Urinalysis Market Outlook:

Urinalysis Market size was over USD 3.5 billion in 2025 and is estimated to reach USD 4.6 billion by the end of 2035, expanding at a CAGR of 6.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of urinalysis is estimated at USD 3.3 billion.

The consistent increase in the global patient population of diabetes, kidney disorders, and urinary tract infections (UTIs) is fueling demand in the market. Exemplifying the same, a 2024 NLM study, the count of diabetic residents worldwide is expected to surpass 783 million by 2045, while costing around $1054 billion. It also mentioned that approximately 50% of this epidemiology is unaware of their affliction, which underscores the need for equal distribution of scalable testing solutions. Thus, being the most preferred diagnosis method for early detection and monitoring of these conditions, such demographic expansion is creating a sustainable consumer base for this sector.

The globalized supply chain of the market primarily relies on the manufacturing and sourcing of associated laboratory equipment, APIs for reagent chemistry, semiconductors, and plastic polymers. However, despite a notable rise in the import-export value of these components, the concentration of urinalysis system production and assembly in OEMs often creates volatility in payers’ pricing in this sector. Further, the additional expense on the workforce and maintenance translates to an inflation in service prices. Testifying to the same, a 2025 study published by the NLM calculated the annual direct cost of supplies and materials for urinalysis with reflex culture, when not medically necessary, to be $8,490.6. Although the total costs, including labor and antibiotics for inappropriate treatment, were extrapolated to about $49,701.0.

Key Urinalysis Market Insights Summary:

Regional Highlights:

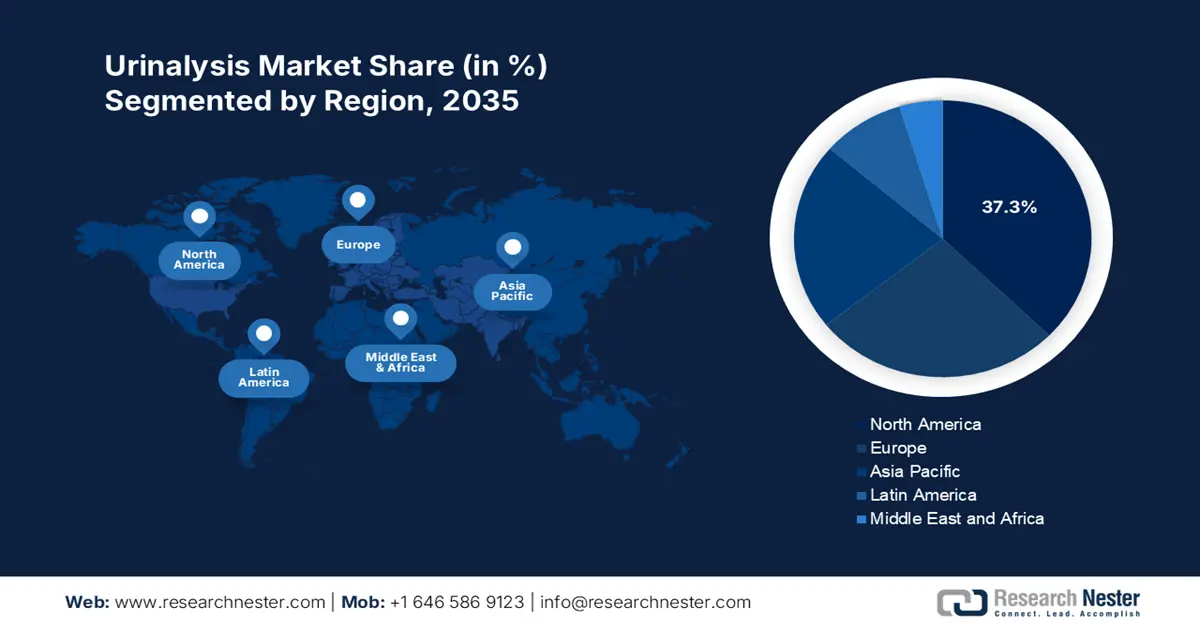

- North America is anticipated to lead the global Urinalysis Market with 37.3% share by 2035, driven by advanced healthcare infrastructure, high prevalence of UTIs, and strong public funding.

- Asia Pacific is poised to become the fastest-growing region during 2026–2035, impelled by rapid urbanization, improving healthcare access, and rising awareness of early disease detection.

Segment Insights:

- Consumables are projected to account for 68.4% share by 2035, owing to the recurring, high-volume use of reagents, dipsticks, and disposables in laboratories and research institutions.

- Hospitals & clinics are expected to hold 45.3% share by 2035, propelled by rising patient volumes and the increasing need for continuous UTI and other diagnostic testing.

