Underwater Connectors Market Outlook:

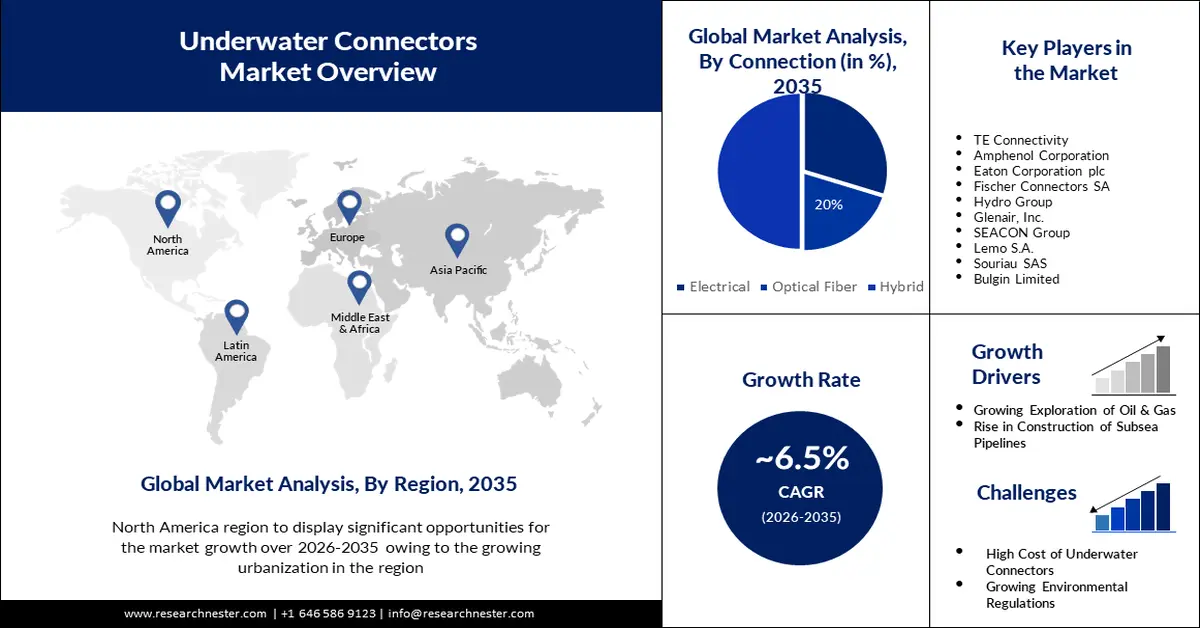

Underwater Connectors Market size was over USD 1.68 billion in 2025 and is projected to reach USD 3.15 billion by 2035, growing at around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of underwater connectors is evaluated at USD 1.78 billion.

The market's growth can be ascribed to the growing demand for oil and gas worldwide. For instance, data published by the International Energy Agency in June 2024, oil demand in advanced countries is projected to reach 43 million barrels per day by 2030. The underwater connector is usually used in gas and oil exploration to ensure power supply in deep sea ambiance.

Moreover, underwater connectors are in high demand as a result of the expansion of offshore renewable energy projects such as offshore wind farms. Department of Energy in the U.S. stated that the federal government endeavors to develop 30 gigawatts of new offshore wind energy by 2030. Underwater connector cables are utilized to connect wind farms and enable them to optimize power transmission. These connectors are necessary for transporting power from the turbines to the coast via the undersea cables.

Key Underwater Connectors Market Insights Summary:

Regional Highlights:

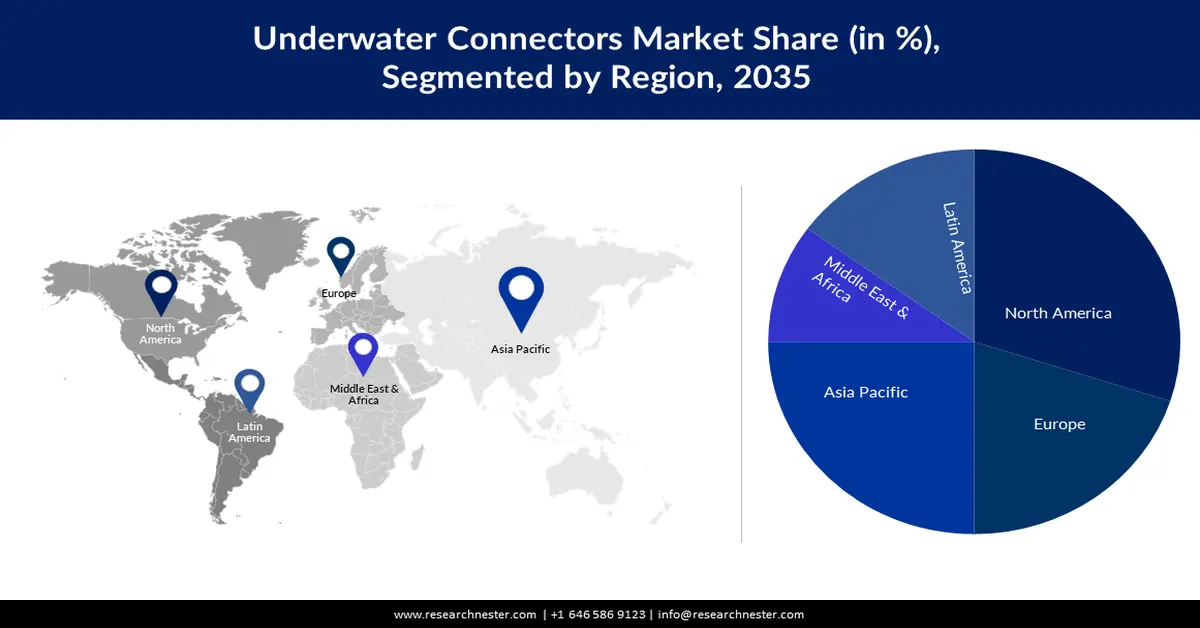

- North America underwater connectors market will hold around 33% share by 2035, driven by expanding aquaculture and marine farming applications requiring reliable underwater connectivity.

- Asia Pacific market will secure the second largest share by 2035, driven by rising subsea cable deployments and support for marine mining by countries like China, Japan, and India.

Segment Insights:

- The oil & gas segment in the underwater connectors market is anticipated to capture the highest market share by 2035, influenced by increasing demand for oil and gas transportation, requiring durable underwater connectors.

- The hybrid segment in the underwater connectors market is projected to achieve significant growth during 2026-2035, attributed to the dual functionality of hybrid connectors in transmitting both power and data efficiently.

Key Growth Trends:

- Surge in construction of subsea pipelines

- Rise in demand for underwater data centers

Major Challenges:

- High cost of underwater connectors

- Prevalent common failures

Key Players: TE Connectivity, Amphenol Corporation, Eaton Corporation plc, Fischer Connectors SA, Hydro Group, Glenair, Inc., SEACON Group, Lemo S.A., Souriau SAS, Bulgin Limited.

Global Underwater Connectors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.68 billion

- 2026 Market Size: USD 1.78 billion

- Projected Market Size: USD 3.15 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, Japan, China

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 9 September, 2025

Underwater Connectors Market Growth Drivers and Challenges:

Growth Drivers

-

Surge in construction of subsea pipelines: In recent years, there has been a surge in the requirement for global energy requirements and rising environmental concerns. Subsea pipelines play a crucial role in the exploration of the gas industry and provide an efficient mode of transporting hydrocarbon. Market players are demanding quality underwater connectors for installing a well-organized subsea pipeline infrastructure. According to the Carnegie Endowment for International Peace in December 2024, the European Union is projected to invest nearly USD 1 billion in establishing subsea pipeline projects by the end of 2027.

- Rise in demand for underwater data centers: Deep Sea data centers utilize the capacity of the ocean to constantly maintain the lower temperature. Various IT giants are finding underwater data centers practical, reliable, and sustainable. Sea water provides free cooling and separation from the constantly changing weather on land. In February 2025, China announced the news of creating an underwater data center holding capability to support 7,000 conversations per second with chatbots of DeepSeek. These submerged data centers use high-end underwater connectors to avoid any malfunctions due to water.

- Expansion of underwater telecommunication network: According to data published by Internet Society Pulse in May 2024, currently there are 559 submarine cable systems covering almost 1.5 million kilometers. These submarine cables link the smallest islands of the Pacific to Asia, Europe, and North America region. Underwater connectors play a crucial in conveying power, image, and data transmission.

