Ultra-high-speed WiFi Market Outlook:

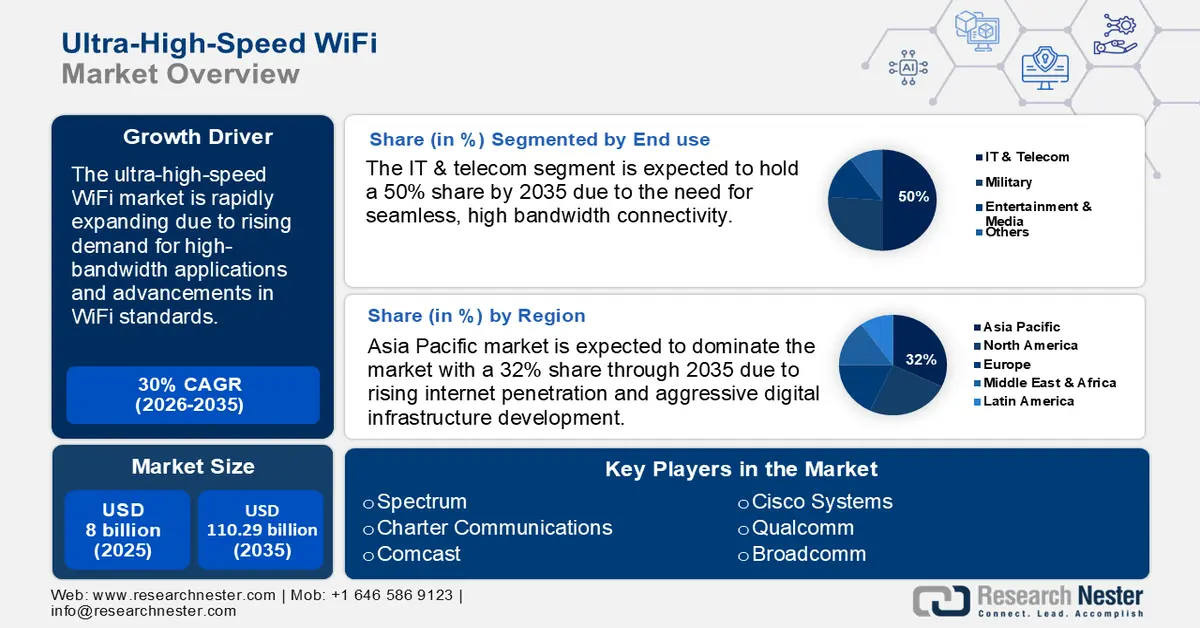

Ultra-high-speed WiFi Market size was valued at USD 8 billion in 2025 and is likely to cross USD 110.29 billion by 2035, registering more than 30% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ultra-high-speed WiFi is assessed at USD 10.16 billion.

The ultra-high-speed WiFi market is driven by rising demand for high-bandwidth applications. The global adoption of smart home devices, AR/VR systems, 8K streaming, gaming consoles, and teleconferencing tools has intensified demand for ultra-high-speed WiFi. According to the World Economic Forum report of July 2022, the global gaming industry is likely to exceed USD 320 billion by 2026, thus driving the need for ultra-high-speed WiFi. The demand for the same is rising as enterprises also rely heavily on high-performance networks for real-time collaboration and data transfer.

In addition, the digital-first approach adopted by governments and enterprises is accelerating the need for ultra-high-speed, low-latency wireless infrastructure. This surge in digital demand is supported by public investments. For instance, in September 2024, the U.S. National Telecommunications and Information Administration (NTIA) reported that through the Broadband Equity, Access, and Deployment (BEAD) Program, USD 42.45 billion has been allocated to expand high-speed internet access, including WiFi in public libraries, schools, and government facilities. Additionally, the report states that the Biden-Harris Administration’s Internet for All initiative is working towards connecting everyone in America to affordable and high-speed Internet service by 2030.

