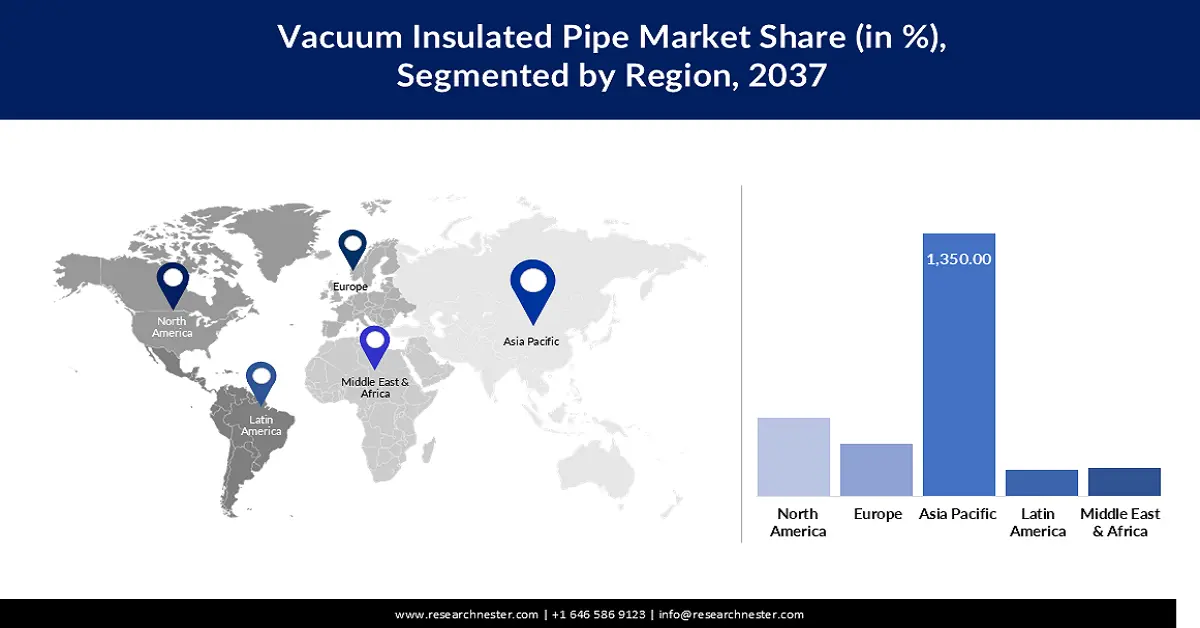

Vacuum Insulated Pipes Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific is projected to dominate the vacuum insulated pipe market with the largest revenue share of 37% during the forecast period from 2025 to 2037, attributed to the industrial growth and investments in LNG and hydrogen infrastructure. The growing demand for energy and increased focus on the reduction of emissions are enhancing market expansion. Technological advancement and a strong manufacturing industry are also key factors in the significant market share of the region. The ambitious green hydrogen vision of South Korea's goal is to grow hydrogen consumption from 130,000 tons per year to 5.26 million tons per year, with 420,000 jobs through investments of 43 trillion won. The number of hydrogen refuelling stations will grow as the government intends to install 1,200 hydrogen refuelling stations by 2040, compared to the current 24 in 2019, which will require the use of vacuum insulated pipes (VIPs), which could help sustain the transport and storage of cryogenic hydrogen.

The major conglomerate investment in hydrogen technologies in South Korea of $38 billion is boosting the growth of the Asia Pacific VIP market by enhancing hydrogen infrastructures. Moreover, CIMC Enric provides advanced hydrogen refueling stations, which could be safely, efficiently, and scaled to use in transportation that uses hydrogen as a fuel. There is the completion of the modular vacuum-insulated pipe (VIP) modules by the company, which have been installed in more than 100 hydrogen refueling stations around the country, indicating the roaring growth of the infrastructure. This massive application propels the need for VIPs necessary to store and transport cryogenic hydrogen, playing a key role in the development of the vacuum insulated pipe market in the Asia Pacific to facilitate a shift towards clean energy.

