Nuclear Plant Services Market Outlook:

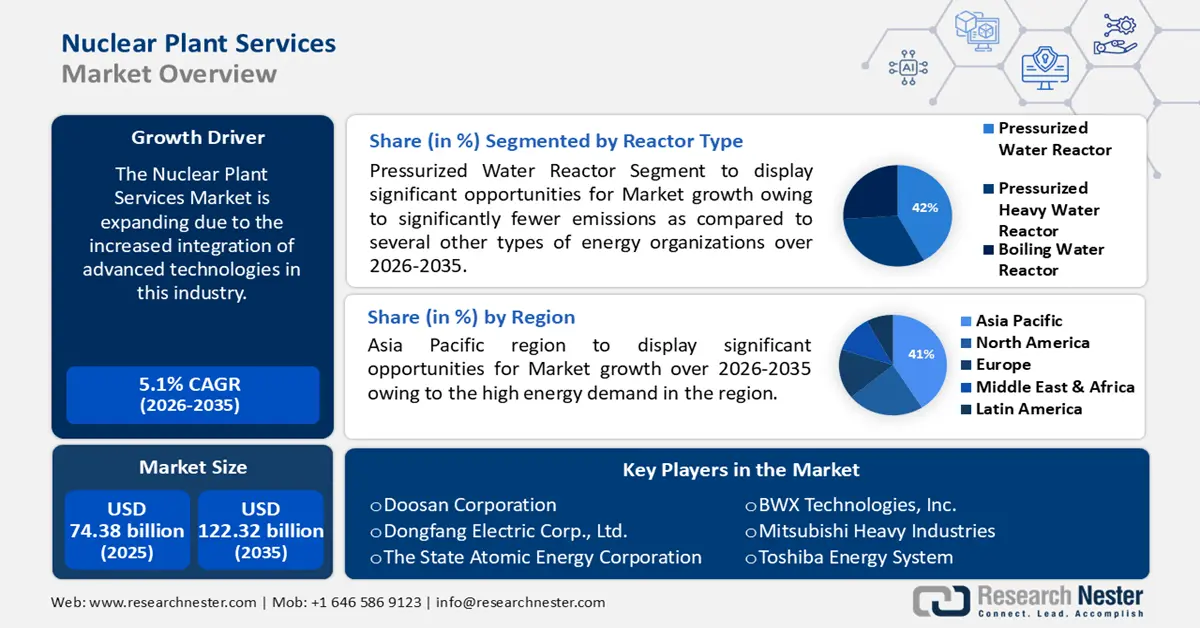

Nuclear Plant Services Market size was over USD 74.38 billion in 2025 and is poised to exceed USD 122.32 billion by 2035, witnessing over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nuclear plant services is estimated at USD 77.79 billion.

The growth of the market is due to the advanced technologies made to be introduced in the market. According to the International Atomic Energy, fast reactors such as thorium reactors can provide novel fuel cycle solutions. Agency, The Nuclear power plants are now having advanced reactor technologies that have been developed and are now being implemented with next-generation reactors, that too with inherent safety features.

Furthermore, Government sectors are actively participating and looking to promote nuclear power plant setup by providing loan approvals, and subsidies and making it cost-efficient. The regulations are being maintained by the government organizations that focus on the construction of the plant and its safety and security measures to be taken. They are helping newcomers with improved safety features and waste management to plan a better and safer future.

Key Nuclear Plant Services Market Insights Summary:

Regional Insights:

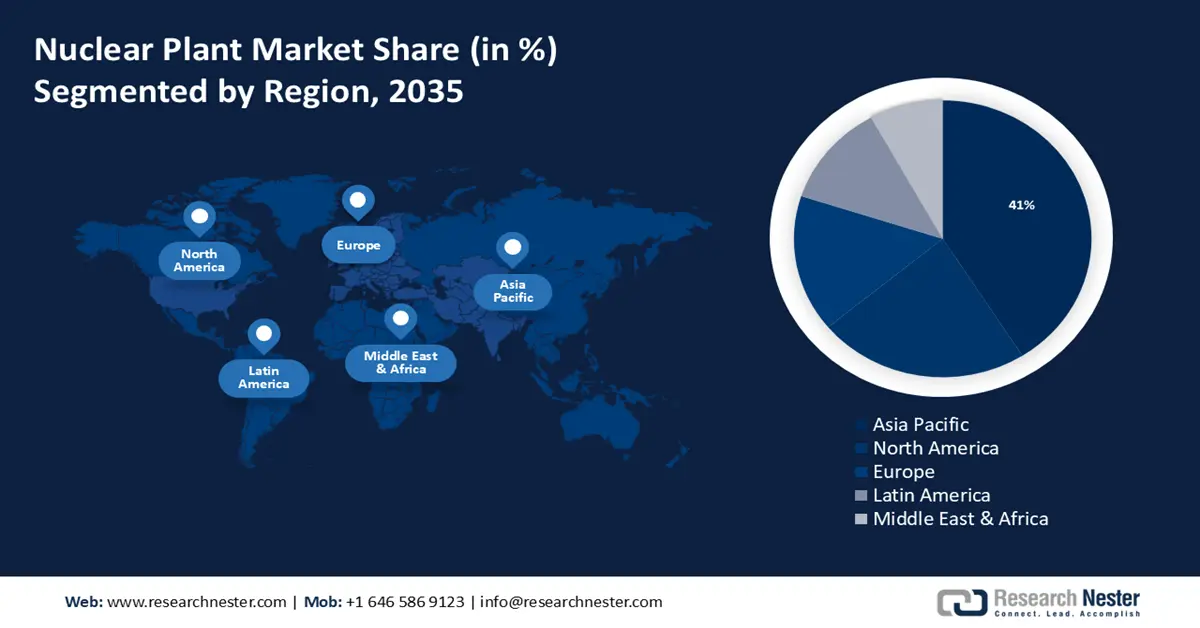

- Asia Pacific is expected to command a 41% share by 2035 in the nuclear plant services market, propelled by high energy demand and strong governmental support for nuclear expansion.

- The North American nuclear plant services market is projected to be the second largest by 2035, sustained by renewed interest in low-carbon energy and the rising deployment of small modular reactors (SMRs).

Segment Insights:

- The Pressurized water reactor (PWR) segment is forecast to represent a 42% share by 2035 in the nuclear plant services market, owing to significantly fewer emissions compared to fossil-fuel-based energy sources.

- The Inland segment is set to secure a notable share by 2035, encouraged by enhanced operator safety within the reactor island.

Key Growth Trends:

- Government Investment In Nuclear Plant Services

- Increasing demand for clean and affordable energy

Major Challenges:

- High capital costs

- Limited availability of expertise

Key Players: General Electric, Alstom, Shanghai Electric, Toshiba Corporation, Korea Electric Power Corporation, Larsen & Toubro Limited, Doosan Corporation, Dongfang Electric Corp., Ltd., The State Atomic Energy Corporation, BWX Technologies, Inc., Mitsubishi Heavy Industries, Toshiba Energy System.

Global Nuclear Plant Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 74.38 billion

- 2026 Market Size: USD 77.79 billion

- Projected Market Size: USD 122.32 billion by 2035

- Growth Forecasts: 5.1%

Key Regional Dynamics:

- Largest Region: Asia Pacific (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, France, Russia, United Kingdom

- Emerging Countries: India, South Korea, Canada, United Arab Emirates, Japan

Last updated on : 1 December, 2025

Nuclear Plant Services Market - Growth Drivers and Challenges

Growth Drivers

- Government Investment In Nuclear Plant Services- Governments and organizations are highly investing in the development of the research and development of nuclear energy technologies and their solutions. This is creating a highly favorable environment for the increase of the nuclear power services market.

- Increasing demand for clean and affordable energy- Nuclear energy is a clean and sustainable source of power, which is highly anticipated in response to the concerns over climate change and an increasing demand for sustainable energy. This will drive the need for such nuclear power plant services to support and maintain operations.

- Aging infrastructure- The existing nuclear power plants have an aging infrastructure, which requires regular maintenance and replacement of several devices. This creates a surge in the demand for specialized services while mainly ensuring safety and seamless operations.

- Growing awareness of nuclear power- Nuclear power has gained public support as a clean and reliable source of energy. This has led to a surge in the increase of awareness of such nuclear power services.

- Growth of small modular reactors (SMRs)- SMRs are a new concept in nuclear power, with benefits such as small size and high flexibility. This can lead to increasing investment in the nuclear power services industry, mainly to support the operations and maintenance of these SMRs.

