Veterinary Imaging Market Outlook:

Veterinary Imaging Market size was over USD 2.5 billion in 2025 and is estimated to reach USD 4.8 billion by the end of 2035, expanding at a CAGR of 6.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of veterinary imaging is evaluated at USD 2.6 billion.

The amplifying volume of pet owners around the world is one of the leading growth drivers in the market. As awareness and empathy about animal welfare are widely spreading, personal expenditure and public investments in this sector are increasing. According to a report published by the Global Animal Health Association in September 2022, the net count of cats and dogs as pets in key economies, including Europe, China, and the U.S., crossed 496 million. It also mentioned that more than 50% of the citizens living across the globe had a pet at home during the same timeline. Besides, with the rapidly growing global population, the demand for livestock products is expected to double by 2050, as per the Climate Risk Management journal.

This demography indicates the urgent need for deploying tools and services available in the market to ensure the health of both humans and animals. However, the expensiveness of animal healthcare often creates a barrier to widespread adoption in this sector. In this regard, a 2025 journal of Preventive Veterinary Medicine unveiled that the median inflation-corrected cost per visit in veterinary clinics in Denmark was 133 EUR, where the median lifetime health care cost for dogs was approximately 2800 EUR. This signifies the requirement of cultivating value-based models of medical settings to enhance affordability that can be achieved through strategic partnerships and cost-effective innovations.

Key Veterinary Imaging Market Insights Summary:

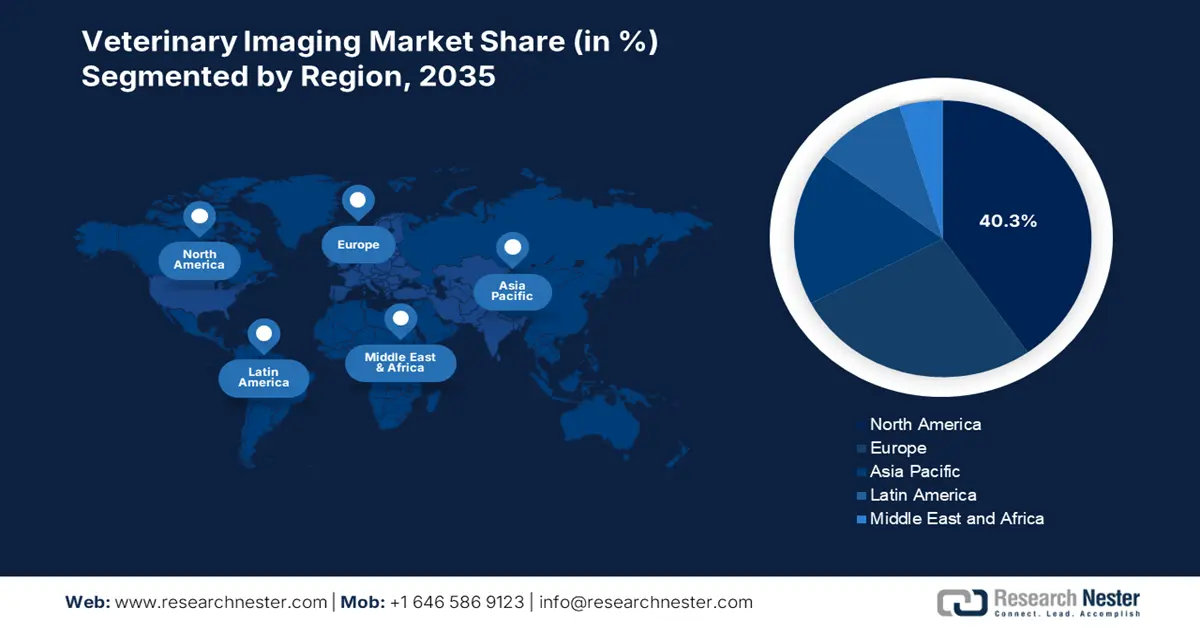

Regional Highlights:

- By 2035, North America is forecasted to secure a 40.3% share in the veterinary imaging market, upheld by its robust animal-health ecosystem, strong livestock demand, and expanding federal disease-prevention investments.

- Across 2026–2035, Asia Pacific is anticipated to emerge as the fastest-growing region, supported by rising production capacity and intensified governmental focus on early veterinary disease prevention.

Segment Insights:

- By 2035, the X-ray sub-segment is estimated to command a 41.6% share in the veterinary imaging market, bolstered by its broad diagnostic applicability and workflow advantages enabled through digital radiography.

