Tunnel Monitoring System Market Outlook:

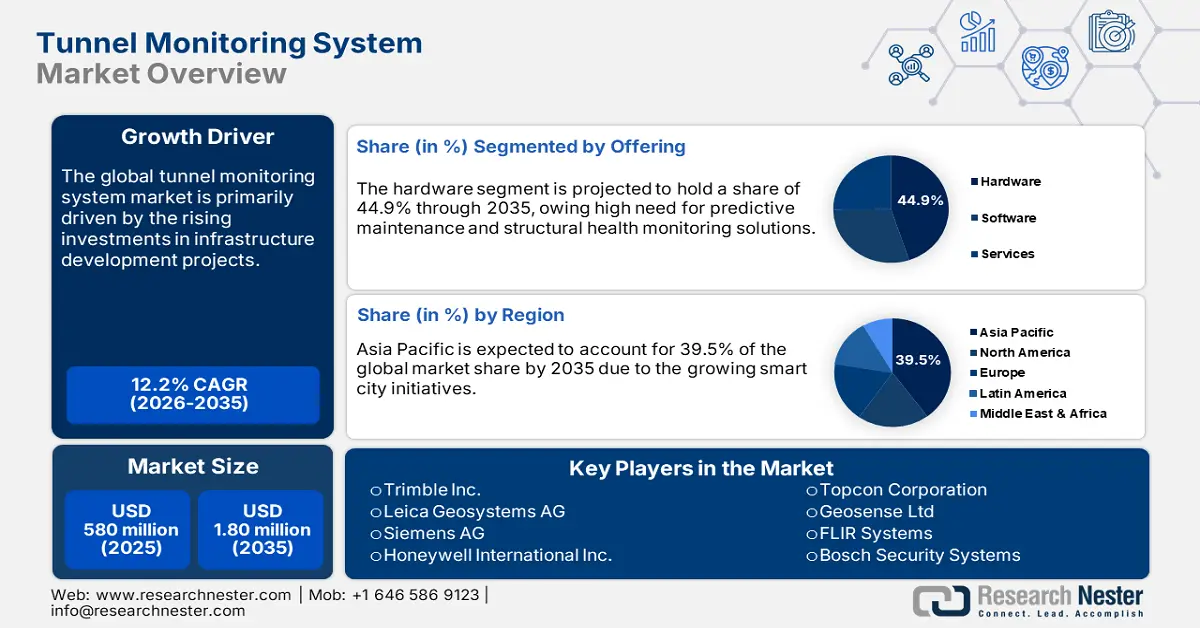

Tunnel Monitoring System Market size was USD 580 million in 2025 and is estimated to reach USD 1.80 billion by the end of 2035, expanding at a CAGR of 12.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of tunnel monitoring systems is assessed at USD 620 million.

The sales of tunnel monitoring systems (TMS) rely on the stable supply chain of sensors, precision electronics, and other components. North America, Germany, Japan, and South Korea are key producers of precision electronics and fiber optic sensors. As per the European Union, the EU imported a total of 18,300 tonnes of rare earth elements (REE+) valued at €123.6 million in 2023. This reflects that the growth in the import and export activities of raw materials is expected to fuel the production of tunnel monitoring solutions. The booming demand for infrastructure monitoring applications is poised to fuel the overall trade of TMS in the years ahead. Investments in tunnel infrastructure digitization are gaining traction across the world. This underscores that the government-funded programs are set to propel the sales of tunnel safety and monitoring technologies in the coming years.

Recent trends indicate that tunnel monitoring systems (TMS) are heavily diverging toward smarter, more integrated, and more cost-effective solutions. IoT is used now as a matter of course to produce real-time data capture and remote monitoring, provided by the installation of relatively inexpensive wireless networks. Equally, the rise of predictive analysis technologies powered by artificial intelligence is enabling operators to observe anomalies and predict the need for maintenance prior to failure occurring. Fiber optics technologies, including Distributed Acoustic Sensing (DAS) have become a common part of TMS, providing high-resolution continuous data over lengthy tunnels that can work even in adverse conditions. TMS types of applications have pushed beyond transportation infrastructure and into domains such as mining, hydropower, and oil & gas, to meet safety standards.

