Ultra-Fine ATH Market Outlook:

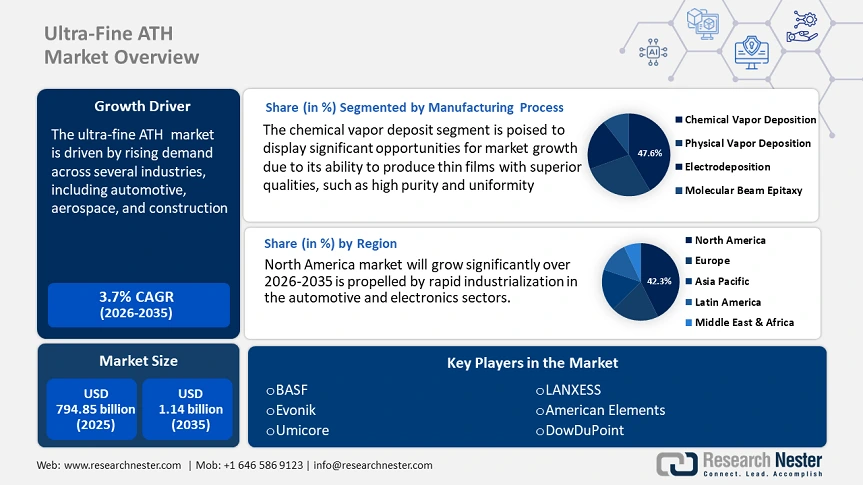

Ultra-Fine ATH Market size was valued at USD 794.85 million in 2025 and is likely to cross USD 1.14 billion by 2035, registering more than 3.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ultra-fine ATH is assessed at USD 821.32 million.

The ultra-fine ATH market is experiencing substantial growth driven by rising demand across several industries, including automotive, aerospace, and construction. The adoption of Advanced High-Strength Steel (AHSS) and Ultra-High-Strength Steel (UHSS) in the automotive sector is a major factor propelling the growth. These materials facilitate the generation of lightweight yet highly durable vehicles, enhancing fuel efficiency and minimizing emissions while maintaining superior safety standards.Another key trend shaping the ultra-fine ATH market is the shift towards sustainability and environmental consciousness. Ultra-fine ATH is broadly utilized in the construction industry due to its capability to improve the strength and durability of concrete and other building materials. By minimizing the need for frequent maintenance and repairs, this contributes to lower construction waste and environmental impact. For instance, India is increasingly adopting ultra-fine ATH in industries like construction, automotive, and electronics due to its high strength and durability.Companies like Tata Chemicals are exploring their applications in diverse sectors, including specialty silicas and nano zinc oxide for applications in paints, coatings, and adhesives. Their product portfolio focuses on materials such as Highly Dispersible Silica (HDS) for high-performance tyres and nano Zinc Oxide (nZnO) for improved anti-fungal, anti-microbial, and UV-blocking properties in industrial and cosmetic applications.

Additionally, the aerospace sector is driving further in need for ultra-fine ATH, using its high strength-to-weight ratio for critical components such as structural reinforcements, wings, and aircraft. This makes it essential material for modern aircraft designs, helping manufacturers achieve enhanced efficiency and performance.

Key Ultra-fine ATH Market Insights Summary:

Regional Highlights:

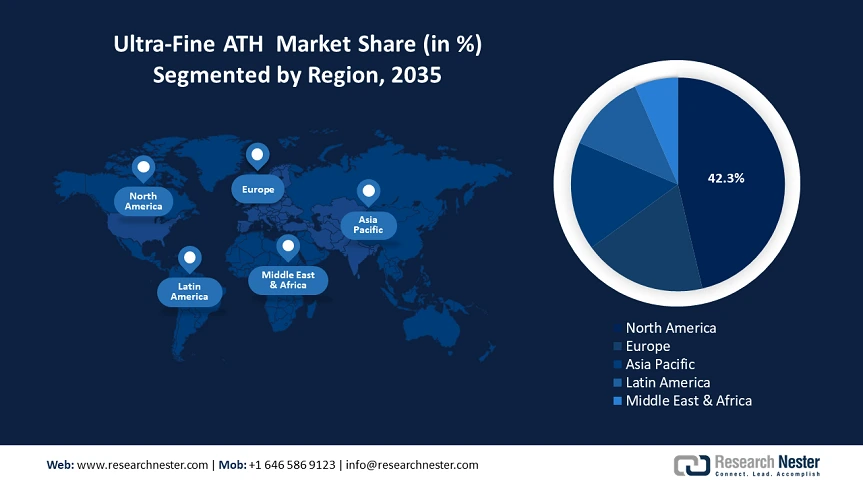

- North America dominates the Ultra-Fine ATH Market with a 42.3% share, driven by rapid industrialization, urbanization, and growth in automotive and electronics sectors, fostering strong growth prospects through 2035.

- The Ultra-Fine ATH Market in Europe is poised for the fastest growth through 2026–2035, driven by increasing demand for sustainable, fire-resistant materials and strict environmental regulations.