Challenges

- High capital costs- Nuclear plant services involve heavy capital investment, including for the development and construction of specialized facilities and advanced technologies. This can be a restraining factor for nuclear plant services market growth, as it limits the number of players who can enter the market.

- Limited availability of expertise

- long-term commitment from customers

Nuclear Plant Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 74.38 billion |

|

Forecast Year Market Size (2035) |

USD 122.32 billion |

|

Regional Scope |

|

Nuclear Plant Services Market Segmentation:

Reactor Type Segment Analysis

Pressurized water reactor (PWR) segment is predicted to account for of 42% share of the global nuclear plant services market during the forecast period owing to significantly fewer emissions as compared to several other types of energy, such as fossil fuels. According to a report by the Energy Transitions Commission, about 80% of fossil-related emissions are a result of the combustion of the fossil fuels in use, which shows the necessity to lower the demand and supply of these fossil fuels.

Furthermore, this shows that they produce a more stable energy and comparatively cause a lesser environmental impact, which acts as a highly significant environmental advantage for Pressurized Water Reactors, this can drive the demand for Pressurized Water Reactors and would create a favorable market environment for nuclear plant services industry. PWRs have several safety features, which include containment buildings, coolant systems, along emergency cooling systems. This increases the safety of such nuclear reactors and would help to reassure customers and the public of their reliability.

Equipment Type Segment Analysis

The Inland segment is set to garner a notable share shortly and is likely to remain the second largest segment in the equipment type of the nuclear plant services market as it provides improved safety to the operators working inside the reactor island. This helps to improve the overall safety of these plants and also for the staff that are working inside the reactor inland, this increased safety can highly boost the customers' confidence and trust in the plant, which helps in creating a supportive environment for this market growth.

Moreover, the availability of island equipment can make it easier to expand the capacity of a nuclear power plant, as there is already a pre-selected space and infrastructure available for the expansion. This can drive the market growth of new nuclear power plants, as well as existing plants.

Service Segment Analysis

The operation segment is estimated to hold a noteworthy share as it provides a platform for the efficient utilization of human resources along with the training procedure. This can help to improve several skills and capabilities of the plant staff, which can create opportunities for them to advance in their careers. This can help to create a positive work environment and increase the likelihood of retaining and attracting skilled and talented workers, which helps to support the growth of the market.

Our in-depth analysis of the global market includes the following segments:

|

Reactor |

|

|

Equipment |

|

|

Service |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nuclear Plant Services Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is expected to hold largest revenue share of 41% by 2035, driven by high energy demand and the rapid growth observed in the economy of countries like China and India. According to a report by the International Atomic Energy Agency, the Government in these regions is actively supporting and promoting nuclear energy by providing financial incentives for new plant construction or making the approval process a bit simpler.

Moreover, safety is also a major concern and hence creates demand for advanced reactor usage, better safety technologies, and strict rules and regulations. These factors are expected to fuel the demand for Nuclear Plant Services in the region.

North American Market Insights

The North American nuclear plant services market is estimated to be the second largest, during the forecast timeframe led by their renewed interest in this sector, for clean energy sources having low-carbon emissions, which is why they are looking forward to new nuclear plant construction, and hence the related services would be in demand soon. The deployment of small modular reactors (SMRs) provides new opportunities, instead of those aging traditional.

Nuclear Plant Services Market Players:

- AREVA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- General Electric

- Alstom

- Shanghai Electric

- Toshiba Corporation

- Korea Electric Power Corporation

- Larsen & Toubro Limited

- Doosan Corporation

- Dongfang Electric Corp., Ltd.

- The State Atomic Energy Corporation

- BWX Technologies, Inc.

Recent Developments

- Electricite de France (EDF), has been seized by the French Government for providing an irradiation service, that is, it is held responsible for inserting the radioactive material into the reactor core at Civaux nuclear power plant. The main purpose of EDF’s nuclear reactors is to produce low-carbon, pilotable electricity, which will be a major contribution towards electricity generation.

- Rosatom, was recently invited to the ATOMEXPO-2024 and is hosting a round table on the synergy of renewable and nuclear generation for low-carbon generation and efficient energy building systems, pricing for clean energy sources, and the rapid development of renewable energy sources.

- Report ID: 5970

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nuclear Plant Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.