The vacuum insulated pipe market in China is predicted to lead the Asia Pacific region with a significant revenue share by 2037, owing to the rising attention to clean energy and industrial development in the country. The market is being propelled by significant investments in LNG terminals and hydrogen production capabilities. In 2024, China would import 78 million tonnes of LNG, up by 9% annually, driving infrastructure growth even as renewables compete. This investment will lead to the development of the market of vacuum-insulated pipes in China, as it will increase the capacity of LNG terminals with the ability to transport liquor in the cryogenic mode. In addition, China had an augmented production of hydrogen capacity of 80.800 tons in October 2023, which exemplifies a fast growth. This increased rate of hydrogen production stimulates the need for vacuum-insulated pipes in cryogenic hydrogen storage and transportation infrastructure in China. Furthermore, favourable government initiatives and commitment to innovative technologies are boosting market growth. For example, in April 2024, China designed ultra-large cryogenic refrigeration equipment with an operational temperature ranging from 20K (liquid hydrogen) to 2K (superfluid helium), to maintain its stable and continuous operation. The invention optimises the vacuum insulated pipe operation in LNG and hydrogen transportation, and fuels the VIP market in growing cryogenic energy infrastructure in China.

India’s vacuum insulated pipe market is expected to grow with the fastest CAGR over the projected years, due to the increasing energy needs of India and its infrastructure initiatives. The commitment of the government to develop natural gas infrastructure as well as to promote clean energy solutions is one of the driving forces behind the increasing adoption of VIPs. For example, India has added 24,623 km of natural gas pipeline to the existing 15,340 km in operation in 2014, and 10,860 km are currently being built. The capacity of LNG terminals increased to 47.7 MMTPA, increasing VIP demand in the cryogenic storage and transport infrastructure. Furthermore, the Indian National Gas Grid presently serves 307 Geographical Areas, which include 100 percent of the population, which is facilitated by pipeline expansion and city gas distribution networks. The vacuum insulated pipe market is powered by this massive expansion of the infrastructure that will make the Indian natural gas and LNG transport and storage safe and efficient by supporting cryogenic transportation and storage across India.

Additionally, increased investments in cryogenic gas use in the industrial and healthcare industries are enhancing the vacuum insulated pipe market growth. The Ministry of Petroleum and Natural Gas has ordered 80 Compressed Biogas plants and requires the use of CBG in the distribution of city gases between 1% and 5% by 202829. The development of pipeline infrastructure and the expansion of geographical coverage areas increase the VIP demand within the clean energy industry of India. This improvement to infrastructure represents an important step towards increasing India's cryogenic transportation infrastructure.

North America Market Insights

The North American market is projected to grow significantly with a CAGR of 6.9% from 2025 to 2037. The commitment of the region to clean energy and advanced manufacturing is increasing the demand for VIP systems. Government promotion and strong investment in the development of energy infrastructure play a key role in maintaining vacuum insulated pipe market growth. For instance, the national energy plan of Mexico envisions the rise in the production of natural gas to more than 5 Bcf/d, compared to 3.5 Bcf/d, by the early 2030s, with mega-projects of pipeline construction envisaged. The presence of infrastructure gaps threatens the growth in the industrial sphere, which would boost the need for VIPs to facilitate effective cryogenic transportation in the area. Moreover, the nation also spends USD 1.75 billion on local industrial content development with an emphasis on such areas as chemicals and petrochemicals, which are dependent on the hydrocarbons provided by PEMEX. It is also backed by investments in energy infrastructure, including renewable energy initiatives worth USD 22.4 billion, which contribute to efficient energy transport, which has a direct influence on market development in the region through the increase of the cryogenic and gas transport capacity. The market's upward trend is largely driven by major industry companies and constant technological advancements. Additionally, the FY 2024 ERCIP guidance details the DoD's interest in energy resiliency initiatives like microgrids and clean energy infrastructure, which facilitates the proliferation of vacuum insulated pipes (VIPs) in North America to support efficient cryogenic and thermal systems. This effort highlights the invaluable role VIPs occupy in essential healthcare and national defense services.

