Ursodeoxycholic Acid Market Outlook:

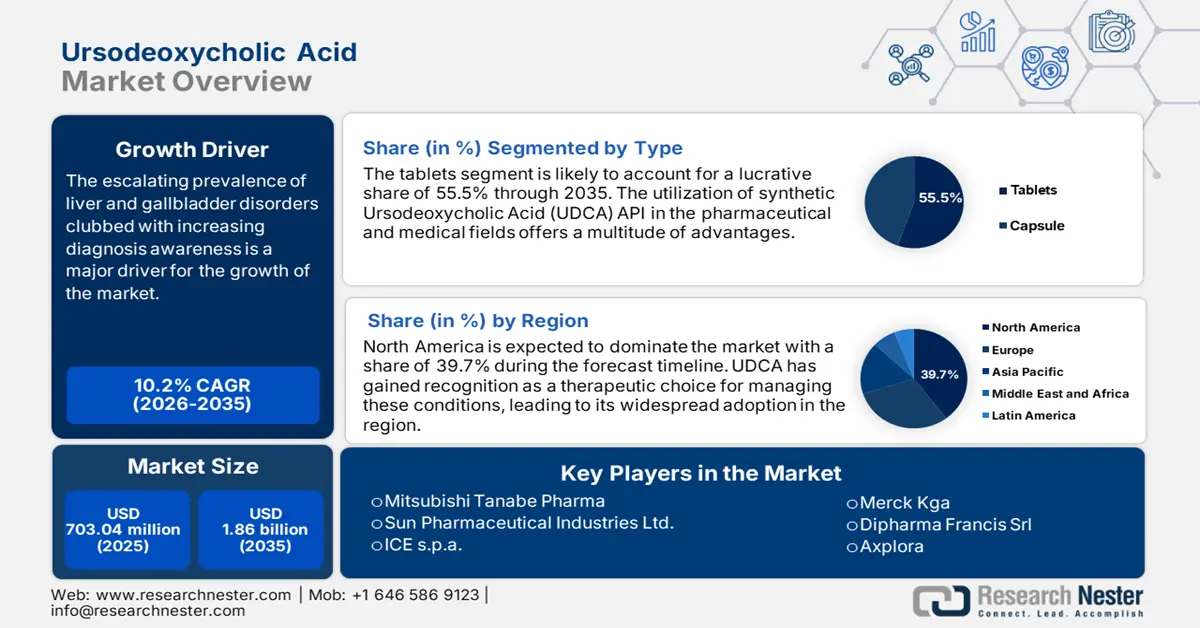

Ursodeoxycholic Acid Market size was valued at USD 703.04 million in 2025 and is expected to reach USD 1.86 billion by 2035, expanding at around 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ursodeoxycholic acid is evaluated at USD 767.58 million.

The ursodeoxycholic acid market growth is largely driven by the ever-increasing global incidence rate of such gallbladder and liver disease, driven by increased awareness and sophisticated diagnosis technology and therapeutic drugs. In March 2024, Rezdiffra (resmetirom), which is taken in conjunction with diet and exercise, was approved by the U.S. Food and Drug Administration today for the treatment of people with moderate to advanced liver scarring (fibrosis) associated with noncirrhotic non-alcoholic steatohepatitis (NASH).

Furthermore, ongoing research on ursodeoxycholic acid drug therapeutic used in more established liver disease and newer forms of dosing presentations are new trends in the industry. For instance, in December 2024, a novel strategy for the pharmacological management of metabolic liver disorders has been discovered by a MedUni Vienna study. Pharmacological suppression of an enzyme essential to fat metabolism in experimental research decreased inflammation, fibrotic remodeling (connective tissue scarring), and liver fat while promoting liver function.

Key Ursodeoxycholic Acid Market Insights Summary:

Regional Highlights:

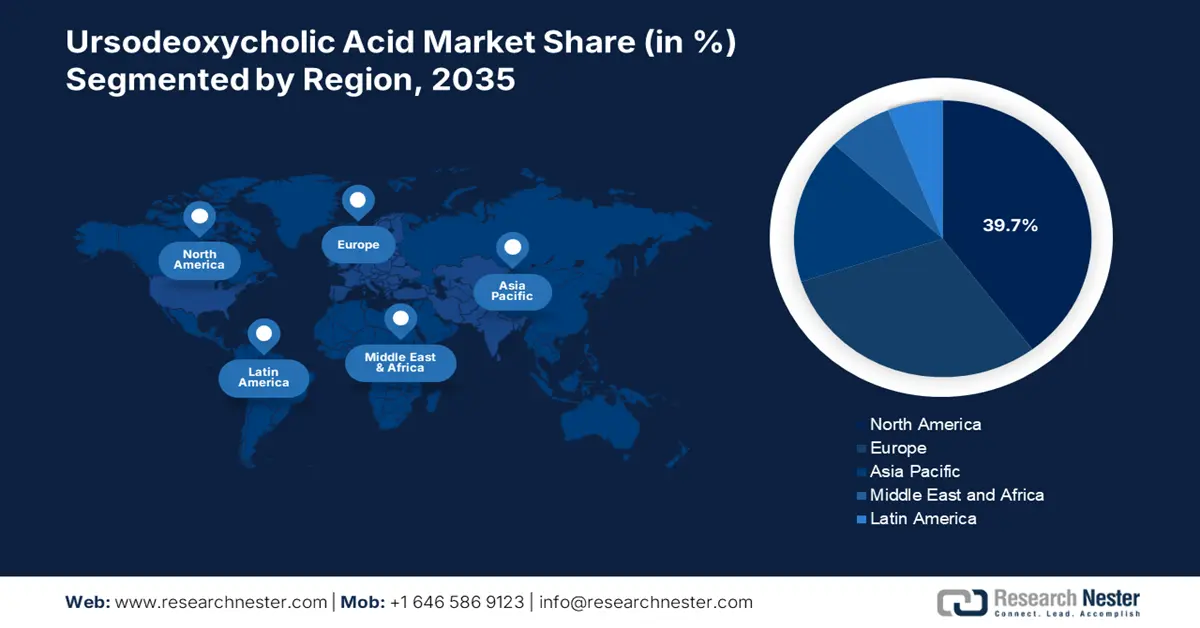

- North America commands a 39.7% share of the Ursodeoxycholic Acid Market, driven by strict regulatory oversight, strategic market activities, and ongoing investment in research, ensuring sustained growth through 2026–2035.

Segment Insights:

- The Primary Biliary Cholangitis segment is expected to hold a major share by 2035, driven by the proven therapeutic efficacy of ursodeoxycholic acid and increased global awareness of PBC.

- The Tablet segment is projected to achieve a 55.5% share by 2035, fueled by its acceptability, affordability, and longer shelf life.

Key Growth Trends:

- Growing awareness and improved diagnostics

- Expanding research applications

Major Challenges:

- Limited efficacy in certain conditions

- Competition from emerging therapies

- Key Players: AstraZeneca plc, Epic Pharma, Sun Pharmaceutical Industries Ltd., ICE s.p.a., and more.

Global Ursodeoxycholic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 703.04 million

- 2026 Market Size: USD 767.58 million

- Projected Market Size: USD 1.86 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Italy

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 12 August, 2025

Ursodeoxycholic Acid Market Growth Drivers and Challenges:

Growth Drivers

- Growing awareness and improved diagnostics: A major growth catalyst in the ursodeoxycholic acid market is characterized with a long history of use, in improving liver function, lowering inflammation, and slowing the progression of a number of liver illnesses. For instance, in June 2023, Owlstone Medical, the world leader in Breath Biopsy for use in precision medicine and early illness diagnosis, revealed fresh information on the creation of innovative liver disease detection tests at the 2023 EASL Congress in Austria, June 21–24. Results showed a link with the severity of the disease and justify the use of limonene as an EVOC probe for cirrhosis identification.

- Expanding research applications: Augmentation of research in ursodeoxycholic acid market is justified by its proven therapeutic effectiveness in cholestatic liver disease and dissolution of gallstones. For instance, in June 2024, according to recent studies, improving diabetes and weight loss medications could be a game changer for the treatment of fatty liver disease. According to a global clinical trial headed by a researcher from VCU, survodutide improved liver disease symptoms in up to 83% of participants. These moves result in creating new formulations and delivery systems that improve the bioavailability of UDCA and selectivity of action to maximize the therapeutic efficacy.

Challenges

- Limited efficacy in certain conditions: One of the principal limitations inherent in ursodeoxycholic acid market is its modest efficacy within the whole spectrum of the cholestatic liver disorders. Most notably, its therapeutic effect is reduced or even lacking in certain conditions, such as in established primary sclerosing cholangitis or in certain inborn cholestasis, and thus necessitates the trial of other or other therapeutic modalities in such patient groups. This differential response is enabling effective patient selection and further studies to determine differential drug responsiveness mechanisms. Clinical use of UDCA is hence threatened by new medications.

- Competition from emerging therapies: A crucial obstacle in the growth of ursodeoxycholic acid product market is availability through discovery and the approval by the regulators. Researches having more targeted action mechanisms, or able to satisfy earlier unmet clinical need in liver diseases is a material competitive threat. In addition, ongoing research with newer pharmacologic strategies for the management of many such liver conditions further diminishes UDCA's already established niche position in the treatment algorithm. This dynamic therapeutic landscape requires continued reassessment of the cost-effectiveness, relative efficacy, and optimal placement.