Key Growth Trends:

- Expansion of point-of-care (PoC) testing

- Aging population and geriatric care needs

Major Challenges:

- Complex and expensive process of compliance

- Fragmented payer landscape and coverage policies

Key Players: Roche Holding AG, Siemens Healthineers AG, Abbott Laboratories, Danaher Corp. (Beckman Coulter), BD (Becton, Dickinson and Company), Bio-Rad Laboratories Inc., 77 Elektronika Kft., ACON Laboratories Inc., QuidelOrtho Corporation, Dirui Industrial Co. Ltd., Mindray Medical International Ltd., Teco Diagnostics, URIT Medical Electronic Co. Ltd., PZ CORMAY S.A., Cypress Diagnostics, Analyticon Biotechnologies AG, Boditech Med Inc., Copan Diagnostics, Qassay.

Global Urinalysis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size: USD 3.3 billion

- Projected Market Size: USD 4.6 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, Canada

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 5 September, 2025

Urinalysis Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of point-of-care (PoC) testing: The rising demand for rapid and remote testing solutions is creating new business opportunities for PoC solutions available in the market. The amplifying adoption and value of this category can be testified by the robust expansion of the point-of-care glucose testing industry, which is poised to reach a significant value by 2035. Moreover, these devices assist non-laboratory settings, such as clinics, homes, and remote areas, in delivering faster and precise results. Especially in underserved regions, the growing acceptance of PoC is making this sector an important asset for the improvement of accessibility.

- Aging population and geriatric care needs: As the population around the globe ages rapidly, particularly in developed nations, the demography of the market expands rapidly, as they are highly prone to develop kidney disorders, diabetes, and urinary infections. Displaying the same, the World Health Organization (WHO) revealed that the number of elderly people worldwide (aged 60 and over) is estimated to double by 2050, reaching 2.1 billion. This age group requires frequent health screenings and chronic disease management, making the demographic shift a powerful growth driver in this sector.

- Advancements in urinalysis technology: Technological innovations are the key to future expansion of the market. The introduction of automated urine analyzers, dipstick readers, and digital microscopy has made assessments faster, more accurate, and user-friendly. In addition, these advancements reduce human error and increase diagnostic scalability, while allowing seamless integration with existing electronic health records (EHRs), which help ensure the sector’s relevance with the evolving trends. For instance, to capitalize on the same approach, in December 2023, Siemens launched a compact solution for urine sediment analysis, Atellica UAS 60 Analyzer, that enhances laboratory capacity by automating the workflow.

Patient Population Worldwide that Enable a Sustainable Demand Base for the Market

Number of Adults (20-79 Years) Living with Diabetes Worldwide (2024)

|

Analyzed Region |

Count of Diabetic Adults (Million) |

|

North America and the Caribbean |

56 |

|

Europe |

66 |

|

South-East Asia |

107 |

|

Middle East and North Africa |

85 |

|

Africa |

25 |

|

South and Central America |

35 |

|

Western Pacific |

215 |

Source: IDF

Cost Distribution/Analysis Related to Specified Components and Methods in the Market

Direct Costs Associated with Urine Testing (2023)

|

Supplies |

Direct cost/unit |

|

Urinalysis cup |

$0.24 |

|

Urinalysis with micro supplies |

$1.00 (estimate) |

|

Culture plate and single-use inoculating loop |

$0.71 |

|

Organism identification via mass spectroscopy supplies |

$0.95 |

|

Organism susceptibility via VITEK-2 |

$3.78 |

Source: NLM

Challenges

- Complex and expensive process of compliance: The regulatory pathway for Class II medical devices, which includes most urinalysis instruments, requires rigorous clinical validation. However, the divergent requirements between major agencies, such as the FDA and MDR, often force manufacturers to customize their pipeline for individual regions, causing financial loss and launch delays. This is particularly a major roadblock for small-sized or budget-constrained companies and service providers operating in the market.

- Fragmented payer landscape and coverage policies: The variability of coverage policies and reimbursement thresholds, even within a single country, creates uncertainty of cash inflow in the market. Among different public and private insurers, a specific biomarker used in these tests may be covered by one but be deemed by another. Such differences push manufacturers to engage in lengthy, individual negotiations with numerous payers, creating a complex and costly market access environment that hinders widespread adoption.

Urinalysis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 4.6 billion |

|

Regional Scope |

|

Urinalysis Market Segmentation:

Product Segment Analysis

Consumables are predicted to dominate the market with the largest revenue share of 68.4% over the assessed timeline. The recurring, high-volume nature of purchasing these components among laboratories and research institutions is the foundational pillar for the leadership. In contrast to instruments, which are a one-time capital expenditure, reagents, dipsticks, and disposables are continuously consumed in every test performed. This can be testified by the global trade value of laboratory reagents, which attained $396 million in 2023, according to a report from the OEC. However, the trend of cost-optimization in lab operations suggests recycling or renting consumables to reduce overall expenses, shrinking the scale of business in this segment.