Key Tunnel Monitoring System Market Insights Summary:

Regional Highlights:

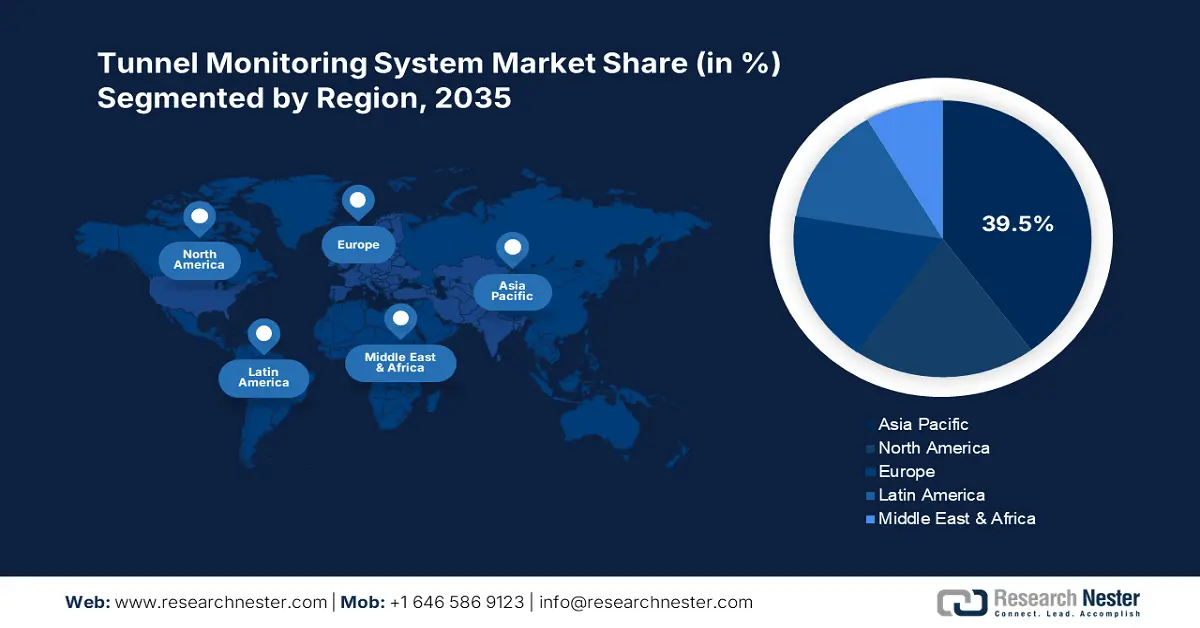

- The Asia Pacific Tunnel Monitoring System Market is projected to command 39.5% of the global revenue share by 2035, propelled by rapid urbanization and large-scale infrastructure development projects.

- North America is anticipated to expand at a CAGR of 7.9% during 2026–2035, supported by growing infrastructure modernization efforts and ICT-driven initiatives.

Segment Insights:

- The hardware segment is projected to account for 44.9% share of the Tunnel Monitoring System Market by 2035, propelled by the growing need for predictive maintenance and structural health monitoring in public infrastructure projects.

- The railway tunnel segment is anticipated to hold 36.8% share by 2035, supported by rapid urban transit modernization and underground rail expansion initiatives.

Key Growth Trends:

- Propelling smart city initiatives

- Public-private partnerships (PPPs) in infrastructure projects

Major Challenges:

- Infrastructure readiness gaps

- High CAPEX and long ROI periods

Key Players: Trimble Inc., Leica Geosystems AG (Hexagon AB), Siemens AG, Honeywell International Inc., Topcon Corporation, Geosense Ltd, FLIR Systems (Teledyne Technologies), Bosch Security Systems, RIEGL Laser Measurement Systems GmbH, GEOKON, Inc., Keller AG für Druckmesstechnik, SICK AG, Hanjin Heavy Industries & Construction, M/s BHEL (Bharat Heavy Electricals Limited), Telematics Solutions Sdn Bhd.

Global Tunnel Monitoring System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 580 million

- 2026 Market Size: USD 620 million

- Projected Market Size: USD 1.80 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: South Korea, United Kingdom, Australia, France, Italy

Last updated on : 8 September, 2025

Tunnel Monitoring System Market - Growth Drivers and Challenges

Growth Drivers

- Propelling smart city initiatives: The swift rise in global investments in underground infrastructure projects is expected to propel the sales of tunnel monitoring systems in the years ahead. The World Bank study estimates that more than USD 1.9 trillion is projected to be invested globally in urban transit through 2030. The robust construction activities of subways, high-speed rail, and road tunnels, owing to smart city initiatives, are set to boost the revenues of key tunnel monitoring system market players.

- Public-private partnerships (PPPs) in infrastructure projects: The booming public and private engagements in the infrastructure development programs are anticipated to create a profitable environment for tunnel monitoring system manufacturers. PPPs are expected to drive expansions in tunnel monitoring system procurement. For tunneling projects, PPPs can close finance gaps and decrease projects having extended timelines, by funding the projects via private financing and technical and resource expertise. In the PPP agreement, stakeholders may need comprehensive safety monitoring and safety technologies to satisfy performance standards and compliance requirements. Consequently, there are increasing requirements for TMS solutions with real-time data, predictive analytics, and automated alerts to prevent structural integrity and operational safety breaches.

