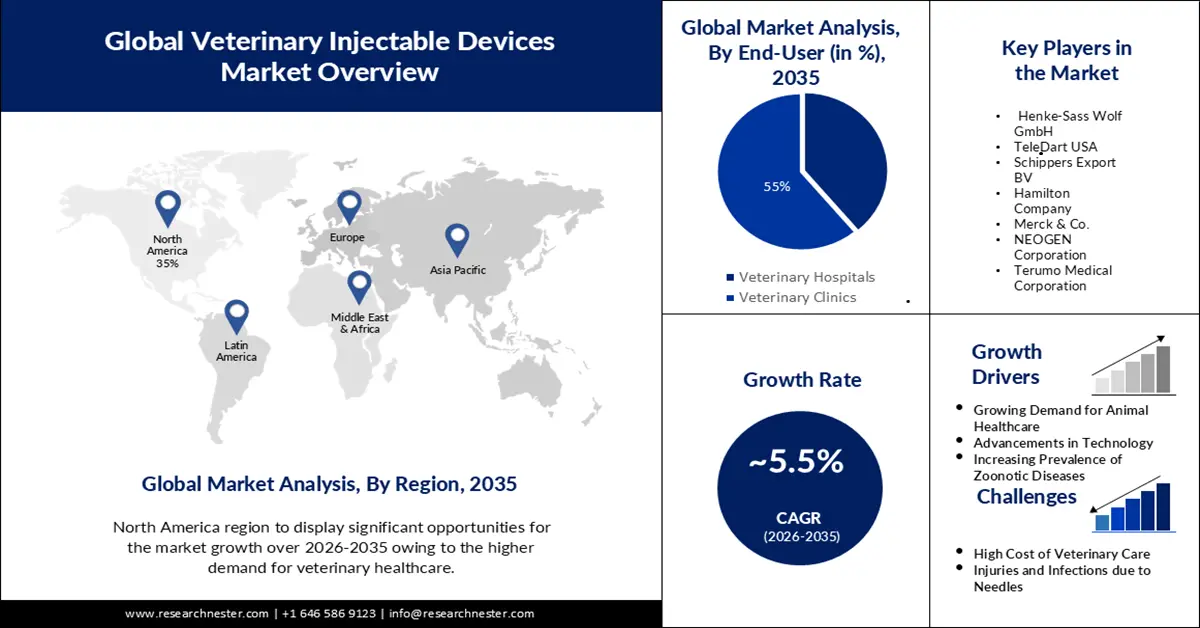

Veterinary Injectable Devices Market size was valued at USD 981.36 million in 2025 and is set to exceed USD 1.68 billion by 2035, registering over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of veterinary injectable devices is estimated at USD 1.03 billion.

The increasing number of pet owners globally is boosting the demand for veterinary injectable devices. Since pet owners are investing highly in the health of their pets.

Furthermore, new drug delivery systems that enhance the convenience, safety, and efficiency of veterinary injection devices are open to development. The increasing investment in R&D for veterinary products is significantly increasing the demand for new and innovated devices. These factors are bolstering the market growth of veterinary injectable devices.

Key Veterinary Injectable Devices Market Insights Summary:

Regional Highlights:

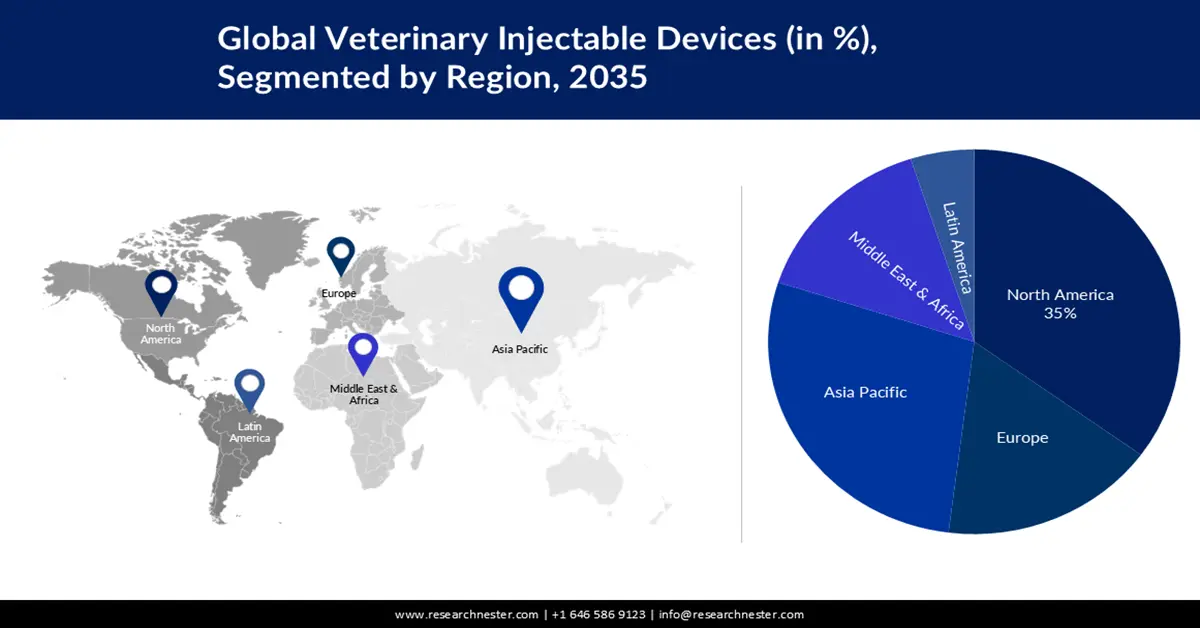

- The North America veterinary injectable devices market is projected to capture a 35% share by 2035, driven by increased spending on companion animals in the U.S.