End user Segment Analysis

Hospitals & clinics are estimated to hold the largest share of 45.3% in the market by the end of 2035. As these facilities are the primary points of care for diagnosing and managing diseases associated with this category, the volume of the patient pool for this segment is remarkably higher than other end users. The amplifying test volumes for inpatients and outpatients, from routine check-ups to critical diagnoses, also make these service providers the biggest contributors to revenue generation in this sector. Besides, the increasing burden of healthcare-associated infections (HAIs) is raising the need for continuous diagnoses, including UTI testing. Evidencing the same, a 2025 Journal of European Urology Focus unveiled that more than 40% of the hospital-associated infections are UTIs.

Application Segment Analysis

Disease screening is poised to represent the leading field of application in the market by acquiring a 48.4% share throughout the discussed period. This position is reflected through the critical role of this testing method in the early detection and monitoring of various chronic and infectious diseases. The increasing number of individuals afflicted with diabetes, kidney disorders, UTIs, and liver conditions is also fueling the demand for urinalysis incorporation in regular healthcare practice. According to a 2025 study, the global age-standardized mortality rate for chronic kidney disease (CKD) is expected to rise from 19.55 to 21.26 per 100,000 population between 2022 and 2032. Moreover, the growing trend of cultivating preventive measures is reinforcing the surge for urinalysis as a non-invasive, cost-effective diagnostic tool.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Product |

|

|

Test Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Urinalysis Market - Regional Analysis

North America Market Insights

North America is anticipated to lead the global market with the highest share of 37.3% by the end of 2035. The presence of an advanced healthcare system, the enlarging diabetic, obese, and UTI afflicted population, and a strong capital influx from public authorities are the major driving factors behind the region’s proprietorship in this sector. Evidencing the large demography, a 2022 NLM article revealed that UTI had a 2.3% mortality rate for hospitalized patients in the U.S., where the medical cost of this condition ranged between $340 million and 450 million every year. Moreover, the widespread access to diagnostic services, expanding reimbursement coverage, and increased activities in medical research and innovation are also key contributors to this landscape.

As per a 2024 report from the Centers for Disease Control and Prevention (CDC), over 38 million people living across the U.S. had diabetes. Besides, between 2021 and 2023, a 40.3% prevalence rate of obesity was observed among adults in the country, as recorded by the CDC. This portrays the continuous expansion of the high-risk population nationwide, which ultimately fuels the urinalysis market. Additionally, the country is home to major global leaders in this field, which enables a progressive atmosphere for this merchandise in the U.S., attracting more domestic and foreign companies to invest.

Canada is one of the emerging landscapes in the North America urinalysis market, backed by its publicly funded healthcare system, growing elderly population, and increasing focus on preventive care. The rising incidence of chronic diseases such as diabetes and kidney disorders, where more than 4 million citizens of the country were suffering from CKD in 2023, is prompting the governing bodies to allocate financial backing for large-scale commercialization of urinalysis kits and services. In addition, the ongoing investment in healthcare technology and the expansion of laboratory services in both urban and remote areas contribute to the steady growth in this sector.

APAC Market Insights

Asia Pacific is poised to become the fastest-growing region in the global urinalysis market during the analyzed tenure. The pace of progress is primarily propelled by rapid urbanization, improving healthcare infrastructure, and rising awareness of early disease detection. Countries such as China, India, and South Korea are a few of the most prevalent landscapes of CKD and diabetes, with concerning mortality rates. This, coupled with the aging populations, is creating a surge in rapid and scalable diagnostic services and tools, including urinalysis. Besides, the growing middle class and increasing public expenditure on healthcare infrastructure are improving patient access to advanced detection technologies and solutions.

China is augmenting the urinalysis market with regional and global leadership in producing medical devices, laboratory instruments, and reagent supplies. On the other hand, its large population, rising healthcare expenditures, and growing burden of chronic diseases are propelling domestic demand for these testing commodities. This demography can be testified by the prevalence rate of CKD in China being 31% among people with type 2 diabetes in 2024, as per the JMIR Publications. In response, the government is focusing on strengthening primary healthcare and preventive screening programs, boosting adoption in this sector.

India is emerging as a growth engine in the Asia Pacific urinalysis market on account of a large and increasingly health-conscious population. The rising prevalence of lifestyle-related diseases, such as diabetes and kidney disorders, coupled with increased disposable income, is influencing people to invest in regular health checkups, where urinalysis is a major component. The expanding healthcare infrastructure and government initiatives for early disease detection are also benefiting this sector. Besides, the improved access to affordable diagnostic services in both urban and rural areas is escalating the adoption of urinalysis technologies nationwide.

