Ureteroscopy Market Outlook:

Ureteroscopy Market size is valued at USD 1.9 billion in 2025 and is projected to reach USD 2.9 billion by the end of 2035, rising at a CAGR of 5.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of ureteroscopy is evaluated at USD 2.1 billion.

The global market is facing growth due to the growing complexity of cases and a clinical preference for minimally invasive approaches. Rising obesity rates, urologic complications during pregnancy, and the need to treat pediatric or solitary kidney patients have also expanded demand for ureteroscopy procedures. According to an NLM report from March 2025, there is strong evidence that ureteroscopy does not cause long-term damage to the kidneys or renal function, and the overall risk of ureteral stricture is only about 1%. Public health systems have responded to this growing demand by standardizing device sterilization, setting reuse policies, and integrating ureteroscopy services into surgical care pathways.

Moreover, in the global market, ureteroscopy techniques are improving day by day, with the clinical range expanding and increasing demand for precision instruments and minimally invasive solutions. According to an NLM report from March 2025, a recent clinical study involving over 3,000 nephrolithiasis patients recommends early intervention, such as ureteroscopy or extracorporeal shock wave lithotripsy, for stones larger than 7 mm and those 5 to 7 mm in size in the mid or proximal ureter. However, the trade of ureteroscopy equipment and components remain under strict regulatory frameworks that affect sourcing, assembly, and global logistics.

Key Ureteroscopy Market Insights Summary:

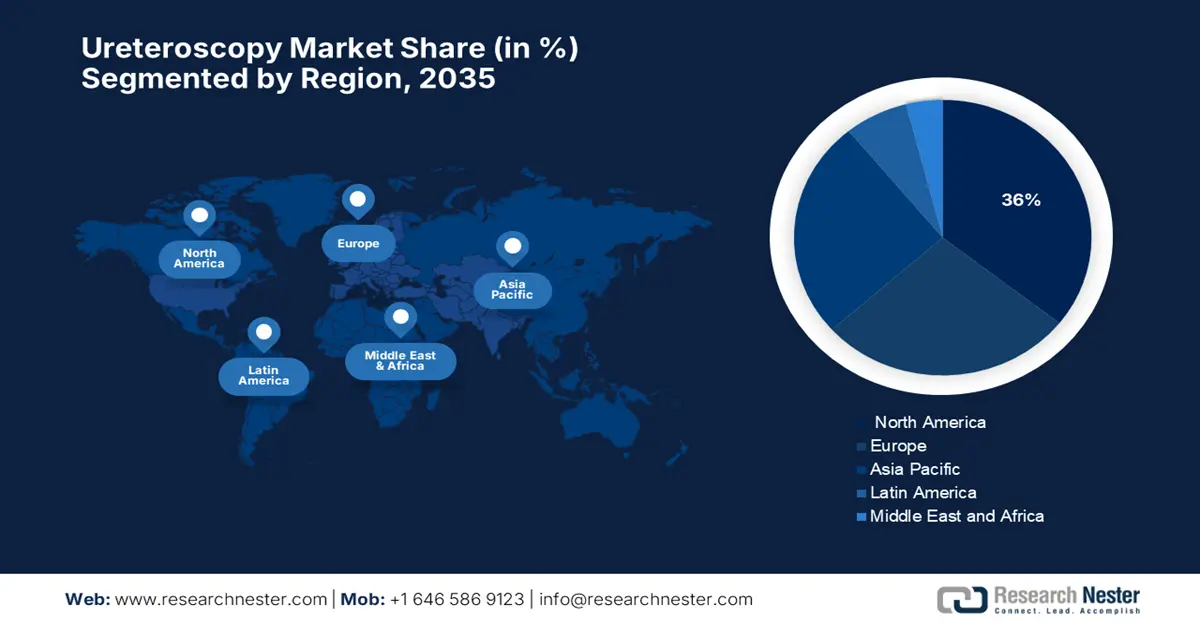

Regional Insights:

- The North America ureteroscopy market is projected to hold a dominant 36% share by 2035, attributed to advanced healthcare infrastructure, high adoption of minimally invasive procedures, and the presence of major medical device manufacturers.

- The Asia Pacific region is poised to witness the fastest growth during 2026–2035 owing to rising awareness of minimally invasive treatments, expanding healthcare infrastructure, and supportive government initiatives.

Segment Insights:

- The Hospitals segment is anticipated to capture the largest 61% share by 2035 in the Ureteroscopy Market, propelled by superior healthcare infrastructure, higher patient influx, and access to specialized surgical teams for complex procedures.

