Vending Machine Market Outlook:

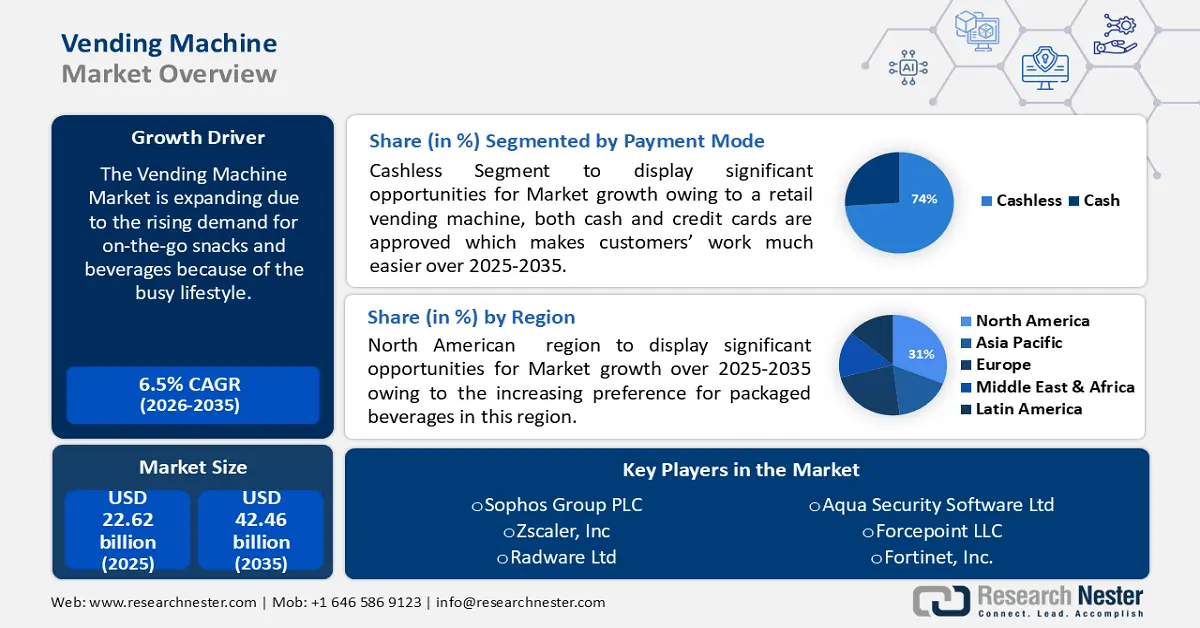

Vending Machine Market size was over USD 22.62 billion in 2025 and is poised to exceed USD 42.46 billion by 2035, growing at over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vending machine is estimated at USD 23.94 billion.

The rising demand for on-the-go snacks and beverages because of the busy lifestyle will exponentially help the market to grow in the coming years. Today's consumers want to be able to quickly obtain the majority of their daily nutrition due to changing household dynamics and hectic lifestyles. Although U.S. male and female consumers of ready meals split pretty evenly, consumers over the age of 55 account for only 26% of consumption, according to our recent survey.

Another reason to propel the vending machine market is the rising inclination of younger consumers toward healthy food substitutes. Younger customers are increasingly choosing healthier options; 65% of Gen Z consumers believe that a diet that is more "plant-forward" is good, and 77% of millennials agree that leading a balanced, healthy lifestyle is crucial. The convenience food and beverage business has experienced positive changes due to the growing purchasing power of millennials and Gen Z and their demands for healthier options.

Key Vending Machine Market Insights Summary:

Regional Highlights:

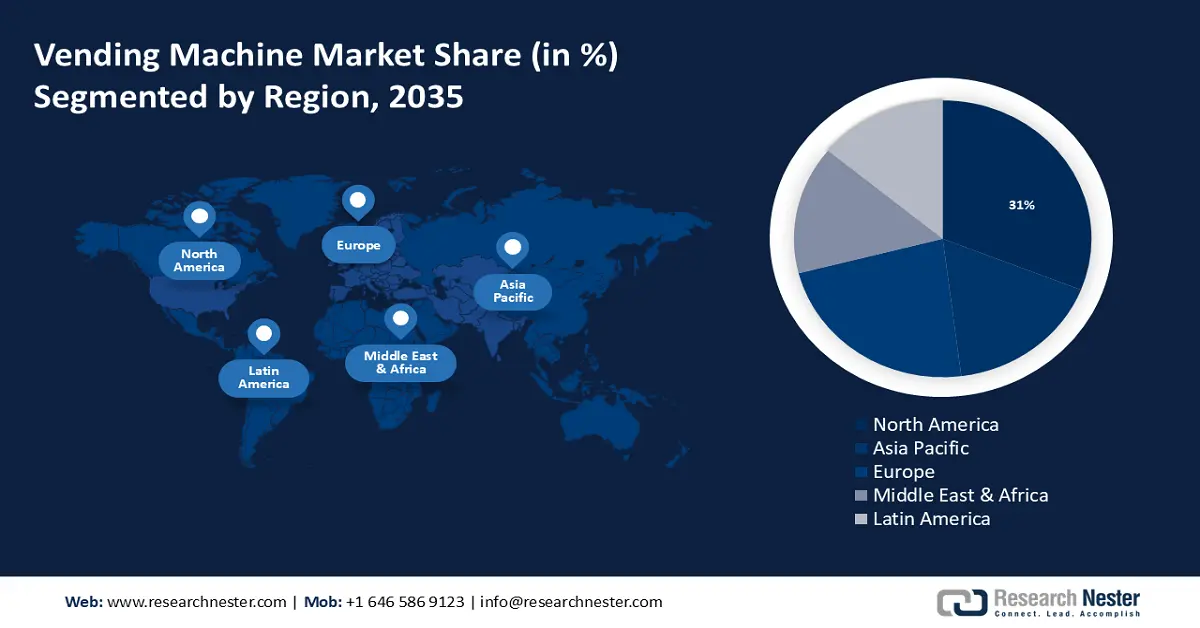

- North America vending machine market will hold more than 31% share by 2035, driven by the increasing preference for packaged beverages and rising disposable income.

- Europe market will capture a 23% share by 2035, driven by the adoption of self-serve beverage vending machines in sports stadiums.

Segment Insights:

- The cashless payment mode segment in the vending machine market is forecasted to witness robust growth through 2035, influenced by the convenience of mobile and card payments in vending machines.

- The corporate offices segment is anticipated to secure a 47% market share by 2035, driven by the demand for food vending machines in corporate environments worldwide.

Key Growth Trends:

- The rising consumption of ready-to-eat food items

- Rising consumption of processed fruits and vegetables across the world

Major Challenges:

- The starting installation cost of vending machine is relatively high

Key Players: Azkoyen Group, Business PlanningMain Product OfferingsFinancial ExecutionMain Performance IndicatorsCantaloupe Systems, Westomatic Vending Services Limited, Royal Vendors, Inc., Glory Ltd., Sanden Holding Corp., Seaga Manufacturing Inc., Orasesta S.p.A, Sellmat s.r.l., JARSS Foods.

Global Vending Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.62 billion

- 2026 Market Size: USD 23.94 billion

- Projected Market Size: USD 42.46 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, China, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 13 October, 2025

Vending Machine Market Growth Drivers and Challenges:

Growth Drivers

- Rising consumption of ready-to-eat food items - An element driving up the vending machine market demand is the growing number of working women who are putting their jobs ahead of cooking duties. The rising use of high-tech appliances such as induction cooktops and microwaves has simplified cooking and encouraged prepared foods that work with these appliances. Furthermore, ready-to-eat food consumption has increased globally as a result of globalization. It is unclear what social and demographic aspects of society influence the consumption of ready-to-eat meals. A few factors that contribute to the convenience preferences of kitchen evaders are mealtime breakdowns, lone meals, and individualistic consuming habits. They pay more for takeout food and are ardent supporters of ready meals.

- Rising consumption of processed fruits and vegetables across the world - Individual family members' decisions about what fruits and vegetables (F&V) to eat differ from those of a typical family in terms of the influence of uncontrollable factors. A typical family's attitude is positive, in contrast to certain family members' unfavorable attitudes. Since they import the most, Germany, the Netherlands, France, the United Kingdom, and Italy present the finest chances of consuming processed fruits and vegetables in the European region. The products that have the most potential in 2024 are dates, cashew nuts, coconut products, frozen fruit, canned tropical fruit, and olive products.

- Endorsement of smart customer service technologies in different food - The development of active and intelligent packing technologies, which promise to produce safer and higher-quality food products, is the key instance of innovation in food packaging. To preserve or increase the product's quality and shelf life, active packaging involves adding an active component to the box. The packed food can be monitored by intelligent systems to give information about the product's quality during storage and transit. Additionally, these packaging technologies can combine to create a food packaging system with several uses.