Key Ultra-high-speed WiFi Market Insights Summary:

Regional Highlights:

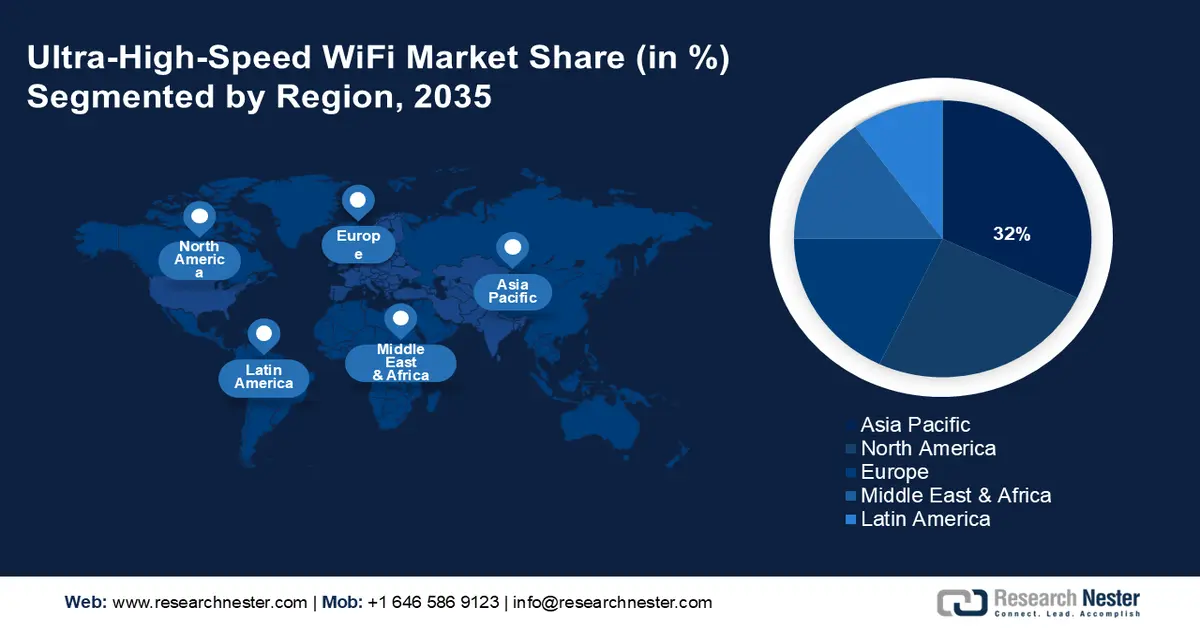

- Across 2026–2035, Asia Pacific is expected to secure a 32% share of the ultra-high-speed wifi market, underpinned by rapid digital infrastructure expansion and nationwide broadband and smart-city investments owing to rising internet penetration.

- North America is set to attain a significant share through 2026–2035 as enterprises and consumers accelerate adoption of advanced wireless standards, supported by federal broadband enhancement initiatives impelled by the region’s mature digital ecosystem.

Segment Insights:

- By 2035, the IT & telecom segment in the ultra-high-speed wifi market is projected to hold a 50% share during 2026–2035, bolstered by the scaling of WiFi 6E and WiFi 7 in enterprise settings propelled by growing demand for seamless, high-bandwidth connectivity.

- The 1 GB segment is expected to account for about 60% share by 2035, strengthened by widespread gigabit-tier broadband adoption and rising consumer requirements for high-definition streaming and smart-home performance driven by fiber broadband rollouts.

Key Growth Trends:

- Advancements in WiFi standards

- Government policies supporting broadband expansion

Major Challenges:

- Infrastructure and hardware compatibility limitations

- Regulatory and spectrum allocation challenges

Key Players: Spectrum, Charter Communications, Comcast, Midcontinent Communications, Altice, Cox Communications, Insight Communications, Verizon, SureWest Broadband, AT&T, China Mobile, Changcheng, China Unicom, ASAHI Net Inc., KT Corp, LG U+, SK Broadband.

Global Ultra-high-speed WiFi Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8 billion

- 2026 Market Size: USD 10.16 billion

- Projected Market Size: USD 110.29 billion by 2035

- Growth Forecasts: 30%

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: India, Indonesia, Brazil, Mexico, Singapore

Last updated on : 3 December, 2025

Ultra-high-speed WiFi Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in WiFi standards: The introduction and adoption of next-generation WiFi standards such as WiFi 6E and WiFi 7 are key technological catalysts for ultra-high-speed WiFi market growth. The introduction of WiFi 6E and the upcoming WiFi 7 standard allows access to the 6GHz spectrum, enabling multi-gigabit speeds, enhanced spectral efficiency, and reduced interference. For instance, in October 2024, VNPT Group, Vietnam’s leading telecommunication provider, launched its next-generation Internet service, integrating WiFi 7 technology with 10G Fiber capabilities. With this, it became the first network operator in Vietnam to deploy this advanced technology in collaboration with Qualcomm Technologies. This initiative utilizes Qualcomm’s 10G Fiber Gateway platforms, delivering high-speed, stable, and low-latency internet experiences to both enterprise and individual customers.