- Stricter safety regulations and compliance requirements: Governments and regulatory agencies are enforcing ongoing safety standards for infrastructure. Tunnels are subject to some of the most demanding compliance checks as a result of their enclosed spaces and potential for high occupancy. Tunnel Monitoring Systems provide operators with real-time data related to the health of tunnels, structural movement and environmental difference. Early warning systems that are triggered by TMS can prevent disasters and liability claims, as well as help to reduce maintenance costs.

Challenges

- Infrastructure readiness gaps: The poor infrastructure, mainly in the underdeveloped areas, is expected to limit the adoption of tunnel monitoring systems. The unavailability of digital solutions such as fiber, power redundancy, or 5G coverage lowers the deployment of smart monitoring systems in price-sensitive markets.

- High CAPEX and long ROI periods: The tunnel monitoring system production is a capital-intensive process, which limits the entry of new market players. The high capital expenditure and long & risky return guarantee are hampering the investments in the manufacturing of tunnel monitoring systems. The typical return on investment time in the tunnel monitoring system field is 5 to 8 years. Thus, the substantial upfront costs and uncertain ROI are expected to hinder the overall market growth to some extent.

Tunnel Monitoring System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 580 million |

|

Forecast Year Market Size (2035) |

USD 1.80 billion |

|

Regional Scope |

|

Tunnel Monitoring System Market Segmentation:

Offering Segment Analysis

The hardware segment is projected to capture 44.9% of the global tunnel monitoring system market share by 2035. The increasing need for predictive maintenance and structural health monitoring in public infrastructure projects is propelling the sales of tunnel monitoring hardware solutions. Thus, the rising public investments in the fiber-optic, piezoelectric, and MEMS sensors for real-time vibration and displacement monitoring are also contributing to the segmental growth.

Application Segment Analysis

The railway tunnel segment is anticipated to hold 36.8% of the global tunnel monitoring system market share throughout the forecast period. Urban transit modernization and underground rail expansion projects are fueling the adoption of tunnel monitoring technologies. The increasing use of automation in tunnel infrastructure projects is opening lucrative earning opportunities for key market players. As per the European Commission, 94 transport projects have been chosen by the European Commission to receive EU grants totaling nearly €2.8 billion through the Connecting Europe Facility (CEF). These projects will create new connections between regions and cities in Europe from north to south and east to west by modernising railways, inland waterways, and maritime routes throughout the trans-European transport network (TEN-T). This directly fueled the sales of smart monitoring technologies to cut downtimes and failure rates.

Monitoring Technique Segment Analysis

Structural Deformation monitoring is the single biggest driver of the tunnel monitoring system market. Structural deformation monitoring specifically observes movements and shifts, such as tilts and displacements, of the tunnel structure, which are key indicators for determining the health and safety of the tunnel as a whole. Structural deformation monitoring can inform operators of early warning signs of failures or damage that could lead to maintenance and/or ultimate catastrophic collapse.

Our in-depth analysis of the tunnel monitoring system market includes the following segments:

|

Segment |

Sub-segment |

|

Offering |

|

|

Application |

|

|

Monitoring Technique |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Tunnel Monitoring System Market - Regional Analysis

APAC Market Insights

The Asia Pacific tunnel monitoring system market is estimated to account for 39.5% of the global revenue share through 2035. The rapid rise in urban activities and infrastructure development projects is anticipated to propel the sales of tunnel monitoring systems. China, Japan, India, and South Korea are the most profitable marketplaces for tunnel monitoring system manufacturers. The high government spending and favorable regulatory policies are fueling the production and commercialization of tunnel monitoring systems.

China is anticipated to account for 17.3% of the Asia Pacific tunnel monitoring system market share throughout the projected timeframe. The massive government investments under the MIIT and CAICT initiatives, aiming for infrastructure development, are fueling the sales of tunnel monitoring technologies. This is set to drive AI and ML integration in TMS and fuel its adoption in the industrial sectors and urban transit projects.

The India tunnel monitoring system market is poised to increase at a CAGR of 10.5% by 2035. The robust rise in digital transformation and infrastructure development projects is propelling the sales of tunnel monitoring technologies. The Ministry of Electronics and Information Technology’s (MeitY) high spending on smart road construction solutions is expected to drive innovations in the tunnel monitoring systems. The public-private investments for the expansion of urban metros and industrial hubs are likely to propel the sales of tunnel monitoring technologies in the years ahead.