- Over 2026–2035, the pet animals segment is expected to remain a leading revenue generator, fueled by growing owner spending, heightened health awareness, and increasing reliance on diagnostic imaging in companion animal care.

Key Growth Trends:

- Growing importance of maintaining animal health

- Government-backed investments and initiatives

Major Challenges:

- Lack of resources and professionals

- Limitations in financial backing and affordability

Key Players: Garmin Ltd., Sigma Sport GmbH, Lezyne U.S. Inc., Knog Pty Ltd., Uno Minda, Blackburn Design, Exposure Lights, BBB Cycling, NiteRider Technical Lighting Systems, Globetronics Technology Bhd, Lupine Lighting Systems, Samsung Electronics

Global Veterinary Imaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.5 billion

- 2026 Market Size: USD 2.6 billion

- Projected Market Size: USD 4.8 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Australia, Mexico

Last updated on : 28 August, 2025

Veterinary Imaging Market - Growth Drivers and Challenges

Growth Drivers

- Growing importance of maintaining animal health: Enhanced focus on animal welfare and preventive care is creating a surge in early diagnosis and, hence, fueling the market. This can be testified by the explosive value of the animal health industry, which is expected to reach USD 163.3 billion by 2034. The heightening prevalence of chronic ailments and musculoskeletal disorders in pets and livestock is also boosting the significance of this sector. Evidencing the same, a study on the impact of disease and infections on livestock production in Tanzania revealed that up to a 31.0% morbidity rate and 58.4% mortality rate were observed across dairy farms in 2022. These push farmers and food safety authorities to invest in this category.

- Government-backed investments and initiatives: Considering the negative influence of ailments on the food quality and environmental balance, more government authorities are showing interest in engaging sources for the expansion of the market. For instance, in 2023, the Department of Animal Husbandry and Dairying allocated a total of Rs. 630.70 crore in funding to empower the maintenance and monitoring of animal health. This indicates the stability of both cash inflow and capital influx in this sector, attracting more MedTech pioneers to participate and invest. Moreover, such allocations act as a financial cushion for innovation in this category.

- Increasing engagement in extensive research: Amplifying volume of investments in medicinal and clinical research boosts demand for advanced technologies, propelling the pace of innovation in the market. Besides, the tendency to develop therapeutic resistance among animals also forces dedicated public and private pharmaceutical entities to conduct rigorous R&D to identify the root cause of disease and effective drug candidates. This subsequently augments a surge in implementing next-generation technologies in this field. Following the same pathway, in September 2022, Konica Minolta launched its VETSMART Digital Imaging System that uses AI to optimize technique based on patient size and exam type.

Historic Expansion in Pet Population Benefiting the Market

Count of Dogs & Cats Owning Households in the U.S.

|

Year |

Number of Dogs (Million) |

Number of Cats (Million) |

|

2001 |

37.8 |

33.2 |

|

2006 |

43.0 |

37.5 |

|

2011 |

43.3 |

36.1 |

|

2016 |

48.2 |

31.8 |

|

2020 |

62.0 |

37.0 |

Source: AVMA

Trend in Pet Care Expenditure Securing Steady Cash Inflow in the Market

Pet Care Expenditure in the U.S. (2023)

|

Category |

Spending Amount |

Notes |

|

Average Annual Spending per Household |

$1,516 |

Average total spent on pets excluding purchase or adoption |

|

Vet Care Spending per Dog Owner |

$580 |

Average annual veterinary care spending by dog owners |

|

Vet Care Spending per Cat Owner |

$433 |

Average annual veterinary care spending by cat owners |

|

Dog Owners Total Annual Spending |

> $1,700 |

Average total annual spending by dog owners |

|

Cat Owners Total Annual Spending |

< $1,350 |

Average total annual spending by cat owners |

Source: AVMA

Challenges

- Lack of resources and professionals: The shortage of specialized infrastructure and workforce remains a persistent roadblock in the rapid expansion of the market. Testifying to the same, the Global Animal Health Association estimated that more than 75 million pets in the U.S. to not have access to care by 2030. This underscores the urgent need for measurable reinforcement in associated medical settings, which also contributes to the minimization of this disparity. Moreover, more training and employment programs are needed to support this cohort.

- Limitations in financial backing and affordability: Unlike human health systems, animal-related medical response is often neglected in various regions, specifically in countries with constrained resources. The absence of standardized reimbursement frameworks is also a contributing factor to making services largely out-of-pocket. This restricts consumer access in the market, particularly among pet owners with lower budgets. To address this lack, both public and private organizations are needed to engage in widespread accessibility initiatives.