Segment Insights:

- The Chemical Vapor Deposition segment is expected to hold 47.6% market share by 2035, fueled by its precision in depositing high-quality, uniform thin films for high-performance materials.

- The aerospace segment is projected to hold a substantial share by 2035, driven by demand for lightweight, durable materials enhancing aircraft and spacecraft performance.

Key Growth Trends:

- Increasing demand for high-performance fabrics

- Technological advancements in fiber production

Major Challenges:

- High production costs

- Raw material supply chain disruptions

- Key Players: Evonik, BASF, Umicore, American Elements, Lanxess, Treibacher.

Global Ultra-fine ATH Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 794.85 million

- 2026 Market Size: USD 821.32 million

- Projected Market Size: USD 1.14 billion by 2035

- Growth Forecasts: 3.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 12 August, 2025

Ultra-Fine ATH Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for high-performance fabrics: The increasing popularity of athleisure trends, growing consumer preference for moisture-wicking, enhancements in textile technology, and sustainability concerns drive the increasing demand for high-performance fabrics. Furthermore, the materials are engineered to give breathability, durability, and moisture-wicking ability, making them unique for sportswear and activewear.As wellness and fitness become integral to daily life, consumers aspire for clothing that seamlessly integrates functionality with comfort. For instance, Under Armour has created UA RUSH, a line of responsive textiles designed to improve athletic performance by recycling the body's energy during activity. These mineral-infused fabrics absorb the heat radiated by the body and convert it into infrared energy, which is re-emitted back into the muscles. This process increases the temporary localized circulation, boosting enhanced performance, energy, and recovery.UA RUSH is engineered to provide athletes with scientifically tested gear that supports them at the time of workouts by harnessing and recycling their energy. Furthermore, enhancements in nanotechnology lead to the development of nanofabrics, which provide properties such as increased elasticity and water resistance, further improving the performance of athletic apparel. These innovations exhibit the dynamic evolution of the textile industry in satisfying the rising need for high-performance, versatile, and comfortable fabrics in today's active lifestyles.

- Technological advancements in fiber production: Ongoing enhancements in fiber production have revolutionized the creation of ultra-fine ATH materials, improving their durability, elasticity, and softness. Innovations such as enhanced spinning techniques, nanofiber technology, and high-performance polymer blends have facilitated the development of ultra-lightweight yet strong fabrics. These enhancements drive demand in several industries, especially in apparel, medical textiles, and aerospace applications.Recent technological enhancements in fiber production have significantly improved the quality and functionality of textile materials. One of the notable developments is the utilization of Automated Fiber Placement (AFP) and Filament Winding (FM) technologies, which allow for precise, material-efficient, cost-effective manufacturing of complex fiber architectures. These techniques are specifically beneficial in developing components for aerospace and automotive applications. Furthermore, companies like Spinnova have pioneered technologies that convert wood pulp and waste into textile fibers without harmful chemicals, boosting sustainability in fiber production. Their process maintains the natural properties of wood, providing an eco-friendly alternative to conventional synthetic fibers. These enhancements show the industry’s commitment to innovation, resulting in fibers that are not only stronger and more versatile but also environmentally sustainable.

Challenges

- High production costs: The production of ultra-fine ATH involves complex refining and processing techniques, which significantly increase manufacturing costs. These processes require enhanced technology, high-purity raw material, and precise particle size control, leading to higher operation expenses. As a result, industries that rely on cost-effective materials, such as construction and consumer goods manufacturing, may find ultra-fine ATH less viable. Furthermore, fluctuating raw material prices and energy-intensive production further contribute to cost challenges. To address this, manufacturers are exploring innovative production methods and economies of scale to minimize costs while maintaining product quality, ensuring broader adoption across several industries.

- Raw material supply chain disruptions: The availability and cost of ATH, the key raw material for ultra-fine ATH, are subject to disruption caused by mining regulations, and trade policies in key producing countries can lead to supply chain instability. Additionally, geopolitical tensions, such as trade disputes or resource nationalism, can further exacerbate raw material shortages or price fluctuations. These disruptions can impact the overall pricing and availability of ATH, creating uncertainty for industries dependent on stable supply chains. To mitigate this, companies are diversifying suppliers and exploring alternative sourcing strategies.

Ultra-Fine ATH Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.7% |

|

Base Year Market Size (2025) |

USD 794.85 million |

|

Forecast Year Market Size (2035) |

USD 1.14 billion |

|

Regional Scope |

|

Ultra-Fine ATH Market Segmentation:

Manufacturing Process (Chemical Vapor Deposition, Physical Vapor Deposition, Electrodeposition, Molecular Beam Epitaxy)

Chemical vapor deposit (CVD) segment is projected to dominate ultra-fine ATH market share of around 47.6% by the end of 2035. CVD is a broadly utilized method in material science to produce thin films and coatings. CVD’s precision in depositing high-quality, uniform thin films makes it essential in creating materials with desired properties. In CVD, precursor gases are introduced into a vacuum chamber, where they react and decompose on a substrate surface, resulting in the deposition of solid materials. This process allows for the creation of high-quality, uniform films with precise control over thickness, composition, and properties.