Ursodeoxycholic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 703.04 million |

|

Forecast Year Market Size (2035) |

USD 1.86 billion |

|

Regional Scope |

|

Ursodeoxycholic Acid Market Segmentation:

Type (Tablet, Capsule)

Tablet segment is expected to hold over 55.5% ursodeoxycholic acid market share by the end of 2035, due to the common acceptability and popularity of tablets, as they are easy to give, accurate in dosage, less expensive, and have a longer shelf life. For instance, in January 2025, JOURNAVXTM (suzetrigine), an oral, non-opioid, highly specific NaV1.8 pain signal inhibitor, was approved by the U.S. FDA to treat moderate-to-severe acute liver pain in adults.

Indication (Gallstones, Hepatopathy, Biliary Disease, Primary Biliary Cholangitis (PBC))

Based on indication, the primary biliary cholangitis segment is expected to garner the major share in the ursodeoxycholic acid market by the end of 2035 attributed to the proven therapeutic efficacy of ursodeoxycholic acid as first-line drug treatment for PBC, as well as increased global prevalence and increased awareness worldwide of PBC as an autoimmune chronic liver disease. For instance, in February 2024, Intercept Pharmaceuticals, Inc., announced that the FDA has approved its supplemental new drug application for Ocaliva, a medication used to treat primary biliary cholangitis (PBC).

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Indication |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ursodeoxycholic Acid Market Regional Analysis:

North America Market Statistics

North America ursodeoxycholic acid market is predicted to hold revenue share of more than 39.7% by 2035. This growth is supported by strict regulatory oversight, strategic market activities, and ongoing investment in research. These moves help the healthcare practitioners and professionals to fully explore its therapeutic potential. The UDCA drug product market is an essential part of the pharmaceutical industry, guaranteeing its availability and efficacy for a diverse range of patients in the region.

The U.S. ursodeoxycholic acid market is growing exponentially owing to the research and investigational studies for liver disorders. It furthers the discovery of therapeutic drugs and help in other findings. For instance, in November 2024, according to the research done by a hepatologist at Virginia Commonwealth University, 42% of individuals in the US have fatty liver disease, which is more common in Hispanics than in other groups.

Canada ursodeoxycholic acid market is likely to witness substantial growth during the forecast period attributed to the increasing prevalence of liver disorders across the country. For instance, in January 2025, the 5th most common cause of cancer-related fatalities in men is liver cancer, which is also one of the malignancies with the greatest rate of growth in Canada. Metabolic dysfunction-associated steatotic liver disease (MASLD) affects approximately 10 million Canadians. By 2030, it is anticipated that this number would increase by an additional 20%.

Asia Pacific Market Analysis

The ursodeoxycholic acid market in Asia Pacific is gaining traction atributable to the ongoing research activities across the region. Moreover, government initiatives boost the scope of UDCA's long-term impacts and range of therapeutic applications. These initiatives demonstrate the healthcare industry's continued dedication to expanding knowledge of therapeutic solutions in order to improve patients health and combat the increasing global burden of liver ailments and conditions.

India ursodeoxycholic acid market is experiencing robust growth due to the experimental studies running across the country for delivering efficacy and improved patient outcome. For instance, in February 2025, to assess the safety and effectiveness of nor-ursodeoxycholic acid 500 mg in patients with non-alcoholic fatty liver disease, Shilpa Medicare had previously finished phase-3 clinical studies of SMLNUD07. The experiment showed a notable improvement in the fatty liver stage and fulfilled all key efficacy goals.

China ursodeoxycholic acid market will exponentially scale during the projected timeframe. It was significantly impacted by the COVID-19 pandemic due to disruptions in global supply chains, particularly UDCA. This resulted in potential UDCA shortages as well as problems with the supply of essential raw materials. Moreover, UDCA is being thoroughly studied for its uses in treating non-alcoholic steatohepatitis (NASH) and non-alcoholic fatty liver disease (NAFLD) within the country.

Key Ursodeoxycholic Acid Market Players:

- Daewoong Pharmaceutical

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AstraZeneca plc

- Epic Pharma

- Sun Pharmaceutical Industries Ltd.

- ICE s.p.a.

- Merck Kga

- Dipharma Francis Srl

- Axplora

The key players in the market are striving for their continuous research informulating novel UDCA formulations. Moreover, they distinguish themselves with strong production capacities and large distribution network, guaranteeing that UDCA therapies are widely accessible. For instance, in January 2023, Albireo and Ipsen announced that they have reached a final merger agreement. This planned acquisition aimed to improve Ipsen's pipeline and portfolio for rare liver diseases and focus on Bylvay (odevixibat), the first medication licensed in the U.S. and the European Union for progressive familial intrahepatic cholestasis.

Here's the list of some key players:

Recent Developments

- In August 2024, Gilead Sciences announced to market the medication, Livdelzi, the FDA authorized novel treatment for primary biliary cholangitis after it acquired CymaBay Therapeutics (developer) for USD 4.3 billion.

- In June 2024, Ipsen announced the accelerated approval granted by the FDA for Iqirvo (elafibranor) 80 mg tablets to treat primary biliary cholangitis (PBC) in adults.

- Report ID: 7549

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ursodeoxycholic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.