- Government policies supporting broadband expansion: Policy frameworks and international cooperation play a crucial role in advancing wireless connectivity. Governments worldwide are implementing policies and funding programs to promote the development of smart cities and bridge the digital divide, particularly in rural and underserved areas. For instance, the European Commission’s WiFi4EU initiative launched in 2018 provides financial support to municipalities across Europe to install free, public WiFi access points. These initiatives include the deployment of high-speed WiFi infrastructure to support economic development and improve access to digital services.

Challenges

- Infrastructure and hardware compatibility limitations: One of the primary barriers to widespread adoption of ultra-high-speed WiFi is the fragmented infrastructure ecosystem. While new standards such as WiFi 6E and WiFi 7 offer multi-gigabit speeds and reduced latency, their full performance potential can only be realized with compatible hardware on both ends i.e., routers, access points, and client devices. As many organizations and households still rely on WiFi 4/5, upgrading to newer hardware increases capital expenditure, thus limiting adoption and ultra-high-speed WiFi market growth.

- Regulatory and spectrum allocation challenges: The availability of the 6 GHz spectrum, which is critical for ultra-high-speed WiFi, remains uneven globally. While countries such as the U.S., U.K., South Korea, and Brazil have opened up the entire 6GHz band for unlicensed use, several others have only partially adopted it or have not approved it due to regulatory security or coexistent concerns with satellite and broadcast services. This lack of uniform global policy creates uncertainty for hardware vendors and service providers, as devices need to be tailored or restricted based on local spectrum rules.

Ultra-high-speed WiFi Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

30% |

|

Base Year Market Size (2025) |

USD 8 billion |

|

Forecast Year Market Size (2035) |

USD 110.29 billion |

|

Regional Scope |

|

Ultra-high-speed WiFi Market Segmentation:

End use Segment Analysis

The IT & telecom segment in ultra-high-speed WiFi market is emerging as a major end user and is expected to hold a 50% share by 2035 due to the need for seamless, high bandwidth connectivity. As cloud computing, remote collaboration platforms, and real-time data processing become integral to business operations, there is a critical need for ultra-low latency and multi-giga-bit speeds. The rapid expansion of 5G backhaul and edge computing is further accelerating the adoption of advanced WiFi standards such as WiFi 6E and WiFi 7 in enterprise environments. This growth is fueled by increasing user expectations for uninterrupted connectivity across mobile and fixed networks.

Speed Segment Analysis

The 1 GB segment is predicted to hold a remarkable ultra-high-speed WiFi market share of around 60% through 2035 as it meets the performance needs of smart homes, small offices, and high-definition streaming. With the rise of 4K and 8K content, video conferencing, and connected devices, users now demand faster and more reliable bandwidth. WiFi 6 and 6E routers now commonly support 1Gbps speeds, making it a practical upgrade for consumers. Its growth is driven by fiber broadband rollouts that offer gigabit tier service plans.

Our in-depth analysis of the global ultra-high-speed WiFi market includes the following segments:

|

End use |

|

|

Speed |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ultra-high-speed WiFi Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific industry is expected to dominate the ultra-high-speed WiFi market with a 32% share through 2035 due to rising internet penetration and aggressive digital infrastructure development. Governments across the region are investing in nationwide broadband initiatives, smart city programs, and 5G integration, fostering a favorable environment for next-generation WiFi deployment. The region’s large base of mobile consumers and tech-savvy enterprises further accelerates demand for high-capacity, low-latency wireless connectivity. This trend is particularly evident in the e-commerce, fintech, and digital education sectors.

In China, the government’s push toward a Digital China and the rapid expansion of industrial IoT ecosystems are propelling demand for ultra-high-speed WiFi. Leading telecom operators such as China Mobile and China Telecom are rolling out WiFi 6 and trialing WiFi 7 solutions in commercial and residential settings. A recent development in China’s ultra-high-speed Wi-Fi market is the rollout of 10 gigabit optical networks marking a significant leap in the country’s digital infrastructure. In January 2025, the Ministry of Industry and Information Technology (MIIT) announced pilot projects for 10-gigabit optical networks in select cities and regions aiming to enhance broadband experiences and support new industrial applications. These initiatives align with China’s dual goals of achieving technological self-reliance and enhancing connectivity in rural and urban centers.

