Ultrasonic Testing Market Outlook:

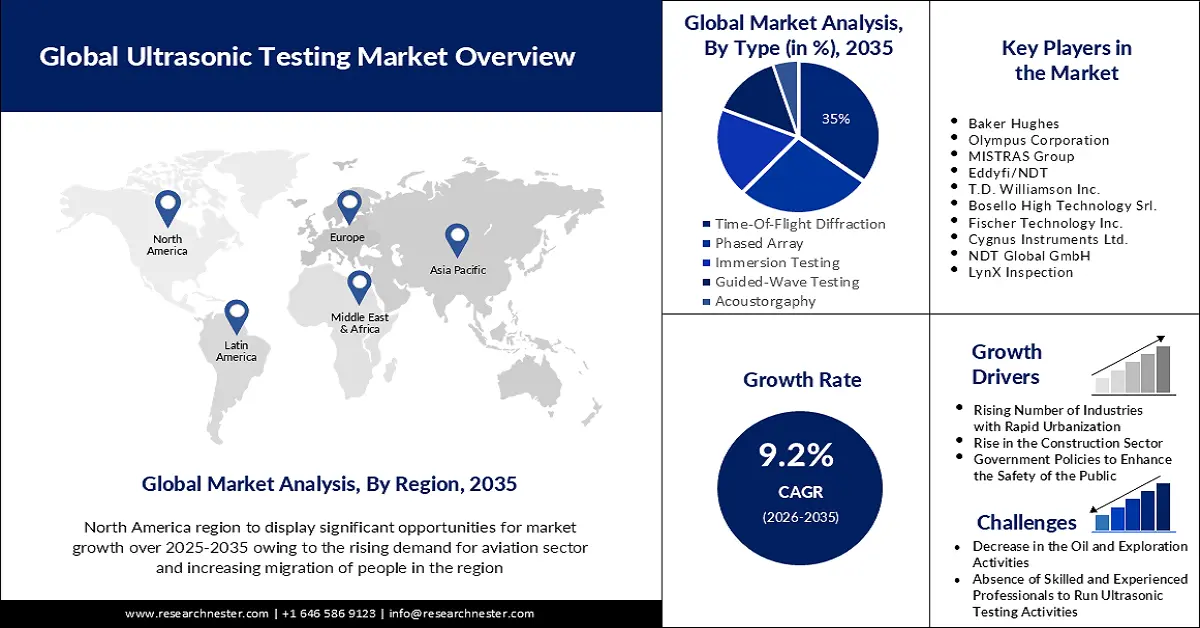

Ultrasonic Testing Market size was valued at USD 3.33 billion in 2025 and is likely to cross USD 8.03 billion by 2035, registering more than 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ultrasonic testing is assessed at USD 3.61 billion.

Rising standards about safety compliance and regulatory requirements are resulting in significant investments in advanced ultrasonic testing equipment. Organizations are actively developing innovative products and introducing them to the market. In April 2024, Baker Hughes unveiled the Krautkrämer CL Go+, an ultrasonic precision thickness gauge designed for applications in the automotive and aerospace industries. The tool is effective for metal component evaluations, including aluminum, steel, copper, and bronze, by maintaining strict quality standards. Innovation in ultrasonic testing is making the method more powerful at the same time, as it is an essential element to support industry standards, which prioritize safety, quality, and operational efficiency in important sectors.

Key Ultrasonic Testing Market Insights Summary:

Regional Highlights:

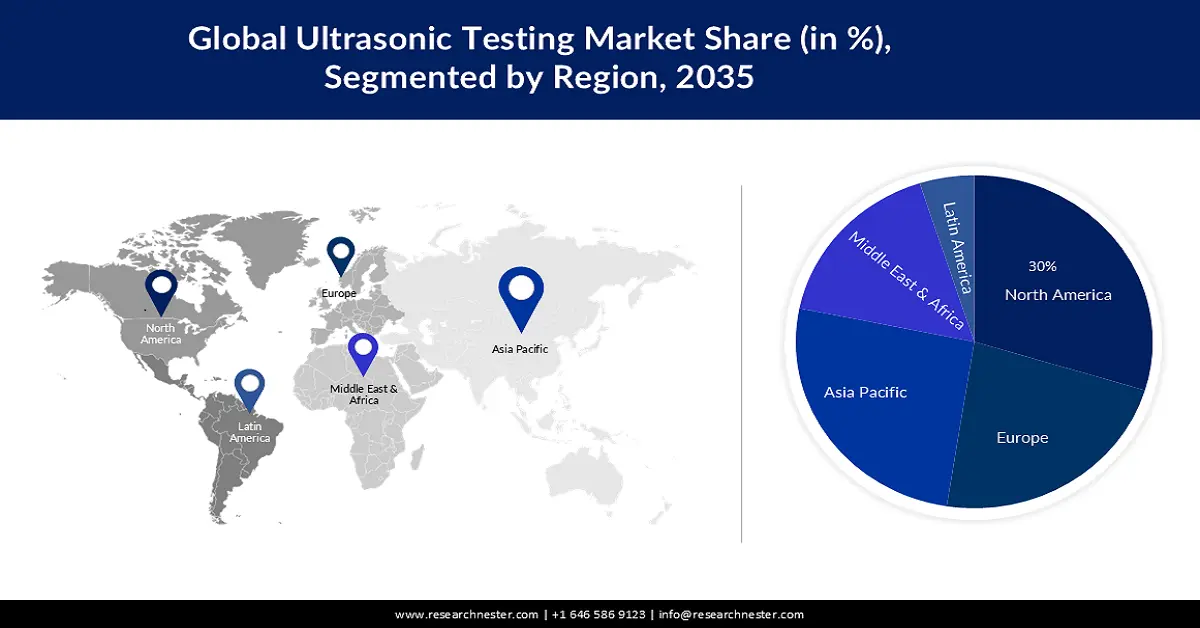

- North America ultrasonic testing market will hold over 30% share by 2035, driven by the rising industries' focus on safety regulations and quality standards.

- Asia Pacific market will capture a 26% share by 2035, driven by increasing automation and digitalization initiatives.

Segment Insights:

- The time-of-flight diffraction segment in the ultrasonic testing market is projected to hold a 30% share by 2035, driven by precise detection capabilities favored in aerospace and critical infrastructure sectors.

- The manufacturing segment in the ultrasonic testing market is forecasted to capture a 29% share by 2035, driven by demand for fast, efficient inspection technologies to enhance operational efficiency.

Key Growth Trends:

- Increasing adoption in the oil and gas industry

- Rising awareness of preventive maintenance

Major Challenges:

- Consumption from alternatives

Key Players: Baker Hughes, Olympus Corporation, MISTRAS Group, Eddyfi/NDT, T.D. Williamson Inc., Bosello High Technology Srl., Cygnus Instruments Ltd., NDT Global GmbH, LynX Inspection.

Global Ultrasonic Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.33 billion

- 2026 Market Size: USD 3.61 billion

- Projected Market Size: USD 8.03 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Ultrasonic Testing Market Growth Drivers and Challenges:

Growth Drivers

Increasing adoption in the oil and gas industry: Technical enhancements of ultrasonic testing within the oil and gas sector are emerging from industry demands for accurate solutions during offshore and remote operations. Companies are introducing newly designed specialized tools that help with pipeline inspection and integrity monitoring to address the rising requirements of advancements. In October 2024, NDT Global, in collaboration with Aramco, launched a 56-inch ultrasonic inline inspection tool tailored to meet the inspection requirements of integrated oil and gas operations. Such innovations are demonstrating reliance on advanced ultrasonic testing technology to conduct both real-time pipeline health evaluations and corrosion detection and weld assessment procedures.

Rising awareness of preventive maintenance: Strategies in several industries rely on ultrasonic testing as an indispensable component of predictive and preventive maintenance, which enables early identification of equipment defects, wear patterns, and material degradation. This process-based strategy addresses potential issues before they lead to equipment failures, resulting in minimized unplanned downtimes and longer equipment service life. Many organizations from different sectors are using advanced ultrasonic testing platforms as a way to enhance their preventive maintenance programs while sustaining equipment reliability. In January 2025, Mitsubishi Heavy Industries Compressor International Corporation (MCO-I) integrated Phased Array Ultrasonic Testing (PAUT) into its steam turbine maintenance processes. Such adoptions of UT devices enable organizations to widely deploy preventive maintenance programs.

Challenges

Consumption from alternatives: The market is facing obstacles due to the availability of its alternatives including eddy current testing, liquid and penetrant testing in the market. These testing methods are cost-effective, provide faster results, and are able to detect flaws without the need for any external energy input. The UT technology faces challenges for widespread usage since many businesses are choosing other inspection approaches that provide expedited results or custom testing features.

Ultrasonic Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 3.33 billion |

|

Forecast Year Market Size (2035) |

USD 8.03 billion |

|

Regional Scope |

|

Ultrasonic Testing Market Segmentation:

Type Segment Analysis

The time of flight diffraction segment in ultrasonic testing market is expected to hold a revenue of 30% during the forecast period, as it provides precise detection capabilities with detailed inspection results for weld investigations. In welded joints, the ToFD demonstrates excellent performance, identifying cracks and voids mostly within several sectors. ToFD provides enhanced detection capabilities, making it the primary technology for testing welded structure integrity, particularly in pressure-sensitive applications and critical infrastructure.

The aerospace sector demonstrates increasing adoption of ToFD technology, which contributes to the segment’s expansion. The aerospace sector relies on ToFD for top-quality inspections of its composite materials and aircraft wings and engine components to maintain flight safety standards. ToFD detection is becoming essential in aerospace operations as it reveals hidden flaws without harming material quality, which is resulting in broader aviation maintenance acceptance and manufacturing process adoption across the sector.

