Vapor Barriers Market Outlook:

Vapor Barriers Market size was valued at USD 15.07 billion in 2025 and is expected to reach USD 24.31 billion by 2035, registering around 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vapor barriers is evaluated at USD 15.73 billion.

The rapidly flourishing construction industry is driving focus on moisture management which is simultaneously boosting the growth of the vapor barriers market. As per the statistics provided by Invest India; the construction industry of India is poised to attain a value of USD 1.5 trillion by 2025.

Key Vapor Barriers Market Insights Summary:

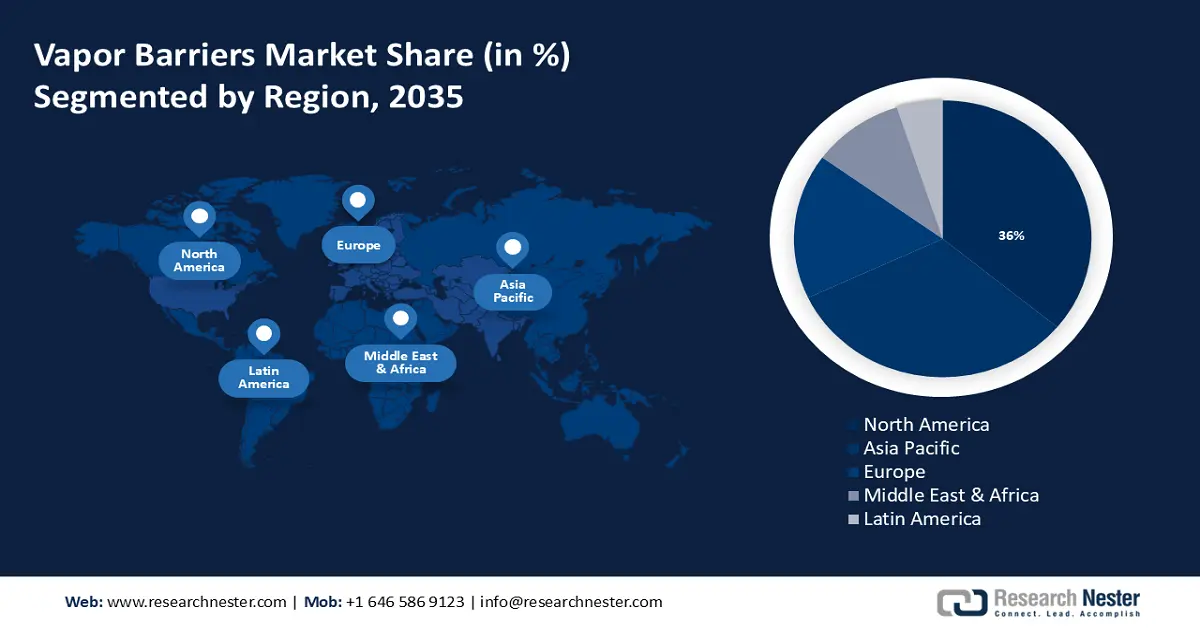

Regional Highlights:

- The North America vapor barriers market will account for 36% share by 2035, driven by increased construction of residential, commercial, and green buildings.

Segment Insights:

- The polymer segment in the vapor barriers market is expected to achieve significant growth till 2035, driven by availability, ease of installation, cost-effectiveness, and moisture resistance properties.

- The insulation segment in the vapor barriers market is forecasted to experience notable growth till 2035, influenced by demand for energy-saving and moisture-resistant building materials in fluctuating climates.

Key Growth Trends:

- Renovation of existing structures

- Environmental Concerns

Major Challenges:

- Alteration in the price of raw materials and high competition

- Lack of awareness

Key Players: Carlisle Companies Incorporated, Soprema Group, BASF SE, DuPont de Nemours, Inc., Polyguard Products, Inc., W. R. Meadows, Inc., Stego Industries, LLC, Raven Industries, Inc., Reef Industries, Inc., Americover, Inc.

Global Vapor Barriers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.07 billion

- 2026 Market Size: USD 15.73 billion

- Projected Market Size: USD 24.31 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Vapor Barriers Market Growth Drivers and Challenges:

Growth Drivers

- Renovation of existing structures - The construction industry is rapidly flourishing along with maintaining a sense of stability by adopting the advances in building materials. So, the old structures that do not constitute high-value materials need to be repaired and upgraded with durable and premium materials. Additionally, the significance of vapor barriers is well known and this way its popularity is increasing among the construction industry.

Offices, residential, and Commercial buildings demand for excellent insulation applications in the buildings and therefore the vapor barriers market is experiencing growth. As per a research nester’s analysis, more than 1 million square meters were built in the office property in 2023 in Bengaluru. - Environmental Concerns - The increasing environmental awareness is influencing manufacturers to develop eco-friendly and sustainable materials. Renewable vapor barriers are also gaining traction due to the increasing need to reduce carbon emissions.