Veterinary Imaging Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 2.5 billion |

|

Forecast Year Market Size (2035) |

USD 4.8 billion |

|

Regional Scope |

|

Veterinary Imaging Market Segmentation:

Product Type Segment Analysis

The X-ray sub-segment is poised to dominate the market with a 41.6% share by the end of 2035. The broad applicability of this tool in routine diagnostics and skeletal evaluations is the foundational pillar of its leadership in the sector. As the subtype is widely used to identify fractures, joint issues, and dental conditions, X-ray systems are essential in both companion animal and livestock care. The forefront position can further be validated by the expanding patient pool, where a 2023 study showcased that the most prevalent medical conditions reported by owners of 25 most common dog breeds were dental calculus, extracted teeth, and osteoarthritis. Moreover, the introduction of digital radiography has improved image quality and workflow efficiency, making X-ray a practical and cost-effective solution.

Animal Type Segment Analysis

Pet animals are expected to be one of the largest contributors to revenue generation in the market over the assessed period. The worldwide rise in out-of-pocket expenditure on companion animals and increasing awareness of pet health are propelling adoption in this category. Dogs and cats, in particular, require regular care, including diagnostic imaging for conditions such as bone injuries, organ disorders, and dental issues, which translates to a steady cash inflow. Besides, advancements in technologies, combined with government-backed accessibility efforts, are amplifying the volume of imaging diagnoses in veterinary clinics.

End user Segment Analysis

Veterinary clinics & hospitals are estimated to maintain their position as the primary end users in the market throughout the discussed timeframe. Their central role in delivering routine and specialized animal care is the major driver behind this dominant augmentation. As these facilities rely heavily on imaging technologies, such as X-rays, ultrasound, and CT scans, to deliver accurate diagnosis and treatment planning across a wide range of conditions, their significance as the priority consumer base solidifies. Furthermore, the widening network of clinics and growing investments in modern diagnostic infrastructure are strengthening the pace of adoption in this sector.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Animal Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Veterinary Imaging Market - Regional Analysis

North America Market Insights

North America is predicted to hold the largest share of 40.3% in the global veterinary imaging market by the end of 2035. The region’s dominance in this sector is primarily attributed to the advanced animal health infrastructure, massive consumption of livestock, and government-backed financial support. In this regard, in May 2024, the U.S. Department of Agriculture’s (USDA) Animal and Plant Health Inspection Service (APHIS) allocated $22.2 million to enhance prevention, preparedness, early detection, and rapid response to the most damaging diseases, threatening the liability and capacity of livestock. Such an influx of capital, coupled with the ongoing technological innovations, is consolidating the region’s strong presence in this sector.

According to the 2025 APPA National Pet Owners Survey, approximately 94 million U.S. households own a pet. Additionally, the sale value of vet care and products in the country accounted for $41.4 billion in the same year. This establishes the nation as both the epicenter of consumer base and revenue generation for the regional landscape. On the other hand, a 2023 OEC database revealed that the net export and import of animal produts in the U.S. were valued at $35.3 billion and $41.9 billion, respectively. These figures testifies to the growing significance of the country in this field.

Canada is a considerable landscape in the North America veterinary imaging market on account of its robust livestock industry and growing demand for animal health diagnostics. As of January 2023, the country consisted of an inventory filled with 11.3 million head of cattle, 13.9 million hogs, 809 million chickens & turkeys, and 854,400 sheep & lambs across more than 76.7 thousand farms. Besides, in 2022, Canada recorded $35 billion in retail sales of meat, poultry, and dairy products, as per the Canadian Agri-Food Policy Institute. This portrays the nation's strong emphasis on this sector, which is gained through an enlarging consumer base.

APAC Market Insights

Asia Pacific is anticipated to become the fastest-growing region in the global veterinary imaging market during the analyzed tenure. The region’s propagation in this sector is fastening under the influence of its globally leading production capacity and government initiatives to implement optimum measures for early disease prevention. These dynamics are portrayed through the enlarging dairy industry in emerging economies, such as India, Malaysia, and China. Such a business environment is further influencing domestic pioneers to invest more in innovations, which can be exemplified by the launch of MyVet CT Plus by WOORIEN in October 2024. The advanced veterinary imaging solution lowered CT barriers and improved diagnostic quality with the use of spiral-Linear Technology.