Challenges

-

High cost of underwater connectors: Underwater connections need specialized construction and materials to resist the severe marine environment. Also, these connectors must be able to survive high pressures, freezing temperatures, and corrosive saltwater. To achieve this, specialized materials such as titanium, ceramic, or premium stainless steel are used for fabrication. Underwater connectors must also be designed to maintain a watertight seal, to prevent water from getting inside and harming the equipment they link. Higher production expenses may be incurred owing to the usage of these specialized materials and designs, which are subsequently passed on to the consumers in the form of higher prices.

- Prevalent common failures: Factors such as seal failures, corrosion, mechanical damage, insulation breakdown, etc., are some of the common failures in underwater connectors. These failures compromise the connector’s structure and further lead to failure.

Underwater Connectors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 1.68 billion |

|

Forecast Year Market Size (2035) |

USD 3.15 billion |

|

Regional Scope |

|

Underwater Connectors Market Segmentation:

Application Segment Analysis

The oil & gas segment in underwater connectors market is expected to garner the highest revenue by the end of 2035. The growth of the segment can be attributed to growing transportation. The transportation industry is the key consumer of the oil and gas energy commodities. As the transportation industry is widening, there is a surge in demand further boosting the oil and gas segment. For instance, in July 2024, the International Energy Agency published data stating that natural gas demand increased by 2.5% in 2024 in comparison with the last year. Underwater connectors decrease the need for regular maintenance and repair to provide dependable and secure connections that are less prone to failure.

Connection Segment Analysis

The hybrid segment in underwater connectors market is expected to have significant growth over the forecast period. Single hybrid connectors enable the transmission of electrical power and data. Hybrid connectors could conserve space and lower the total size and weight of subsea systems and equipment by merging power and data transmission into one connector. Furthermore, hybrid connectors are frequently made following industry standards, which could make it simpler for businesses to collaborate on subsea projects and share data.

Our in-depth analysis of the global underwater connectors market includes the following segments:

|

Type |

|

|

Application |

|

|

Connection |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Underwater Connectors Market Regional Analysis:

North America Market Insights

North America underwater connectors market is poised to dominate the majority revenue share of 33% by 2035. The growth of the market can be attributed to the rising aquaculture and marine farming in the region. For instance, in August 2024, the Global Seafood Alliance stated that the U.S. aquaculture farms contribute USD 4 billion to the economy. Marine underwater connectors are utilized to help in the transfer of power or signals and connect external devices such as sonar, cameras, etc. Additionally, aquaculture farms use various varieties of connectors to link temperature sensors and oxygen supply to ensure accurate conditions for marine life.

Asia Pacific Market Insights

The Asia Pacific market is estimated to be the second largest due to the rising establishment of subsea cables. Subsea cables link nations with high-speed internet, data centers, and other communication infrastructure. Other than this, various countries in the region are inclined towards marine mining. In a meet-up conducted by the International Seabed Authority in July 2023, countries such as China, Japan, and India, supported deep-sea mining. A moratorium was also signed for the discovery of “dark oxygen” on the seafloor. These factors are propelling the growth of the market during the assessed time frame.

Europe Market Insights

The market in the Europe region is also estimated to have significant growth over the forecast period. Europe is a global leader in underwater robotics and has launched several R&D projects aimed at creating sophisticated underwater robots for a variety of uses. Underwater connectors are necessary for the robots to operate and communicate with the surface control systems. For instance, in July 2023, sub drone GmbH, a German maritime start-up, raised USD 1.3 million pre-seed funding to get cracking on the development of its underwater technology.

Underwater Connectors Market Players:

- TE Connectivity

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amphenol Corporation

- Eaton Corporation plc

- Fischer Connectors SA

- Hydro Group

- Glenair, Inc.

- SEACON Group

- Lemo S.A.

- Souriau SAS

- Bulgin Limited

The competitive landscape of the underwater connector market is rapidly evolving as established key players, technical giants and new entrants are investing in deep sea exploration. Key players in the market are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In February 2025, Fischer Keystone declared to continue interoperability with soldier-worn C4ISR communication. The company will launch 3 new cables to enhance the ergonomics and versatility of the connections.

- In January 2025, Teledyne Impulse supplied its high-quality Omicron optical fiber connectors to the BBC studios for their upcoming underwater natural history series. To capture groundbreaking underwater content Marine Imagine Technologies, and BBC Studios fabricated a deep ocean camera integrated with a telemetry bottle.

- Report ID: 3910

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Underwater Connectors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.