Challenges

- High starting installation cost of vending machines - It's not as inexpensive to buy and run a vending machine as it might seem. A machine can cost up to USD 10,000, and the additional costs of upkeep and operation. It might be expensive to keep buying new goods for the machine and to discard and replace any that have gone bad.

- Regular maintenance and servicing are essential to the proper functioning of vending machines. Product stock-outs, malfunctions, and problems with the payment system can all negatively affect the clientele's experience and cost businesses business. Timely maintenance and attentive customer service are needed to resolve these problems.

- Vending machines compete with other retail channels, including convenience stores, online retail, and food delivery services.

Vending Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 22.62 billion |

|

Forecast Year Market Size (2035) |

USD 42.46 billion |

|

Regional Scope |

|

Vending Machine Market Segmentation:

Type Segment Analysis

The food & beverages vending machines segment is slated to hold almost 43% share of the vending machine market by 2035. The surging adoption and frequency of these vending machines across the world is one of the major factors that is predicted to boost the segment growth. Moreover, a survey conducted via the Internet was sent to 1250 employees and students. Since enrolling in the university, the majority of participants reported weight gain (43%) and worse food choices (53%). Participants deemed Foods from VM pricey (54%) and boring (34%). More than 81% asked that healthier options be made available. Among the participants, VM users made up about 75%. Chips, chocolate, and water were the most popular VM purchases.

Payment Mode Segment Analysis

The cashless segment is expected to hold 74% of the revenue share by 2035. In a retail vending machine, both cash and credit cards are approved which makes customers’ work much easier. The benefit was obvious when credit/debit card readers for vending machines were first introduced. Allow customers to use their credit or debit cards, which they already have, to make purchases even if they don't have cash. As more people began carrying smartphones, major tech companies introduced mobile payment features like Apple Pay, giving end customers an additional payment option.

Application Segment Analysis

By 2035, the corporate offices segment is poised to hold the largest share of 47%. This is due to the increasing demand for food vending machines in corporate offices across the globe. The figure demonstrates how commonplace vending machines are in our daily lives. With 7 million machines in use worldwide, it's obvious that vending machines play a significant role in our daily lives by giving us easy access to drinks, snacks, and other necessities.

Our in-depth analysis of the vending machine market includes the following segments::

|

Product |

|

|

Type |

|

|

Payment Mode |

|

|

Temperature Control |

|

|

Application |

|

|

Technology |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vending Machine Market Regional Analysis:

North American Market Insights

The North America vending machine market is expected to dominate a revenue share of around 31% by 2035, owing to the increasing preference for packaged beverages in this region. The food and beverage industry is thriving in the US, which is known for its innovation and energy. Over 30,000 new products are introduced into this large industry annually. However, there is fierce competition and crowding in the US retail market. For F&B brands, this makes it challenging to determine which grocers to target to reach the right consumer. It is anticipated that the two primary drivers of the food and beverage business will be rising disposable income and an increase in the proportion of young people in North America with significant purchasing power.

European Market Insights

Europe region is predicted to account for vending machine market share of 23% by 2035. The market expansion can be attributed to the rising implementation of different food & beverage vending machines at sports stadiums, such as basketball, football, cricket, baseball, and others in this region. Self-serve beverage technology has now reached several dozen major stadiums and arenas in Europe, mirroring a growing trend of consumer-directed and automated experiences in many other areas of commerce, such as checkout-free stores. This technology allows fans to purchase both alcoholic and non-alcoholic drinks themselves, often in a matter of seconds.

Vending Machine Market Players:

- Azkoyen Group

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cantaloupe Systems

- Westomatic Vending Services Limited

- Royal Vendors, Inc.

- Glory Ltd.

- Sanden Holding Corp.

- Seaga Manufacturing Inc.

- Orasesta S.p.A

- Sellmat s.r.l.

- JARSS Foods

Recent Developments

- Azkoyen Group achieved the Most Sustainable Product award for its Neo Q machine vending machine, which blends coffee and water services and encourages renewability in workplaces, leisure centers, gyms, and other institutions by encouraging the utilization of one's cup or bottle. This machine currently accepted the IF Design Award, one of the most esteemed awards in the world of planning.

- Azkoyen Group launched MIA Easymilk technology in their vending machines. It smoothly incorporates operational effectiveness with unbending quality and acts as an accelerator for operators and roasters alike to alleviate their coffee strategy.

- Report ID: 6023

- Published Date: Oct 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vending Machine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.