Vascular Access Device Market Outlook:

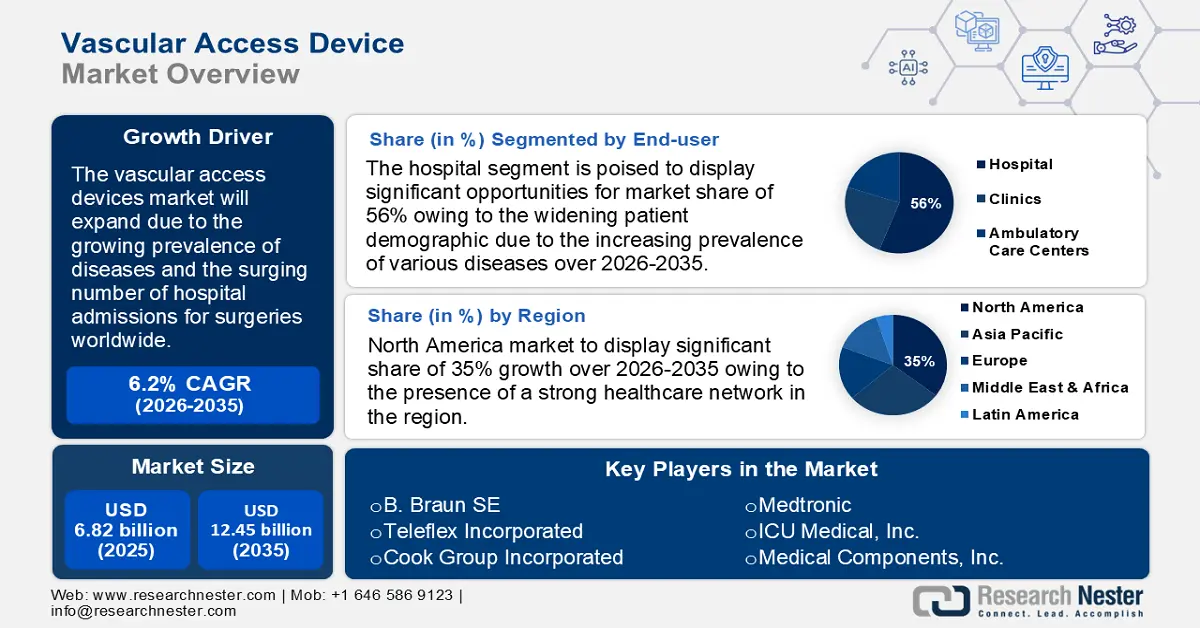

Vascular Access Device Market size was over USD 6.82 billion in 2025 and is projected to reach USD 12.45 billion by 2035, witnessing around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vascular access device is evaluated at USD 7.2 billion.

The growth of the market can be attributed to the growing burden of diseases worldwide as well as the rising number of hospital admissions together with the augmenting percentage of surgeries that require repeated and long-term access to the bloodstream for frequent or regular administration of drugs. For instance, it was observed that a staggering 310 million major surgeries are performed worldwide annually.

In addition to these, factors that are believed to fuel the vascular access device market growth of irritable bowel syndrome drugs include the increasing number of approvals, along with the rise in clinical trials on the available technologies confirming the safety and cost-efficiency of vascular access devices. For instance, in May 2022, Teleflex Incorporated, a leading global provider of medical technologies, announced the receipt of Health Canada approval for the MANTA Vascular Closure Device, which was the first commercially available biomechanical vascular closure device designed specifically for large bore femoral arterial access site closure. Additionally, the growing number of collaborations, acquisitions, and soaring investments is predicted to present the potential for market expansion over the projected period.

Key Vascular Access Device Market Insights Summary:

Regional Highlights:

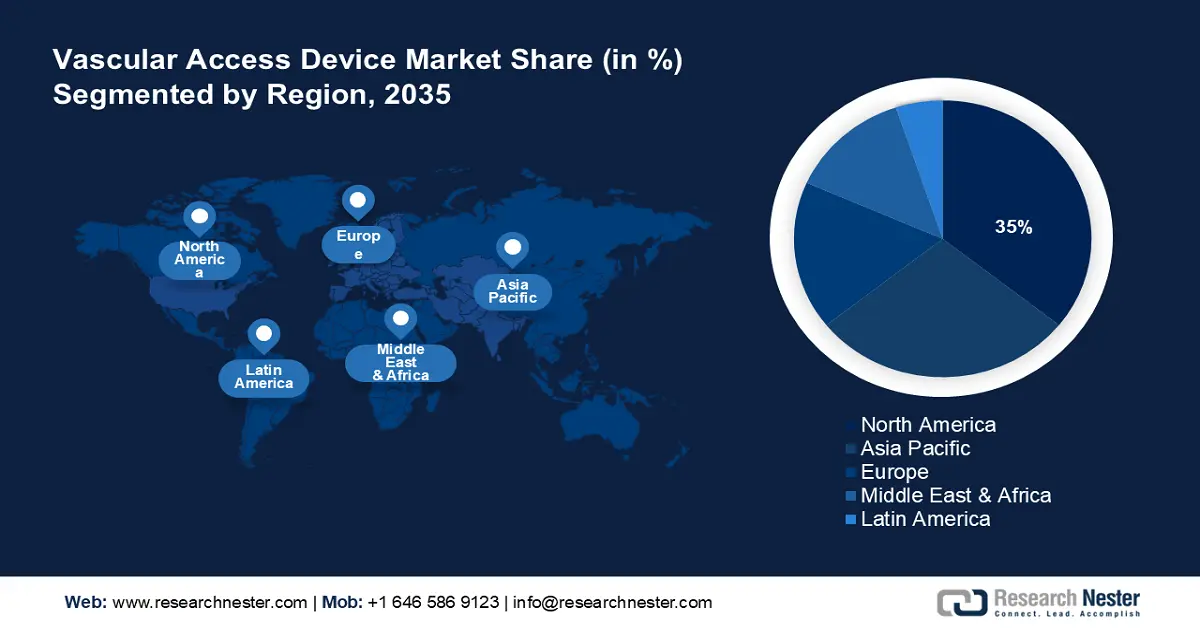

- The North America vascular access device market is projected to capture a 35% share by 2035, driven by presence of a strong healthcare network, increased footfall of patients, growing number of surgeries, and high implantation of coronary stents.

- The Asia Pacific market is expected to secure a 24% share by 2035, fueled by growing technological advancements in the medical field, rapidly expanding medical devices industry, expanding medical tourism, aging population, increased public awareness about preventive health care, and rising prevalence of diabetes, hypertension, and lifestyle disorders.

Segment Insights:

- The hospitals segment in the vascular access device market is expected to hold a 56% share by 2035, driven by widening patient demographics and increasing hospital admissions worldwide.

- The administration of drugs segment in the vascular access device market is projected to achieve a 46% share by 2035, driven by the effectiveness of implanted ports and expanding healthcare centers meeting rising patient demand.

Key Growth Trends:

- Rising Burden of Diseases

- Increasing Ubiquity of Chronic Kidney Disease (CKD) & Rising Number of Patients on Hemodialysis

Major Challenges:

- Possibility of vascular access failure

- Concern for exposure to infections

Key Players: B. Braun SE, Becton, Dickinson, and Company, Teleflex Incorporated, Cook Group Incorporated, Medtronic, ICU Medical, Inc., Medical Components, Inc., Terumo Medical Corporation, Access Vascular, Inc., Siemens Healthineers AG.

Global Vascular Access Device Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.82 billion

- 2026 Market Size: USD 7.2 billion

- Projected Market Size: USD 12.45 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 10 September, 2025

Vascular Access Device Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Burden of Diseases – The growing concern about the changing lifestyle as well as the increasing burden of various chronic diseases worldwide which requires surgical procedures such as chemotherapy, cardiovascular interventions, neurovascular interventions, and others is expected to raise the demand for vascular access devices over the forecast period. Further, the increasing number of hospital admissions is also anticipated to boost the market growth. As per a study, almost 90% of hospital inpatients require IV therapy when hospitalized.

-

Increasing Ubiquity of Chronic Kidney Disease (CKD) & Rising Number of Patients on Hemodialysis – Vascular access is needed for patients undergoing the procedures such as dialysis. Hence, with the increasing number of patients suffering from chronic kidney disease (CKD) and many of them undergoing dialysis, the vascular access device market is expected to grow further. For instance, the prevalence of CKD was estimated to be ~13% in 2019, whereas patients with end-stage kidney disease (ESKD) in need of renal replacement therapy worldwide were estimated to be between ~4.9 and ~7 million. Moreover, it is observed that around 600,000 Americans undergo dialysis every year.

- Growing Geriatric Population – The elderly population is one of the most vulnerable patient groups who undergo vascular access for the administration of drugs and fluids. Thus, the rising geriatric population in the world is considered to be a primary factor for market growth. United Nations Department of Economic and Social Affairs, the World Population Ageing 2020 report revealed that in the year 2020, worldwide there were ~727 million people aged 65 years or above.