The China veterinary imaging market is expanding rapidly alongside rising pet ownership, livestock health awareness, and government support for modern animal health services. The presence of a massive demography can be displayed through the population of dogs and cats as pets in the country, which collectively accounted for 141 million in 2022, as per the Global Animal Health Association. Furthermore, the emergence of advanced imaging modalities, such as digital X-ray and video endoscopy, is also fueling the country’s augmentation in this sector.

India is one of the emerging landscapes in the APAC veterinary imaging market, which is primarily supported by the rising impact of animal-transmitted diseases on human health. As evidence, till 2022, more than 20 thousand cases of rabies transmission to humans from dogs were registered from across the country, making it the most affected country in this category, according to a report from the Global Animal Health Association. As a result, both public and private healthcare authorities are actively promoting the use of early detection and prevention to combat the widespread.

Country-wise Favorable Provinces and Statistics

|

Country |

Segment |

Key Point |

Year of Impact |

|

Australia |

Animal health practices in the livestock industry |

National Action Plan for Production Animal Health |

2022 to 2027 |

|

South Korea |

Regulatory and bio-science testing |

Scientific use of animals reached around 5 million |

2012-2022 |

|

Indonesia |

Livestock biomass

|

The value of livestock crossed USD 54 billion |

2021 |

Source: Australian Government, MAFRA, and ScienceDirect

Europe Market Insights

Europe is expected to maintain its position as the second-largest shareholder in the global veterinary imaging market between 2026 and 2035. The region’s persistent performance in this sector is attributable to the enlarging pet population and livestock demand base. Testifying to the same, in 2022 alone, Europe consists of 92 million and 113 million of dog and cat pets, as recorded by the Global Animal Health Association. In this landscape, the dominance of small clinics is evidently portrayed through 67% of veterinarians practicing in these institutions till 2022. Besides, strong veterinary education standards and regional cooperation in animal health regulation are also supporting growth in this sector.

Germany, as the leading regional economy, represents a predominant share in the Europe veterinary imaging market. The country’s position is consolidated by a strong demand for X-ray diagnosis, which is further complemented by the accelerated adoption of video endoscopy. The country’s leadership can also be testified by the import and export values of animal products in 2023, which accounted for $25.5 billion and $25.7 billion, respectively, as per the OEC report. This signifies the large volume of livestock production and consumption in Germany, benefiting the wide expansion of the merchandise.

According to the OEC, the Netherlands ranked 1st among the global exporters of live animals in 2023, totaling $183 million. As a result, both the governing bodies and small clinics of the country heavily invest in the veterinary imaging market to cultivate high-throughput diagnostic capabilities locally. Besides, the presence of an established ecosystem for sample preparation and reagent utilization during ultrasound assessments creates new opportunities for the suppliers and innovators operating in this field.

Country-wise Population of Pets (2022)

|

Country |

Dogs (Million) |

Cats (Million) |

|

Spain |

6.7 |

3.7 |

|

France |

7.6 |

14.2 |

|

Russia |

17.1 |

22.7 |

Source: Global Animal Health Association

Key Veterinary Imaging Market Players:

- Garmin Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sigma Sport GmbH

- Lezyne U.S. Inc.

- Knog Pty Ltd.

- Uno Minda

- Blackburn Design

- Exposure Lights

- BBB Cycling

- NiteRider Technical Lighting Systems

- Globetronics Technology Bhd

- Lupine Lighting Systems

- Samsung Electronics

Strategic product innovation and regional expansion are the primary roadmaps for key players to reinforce their leadership in the continuously evolving veterinary imaging market. As evidence, in May 2024, Esaote strengthened its position in North America by launching a new veterinary ultrasound system, MyLabFOX, which is designed to reflect the agility and intelligence of its namesake. The launch set a new benchmark in associated ultrasound technology by offering a versatile and adaptive scanning feature.

Such pioneers are:

Recent Developments

- In March 2025, Antech launched a comprehensive in-house canine vector-borne disease (CVBD) screening test, trūRapid FOUR, to detect canine antibodies. With just a few drops of the sample, the tool is designed to deliver a streamlined workflow with proven reliability and broad reactivity.

- In January 2025, Core Imaging introduced the pinnacle of veterinary ultrasound imaging excellence, Carnation, supporting high-volume veterinary practices. The device redefines ultrasound technology with innovative features that ensure precision, versatility, and seamless workflow integration.

- Report ID: 4326

- Published Date: Aug 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Veterinary Imaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.