- The Asia Pacific market is expected to achieve a 26.10% share by 2035, driven by the development of major poultry businesses and improved animal healthcare infrastructure.

Segment Insights:

- The veterinary clinics segment in the veterinary injectable devices market is anticipated to achieve a 55% share by the forecast year 2035, influenced by increasing pet ownership and growing awareness of animal healthcare.

- The disposable segment in the veterinary injectable devices market is forecasted to achieve a remarkable share by 2035, driven by increased demand for secure and convenient devices in animal health.

Key Growth Trends:

- Growing Demand for Animal Healthcare

- Increasing Prevalence of Zoonotic Diseases

Major Challenges:

- High Cost of Veterinary Care

- Injuries and Infections due to Needles

Key Players: Boehringer Ingelheim International GmbH, NuGen Medical Devices Inc, NEOGEN Corporation, Phibro Animal Health, Zoetis Inc.

Global Veterinary Injectable Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 981.36 million

- 2026 Market Size: USD 1.03 billion

- Projected Market Size: USD 1.68 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 8 September, 2025

Veterinary Injectable Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Demand for Animal Healthcare – The focus on animal health and well-being has led to an increase in demand for animal care, which includes the use of injectable medicinal products. The increasing demand for veterinary injectable medicinal products is driving a more proactive attitude by pet owners and animal farmers to seek preventive and curative treatment options. With about 15% of the veterinary injectable devices market at the time, Zoetis had the greatest share in the animal healthcare industry. Boehringer Ingelheim, the second-placed business, had almost 10% of the industry.

-

Advancements in Technology - Significant progress in the development of device design, materials, and features has been made in the animal injection device market. Innovative injectables offering improved accuracy, convenience of use, and safety for both animals and users have been developed by manufacturers. These developments have improved the efficiency and effectiveness of animal health treatments.

- Increasing Prevalence of Zoonotic Diseases – Due to the possibility of spreading infections, an increase in pet ownership puts human health at risk. Zoonotic is an illness that can be passed on from animals to humans. The number of zoonotic diseases worldwide is therefore increasing rapidly. According to research by the WHO, zoonotic diseases cause millions of deaths and about a billion cases of illness each year.

Challenges

-

Stringent Regulatory Supplies – A strict regulatory regime governing the approval and marketing of injectable medicinal products and devices is applicable to the animal health industry. Compliance with these provisions may present challenges to manufacturers and limit market development, which can take a substantial amount of time and cost.

-

High Cost of Veterinary Care

- Injuries and Infections due to Needles

Veterinary Injectable Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 981.36 million |

|

Forecast Year Market Size (2035) |

USD 1.68 billion |

|

Regional Scope |

|

Veterinary Injectable Devices Market Segmentation:

Usability Segment Analysis

Disposable segment is expected to account for remarkable veterinary injectable devices market share by 2035. The emphasis on a high level of security, reduced risk of infections, convenience, and time effectiveness for veterinarians, together with cost-effectiveness are factors that contribute to the increased demand for disposable devices in the animal health sector.

End-User Segment Analysis

The veterinary clinics segment is expected to hold 55% share of the global veterinary injectable devices market during the forecast period.The demand for veterinary services is increasing owing to the growing popularity of pet ownership, shifting demographics, and the growing awareness of animal healthcare. A major provider of animal health services is the veterinary clinic.

Our in-depth analysis of the global veterinary injectable devices market includes the following segments:

|

Product |

|

|

Usability |

|

|

Materials |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Veterinary Injectable Devices Market Regional Analysis:

North American Market Insights

North America industry is anticipated to account for largest revenue share of 35% by 2035. North America is generating the highest revenue owing to the presence of better healthcare facilities. Future trends in the region have also been driven by an increase in spending on companion animals in the United States, which has led to growing market momentum for Veterinary Injectable Devices. Also, the growing adoption of pets in the region is propelling the market growth of veterinary injectable devices.

APAC Market Insights

Asia Pacific veterinary injectable devices market is anticipated to hold the second largest share of 26.1% owing to the development of major poultry businesses, large numbers of animals on farms, and an increase in animal healthcare infrastructure. The risk of contracting the disease is higher in livestock and poultry than in companion animals, and the death of livestock and poultry will lead to financial losses. Government assistance for the protection of farm animals against diseases is used to vaccinate them, and it is expected that this will lead to a higher level of local sales of veterinary injectables.

Veterinary Injectable Devices Market Players:

- Boehringer Ingelheim International GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NuGen Medical Devices Inc

- NEOGEN Corporation

- Phibro Animal Health

- Zoetis Inc

Recent Developments

- NEOGEN Corporation announced that the company had acquired the companion animal health company, CAPInnoVet, Inc. The acquisition would help NEOGEN to expand its portfolio in pet medications to the veterinary market.

- Boehringer Ingelheim announced that its intramuscular needle-free device, FreVAX, can now be managed with the new version of FreVAX smartphone app.

- Report ID: 871

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.