- The Kidney Stone Management segment is expected to secure the second-largest share by 2035, driven by increasing treatment success rates with therapies like shock wave lithotripsy and the growing preference for alpha blocker use to enhance stone passage.

Key Growth Trends:

- Increasing prevalence of urolithiasis and complex patient profiles

- Advancements in medical device sterilization and reprocessing infrastructure

Major Challenges:

- High costs and limited durability of ureteroscopy devices

- Complex supply chain and regulatory barriers

Key Players: Boston Scientific Corporation, KARL STORZ SE & Co. KG, Richard Wolf GmbH, Stryker Corporation, STERIS plc, Elmed Medical Systems, Maxer Endoscopy, Vimex Endoscopy, Cook Medical, Dornier MedTech, OPCOM, AED.MD, Bionet, Transasia Bio-Medicals, Hemsley Holdings.

Global Ureteroscopy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.9 billion

- 2026 Market Size: USD 2.1 billion

- Projected Market Size: USD 2.9 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 8 September, 2025

Ureteroscopy Market - Growth Drivers and Challenges

Growth Drivers

- Increasing prevalence of urolithiasis and complex patient profiles: The rising incidence of kidney and urinary tract stones, along with more complex cases such as obesity, pregnancy, and solitary kidney, is increasing the demand for the market. According to a report by NLM in March 2025, typically, stones smaller than 20 mm are treated with ureteroscopy, while larger stones over 20 mm may require percutaneous nephrolithotomy. These patient profiles support the use of minimally invasive and precise procedures, making ureteroscopy the preferred treatment in many public health systems.

- Advancements in medical device sterilization and reprocessing infrastructure: Improvements in sterilization procedures and reprocessing technologies for ureteroscopes have increased the longevity and availability. This infrastructure supports cost-effective reuse of the equipment, helping ensure access to procedures across all healthcare facilities, especially considering supply chain constraints in manufacturing and imports. Governments, through their healthcare agencies, strongly support safe reprocessing standards to make the best use of available resources in the global market.

- Regulatory frameworks encouraging safe import and trade of medical devices: Strict regulatory oversight on the import, assembly, and trade of various medical devices, including ureteroscopes, ensures compliance with quality and safety standards, thereby suitable for the market. As per a report by NLM June 2025, differences in clinical trial evaluation between drugs and devices are guided by EU Regulation 536/2014 for drugs and EU Regulation 2017/745 for medical devices, focusing on trial design, approval, ethics, and transparency. This regulatory framework supports global supply continuity, timely delivery of critical urological instruments, and market development through organized import-export policies, traceability, and aligned clinical and trade standards.

Global 2023 Exports and Imports of Medical Instruments

|

Country |

Exports |

Imports |

|

United States |

USD 34.8 billion |

USD 37.7 billion |

|

Germany |

USD 18.4 billion |

USD 13.1 billion |

|

Mexico |

USD 17.6 billion |

USD 4.62 billion |

|

Netherlands |

USD 9.38 billion |

USD 14.1 billion |

|

Ireland |

USD 9.06 billion |

USD 1.9 billion |

|

China |

USD 12.3 billion |

USD 10.6 billion |

|

Japan |

USD 7.2 billion |

USD 6.4 billion |

|

Costa Rica |

USD 5.9 billion |

USD 828 million |

|

France |

USD 3.9 billion |

USD 6.4 billion |

|

Belgium |

USD 3.2 billion |

USD 4.5 billion |

|

Italy |

USD 3.1 billion |

USD 4.6 billion |

Source: OEC August 2025

Challenges

- High costs and limited durability of ureteroscopy devices: Ureteroscopes, especially digital flexible types, have very high acquisition and maintenance costs, with a short usage life due to frequent breakdowns that require expensive repairs. This has limited their use in smaller hospitals and emerging markets, leading to underutilization and treatment delays. Besides the high total cost of ownership, allocating funds for these devices is also a challenge, slowing market growth and limiting access to procedures. Therefore, due to all these factors, the market is experiencing hindrance that has affected its growth internationally.

- Complex supply chain and regulatory barriers: The supply chain for devices in the market heavily relies on imported components needed for manufacturing and reprocessing. Regulatory requirements, especially in sterilization, import/export controls, and device tracking, create logistical challenges that increase costs and cause delays. These barriers affect the timely availability and distribution of devices, disrupting procedure schedules and limiting market growth, especially in less developed healthcare systems, thus negatively impacting the market in different nations.