Thus, energy efficiency awareness is fueling the vapor barriers market’s growth. The building and construction sector accounted for 37% of global greenhouse gas emissions. - Expansion of the construction industry - Construction projects are distributed all around the globe and thus the demand for vapor barriers is increasing. Since vapor barriers are very crucial in water vapor prevention.

These barriers play the role of protective shield and maintain the reliability of the building by reducing the growth of molds. The construction sector accounts for 12% of the gross domestic product worldwide.

Challenges

- Alteration in the price of raw materials and high competition - The fluctuations in the cost of raw materials push manufacturers to increase the price which may hamper the growth of the market. Also, the overcrowded market is expected to reduce the profit margin for some companies.

- Lack of awareness - The vapor barriers market growth may decline due to the lack of awareness about the building materials among the builders. This could be due to the absence of programs that provide knowledge about advanced materials and cutting-edge technologies.

Vapor Barriers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 15.07 billion |

|

Forecast Year Market Size (2035) |

USD 24.31 billion |

|

Regional Scope |

|

Vapor Barriers Market Segmentation:

Material Segment Analysis

Polymer segment is poised to capture around 51% vapor barriers market share by the end of 2035. The segment growth can be attributed to its significant availability. Polymer vapor barriers are easy to install, cost-effective, versatile, flexible, and offer prime moisture resistance attributes.

Additionally, these reduce the risk of mildew formation, lessening the risk of damage to the building materials. Further, these are highly demanded under-slab applications due to their enormous properties. The U.S. National Science Foundation along with industry leaders such as BASF announced a sustainable polymer research program that incorporates a huge fund of USD 9.5 million and will leverage data science tools for the creative of new premium polymers.

Application Segment Analysis

By 2035, insulation segment is expected to capture over 40% vapor barriers market share. Insulation helps in maintaining ideal indoor comfort along with saving energy by resisting the entry of moisture in walls and ceilings. The integration of vapor barriers with insulation materials improves the thermal structure of the buildings.

Also, vapor barriers are highly demanded to offer optimal insulation in regions where the climate fluctuates and both indoor and outdoor temperatures differ. Vapor barriers prevent the wall from desiccating by maintaining moisture.

Our in-depth analysis of the global market includes the following segment:

|

Material |

|

|

Type |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vapor Barriers Market Regional Analysis:

North America Market Insights

North America industry is poised to dominate majority revenue share of 36% by 2035. The market is growing in the region owing to the increased construction of residential and commercial buildings, green buildings, and cold weather. Green buildings are estimated to reduce 30% energy usage as per the United States Green Building Council.

The market is growing in Canada owing to the development in the end-use sector. The government of Canada plans to set up 3.87 million new homes by 2031.

The growth driving factors for the market in the United States are the flourishing construction and building industry which lead to the upgradation of vapor barriers. The construction establishments present in the US were reportedly more than USD 0.09 trillion creating structures valued around USD 2.1 trillion every year.

Asia Pacific Market Insights

Asia Pacific region vapor barriers market revenue is estimated to reach USD 6 Billion by the end of 2035 owing to the increasing popularity of vapor barriers in this region.

The market is thriving in India due to the rapid growth of the construction industry. The capital investment expenditure for infrastructure projects in India outstretched up to USD 133.86 under the interim budget 2024-25.

The growth driving factor for the vapor barriers market in China is the increase in automotive sales and the expansion of the construction sector. Moreover, the presence of industry leaders committed to meeting the demands of vapor barriers is also a significant factor responsible for the market’s growth. Shanghai Yingfan Engineering Material Co., is one of the major key players present in China that manufactures reliable high-density polyethylene water vapor barriers.

Vapor Barriers Market Players:

- W.R. Meadows, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Glenroy Inc.

- Celplast Metallized Product Ltd.

- Polifilm Group

- ProAmpac Holdings

- 3M Company

- Amcor Limited

- SAES Getters S.p.A.

- GLT Products

- UFP Industries, Inc.

The vapor barriers market is dominated by key market players who are gaining traction in the market by expanding the construction industry.

Recent Developments

- W. R. Meadows introduced a new addition to its robust AIR SHIELD product line, AIR SHIELD BUTYL FLASHING. It is specially curated to provide excellent sealing for windows and doors.

- W. R. Meadows announced the launch of new water-based sealers, PENTREAT 244-40 W/B and PENTREAT 244-20 W/B into its PENTREAT™ penetrating concrete sealers product portfolio.

- Report ID: 6246

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vapor Barriers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.