Hemodialysis and Peritoneal Dialysis Market Outlook:

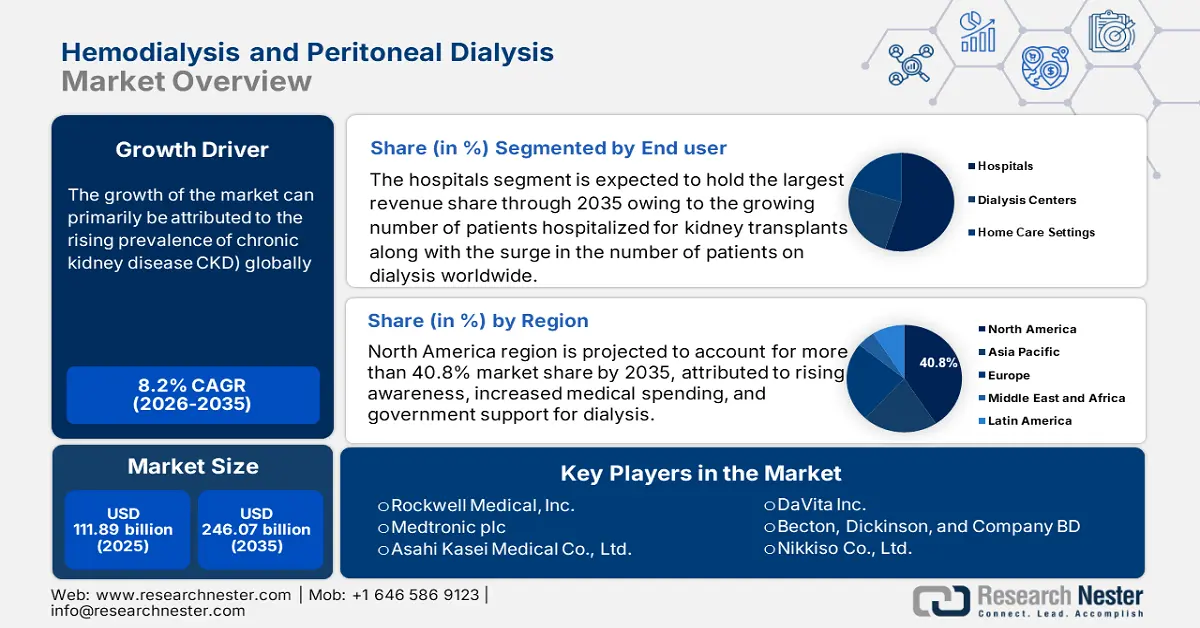

Hemodialysis and Peritoneal Dialysis Market size was over USD 111.89 Billion in 2025 and is anticipated to cross USD 246.07 Billion by 2035, growing at more than 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hemodialysis and peritoneal dialysis is assessed at USD 120.15 Billion.

The growth of the market can primarily be attributed to the rising prevalence of chronic kidney disease (CKD) globally. The unhealthy lifestyle has increased the prevalence of various diseases among the population which, in turn, is projected to increase the adoption rate of hemodialysis and peritoneal dialysis in the healthcare sector. For instance, in the year 2019, the prevalence of CKD was estimated to be 13%, whereas patients with end-stage kidney disease (ESKD) in need of renal replacement therapy were estimated to be between 4.9 and 7 million worldwide.

The increasing number of people with kidney failure today can live as a result of treatments, such as dialysis and kidney transplant. When kidneys can no longer clean the blood, dialysis is a way of doing this job. Hemodialysis and peritoneal dialysis help to remove the body's wastes, extra salt, water, and helps to control the blood pressure of anyone suffering from chronic kidney disease (CKD) or kidney infections. With the rising number of people suffering from various kidney disorders as well as CKD the need for hemodialysis and peritoneal dialysis is showing an upward trend, which in turn, is expected to create massive revenue generation opportunities during the forecast period. For instance, as per the data revealed by The International Society of Nephrology, 850 million individuals suffered from some form of kidney disease in 2020, globally, which is increasing every year.

Key Hemodialysis and Peritoneal Dialysis Market Insights Summary:

Regional Highlights:

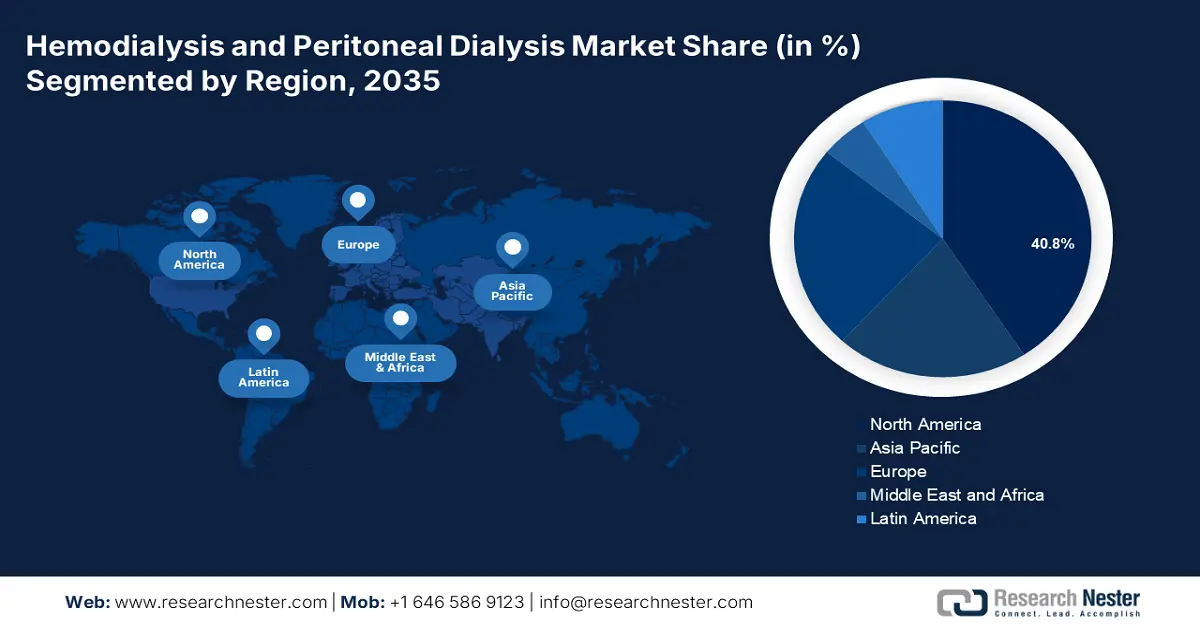

- North America’s hemodialysis and peritoneal dialysis market is predicted to capture 40.8% share by 2035, attributed to rising awareness, increased medical spending, and government support for dialysis.

- Asia Pacific market will register consistent expansion through 2035, fueled by technological advancements and government-supported dialysis programs.

Segment Insights:

- The hospital segment in the hemodialysis and peritoneal dialysis market is forecasted to capture the largest share by 2035, influenced by the growing number of patients requiring dialysis and kidney transplants in hospital settings.

- The conventional segment in the hemodialysis and peritoneal dialysis market dominates with the largest share, driven by the high prevalence of conventional hemodialysis for treating kidney diseases globally, forecast year 2035.

Key Growth Trends:

- Rising Prevalence of Diabetes

- Increasing Concern for the Rising Incidence of Hypertension

Major Challenges:

- Possibilities of Exposure to Infections

- Stringent Regulatory Policies Required for the Manufacturing of Dialysis Products

Key Players: Baxter Healthcare Corporation, B. Braun Melsungen AG, Rockwell Medical, Inc., Medtronic plc, Asahi Kasei Medical Co., Ltd., Nipro Medical Corporation, DaVita Inc., Becton, Dickinson, and Company (BD), Nikkiso Co., Ltd., Fresenius Medical Care AG & Co. KGaA.

Global Hemodialysis and Peritoneal Dialysis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 111.89 Billion

- 2026 Market Size: USD 120.15 Billion

- Projected Market Size: USD 246.07 Billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, Italy

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Hemodialysis and Peritoneal Dialysis Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Geriatric Population - The elderly population is one of the most vulnerable patient groups for whom hemodialysis and peritoneal dialysis would be required. Thus, the rising geriatric population in the world is considered to be a primary factor for market growth. According to the United Nations Department of Economic and Social Affairs, the World Population Ageing 2020 report, in the year 2020, people aged 65 years or above were estimated to 727 million worldwide.

- Rising Prevalence of Diabetes – Diabetes causes damage to many organs in your body, including your eyes, nerves, kidneys, heart, and blood vessels. The rising number of adults living with CKD and diabetes is expected to escalate the demand for hemodialysis and peritoneal dialysis in the forecast period. For instance, in the year 2021, more than 530 million adults were suffering from diabetes globally which is forecasted to increase to 640 million by 2030.

- Increasing Concern for the Rising Incidence of Hypertension – With the surge in the number of adults living with high blood pressure there is an upward shift in chronic kidney disease, as hypertension is the leading cause of chronic CKD. Thus, the rising cases of hypertension in the population are expected to bring lucrative growth market opportunities. The number of people with CKD whose blood pressure was <130/80 mmHg grew from more than 41% in 2003-2006 to 45.5% in 2015-2018. Also, it was found that, in the year 2020, in the United States, hypertension as a primary or contributing cause was responsible for over 670,000 deaths.