Ureteroscopy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 1.9 billion |

|

Forecast Year Market Size (2035) |

USD 2.9 billion |

|

Regional Scope |

|

Ureteroscopy Market Segmentation:

End user Segment Analysis

Hospitals are expected to hold the highest market share with 61% in end user segment in the market due to advanced healthcare infrastructure, higher patient volumes, and the availability of specialized surgical team members capable of undertaking complex ureteroscopy procedures. The infrastructural facilities for medical care, patient turns, and the availability of specialized surgical teams have led hospitals to dominate this sphere of ureteroscopy for complex procedures. Hospitals further strive to buy the state's best equipment and technology for a better treatment outcome.

Application Segment Analysis

The kidney stone management subsegment is expected to hold the second-highest market share in the application segment. According to the March 2023 NLM report, most kidney stones smaller than 5 millimeters pass naturally, and about stones between 5 and 10 millimeters do as well. It also stated that 78 out of 100 people who had shock wave therapy did not have any kidney stones after the treatment. This proves that using alpha blockers can increase the passage rate within four weeks, which improves patient outcomes. However, these medicines may sometimes cause side effects like low blood pressure, dizziness, tiredness, and retrograde ejaculation.

Technology Segment Analysis

The single-use ureteroscopes are expected to lead the technology segment of the market as they are widely accepted in clinical settings. These devices reduce the risk of cross-contamination and infection, making patient safety a top priority. Since they are disposable, there is no need for sterilization, which saves costs for healthcare providers. Additionally, single-use ureteroscopes maintain consistent performance throughout one procedure without any drop in quality. This feature is a key reason why single-use units are preferred over reusable ones, from large hospitals to ambulatory surgical centers.

|

Segment |

Sub-segments |

|

Product Type |

|

|

Application |

|

|

End user |

|

|

Procedure Type |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ureteroscopy Market - Regional Analysis

North America Market Insights

The North America ureteroscopy market is expected to hold the highest share of 36% during the forecast period, due to advanced healthcare infrastructure, high acceptance of minimally invasive procedures, skilled urologists, and major medical device manufacturers. The rising number of kidney and urinary tract stones is increasing procedure volumes. Favorable reimbursement policies and the presence of key companies like Boston Scientific also support growth. New technologies, such as digital and disposable ureteroscopes, further boost clinical acceptance.

The ureteroscopy market in the U.S. is highly driven by the rising prevalence of kidney stones. Besides, the increasing preference for minimally invasive surgeries, strong healthcare spending, and rapid technological advances by key medical device manufacturers are boosting production. As per a study by NLM in June 2023, urolithiasis is common, affecting about 1 in 11 people in the United States. It costs the healthcare system an estimated $5 billion and leads to around 1 million emergency department visits each year. The rising cases in working-age people and increasing obesity rates support strong market growth.

The Canada is growing due to the rising cases of kidney stones over the years and the upgrading of healthcare expenditure. Besides, between 2022 and 2023, the challenges from the ongoing pandemic worsened existing problems in the healthcare system of Canada. As per a report by the Government of Canada, November 2024, Budget 2023 recognized the need to improve population health, and the Government of Canada announced nearly USD 200 billion in funding for the healthcare system. This major funding is expected to improve access to advanced surgical treatments like ureteroscopy and support their use in hospitals and surgical clinics across the country.

Asia Pacific Market Insights

The Asia Pacific ureteroscopy market is expected to be the fastest-growing market during the forecast period due to rising awareness towards minimally invasive treatments, the increasing prevalence of kidney stone cases, the expansion of healthcare infrastructure, and government initiatives that promote early diagnosis and surgical techniques. Rapid urbanization and rising expenditure on healthcare are probably the factors also fueling the market growth. With the increasing use of digital and disposable ureteroscopes, the demand for procedures is being further augmented by the improvement in their efficiency and safety.

The ureteroscopy market in China is growing due to increasing awareness of minimally invasive treatments, government support for advanced healthcare technologies, and a rise in kidney stone cases. As per a report published by BJUI in September 2023, a meta-analysis of 46 studies across 22 provinces found a urolithiasis prevalence of 8.1%, with kidney stones at 7.8%. The highest rates were in Guangdong, 12.7% and Guangxi, 10.3% in the eastern developed regions. These factors together indicate strong growth potential for the market in China in the coming years.