Vertical Segment Analysis

The manufacturing segment is expected to hold a share of 29% during the forecast period. The ultrasonic testing market is experiencing increasing growth due to manufacturing environments requiring advanced inspection technologies that perform more quickly and efficiently. Manufacturers are emphasizing obtaining technologies that enhance operational efficiency with faster inspection times. In June 2024, EVIDENT released the 39DL PLUS ultrasonic thickness gauge, featuring fast scanning speeds and integrated wireless capabilities, streamlining data collection and analysis in manufacturing environments. Such innovations are resulting in productivity enhancements due to real-time data sharing, with inspection accuracy and speed both experiencing improvements.

Our in-depth analysis of the global ultrasonic testing market includes the following segments:

|

Type |

|

|

Application

|

|

|

Equipment |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ultrasonic Testing Market Regional Analysis:

North America Market Insights

The North America ultrasonic testing market is expected to hold a share of 30% during the analysis period. This growth is attributed to the rising industries' focus on safety regulations and quality standards. Companies in aerospace, automotive and energy sectors, are currently facing more regulatory demands, thus they prefer non-destructive UT techniques to maintain compliance. The detection of internal structural defects by UT technology ensures material safety through non-destructive testing, which simultaneously minimizes operational risks, thus making it vital for maintaining compliance with quality standards in the manufacturing facilities.

The market in the U.S. is expected to grow at a steady pace, owing to the modernized industrial infrastructure and mandatory preventive maintenance. The expansion of industries such as oil & gas, power generation, and transportation requires dependable non-destructive testing methods to ensure reliable asset inspections. Real-time, accurate results and nondestructive capabilities of UT prevent substantial downtimes and early issue detections, leading to longer critical asset lives, thus propelling the market.

The rising emphasis on environmental and sustainability is also boosting the market growth. Ultrasonic testing emerges as the most appropriate solution for critical infrastructure monitoring as it uses non-destructive methods to assess components while maintaining full environmental compliance. UT enables industries to accomplish regulatory requirements while minimizing environmental impacts of their operations, particularly when quality materials and structures maintain sustainability standards in the construction, aerospace, and energy sectors.

Asia Pacific Market Insights

The ultrasonic testing market in Asia Pacific is expected to hold a share of 26% during the stipulated timeframe. The market experiences strong growth due to increasing automation and digitalization initiatives. The adoption of Industry 4.0 technology, along with advanced manufacturing methods and automated inspection tools, is making industries depend on ultrasonic testing for real-time quality control functions. Ultrasonic testing, when combined with automated production lines, delivers operational improvements while decreasing human errors and producing better quality products, thus making it crucial for various industries.

The market in China is all set to witness rapid growth, due to rising manufacturing sector. China upholds its position as the world's top manufacturer while currently experiencing an increase in advanced non-destructive testing methods needed to verify product quality and operational efficiency. Industries such as automotive, electronics, and heavy machinery depend largely on ultrasonic testing owing to its importance in maintaining product precision. Manufacturers are adopting ultrasonic testing technologies to discover underlying material flaws without material destruction, as production safety regulations and quality control needs are continually expanding.

Continuous expansion of infrastructure construction projects across transportation and energy development, alongside construction works, is resulting in a rising demand for ultrasonic testing. The substantial investments in infrastructure development are propelling the requirement for effective inspection tools for materials, welds, and pipelines. Ultrasonic testing represents an efficient yet budget-friendly non-destructive method for maintaining critical infrastructure components such as bridges and tunnels, as well as pipelines throughout the massive infrastructure growth.

Ultrasonic Testing Market Players:

-

The market is highly competitive, with several key players offering advanced solutions across various industries. Prominent companies such as Olympus Corporation, GE Inspection Technologies, Sonatest Ltd., and MISTRAS Group lead the market with innovative products like phased array and time-of-flight diffraction systems. These companies focus on expanding their product portfolios, enhancing accuracy, and improving user-friendliness through technological advancements. Additionally, partnerships and collaborations, such as those between NDT Global and Aramco, are driving market growth. The increasing demand for non-destructive testing (NDT) in sectors like aerospace, automotive, and energy continues to fuel competition and innovation in the market. Here are some key players operating in the global market:

- Baker Hughes

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Olympus Corporation

- MISTRAS Group

- Eddyfi/NDT

- T.D. Williamson Inc.

- Bosello High Technology Srl.

- Fischer Technology Inc.

- Cygnus Instruments Ltd.

- NDT Global GmbH

- LynX Inspection

Recent Developments

-

In June 2024, Vallourec's Tianda Chuzhou facility in China advanced its inspection capabilities by implementing phased array ultrasonic testing (PAUT) technology, ensuring precise evaluation of tube quality.

-

In May 2024, Thornetix, in collaboration with Ionix Advanced Technologies, introduced an advanced high-temperature ultrasonic testing feature. This innovation integrates digital signal processing and wireless communication, enabling real-time data transmission and analysis in manufacturing environments.

- Report ID: 5020

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ultrasonic Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.