The U.S. vacuum insulated pipe market is anticipated to dominate the North American region with a notable share by 2037, attributed to a boom in investments concerning LNG and hydrogen infrastructure. Increased application of cryogenic technologies in various industries is fuelling growth. In addition, DOE is putting in place deployments across buildings, hydrogen, carbon management, grid, storage, and clean energy infrastructure more quickly, with more than $97 billion invested through the Bipartisan Infrastructure Law and Inflation Reduction Act. This highlights an increasing need for better systems, such as vacuum-insulated pipes, within energy networks. Furthermore, increased safety requirements are pushing the adoption of advanced VIP systems. For example, the PHMSA report of the Freeport LNG accident stated that the violation of safety measures, a vacuum-insulated pipe (VIP) with an 18-inch diameter, exploded, causing a catastrophe.

Part of VIP was contained within the LNG and became hot over a period of five days, raising the pressure from 37 psig to 1,313 psig before the rupture, discharging 10,000 pounds of flammable gas and creating a 450-foot fire that resulted in a 500-foot blast and eventual fire. The incident indicates how important the higher safety systems and monitoring of VIP infrastructure are. Furthermore, US CFR 49 §178.277 provides strict design, construction, and testing requirements on vacuum-insulated portable tanks, such as a pressure of at least 3 bar, triple shut-off valves, and enhanced insulation requirements. These standards promote safety, which promotes the use and expansion of vacuum-sealed pipes in the U.S. energy sector and their cryogenic transportation. These regulations and incentives are set to stimulate the high-speed implementation of VIP technology in energy use.

The market in Canada is likely to grow at a steady rate during the projected years, mainly due to the country’s commitment towards net-zero emissions by 2050, which is fueling the implementation of VIPs. Effective cryogenic transportation systems are needed for hydrogen corridors and LNG export expansion. For instance, the Hydrogen Strategy of Canada has seen projections of 4 MT of hydrogen production by the year 2030, which is expected to contribute to 6% of national power consumption, with more than USD 15 billion in investment and policy. Such expansion requires modernized cryogenic transportation infrastructure, such as vacuum-insulated pipes that allow the development of hydrogen corridors and the expansion of LNG export. Government initiatives and financial support are major contributors to the growth of VIP infrastructure across the country. The Canadian government initiated the Critical Minerals Infrastructure Fund, where the government contributed CAD 1.5 billion across seven years to deal with infrastructure deficiencies in the production of critical minerals.

The investment promotes clean energy and transportation initiatives, which contribute to the development of vacuum-insulated pipe infrastructure, which is vital in the transportation of cryogenic in the Canadian energy buildup. Moreover, the Energy Innovation Program, which involved the allocation of over CAD 319 million by Canada to carbon capture, utilization, and storage (CCUS) projects, such as improved underground CO2 transport and storage facilities. This governmental support helps to create high-tech cryogenic transport systems, such as vacuum-insulated pipes (VIP), which are essential to the expanding low-carbon energy industry in Canada. This initiative demonstrates how VIPs are taking a leading role in helping Canada shift toward clean energy.

Europe Market Insights

The European market is anticipated to expand significantly over the forecast years by 2037, owing to the strict energy efficiency directive of the EU, which aims at reducing final energy consumption by 11.7% by 2030, which will cause investments in energy-efficient infrastructure development, such as VIPs in the transportation of cryogenic gases. In addition, safety standards such as the Pressure Equipment Directive (PED) will ensure that the cryogenic vessels are highly and positively inspected to boost the VIPs uptake in industrial and healthcare sectors. Decarbonization, renewable energy growth, and hydrogen corridors are strategic EU policies that develop VIP demand that is supported by funding programs promoting the rapid transition to clean energy. Regular monitoring of the cryogenic vessels also promotes reliability and safety, and this is what is increasing the VIP market. In 2023, the EU attributed a level of 1,211 Mtoe of primary energy use, representing a 19.9% from the 2006 level and 3.9% lower than 2022, with a 32.5% efficiency goal by 2030. The efficiency development is driving the vacuum insulated pipes requirements in the transport of cryogenic energy in Europe. Additionally, to strengthen VIP infrastructure, the UK government has pledged to create regional hydrogen transportation and storage systems worth more than half a billion dollars by 2031. Moreover, the infrastructure fund of €500 billion in Germany is aimed at infrastructure transition initiatives, thus boosting the investment in VIP-based cryogenic pipelines.