3D Printing Market Outlook:

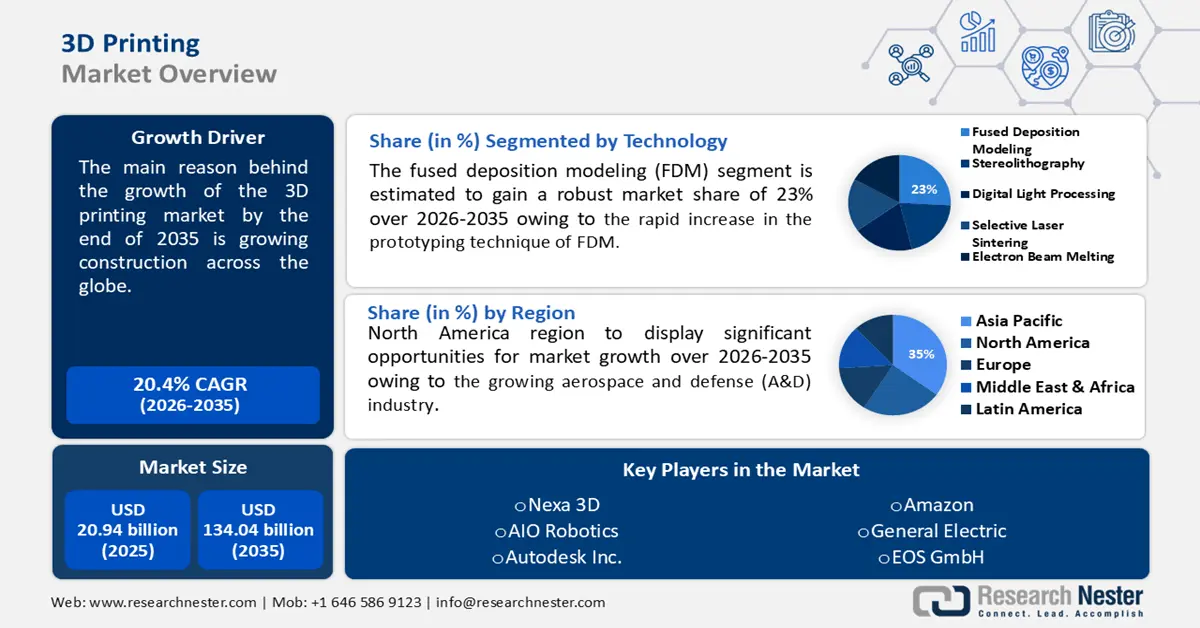

3D Printing Market size was valued at USD 20.94 billion in 2025 and is expected to reach USD 134.04 billion by 2035, expanding at around 20.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 3D printing is evaluated at USD 24.78 billion.

The construction sector has had exceptional growth in recent times, bolstered by both international investments and driven by elements including population growth, urbanization, and growing infrastructural needs. Construction companies and firms are increasingly adopting 3D printing to produce custom-made parts and structures, as well as for prototyping and testing purposes. As per a recent report, the construction industry of the United States plays a vital role in the growth and shaping of cities and infrastructure. Around USD 1.8 trillion was spent which contributes to 4% to the country’s economy.

Key 3D Printing Market Insights Summary:

Regional Highlights:

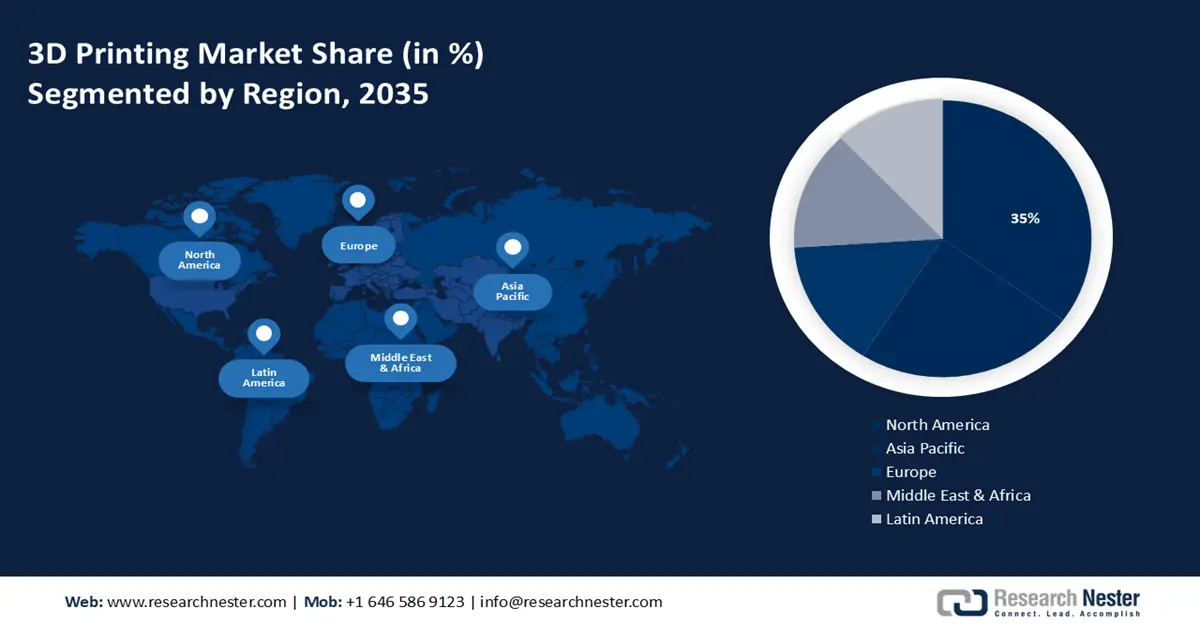

- North America 3d printing market will hold more than 35% share by 2035, driven by the aerospace and defense industry's expansion in the region.

- Asia Pacific market will capture the second largest share by 2035, driven by higher adoption of robotics and modern mechanics driving demand for 3D printing.

Segment Insights:

- The hardware segment in the 3d printing market is projected to achieve substantial growth over 2026-2035, enabled by high-precision applications across various industries.

- Aerospace & aeronautics segment in the 3d printing market is expected to achieve 33% growth by the forecast year 2035, driven by rapid creation of prototypes and parts, saving time and development costs.

Key Growth Trends:

- Government investment towards 3D printing

- High demand for customized gifts and jewelry manufacturing

Major Challenges:

- Lack of standardized test methods

- Presence of alternatives

Key Players: Schaeffler Group, Nexa3D, 3D Systems Corp., AIO Robotics, Autodesk Inc., Amazon, General Electric, Materialise NV, Stratasys Ltd., EOS GmbH.

Global 3D Printing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.94 billion

- 2026 Market Size: USD 24.78 billion

- Projected Market Size: USD 134.04 billion by 2035

- Growth Forecasts: 20.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

3D Printing Market Growth Drivers and Challenges:

Growth Drivers

-

Government investment towards 3D printing - The global government has started to recognize the potential of 3D printing in various fields, including healthcare, defense, transportation, and infrastructure. These investments are expected to strengthen the infrastructure and resources for 3D printing, driving the development and adoption of new technologies and applications.

According to GOV.UK, the government has released a collective fund of USD 1,73,50,351 which includes sustainable 3D printing at scale, digitizing century-old baking techniques, and using AI to improve steel production efficiency. This has created 1000 jobs across the UK and saved 300,000 tonnes of carbon dioxide emission which is taking 65,000 cars off roads. - High demand for customized gifts and jewelry manufacturing - The demand for silver, platinum, and gold jewelry is rising along with personalized and customizable gifts. 3D printing also known as additive manufacturing allows for a high degree of personalization, and it's a good production process for jewelry creation which allows jewelry designers to create designs that would be extremely challenging to hand carve conventionally.

According to the World Gold Council, the demand for gold jewelry across the globe in the first quarter came in at 479 tonnes (t), and around 3% of the first quarter average from the past five years of 465t.

- Increasing demand for automobiles - The automotive industry has achieved great success with the use of 3D printing technologies as a result of which auto parts may be produced on demand due to 3D printing's accuracy, and also eliminates the carbon emissions associated with international supply chains.

According to the latest report, passenger cars have the largest share of motor vehicle sales across the world which represents around 70.4 percent of sales.

Challenges

-

Lack of standardized test methods - The accuracy and efficiency of the products that are formed by 3D Printing are neglected due to the lack of standardized tests to verify their properties such as stiffness, toughness, strength, and hardness.

-

Presence of alternatives - The availability of alternatives in the market due to methods such as traditional manufacturing, injection molding, and stereolithography are available and the high purchasing and maintenance costs hinder the market growth of the 3D printing market.

3D Printing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.4% |

|

Base Year Market Size (2025) |

USD 20.94 billion |

|

Forecast Year Market Size (2035) |

USD 134.04 billion |

|

Regional Scope |

|

3D Printing Market Segmentation:

Technology Segment Analysis

Fused deposition modeling (FDM) segment is poised to hold more than 23% 3D printing market share by 2035 owing to thermoplastic filament through a hot end to print the desired 3D object. The rapid increase in the prototyping technique of FDM drives the 3D printing market during the forecast period as it enables a clean and cost-efficient development for small functional components.