The ultra-high-speed WiFi market in South Korea is growing due to advancements in ultra-high-speed WiFi technologies. The government-backed Digital New Deal includes significant investments in WiFi 6E and WiFi 7 deployment, particularly in public infrastructure, education, and healthcare. Major tech companies such as Samsung and KT Corporation are actively testing WiFi 7 routers and solutions to enable future-facing applications such as 8K video streaming and immersive metaverse experiences. These initiatives reflect the strategic aim to maintain global leadership in digital connectivity.

North America Market Insights

North America is anticipated to garner a robust share from 2026 to 2035 owing to the mature digital ecosystem and strong consumer demand for uninterrupted, high-performance connectivity. The region’s widespread adoption of remote work, cloud computing, and streaming services intensifies the need for faster wireless networks. Network providers are upgrading infrastructure to accommodate WiFi 6E and WiFi 7 standards. Additionally, federal initiatives supporting broadband expansion also play a key role in closing connectivity gaps, especially in underdeveloped communities.

In the U.S., the ultra-high-speed WiFi market is being bolstered by private sector innovation and large-scale infrastructure funding. Tech giants and ISPs are rolling out advanced wireless solutions in both residential and enterprise settings, responding to increasing expectations for seamless, multi-device connectivity. For instance, In April 2025, Greenlight Networks, a top fiber internet provider in New York announced its first expansion project in Pennsylvania. The company is investing over USD 13 million to bring high-speed internet to Northeast Pennsylvania, starting with Dickson City. By the end of 2026, Greenlight plans to offer internet to more than 10,000 homes and small businesses in Lackawanna County. Additionally, the Federal Communications Commission (FCC) move to release additional spectrum in the 6GHz band enables faster wireless services. These policy and industry efforts help in a robust deployment of next-gen WiFi in smart homes, offices, and educational institutions.

The ultra-high-speed WiFi market in Canada is rising rapidly due to the nation’s digital inclusion drive. The government’s Universal Broadband Fund is accelerating the delivery of high speed internet to rural and Indigenous communities, many of which rely on wireless connectivity. For instance, in June 2023, the Federal government in Canada and Ontario governments committed over USD 71 million to extend high-speed internet access to more than 22,000 homes across 74 communities in eastern Ontario. This investment, part of Canada’s Connectivity Strategy aims to ensure that 98% of people in Canada have access to high-speed internet by 2026 and 100% by 2030. Hence, such initiatives are crucial in enhancing digital connectivity, particularly in underserved regions, thereby supporting the expansion of ultra-high-speed WiFi infrastructure.

Ultra-high-speed WiFi Market Players:

- Spectrum

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Charter Communications

- Comcast

- Midcontinent Communications

- Altice

- Cox Communications

- Insight Communications

- Verizon

- SureWest Broadband

- ATandT

- ChinaMobile

- Changcheng

- China Unicom

- ASAHI Net Inc.

- KT Corp

- LGU

- SKBroadband

The ultra-high-speed WiFi market is extremely competitive with key players such as Cisco Systems, Qualcomm, Broadcom and Intel driving innovation through advanced chipsets and wireless technologies. The market is projected to expand as consumer electronics giants are rapidly launching WiFi 6E and WiFi7-enabled routers to meet rising demand. Additionally, strategic collaborations, R&D investments and spectrum advancements are shaping the market dynamics. Here are some leading players in the ultra-high-speed WiFi market:

Recent Developments

- In March 2025, Bharti Airtel teamed up with SpaceX to bring high-speed internet to remote parts of India using Starlink satellites. The goal is to improve Airtel’s network with SpaceX’s technology. Starlink devices will be available through Airtel stores, focusing on helping areas that don’t have good internet.

- In February 2025, Spectrum Business introduced new internet plans with flexible pricing and free speed upgrades. Their plans now start at 500 Mbps starting speeds at USD 40/month when bundled with other Spectrum services such as business voice, business connect, spectrum mobile and business TV. However, existing customers with high speed plans are getting automatic speed increases from 600 Mbps to 750 Mbps.

- Report ID: 7661

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ultra-high-speed WiFi Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.