The ureteroscopy market in India is growing due to the need for better healthcare infrastructure, rapid adoption of diagnostic and treatment technologies, and rising cases of urological disorders in both urban and rural areas. As per a study by NLM in February 2023, kidney stones affect about 12% of the population, reaching up to 15% in the northern parts of the country, which drives demand. Kidney colic and related complications account for nearly 1% of hospital emergencies, highlighting the need for effective treatments. These factors strongly support the growth of the market in India.

Europe Market Insights

Europe’s ureteroscopy market is growing due to the rising number of kidney stone cases, which are affected by geography, climate, ethnicity, diet, and genetics. As per a study by EAU 2023 in developed nations like Sweden and the U.S., kidney stone prevalence is over 10%, with some regions seeing a 37% increase in the past 20 years. This rise, along with new evidence linking kidney stones to chronic kidney disease (CKD), is boosting the demand for effective ureteroscopy procedures across Europe. The increasing availability of advanced ureteroscopes and laser lithotripsy devices in hospitals is improving treatment outcomes.

The ureteroscopy market in Germany is growing due to a major shift from shock wave lithotripsy (SWL) to ureterorenoscopy (URS), driven by technological improvements like flexible ureteroscopes and laser fragmentation. A nationwide German survey showed that most centers now prefer URS over SWL for stone removal. Germany’s strong healthcare system, supported by DRG-based reimbursement, promotes the use of endoscopic methods like URS. The country also invests large funds each year through its Innovation Fund under the statutory health insurance system to support new medical technologies and cross-sector care projects.

The ureteroscopy market in the UK is experiencing growth as kidney stones are common today in many population groups. As per a study by BAUK in 2025, kidney stones can be an accidental finding in 8% of patients undergoing CT scans, with incidence steadily increasing since the early 1900s. Besides, 4% to 5% of the population actually suffer from the problems during their lifetime. Males are a bit more affected than females. The average age for the appearance of the first stone is around 45, generating demand for successful ureteroscopy treatments across all ages.

Analysis of Current Healthcare Expenditure (2022) in EU countries

|

Country |

Govt. Schemes |

Compulsory Schemes & Savings Accounts |

Other Financing Agents |

Curative & Rehabilitative Care |

Medical Goods |

Other Functions |

Hospitals |

Providers of Ambulatory Health Care |

Retailers & Other Medical Goods |

|

Germany |

11.7 |

75.0 |

13.3 |

45.9 |

17.8 |

36.3 |

26.9 |

30.3 |

26.3 |

|

France |

4.3 |

80.4 |

15.4 |

51.7 |

19.1 |

29.2 |

38.9 |

22.4 |

16.8 |

|

Italy |

10.9 |

0.2 |

25.6 |

58.4 |

20.2 |

21.6 |

43.5 |

24.2 |

16.0 |

|

Denmark |

84.6 |

0.0 |

15.4 |

59.4 |

10.4 |

30.1 |

44.9 |

26.2 |

10.4 |

|

Spain |

10.3 |

3.7 |

26.0 |

57.6 |

21.4 |

21.0 |

46.0 |

- |

- |

Source: Eurostat, November 2024

Key Ureteroscopy Market Players:

- Boston Scientific Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- KARL STORZ SE & Co. KG

- Richard Wolf GmbH

- Stryker Corporation

- STERIS plc

- Elmed Medical Systems

- Maxer Endoscopy

- Vimex Endoscopy

- Cook Medical

- Dornier MedTech

- OPCOM

- AED.MD

- Bionet

- Transasia Bio-Medicals

- Hemsley Holdings

The market has a diversified marketplace with international players from the U.S. and Europe dominating most of the important ranks. These companies concentrate on innovation, single-use technologies, and sterilization solutions. Apart from them, the companies from South Korea, India, and Malaysia are pushing for greater accessibility into emerging markets. Last ranks are Japanese companies, with Olympus and HOYA dominating as primary names in advanced imaging and tech integration. These companies invest heavily in R&D and strategic partnerships to maintain their competitive edge and grow their global presence.

Here is a list of key players operating in the global market:

Recent Developments

- In April 2024, Olympus announced FDA clearance of RenaFlex, its first single-use flexible ureteroscope that can be used to perform diagnostic and therapeutic procedures within the urinary tract.

- In February 2023, Boston Scientific received FDA clearance for the LithoVue Elite Single-Use Digital Flexible Ureteroscope System, which is the first ureteroscope system suitable for monitoring intrarenal pressure.

- Report ID: 8080

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ureteroscopy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.