CVD is employed in several industries, including electronics, optics, and energy storage, due to its ability to produce thin films with superior qualities, such as high purity and uniformity. For instance, CVD is commonly utilized in semiconductor manufacturing for depositing thin films for device functionality. CVD enables the development of several materials, such as dielectric layers, conductive films, and semiconducting films, by introducing reactive gases into a chamber where they decompose onto a heated substrate, forming a solid film. One notable instance is its use in producing enhanced material like carbon nanotubes, which are essential for applications in electronics and energy storage. CVD’s capacity to produce materials with specific properties makes it an integral process in the ultra-fine ATH market, especially to produce high-performance materials.

Application (Aerospace, Electronics, Medical, Automotive, Chemical, Energy)

The aerospace segment is anticipated to hold a substantial share in the ultra-fine ATH market, driven by the demand for lightweight, durable materials for aircraft and spacecraft, where ultra-fine ATH plays a crucial role in improving performance while minimizing weight. For instance, ultra-fine ATH is utilized in the production of high-strength composites and coatings for aerospace components, contributing to fuel efficiency and safety. The electronics sector also plays a pivotal role, contributing around 21% of the ultra-fine ATH market revenue, as ultra-fine ATH is utilized for its excellent thermal conductivity and electrical insulation properties, vital in producing enhanced electronic devices and components.

The medical industry is experiencing steady growth, with ultra-fine ATH being used in medical implants and surgical tools. Similarly, the automotive, chemical, and energy sectors are witnessing increasing adoption, driven by the need for high-performance materials in these industries. The market is set to grow with technological advancements and rising investments in research and development, especially in emerging economies.

Our in-depth analysis of the global ultra-fine ATH market includes the following segments:

|

Manufacturing Process |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ultra-Fine ATH Market Regional Analysis:

North America Market Statistics

North America in ultra-fine ATH market is expected to capture over 42.3% revenue share by 2035, propelled by rapid industrialization, urbanization, and significant growth in the automotive and electronics sectors. This surge is particularly notable in countries like the U.S. and Canada. where the demand for flame-retardant materials is escalating due to strict safety regulations and a heightened focus on sustainability. Canada has emerged as a dominant player, with numerous manufacturers producing ultra-fine ATH to satisfy both domestic and international demands.

The ultra-fine ATH market’s expansion is also fueled by technological enhancements and increased investments in research and development, aiming to improve the performance and cost-effectiveness of ultra-fine. On the other hand, for instance, companies such as Albemarle Corporation and Huber Engineered Materials have been actively expanding their ultra-fine ATH production, including Hydral and Martinal ATH grades, which are implemented in ceramics requiring resistance to thermal shock and extreme temperatures. This underscores the expansion of the ultra-fine ATH.

The rapid industrialization of the U.S. demand for ultra-fine ATH is anticipated to grow significantly during the forecast period. These developments position the North America region as a leader in the global market, catering to diverse applications across various industries.

Europe Market Analysis

Europe has rapidly emerged as the fastest-growing ultra-fine ATH market, driven by increasing demand for sustainable, fire-resistant materials in various industries. Strict environmental regulations, such as those set by the European Union, encourage the use of non-toxic, high-performance materials, further driving the market growth. The UK and Germany play a pivotal role in enhancing the ultra-fine ATH market, The UK is actively investing in eco-friendly materials to meet strict environmental regulations, fostering demand for ATH in sectors like construction and automotive.

Similarly, Germany, known for its advanced industrial base, has increasingly adopted ultra-fine ATH in the automotive and electronic sectors, where high-performance materials are essential. For instance, Nabaltec AG, headquartered in Schwandorf, Germany, is a prominent manufacturer of ultra-fine ATH. The company specializes in producing high-purity ATH products, which are widely used as flame retardants in various applications, including plastics, coatings, and rubber. These developments enabled Europe to stand forwards in the ultra-fine ATH market, catering to diverse applications across various industries.

Key Ultra-Fine ATH Market Players:

- Arkema

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik

- BASF

- Umicore

- American Elements

- Lanxess

- Treibacher

- DowDuPont

- Skyspring Nanomaterials

- Altairnano

- Tancan

- PQ Corp.

- C. Starck

- Nanoamor

- Synano

Key players in the ultra-fine AT market leverage enhanced processing technologies like chemical vapor deposition, surface modification techniques, and nanotechnology to enhance product performance and efficiency. These innovations improve thermal stability, dispersion, and flame-retardant properties, ensuring their competitive edge in high-performance applications.

Recent Developments

- In January 2024, Albemarle Corporation announced a significant expansion of its ultra-fine ATH production facilities to meet the growing demand from the automotive, electronics, and energy storage sectors. The company is increasing its production capacity for ultra-fine ATH to support applications in electric vehicle batteries and fire-resistant materials.

- In March 2023, AkzoNobel, a global leader in coatings and performance materials, launched a new line of ultra-fine ATH materials designed specifically for high-performance electronic components. These materials are optimized for heat resistance and electrical insulation, making them ideal for advanced electronics and electric vehicle applications.

- Report ID: 7510

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ultra-fine ATH Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.