North America Market Insights

The North America tunnel monitoring system market is foreseen to expand at a CAGR of 7.9% from 2026 to 2035. The infrastructure modernization and ICT initiatives are propelling the sales of tunnel monitoring technologies. The high budgets for ICT solutions are accelerating the production and commercialization of tunnel monitoring systems. The easy accessibility of the broadband network is also contributing to the increasing adoption of tunnel monitoring systems. The public-private partnerships are set to foster innovation in 5 G-enabled IoT systems and tunnel monitoring solutions in the years ahead.

The sales of tunnel monitoring solutions in the U.S. are expected to increase at a high pace throughout the assessed period. High application of smart sensing and construction technologies is set to double the profits of key players in the years ahead. The positive funding programs are poised to propel the trade of tunnel safety and monitoring systems during the foreseeable period.

Government policies emphasizing digital infrastructure expansion and safety in aging urban tunnels are fueling the sales of tunnel monitoring systems in Canada. The majority of urban tunnels in Canada were built decades ago and now require sophisticated monitoring systems to ensure their integrity and the safety of the public. In this context, governments at the federal and provincial levels are continuing to promote modernization efforts that include smart technologies. These policies often prescribe strict safety standards and ongoing monitoring to avoid failures and costly emergency repairs.

Europe Market Insights

The Europe tunnel monitoring system market is anticipated to grow due to several converging factors. The region is home to a vast and aging tunnel network, including road, rail, and metro tunnels that require case-by-case monitoring and maintenance to maintain public safety and reliability. In addition, the increased funding to upgrade transportation infrastructure and expand urban transit networks is causing demand for Tunnel Monitoring Systems (TMS) to rise. Further, the rising environmental challenges associated with issues such as climate-related flooding and ground movement require a culture of ongoing structural health monitoring. Also, financing support from the European Union and similarly structured public-private institutions, will accelerate the acceptance and implementation of more modern TMS in growing sustainable infrastructure activities.

France maintains a considerable length of tunnels used by road, rail, and urban transport. Many of the tunnels are aging and continually require structural health monitoring to ensure public safety. The French government has made significant investments to modernize or 'retrofuturize' their infrastructure, especially in retrofitting existing tunnels with smart technologies to meet EU safety regulations. Through the modernization process, there is increased initiative surrounding digital infrastructure and IoT-enabled monitoring systems, which provide real-time data and predictive maintenance tools.

The growing tunnel monitoring system market in Germany can be largely attributed to the country's extensive transportation network and the proliferation of tunnels. As per the Federal Minister of Research, Technology, and Space, Germany is regarded as one of the top countries for infrastructure. With around 830,000km of roads (13,000km of motorway) and 38,400km of rail, and 23 major airports, and continued regular modernization, the country has excellent transport links throughout. Many of Germany's tunnels were erected decades ago, which has brought an urgency to continuous monitoring to mitigate the risks associated with their structural failures, and to comply with stringent national and EU safety standards.

Key Tunnel Monitoring System Market Players:

- Trimble Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Leica Geosystems AG (Hexagon AB)

- Siemens AG

- Honeywell International Inc.

- Topcon Corporation

- Geosense Ltd

- FLIR Systems (Teledyne Technologies)

- Bosch Security Systems

- RIEGL Laser Measurement Systems GmbH

- GEOKON, Inc.

- Keller AG für Druckmesstechnik

- SICK AG

- Hanjin Heavy Industries & Construction

- M/s BHEL (Bharat Heavy Electricals Limited)

- Telematics Solutions Sdn Bhd

The tunnel monitoring system market is characterized by the dominance of the gigantic companies and the increasing emergence of start-ups. Leading companies are focusing on integrating advanced sensor technologies and integrated ICT solutions in their product offerings to maintain market dominance. Key players are expected to hold hefty shares due to their expansion of product supply in precision engineering and local infrastructure projects. Companies from the developing regions are emphasizing innovations and automation to uplift their market presence. The key players are employing various organic and inorganic marketing strategies to earn lucrative gains and maximize their reach.

Recent Developments

- In June 2023, the Delhi Metro initiated a tunneling operation on Friday by the Tunnel Boring Machine (TBM) "Bhoomi" from Derawal Nagar to Pulbangash in an upcoming corridor under the Delhi Metro's 'Phase IV' project. The TBM was launched from the site of Derawal Nagar metro station on 'Line 8', which is being built from Janakpuri West to R K Ashram, with the Delhi Metro Rail Corporation (DMRC).

- In July 2025, Serbian President Aleksandar Vucic inaugurated the last piece of the E-763 “Milos Veliki” highway, completing the 30.9-kilometer long trail from Preljina-Pozega in southwestern Serbia. The project was delivered through a construction contract with China Communications Construction Company (CCCC). It included the country's two longest road tunnels and represents a key part of the process of modernization in Serbia's road transport infrastructure, News.Az reports, referring to Xinhua.

- Report ID: 7787

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tunnel Monitoring System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.