Country-wise Government Provinces

|

Country |

Initiative/Allocation |

Key Focus |

Year |

|

India |

NPCDCS (National Programme for Prevention and Control of Diabetes, CVDs, Stroke) |

Nationwide awareness, early diagnosis; annual allocations exceed ₹100 crore |

2024-2025 |

|

Australia |

Partnerships for a Healthy Region |

AUD $620 million investment for screening, awareness, and regional cooperation |

2023-2027 |

|

China |

Healthy China 2030 |

Coverage for the 100% patient population of all chronic ailments |

2025-2030 |

Source: MOHFW, Australian Government, and WHO

Europe Market Insights

Europe is estimated to maintain a considerable position in the global urinalysis market over the timeline between 2026 and 2035. The steady growth of the region is highly attributable to its well-established medical systems, increased healthcare spending, and public efforts on preventive care and early disease detection. The region further benefits from the ongoing discoveries in advanced diagnostic technologies and the cultivation of comprehensive screening facilities, fostering lucrative opportunities for global MedTech innovators. Besides, continuous allocations to R&D, along with favorable related protocols, influence both pioneers and clinical settings to invest in automated and point-of-care solutions available in this sector.

The UK is a key contributor to the Europe urinalysis market, which is growing steadily in support of its robust healthcare infrastructure and strong National Health Service (NHS) backing. The expanding demography of diabetes and kidney disease is securing a sustainable consumer base for reliable and efficient urinalysis testing across hospitals, clinics, and primary care settings. Displaying such dynamics of a surge in this sector, in January 2024, UNA Health commercialized a new urine analyzer, the Urisys 1100, under its PoC pipeline of services. This state-of-the-art device from Roche elevates the standard of urinalysis with improved usability and connectivity.

Germany is a leading landscape in the Europe urinalysis market, which is backed by its advanced healthcare system, high healthcare expenditure, and the ongoing MedTech research and innovation. On the other hand, the country’s aging population is increasing the occurrence of chronic diseases, such as diabetes and renal disorders, driving demand for urinalysis tests. Additionally, the country is home to a globally dominating medical device industry that encourages widespread adoption of cutting-edge testing technologies, including automated and point-of-care solutions.

Country-wise Number of Adults (20-79 years) Living with Diabetes

(2024)

|

Country |

Number of People with Diabetes (Thousand) |

Age-standardized Prevalence of Diabetes (%) |

|

Russia |

7577.6 |

5.9 |

|

France |

4107.0 |

6.5 |

|

UK |

4454.6 |

7.4 |

|

Germany |

6485.3 |

7.8 |

|

Italy |

5018.4 |

7.7 |

|

Switzerland |

433.3 |

5.3 |

|

Spain |

4660.2 |

9.7 |

Source: IDF

Key Urinalysis Market Players:

- Roche Holding AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Healthineers AG

- Abbott Laboratories

- Danaher Corp. (Beckman Coulter)

- BD (Becton, Dickinson and Company)

- Bio-Rad Laboratories, Inc.

- 77 Elektronika Kft.

- ACON Laboratories, Inc.

- QuidelOrtho Corporation

- Dirui Industrial Co., Ltd.

- Mindray Medical International Ltd.

- Teco Diagnostics

- URIT Medical Electronic Co., Ltd.

- PZ CORMAY S.A.

- Cypress Diagnostics

- Analyticon Biotechnologies AG

- Boditech Med Inc.

- Copan Diagnostics

- Qassay

The commercial dynamics of the urinalysis market are characterized by high competition among established multinational corporations and innovative regional players. Both of this cohort of leading companies focus on continuous product development, technological advancements, and strategic partnerships to strengthen their position in this sector. The competitive landscape is currently shaped by the introduction of automated urinalysis systems, integration of AI, and digitization of health technologies. Additionally, these players invest heavily in research and development to enhance accuracy, efficiency, and ease of use, catering to the future growth of this merchandise.

Such pioneers are:

Recent Developments

- In December 2024, Copan received clearance from the FDA for its innovative urine collection and transport device, UriSponge, enhancing urine specimen collection and preservation processes. The system’s dip-and-close design allows for quick and simple urine specimen collection, reducing handling time and lowering the risk of errors.

- In July 2024, Qassay launched a state-of-the-art device, the URA Reader, designed to make urinalysis easier, more convenient, and fully digital. This innovative range of urinalysis sets a new standard in the qualification and quantification of results from urine test strips.

- Report ID: 8059

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Urinalysis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.