- Widening Scope of Vascular Screening – The use of vascular screening in the medical field is rapidly rising as it is one of the only effective and noninvasive ways of gauging risk levels for several conditions it investigates and has the ability to detect health issues that are not yet obvious to the patient. For instance, as per recommendations, a patient with a risk for vascular disease or a personal or family history of cardiac disease needs to get a vascular screening done every 3 to 5 years. This, as a result, is expected to boost the market growth.

Challenges

-

Possibility of vascular access failure - All types of vascular access may cause problems that require further treatment or surgery, the most common problems include low blood flow due to blood clotting in the access. It is considered a major challenge and can be anticipated to hamper the market growth.

-

Concern for exposure to infections

- Side-Effects associated with long-term usage

Vascular Access Device Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 6.82 billion |

|

Forecast Year Market Size (2035) |

USD 12.45 billion |

|

Regional Scope |

|

Vascular Access Device Market Segmentation:

End-user Segment Analysis

The global vascular access device market is segmented and analyzed for demand and supply by end-user into hospitals, clinics, ambulatory care centers, and others. Amongst this end-user of the vascular access device, the hospital segment is estimated to gain the largest market share of about 56% in the year 2035. The growth of the segment can be attributed to the widening patient demographics owing to the increasing prevalence of various diseases as well as a surge in the number of hospital admissions worldwide. For instance, as per the 22nd edition of the AHA Hospital Statistics report published by the American Hospital Association (AHA), the total number of admissions was recorded as 33,356,853 in all the hospitals across the nation in 2021.

Application Segment Analysis

The global vascular access device market is also segmented and analyzed for demand and supply by application into the administration of drugs, administration of fluid & nutrition, transfusion of blood products, diagnostics & testing. Amongst these segments, the administration of drugs segment is expected to garner a significant share of around 46% in the year 2035. For patients treated with systematic anti-cancer treatment, the completely implanted ports (PORTs) are safe and more effective than Hickman. Consequently, the segment's growth is supported by the availability of a wide range of vessels for access and their effectiveness in comparison with other devices. The expanding number of healthcare centers as well as the growing number of patients admitted to hospitals owing to the rapid widespread of many concerning diseases and severe health conditions are anticipated to boost the segment growth of the segment in the upcoming years.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vascular Access Device Market Regional Analysis:

North American Market Insights

The vascular access device market in North America is projected to be the largest with a share of about 35% by the end of 2035. The growth of the market can be attributed majorly to the presence of a strong healthcare network as well as the increased footfall of patients together with the growing number of surgeries in the region with growing concern about several diseases. For instance, it is observed that in the United States alone, every year nearly 50 million surgeries are performed. Additionally, it is seen that every year over 600 000 coronary stents are implanted during percutaneous coronary interventions (PCIs) in the United States.

APAC Market Insights

The Asia Pacific vascular access device market is estimated to be the second largest, registering a share of about 24% by the end of 2035. The growth of the market can be attributed majorly to the growing technological advancements in the medical field as well as the rapidly expanding medical devices industry besides expanding the scope of medical tourism in the region. The aging of the population and increased public awareness about preventive health care are driving growth in this area. Major global firms are further expanding their presence in these emerging nations, with a view to exploiting the growing potential offered by China, Japan, India, and South Korea. Moreover, the rising prevalence of diabetes, hypertension, and other severe lifestyle disorders is leading to the vast pool of the population suffering from various cardiological, nephrological, and neurovascular disorders. This, as a result, is anticipated to boost the regional market growth.

Europe Market Insights

Europe region is projected to observe substantial growth through 2035. There has been a rise in the acceptance of safety devices preventing needlestick injuries on the market. In particular, the market for PIVC and syringe and needle products that account for a substantial proportion of Europe's total vascular access market is affected by this trend. The constant research & development in the field of medical devices as well as the growing pool of patients admitted to hospitals in the region besides the increasing pool aging population is expected to boost the market growth in the region over the forecast years.

Vascular Access Device Market Players:

- B. Braun SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Becton, Dickinson, and Company

- Teleflex Incorporated

- Cook Group Incorporated

- Medtronic

- ICU Medical, Inc.

- Medical Components, Inc.

- Terumo Medical Corporation

- Access Vascular, Inc.

- Siemens Healthineers AG

Recent Developments

- BD (Becton, Dickinson, and Company), a leading global medical technology company, launched BD Prevue II System. It’s a new, easy-to-use advanced ultrasound device with a specialized probe designed to provide clinicians with optimal IV placement.

- B. Braun SE and REVA Medical announced their strategic partnership for the distribution of Fantom Encore - a bioresorbable scaffold for coronary interventions, manufactured with REVA's patented material Tyrocore.

- Report ID: 4854

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vascular Access Device Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.