As per a recent report, FDM processes can achieve pore sizes ranging from 160 to 700 microns, with porosities ranging from 48% to 77%. Fused deposition modeling works on a CAD/CAM-based design-specific diagram that is used in an FDM system, this system then sends a design-specific command to the controller’s head, and then ultimately the melted thermoplastic is released.

Component Segment Analysis

By 2035, hardware segment is expected to account for around 63% 3D printing market share. The advanced hardware makes it possible for high-precision 3D printing to be applied in a variety of applications. The software component, on the other hand, provides the technology and processes for creating and managing print jobs. Its advanced capabilities allow for more complex designs as well as more efficient processes. According to the latest report, around 2.2 million 3D printer units were shipped in 2021.

End-Users Segment Analysis

In 3D printing market, aerospace & aeronautics segment is expected to capture around 33% revenue share by the end of 2035, which makes it a key segment for the rapid creation of prototypes and parts, and providing great savings in time & development costs for the industry which drives the segment growth.

According to the Aerospace Industry Association, in 2021, Aerospace and Defense industry exports increased by 11.2 percent to a total value of USD 100.4 billion. In addition, the 3D Printing is being increasingly applied to create custom-matched organs, implants, and other medical devices in the healthcare sector. With this technology, the industry can provide a more personalized and tailored treatment cost-effectively.

Our in-depth analysis of the 3D printing market includes the following segments:

|

Technology |

|

|

Component |

|

|

End-users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

3D Printing Market Regional Analysis:

North American Market Insights

North America in 3D printing market is predicted to dominate over 35% revenue share by 2035, impelled by the growing aerospace and defense (A&D) industry in the region. According to the Aerospace Industries Association, in 2021, the A&D sector had a workforce of more than 2.1 million creating employment in every U.S. state.

The workforce was increased by around 6,000 employees in 2021 which is a 0.3% increase from 2020. The aerospace business, which supplies goods and services including satellites, space launch vehicles, spacecraft, and ground systems for both government and commercial use is one of the biggest in the region.

The growing demand for customized products in different sectors is driving the market of U.S. 3D printing market in the region. For instance, around 49% of customers want personalized and customized product experiences.

The government of Canada has started various initiatives that promote advanced manufacturing, and the regional government has made substantial investments in research and development which is resulting in the growth of the 3D printing market. According to a recent report, Canada has allocated USD 600 million for 3D printing to construct houses cheaper and more sustainable.

APAC Market Insights

The Asia Pacific 3D Printing market is set to be the second largest, during the forecast timeframe led by the higher adoption of robotics and modern mechanics, this in return raises the demand for 3D printing in the industry.

According to the International Federation of Robotics, Asia has a robot density of 168 units per 10,000 employees in the manufacturing industry. Along with this, developments and upgradation in the manufacturing industry with increasing demand for fab shops in this region that aim to provide a 3D print of the component and several items according to the designs provided by the clients can act as a market’s key to growth in the upcoming years.

China is coming out as a manufacturing center for the automotive and healthcare industries to grow. For instance, annual sales of the automobile sector reached 26.9 million units in 2022 and around 23.6 million units were passenger cars.

Korea has a strong grip on the production of consumer electronics as with growing urbanization, demand for electronics is increasing in a parallel way.

3D Printing Market Players:

- Schaeffler Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nexa3D

- 3D Systems Corp.

- AIO Robotics

- Autodesk Inc.

- Amazon

- General Electric

- Materialise NV

- Stratasys Ltd.

- EOS GmbH

The major players in the 3D printing market are offering a detailed portfolio of demand 3D technology in aerospace, construction, robotics, and others. These companies are developing and delivering high-quality 3D prints across various industries.

Recent Developments

- Schaeffler Group announced its new complex multi-material 3D Printing at Automatica 2023. This product will help customers to use innovative materials to combine, and integrate new functions into tools and components, and to provide a higher degree of flexibility in the manufactured design of the products and tools.

- Nexa3D has made an announcement of its new product- XiP Pro ultrafast industrial 3D Printing at Rapid + TCT 2023. This printer offers a high print speed which is exponentially faster than traditional SLA and DLP-based technologies printers, and has higher powerful print engine, along with a 19.5-liter build volume.

- Report ID: 6109

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

3D Printing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.