- Upsurge in the Rate of Obesity – Obesity leading to chronic conditions including damage to the kidney's filtering units in many adults is expected to increase the need for hemodialysis and peritoneal dialysis in the forecasted period. According to research, there were 42% of adults in the United States were obese in 2020, up 26% from 2008.

Challenges

-

Possibilities of Exposure to Infections – The process of hemodialysis and peritoneal dialysis is associated with several infections. Thus, the fear of catching infections is anticipated to push the population farther away from getting done the procedure.

-

Stringent Regulatory Policies Required for the Manufacturing of Dialysis Products

-

Concern for Bladder Spasms and Stomach Cramps Associated with Long Term Use of Catheter

Hemodialysis and Peritoneal Dialysis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 111.89 Billion |

|

Forecast Year Market Size (2035) |

USD 246.07 Billion |

|

Regional Scope |

|

Hemodialysis and Peritoneal Dialysis Market Segmentation:

End-user Segment Analysis

The global hemodialysis and peritoneal dialysis market is segmented and analyzed for demand and supply by end-user in hospitals, dialysis centers, and home care settings. Amongst these segments, the hospital segment is anticipated to garner the largest revenue by the end, of 2035, backed by the growing number of patients hospitalized for kidney transplants along with the surge in the number of patients on dialysis worldwide. For instance, in 2018, 229,000 kidney transplants were performed, while 554,000 patients got dialysis to replace kidney function.

Types Segment Analysis

The global hemodialysis and peritoneal dialysis market is also segmented and analyzed for demand and supply by types into conventional, daily, and nocturnal. In daily hemodialysis, daily treatment for extended periods (six to eight hours) is given. In nocturnal hemodialysis, the procedure is carried out overnight while the patient is asleep. However, conventional hemodialysis, which is carried out three times a week for three to four hours each session, is still the most prevalent and is expected to garner the largest market share by the end of 2035. The growth can be attributed to the growing cases of kidney diseases globally, and also in developed countries. For instance, according to research about 600,000 Americans are on dialysis every year.

Our in-depth analysis of the global market includes the following segments:

|

By Types |

|

|

By Products |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hemodialysis and Peritoneal Dialysis Market Regional Analysis:

North American Market Insights

North America region is projected to account for more than 40.8% market share by 2035. Rising disposable income and growing awareness among people are estimated to propel the market growth during the forecast period. Another reason fueling the market's expansion is the aging of the world's population since the prevalence of renal illness rises with advancing age. Moreover, governments are taking steps to increase access to dialysis therapy, including paying for dialysis treatments, funding the advancement of dialysis machinery and technology, and raising awareness of kidney illness in the general population. Increased per capita medical spending is also the highest in the United States, amounting to over USD 12000 per person.

APAC Market Insights

Further, the market in Asia Pacific had consistent expansion over the anticipated period owing to the industry's quick technological advancement and rising governmental and private investment in healthcare facilities. The Pradhan Mantri National Dialysis Program (PMNDP), launched by the Indian government, provides free dialysis services to all patients who fall below the poverty line (BPL) at district hospitals across the nation. Similarly, one of the most popular packages under the Pradhan Mantri Jan Arogya Yojana (PMJAY) is dialysis. Additionally, the Chinese government has implemented several policy changes to expand the range of medical services that are currently covered for people with end-stage kidney disease. As a result, about 20% of all dialysis patients in China now receive peritoneal dialysis, which has seen a significant rise in recent years. Over the course of the projection period, these variables are anticipated to support the market's expansion in the area.

Hemodialysis and Peritoneal Dialysis Market Players:

- Baxter Healthcare Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- B. Braun Melsungen AG

- Rockwell Medical, Inc.

- Medtronic plc

- Asahi Kasei Medical Co., Ltd.

- Nipro Medical Corporation

- DaVita Inc.

- Becton, Dickinson, and Company (BD)

- Nikkiso Co., Ltd.

- Fresenius Medical Care AG & Co. KGaA

Recent Developments

-

Medtronic and DaVita Inc. announced the willingness to form an independent and new kidney care-focused medical device company to enhance the treatment experience and outcomes for patients. The intent company will work on the development of a broad suite of novel kidney care products and solutions, including future home-based products.

-

Becton, Dickinson, and Company (BD) announced the receipt of 510(k) clearance from the U.S. Food and Drug Administration (FDA) for the Pristine Long-Term Hemodialysis Catheter. It is a new hemodialysis catheter with a unique side-hole free symmetric Y-Tip distal lumen design developed by Pristine Access Technologies, Ltd., a privately-owned company based in Israel, which was acquired by BD in July 2020.

- Report ID: 4271

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hemodialysis and Peritoneal Dialysis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.